Cn-down > Domestic news > News content

2024-04-28 来源:金绒 浏览量:1245

Summary

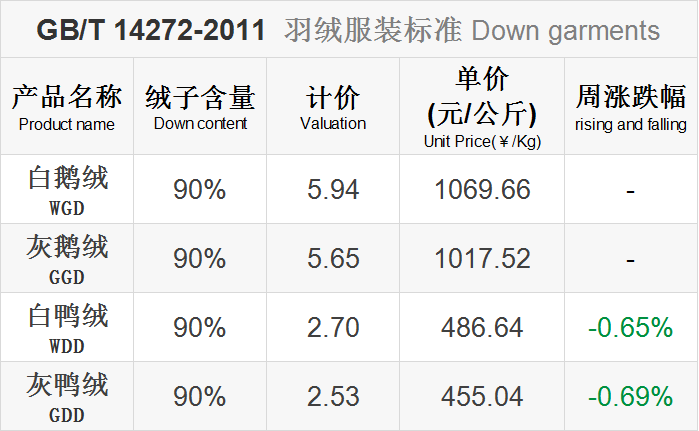

The market in the 17th week of 2024 (4.22-4.28) was generally stable, with duck down falling slightly.

Since mid-March, the supply of ducklings has improved significantly. The current supply of commercial ducklings nationwide is estimated to be in the range of "10.2 million ducks per day."

Previously, due to the increase in orders and stocking of washed down down factories, the price of down has risen again. However, due to the high price of down, many clothing brands started purchasing down late this year and in small quantities. Therefore, down suppliers stopped stocking up when they reached a certain amount. In addition, the export of down and its products has deepened the decline again this year.

In previous years, the export trade of down jackets would start in May. The domestic 6.18 e-commerce festival is approaching, so you may want to pay more attention to the market in May. Only in the first quarter of this year, our country's clothing exports to Japan and South Korea declined significantly, and these two countries are the main markets for our country's down jacket exports.

Good news this week

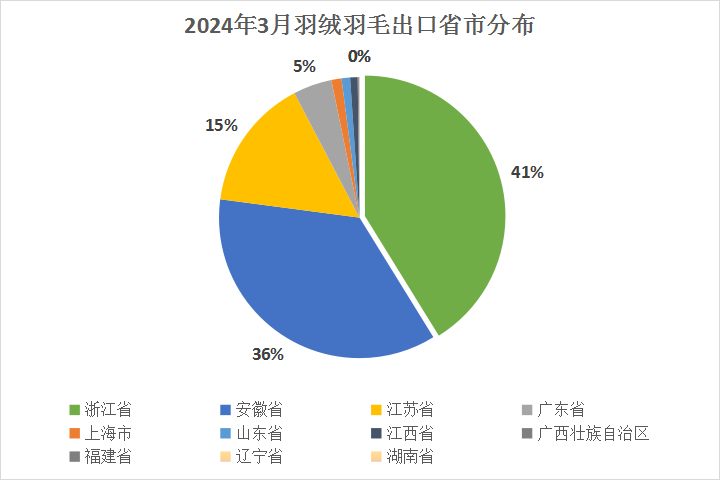

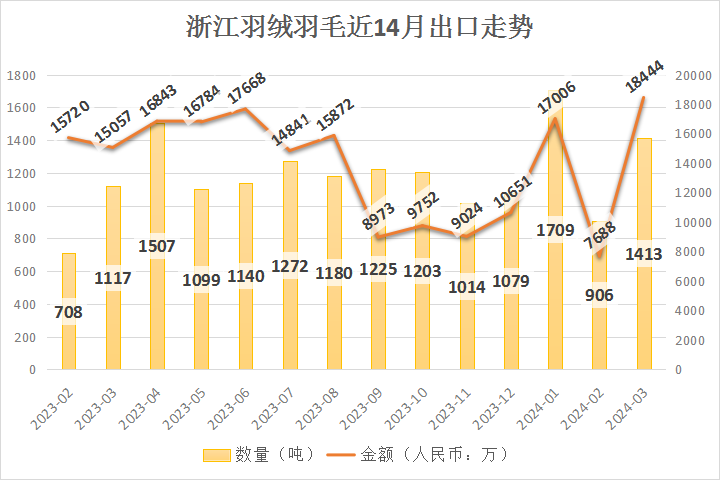

According to China Customs data, in March 2024, Zhejiang Province ranked first in the country in terms of export volume and export value of down and feathers.

