Cn-down > Domestic news > News content

2024-03-03 来源:金绒 浏览量:1344

Summary

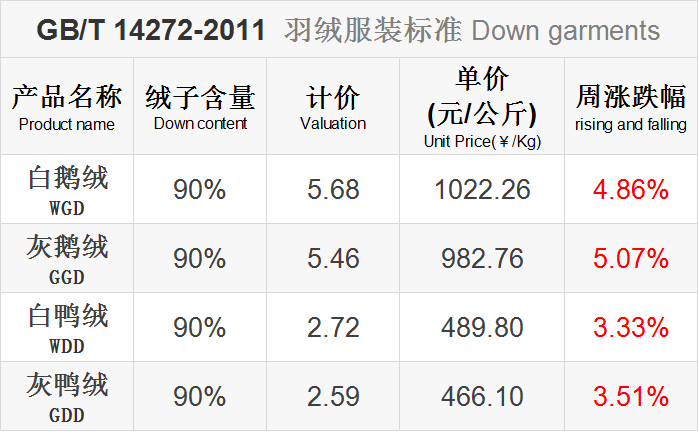

The market will generally rise in the 9th week of 2024 (2.26-3.3).

After the Lantern Festival, down production companies and product companies have started operations one after another, while the prices of feathers and down have continued to rise. Affected by two rounds of strong cold air during the Spring Festival, the sales of raw down were faster. At the same time, the slaughter volume after the holiday was less than in previous years, resulting in a short-term shortage of raw wool supply. Therefore, the down market was relatively strong despite the shortage of supply.

According to the National Climate Center, the national average temperature in February 2024 was 0.5 degrees lower than the same period in normal years. However, because the first two months were too warm, it still failed to reverse the warm winter trend. However, due to the very strong cold wave and unusually large amounts of rain and snow this winter, everyone thought it was a "cold winter", which ultimately allowed the inventory of down products to be digested well.

Data from the National Bureau of Statistics show that the output of down clothing will drop by 23.78% year-on-year in 2023. However, in the autumn and winter of that year, down jacket consumption showed signs of recovery, and the recent cold wave ushered in a sales peak for down clothing, which also extended the sales season of down clothing.

Good news this week

At the end of the previous lunar calendar, both upstream and downstream producers of white-feathered meat ducks were profitable. However, in the first week after the new year, the trends at each end began to diverge. As of February 25 (the sixteenth day of the first lunar month), the price of hatching eggs has dropped by 1.20 yuan/piece, or 37.5%, compared with February 10 (the first day of the first lunar month), while the price of ducklings has dropped by 2.80 yuan/each, or 55.45%.

Recently, the main duck seedling-producing areas have been affected by rain and snow, causing difficulties in receiving and transporting seedlings. At the same time, feed prices will resume their rise after the year. Considering poor profits, farmers are in a low mood for harvesting seedlings and it is more difficult to release contracts.

In response to the rapid decline in seedling prices, hatching eggs have experienced a decline due to weak support. At the same time, affected by rain and snow, incubation companies are not in a high mood to increase incubation. However, as the temperature gradually warms up, parent breeding poultry companies have begun to gradually increase production. The number of eggs produced by small factories has increased, and the supply side is on an increasing trend.

After the holiday, manufacturers gradually returned to normal production volumes, inventories were at a medium level, production and sales remained low, and new orders were lower than expected. And because the price of live pigs has continued to fall since the market opened during the Spring Festival, this has suppressed the sentiment for purchasing poultry meat to a certain extent.

source | Mysteel

VDFI conducted a survey on the economic conditions of the bedding and down industry in the past five years at the end of 2023, and painted a picture of opportunities amid crisis and stable prospects. Most participants commented positively on sales developments since 2018 – whether for down and feathers, man-made fibers or natural fibres.

Various trends and factors have become boosters for industry growth.In particular, the coronavirus crisis has not only upended household trends, but also boosted sales in the sector due to "cocoon living" (a closed-door lifestyle) and "hygge (Danish for comfortable feeling or environment) concepts."

The sales growth was also driven by the trending topic of sleep, increased health awareness, and the development of sustainable and environmentally friendly materials, while for many association members a further positive driver came from the expansion of online sales channels. Of course, the energy crisis has also prompted people to buy warmer winter beds and reduce heating.

Looking at the overall ranking, coronavirus, sustainability and online retail top the list of sales drivers. However, what has a significant inhibitory effect on the industry is that in some cases, the loss of Ukraine as a procurement market for down and feathers has created a large gap in the supply chain.

Natural materials remain popular with consumers, especially down and feathers, as well as natural fibers that tend to outperform petroleum derivatives when in contact with skin. At the same time, new products such as sleep monitoring apps have not yet played a central role among most older customers.

