Cn-down > Domestic news > News content

2024-02-24 来源:金绒 浏览量:1570

Summary

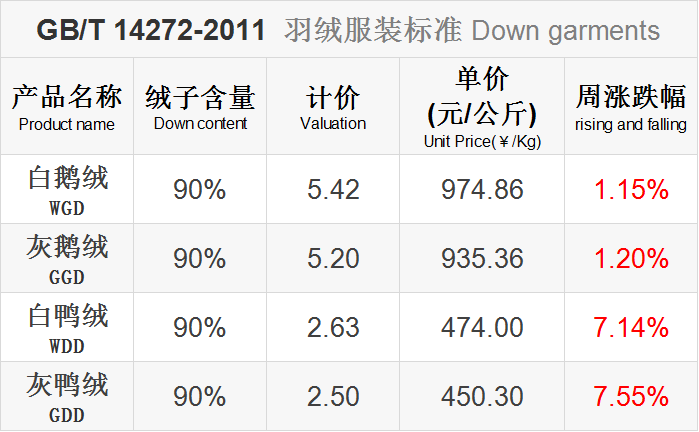

In the 8th week of 2024 (2.19-2.25), the market generally rose, and duck down rose sharply.

Currently, the raw material raw material trading has started, but the supply of raw material raw material is insufficient in the short term, so the price is relatively strong. The supply of ducklings has been obviously tight recently, and since the overall number of ducks killed after the holidays is not large, duck-killing households are generally bullish, and the price of raw material wool has increased across the board.

At the beginning of the Year of the Dragon, the cooling brought by the cold wave has made warm clothing continue to sell well. Vipshop data shows that from February 18th to 22nd, sales of down jackets in Northeast China, North China and other places increased sharply, with a 59% increase from the previous week. The impact of the current cold wave has come to an end, but due to the rainy weather, the warming process in various places is relatively slow. In addition, there will be a wave of strong cold air gaining momentum towards the south at the end of the month.

Global manufacturing is finally showing signs of recovery. Wind data shows that after being in the contraction range for 16 consecutive months, the global manufacturing PMI rebounded to 50 in January, the highest since September 2022, and sub-indicators such as new orders generally rebounded. The PMI uses 50 as the benchmark for change, and a rise to 50 indicates that the global manufacturing industry has emerged from contraction.

Good news this week

For major down jacket OEMs Quang Viet and KWONG LUNG, the first quarter of each year is traditionally the off-season for operations. However, this year’s cold weather in Europe and the United States, coupled with the uncertainty of the Red Sea voyage, has many brand customers worried about shipping schedules. As certainty increases, orders are placed in advance.

Guangyue's main customers, Nike and Adidas, had a low performance base due to inventory adjustments last year. Therefore, this year, as customers' inventory levels have decreased and orders have been purchased in advance, Guangyue believes that there is a chance that performance will improve in the first half of the year.

Guangyue's consolidated revenue in January was 865 million yuan, a decrease of approximately 10.51% compared with the same period last year. Chairman Wu Chaobi said that operations in the first half of 2024 will still be affected by inventory adjustments by brand customers. It is estimated that inventory adjustments are expected to slow down in the second half of the year, and an additional brand customer order will be added this year.

Guanglong pointed out that the winter in the northern hemisphere has been colder than before since last year, and consumers have strong demand for warm clothing. The order momentum of brand factories this year is indeed stronger than that of the same period last year. Guanglong predicts that operations in the first half of the year will recover significantly compared with the same period last year, and revenue growth is expected to reach double-digit percentages.

Guanglong's top five garment factory customers are Mont-bell, Burton, 5.11, Columbia and VOLCOM. Only Columbia's orders remain unchanged, while the other four major customers will all have double-digit annual growth. In particular, Mont-bell, the largest customer, is expected to grow by 20%, and six new customers have been added, one of which is a large European sports chain distributor, and volume will increase in the second half of the year.

At present, Guanglong has received 50% of orders throughout the year, and its main shipments are concentrated in the traditional peak seasons of the second and third quarters. Among them, the garment business aims to grow by 10-15%. If additional orders are obtained in the first quarter, it will have the opportunity to challenge growth of 15-20%.

source | 中时新闻网

On February 8, local time, the National Oceanic and Atmospheric Administration (NOAA) Climate Prediction Center reported that El Niño will transition to ENSO neutral in the spring of 2024, and then La Niña may occur in the summer of 2024. At the same time, officials announced that the ENSO outlook was under "La Niña observation."

Climate model feedback shows that El Niño has a 79% chance of reaching ENSO neutrality from April to June, and is expected to have a 55% chance of transforming into La Niña during June to August. Although forecasts tend to be less reliable in the spring, climate conditions are already conducive to the development of La Niña.

Dating back to 1950, more than half of El Niños have been preceded by an immediate transition to La Niña (after a period of neutrality). Judging from the strong El Niño phenomenon similar to the current one, five of the eight events quickly turned into La Niña events. Two years (1973 and 1998) were separated by only one month.

From a time point of view, La Niña happens to appear in the autumn and winter, so the main impact period is still in the second half of 2024. It is worth noting that from 1951 to the mid-1980s, our country experienced cold winters during La Niña events. However, in the context of global warming, winter temperatures in our country have occasionally been high during La Niña events since 1986.

source | 金绒采编自NOAA、ENSO博客

March and April are the traditional peak seasons for the textile industry. Although the popularity of "Gold Three Silver Four" is not as high as in previous years, and many orders are spread throughout the year, there are still many orders placed during this period, and dyeing factories often liquidate their positions in these two months.