In that month, Zhejiang Province exported 1,413 tons of down and feathers, an increase of 27% year-on-year; the export value was 184 million yuan (RMB, the same below), an increase of 22% year-on-year.

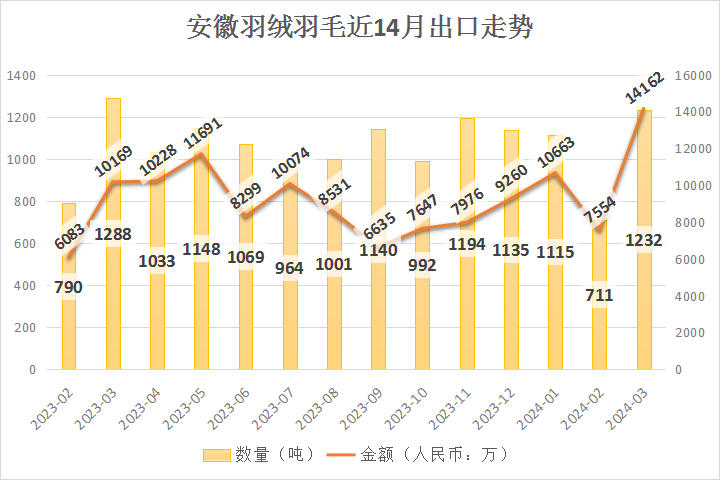

In March 2024, Anhui Province ranked second in the country in terms of export volume and export value of down and feathers.

In that month, Anhui Province exported 1,232 tons of down and feathers, a decrease of 4% year-on-year; the export value was 142 million yuan, an increase of 39% year-on-year.

In March 2024, Jiangsu Province exported 523 tons of down and feathers, a decrease of 1% year-on-year; the export value was 117 million yuan, an increase of 23% year-on-year.

Different from other provinces and cities, Guangdong's down and feather export volume bucked the trend and increased in February, and after March, the good momentum took another step forward.

In March 2024, Guangdong Province exported 153 tons of down and feathers, an increase of 9% year-on-year; the export value was 24 million yuan, an increase of 36% year-on-year.

In March 2024, Shandong Province exported 33 tons of down and feathers, a decrease of 42% year-on-year; the export value was 13 million yuan, an increase of 3% year-on-year.

source | 金绒采编 数据来自海关

Since its reorganization in 2020, "Yaya" has achieved a blowout growth in annual sales and has regained its vitality. Although it is the off-season for down jacket sales, the production line of Yaya Intelligent Manufacturing Co., Ltd. is still at full capacity and is going all out to catch up on orders.

Recently, in Yaya's production workshop, workers were busy at various stations on the intelligent hanging production line. "The overall sales last year were quite good, but there were not enough clothes to sell, so during the off-season this year we are rushing production to prepare for the peak season." said Qi Bing, director of Yaya Intelligent Manufacturing Co., Ltd.

In recent years, "Yaya" has cooperated with well-known IPs at home and abroad and independent designers to completely upgrade its products and increase capital investment to build a standardized model factory for intelligent manufacturing of down clothing, achieving both efficiency and quality improvements.

Li Yao, head of Yaya Co., Ltd.'s industrial park, said: "This year, we will focus on promoting work in four aspects: brand upgrade, product research and development, comprehensive digitalization, and consumer experience. We will continue to increase the share of the down jacket industry and create a fast market model for down jackets.

source | 共青城新闻网

At Anhui Fangxiang Down Products Co., Ltd., the down washing, dehydration, drying, cooling, packaging and other processes are in order.

With its excellent quality and stable production capacity, Fangxiang Down has become one of the top 10 companies in China's down industry and has won wide recognition from domestic and foreign markets. It has established long-term and stable relationships with many well-known down brands such as Ailai, Bosideng and YaYa.

"Our overall sales revenue in 2023 will be around one billion, mainly exporting to the European and American markets. Export sales will be more than 30 million US dollars, domestic sales will exceed 800 million, and taxes will be close to 20 million." Zhu Wen Hui, general manager of Anhui Fangxiang Down Products Co., Ltd. said.

He said that the company's total order value in the first quarter of this year reached 500 million yuan, and production is now at full capacity. In the next step, we will continue to optimize the product structure, improve production efficiency, strive to set a higher benchmark in the down industry, provide better products and services to domestic and foreign customers, and strive to achieve an output value of 1.2 billion yuan this year.

source | 郎溪发布

Bad news this week

In March 2024, our country's total exports of down clothing were 571,000 pieces, a decrease of 38% from February this year; the export value was 117 million yuan, a decrease of 29% from February this year.