As consumers turn to natural materials and sustainability proves to be a driver of sales, the VDFI also asked companies participating in the survey whether they have undertaken, or plan to undertake, any activities to improve sustainability.

Two-thirds of participants said that the concept of circular economy has determined their product design today. Measures already in place include the use of sustainable materials (recycled fibers or down), reduction of chemicals, minimization of packaging and certification according to international sustainability and environmental protection standards.

In terms of standards, OEKO-TEX 100 is particularly important, followed by the DOWNPASS animal welfare and quality standard, and OEKO-TEX STeP. The companies also hope to impress consumers with their commitment to supply chain transparency, and a commitment to recycling and upcycling is on the agenda for the future.

source | 德国羽绒羽毛协会

Affected by the "wet and cold" weather, jackets, down jackets, heating and dehumidification appliances, etc. have ushered in a new round of consumption peaks.

In many clothing counters in the Tianyi Store of Intime Department Store, heavy down jackets and cotton-padded clothes still occupy the major position. At the sportswear brand Fila on the 4th floor, you can see that the down jackets that have been withdrawn at this time are rarely displayed in a prominent position together with spring clothes.

"Considering that this year's cold wave has not yet ended, we have left six or seven types of down jackets in the store, and the sales volume and inquiries are much higher than usual at this time. "Store staff said that due to the low temperature, some thick clothing was selling well.

“Buying thick clothes in this season is for temporary transition, and the clothes on sale are enough. ”A consumer said that several down jackets at home, which are used for keeping warm, were sent for dry cleaning during the Spring Festival. However, according to the weather forecast, there will be low temperatures for a long time, so he bought a winter coat to wear temporarily.

Warm clothing and supplies also continue to sell well on major online e-commerce platforms. According to data from special sale e-commerce company Vipshop, during this cold wave, down jackets, thermal underwear, sports sweatshirts, jackets and other warm clothing have experienced a sales peak.

From February 19th to 25th, sales of women's down jackets in Ningbo increased by 67% month-on-month, and sales of children's down jackets increased by 115% month-on-month. In addition, thermal underwear has also become one of the choices for Ningbo consumers to keep out the cold.

source | 中国宁波网

Currently, the 14th National Winter Games is being held in Hulunbuir, Inner Mongolia, adding another fuel to the "ice and snow fever". This winter, the popularity of ice and snow tourism has soared, and orders for ice and snow equipment have surged.

Weihai Yunzhen Clothing Co., LTD., established in 2019, is committed to the design and manufacture of professional ski wear, has undertaken the production and manufacture of professional sports clothing for major competitions for many times, and has long-term cooperation with Fila, Anta, Desante, Skeches and other brands.

At present, Weihai Yunzhen Clothing Co., Ltd. is carrying out the winter clothing design work in 2025. In the past, there were generally only two or three professional ski wear brand companies required to design and produce ski wear, and this year it has increased to more than a dozen brands, with dozens of styles.

"The main sales market for our clothing is in China, and the growth in the number of developed and designed products stems from the brand's optimistic judgment on the prospects of the domestic ski market." said Zhiguo, general manager of the operation and management center of Weihai Yunzhen Clothing Co., Ltd., "After years of development, Now the trends seems to have really come. "

source | 大众日报

Bad news this week

According to a Reuters report on February 27, Denmark's Maersk Line warned that disruptions to container shipping through the Red Sea will continue into the second half of this year, and cargo destined for the United States will experience serious delays and delays.

Reports say that after Houthi militants attacked ships, the world's major container shipping companies have abandoned the route through the Suez Canal via the Red Sea and instead opted for a longer route around Africa's Cape of Good Hope.

Maersk Line, a bellwether for global trade, said it had increased ship capacity by about 6% to offset delays caused by ships detouring around southern Africa. The company has also told customers, including retail giants such as Walmart and Nike, to prepare for increased supply chain costs as longer sailing times have pushed up freight rates.

Maersk Line said the detour around Africa would also mean significant delays for ships bound for the U.S. East Coast, so it advised customers to consider alternative ports in Mexico, the Pacific Northwest and Los Angeles for East Coast-bound cargo. At the same time, it may also cause delays in container ships returning to Asia for loading.

source | 参考消息网

According to a survey of waterfowl production in 23 major waterfowl-producing provinces (cities, districts) across the country, the total output value of the waterfowl industry in 2023 was 217.241 billion yuan, an increase of 2.54% compared with 2022 (the same below).