According to research, currently more than 50% of textile companies have received orders as soon as the market opened in the New Year, achieving a "good start". A boss said: "We had some orders a year ago that were not ready. Now, just two days after we started work, customers are starting to rush us." Judging from the customers' anxious look, it can be seen that the orders placed those years ago are really in demand.

In January, due to the Red Sea crisis, a large number of foreign businessmen placed orders in advance, and many textile companies received orders, triggering a long-awaited wave of year-end stocking.

To accept this wave of enthusiasm, textile companies may resume work faster after the Spring Festival this year than in previous years. In the labor market, recruitment advertisements have been hung at the entrances of many factories, waiting to start working at full capacity. Once work starts, raw materials are indispensable. Before the holiday, you need to stock up, and after the holiday, buying raw materials is just what you need.

source | 绸都网、布工厂

"Family members, if you lock our down jackets and duvets, you will lock in the warmth! Top-quality goose down, water can't penetrate it!"

Zhang Susu, the person in charge of the e-commerce project, said that after several rounds of cooling this winter, sales in the live broadcast room increased by at least 20%. "Especially home textile products such as down quilts and down cushions are very popular with online consumers. Online sales doubled before and after the snowfall. "

Zhang Susu said: "The mid-to-high-end down we produce has been directly or indirectly supplied to major brands such as Canada Goose, Yalu, Bosideng, Luolai Home Textiles, and Mengjie Home Textiles; now, we hope to build our own brand and enter the public eye. "

"Let 'downstream' enterprises such as down clothing, quilts, bedding, and feather handicrafts 'move in' with their bags." Sun Qingwei, secretary of the county party committee, said that the county will strive to bring the down industry to the "step" of tens of billions.

source | 大河网-河南日报

From February 17th to 27th, the 14th National Winter Games (hereinafter referred to as "14th Winter") was held in Inner Mongolia Autonomous Region. Volunteers wearing uniform white down jackets and holding guide signs can be seen everywhere at the airport exit, hotel lobby, and venues in the main competition area.

This Winter Games is the largest in scale, with the most events and the highest standards among all previous National Winter Games. A total of more than 3,000 athletes from 35 delegations from 31 provinces, autonomous regions and municipalities, the Xinjiang Production and Construction Corps, Hong Kong and Macao regions will participate in competitive sports and group events. It will be a true "National Winter Games".

In addition, "Fourteenth Winter" also actively reaches the public. Before the opening of the "14th Winter", the "competition-style" venues and tracks at the main venue and each branch venue will continue to be open to the public, allowing ice and snow sports enthusiasts to enjoy high-quality snow and professional facilities.

The person in charge of a travel agency said that taking advantage of the "14th Winter" opportunity, the tourism industry was in the off-season in previous years. Just a few days after the Spring Festival, tour groups from the south came to Hulunbuir to experience the unique ice and snow feast. At present, "driving 300 million people to participate in ice and snow sports" is gradually moving from vision to reality, and the surge in ice and snow tourism has also driven the sales of cold-proof and warm clothing.

source | 中国新闻网、央广网

Bad news this week

In 2023, affected by factors such as shrinking external demand, weak domestic demand growth, and rising costs, the production scale of our country's garment industry has declined, and industrial added value has continued to grow negatively. However, with the improvement of my country's macroeconomic recovery and the effective implementation of a series of policies and measures to expand domestic demand and promote consumption, the domestic sales market continues to pick up.

According to data from the National Bureau of Statistics, from January to December 2023, the output of woven garments by enterprises above designated size in the garment industry was 6.556 billion pieces, a year-on-year decrease of 15.01%, and the decline was 9.86 percentage points deeper than the same period in 2022. Among them, the output of down clothing dropped by 23.78% year-on-year.

In 2023, affected by factors such as the contraction of international market demand and the intensification of the "de-Chinaization" trend, our country's clothing exports continued the slowdown in growth in the fourth quarter of last year. The downward pressure on exports increased and the export scale declined significantly. The export value of cold-proof clothing such as coats and down jackets decreased by 18.2% year-on-year respectively.

In 2024, from an international perspective, although export pressure will not ease in the short term, driven by the rebound in demand for inventory replenishment in developed countries, accelerated expansion of emerging markets, and the rapid development of new models such as cross-border e-commerce, it is expected that my country's clothing export situation will Becoming more stable; From a domestic perspective, the domestic apparel sales market is expected to continue its recovery trend, but the confidence and expectations of market entities still need to be improved.

source | 中国服装协会

News situation

This week’s news is more positive than negative.

During the Spring Festival (2/5-2/18), many companies choose to stop incubation for a few days, so the overall number of duck seedlings emerging is not large. After the new year, the emergence of seedlings will enter a rapid growth trend, and the number of seedlings emerging per day is currently estimated to be more than 10 million birds. The subsequent production of meat ducks will decrease accordingly, resulting in duck down being in short supply.

As the strong cold air continues to rage in the northern hemisphere, demand from European and American end brands is strong, and the export situation of down filling is good. Major down jacket OEM manufacturers estimate that the momentum of customer orders this year is stronger than the same period last year, and factory operations are likely to improve in the first half of the year.

The Russia-Ukraine conflict broke out on February 24, 2022, and has lasted for two full years, and there are still no signs of subsidence in sight. The recent international situation has been turbulent, and perhaps this year's foreign trade situation will be full of variables again. The downward pressure on our country's clothing exports will be difficult to alleviate in the short term.

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

2017羽绒原料价格一路上涨,究竟为何?

你的羽绒服为什么钻绒?涨知识了

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

2017羽绒原料价格一路上涨,究竟为何?

你的羽绒服为什么钻绒?涨知识了

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展