Down jacket export list for March 2024

| 商品 名称 | 数量 (万件) | 人民币 (亿元) | 数量同 比去年 | 金额同 比去年 |

| 棉制男 羽绒服 | 5.7 | 0.09 | -94.4% | -92.6% |

| 化纤制男 羽绒服 | 22.0 | 0.51 | -45.9% | -53.8% |

| 棉制女 羽绒服 | 1.3 | 0.02 | -98.7% | -98.7% |

| 化纤制女 羽绒服 | 28.2 | 0.55 | -40.7% | -75.0% |

Export situation of men's down jackets in the past 14 months

Export situation of women's down jackets in the past 14 months

It can be seen from past data that the export of down jackets has entered the traditional off-season, and has continued to decline to the lowest level since February. The export volume in March this year fell by 80% compared with the same period last year.

Compared with the same period in the past ten years, the overall export volume of down clothing in March this year was at the bottom, but the export volume was at least better than the three years of 2015, 2016 and 2018. In the past ten years, the month with the lowest annual export volume has occurred in February in five years and in March in five years.

In terms of imports, in March 2024, a total of 115,000 pieces of down clothing were imported, an increase of 49% from the previous month; the import value was 79 million yuan, a decrease of 38% from the previous month.

source | 金绒采编 数据来自海关

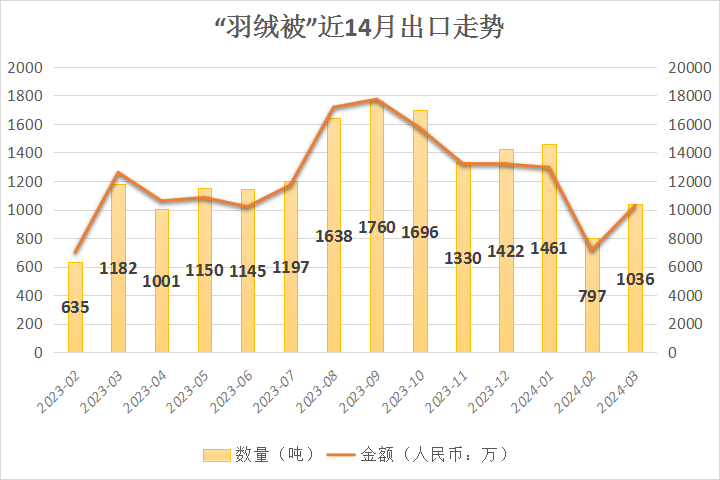

Duvet:

From January to March 2024, a total of 3,294 tons (1.39 million pieces) of duvet were exported, an increase of 5% year-on-year; the export value was 304 million yuan, a decrease of 6% year-on-year.

In March 2024, 1,036 tons (470,000 pieces) of duvet were exported, a decrease of 12% year-on-year; the export value was 103 million yuan, a decrease of 18% year-on-year.

In March 2024, the United States continued to be our country's largest trading partner for "duvet" exports, accounting for 37% of total exports this month, a slightly expanded share. Among them, the export quantity was 383 tons (120,000 pieces), a year-on-year increase of 10%; the export value was 37 million yuan, a year-on-year increase of 11%.

Japan was the second largest trading partner during the month, accounting for 13% of total exports; followed by Australia at 9%, Germany at 8%, and the United Kingdom at 6%.

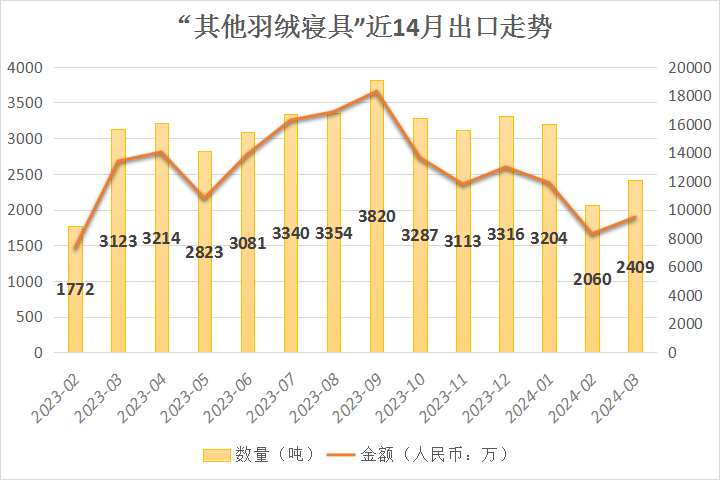

Other down bedding:

According to China Customs data, a total of 7,673 tons of "other down bedding" were exported from January to March 2024, a decrease of 7% compared with last year; the export value was 296 million yuan, a decrease of 17% compared with last year.