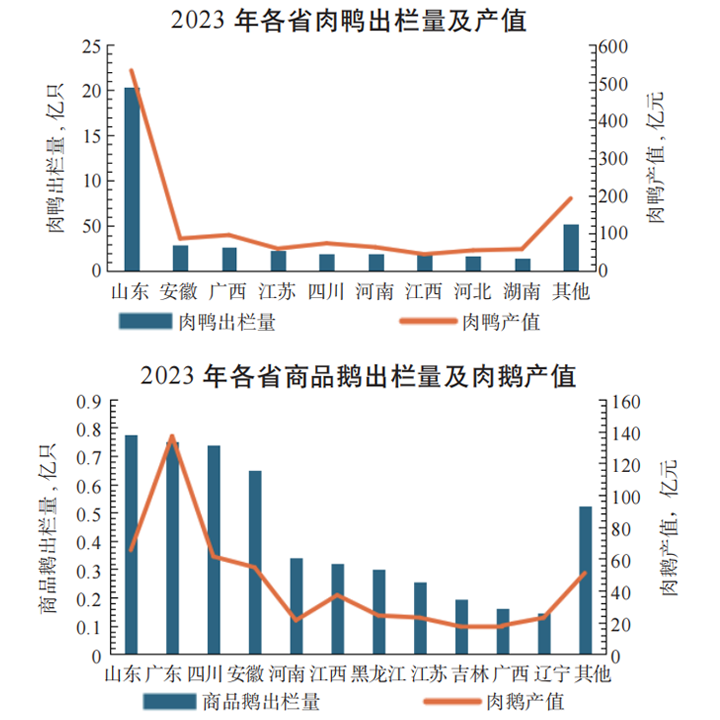

Throughout the year, 4.218 billion commercial meat ducks were sold, an increase of 5.40%; the total output value of meat ducks was 126.369 billion yuan, an increase of 5.04%. 515 million commercial geese were sold, an increase of 10.04%; the output value of meat geese was 53.172 billion yuan, an increase of 0.95%.

In 2023, the meat duck production areas are mainly concentrated in East China, with a slaughter volume of up to 2.61 billion, accounting for 62% of the country's total slaughter volume. In terms of provincial production layout, Shandong ranks first in terms of sales volume and output value, which are 7 times and 5.5 times that of Anhui and Guangxi, which ranked second.

As far as the breeding varieties of Muscovy ducks are concerned, white ducks are still the main ones, accounting for 82.75%, Muscovy ducks and half Muscovy ducks account for only 5.36%, and other local varieties account for 11.89%. Among them, Shandong ducks are all white ducks, and Guangdong is the province with the most concentration of Muscovy ducks and half Muscovy ducks in China.

In 2023, the East China region leads the pack in meat goose breeding, with a slaughter volume of about 174 million, accounting for 1/3 of the country's total slaughter volume. However, the output value of the South China region is slightly higher than that of the East China region. In terms of provincial production layout, Shandong, Guangdong, Sichuan and Anhui are the provinces with the highest concentration of commercial goose production. The total breeding volume of the four provinces accounts for 56.59% of the country's total. Among them, due to its price advantage, the output value of Guangdong's meat goose breeding is higher than that of Shandong, ranking first in the country.

At present, meat duck consumption accounts for nearly 1/3 of poultry meat consumption in my country. In 2023, our country's per capita meat duck consumption will be 5.7kg/person, a year-on-year increase of 10.6%. Goose meat only accounts for about 8% of poultry meat consumption, which is equivalent to goose meat accounting for 2% to 3% of total meat consumption. It can be calculated that the average annual goose meat demand of Chinese people is about 1.4 kg.

source | 中国畜牧杂志

News situation

This week’s news is more positive than negative.

During the 8th week (2/19-2/25), the industry estimates that the number of duck seedlings will rise to an average of about 10.5 million birds per day. However, due to the impact of rain and snow in the main duck seedling production areas, the number of duck seedlings may decline. There was a corresponding decrease and no longer growth, and the subsequent corresponding meat duck sales also decreased accordingly, causing duck down to continue to be in short supply.

In 2023, the sales volume of commercial ducks and commercial geese will both increase, but the sales volume of commercial geese is still significantly lower than in previous years. At present, the raw materials for goose down products are in short supply, so Anhui, Heilongjiang, Inner Mongolia, Jilin and other provinces are promoting the expansion of goose breeding.

A survey by the VDFI shows that down and feathers are still very popular with consumers, but the concept of circular economy has determined their operating philosophy. The EU's commitment to down recycling and upcycling may affect the import and export prospects of down.

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

2017羽绒原料价格一路上涨,究竟为何?

你的羽绒服为什么钻绒?涨知识了

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

2017羽绒原料价格一路上涨,究竟为何?

你的羽绒服为什么钻绒?涨知识了

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展