In March 2024, 2,409 tons of "other down bedding" were exported, a decrease of 23% from last year; the export value was RMB 95 million, a decrease of 29% from last year.

In March 2024, the United States was still our country's largest trading partner for exports of "other down bedding", accounting for 41% of total exports this month, a slightly smaller share. Among them, the export quantity was 998 tons, a decrease of 27% compared with the same period last year; the export value was 32 million yuan, a decrease of 29% compared with the same period last year.

Germany was the second largest trading partner in the month, accounting for 8.3% of total exports; followed by the United Kingdom at 7.7%, Australia, Canada, Japan and South Korea at 6.7%, 5.4%, 5.2% and 2.3% respectively.

Down bedding (duvet + other bedding)

From January to March 2024, our country exported a total of 10,968 tons of "down bedding", a decrease of 4% year-on-year; the export value was 600 million yuan, a decrease of 12% year-on-year.

source | 金绒 整理自海关数据

The duck market has also ushered in a long-awaited upward trajectory after experiencing a downturn. Judging from the driving force behind the increase in seedling prices, many people in the industry analyzed that it comes from the active stocking of butchery companies, and the current further reduction in feed costs will inevitably reduce butchery companies' concerns about costs.

As the saying goes, supply depends on the stock and demand depends on the season. Traditional duck stocking is currently at a fever pitch. Since the Qingming Festival, the price of big ducks has continued to rise, and manufacturers currently have no major inventory pressure. The demand driven by rising temperatures and the two-way guarantee of mid-to-low prices have made the market more popular for stocking up.

Nowadays, more influencing factors of the duck market come from consumption, and here we have to mention the by-products that are still advancing rapidly. After the Qingming Festival, by-products continued to increase slightly, and this price has exceeded the same period in previous years. This situation will not last long, and ultimately the consumer side of the market will prevail and return to normal matching prices.

Stimulated by stocking up before May Day, various manufacturers' orders and market shipments performed well. For medium-sized and large white-striped ducks, manufacturers have basically been in a tight supply situation recently, and dealers have begun to enter the stage of strategic reserve products, which has also contributed to further slow increases in product prices.

source | 佳合食品集团

Descartes data shows that in March 2024, the import container volume at all ports in the United States was 2.145 million TEU, a slight increase of 0.4% from February 2024, an increase of 15.7% from March 2023, and an increase of 15.7% from March 2023, which was 2.145 million TEUs before the epidemic. The growth rate was 20.6% in March, indicating that year-on-year performance remains strong.

However, there are signs that global supply chain performance may be affected throughout 2024 due to the Red Sea crisis, upcoming labor negotiations at US Eastern ports, and the impact of the Baltimore Bridge collapse.

Imports from China in March 2024 fell by 13.8% from February to 697,000 TEU, which was 30.5% different from the peak in August 2022.

In March, China accounted for 32.5% of total U.S. container imports, down 5.0% from February and 9.0% below the high of 41.5% in February 2022. Imports from India and South Korea saw the largest increases.

source | 航运界网

News situation

This week’s news is slightly more negative than positive.

During the 16th week (4/8-4/14), the industry estimates that the number of duck seedlings will increase to an average of about 10.5 million per day, and will continue to increase in the future. The current number of hatchlings will correspond to a corresponding increase in the number of meat ducks sold in the future, which may lead to an increase in the supply of duck down.

According to customs data, the export volume of down filling in March 2024 was 3,431 tons, which is still at a low level. The main reason is that exports to the United States have shrunk. Fortunately, the textile industry in Southeast Asian countries is operating stably, which has expanded the demand for down and feathers. According to RMB calculations, the export volume of raw wool increased by 20% in March.

As our country's largest single export market, U.S. container imports started strongly in the first quarter of 2024. However, affected by the Chinese Spring Festival, container imports from China dropped significantly in March. On the contrary, import volume in February was not affected by the Spring Festival.

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

2017羽绒原料价格一路上涨,究竟为何?

你的羽绒服为什么钻绒?涨知识了

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

2017羽绒原料价格一路上涨,究竟为何?

你的羽绒服为什么钻绒?涨知识了

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展