Cn-down > Domestic news > News content

2024-01-28 来源:金绒 浏览量:4770

Summary

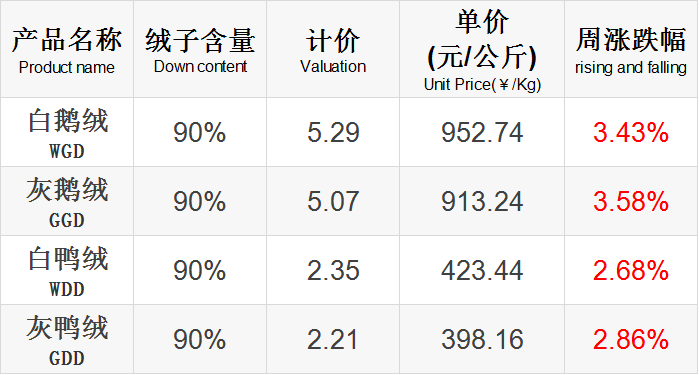

The market will generally rise in the fourth week of 2024 (1.22-1.28), and goose down will increase significantly.

On January 26, the 2024 Spring Festival transportation officially started, but the transactions in the down market have not yet subsided.

This year, goose down has been sought after in the domestic market, and the price of goose down has soared for several consecutive weeks. At present, it seems that as the slaughterhouses have stopped harvesting and taking holidays, the breeding side has also reduced the overall slaughter volume, which has greatly reduced the supply of goose in the market, and the supply of goose down has been insufficient, which has further pushed up the price.

In 2023, the overall export situation of the down industry will be under pressure, with the export quantity and value of feather and down and down clothing both falling by more than 20%.However, the export of down bedding gradually stabilized and rebounded in the second half of the year. Especially with the empowerment of new foreign trade formats such as cross-border e-commerce and overseas warehouses, home textile companies will usher in new opportunities when going overseas.

Good news this week

Duvet:

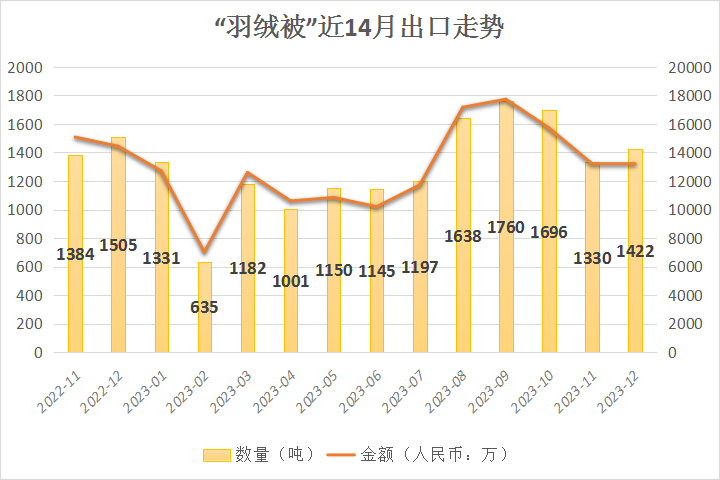

From January to December 2023, a total of 15,488.0 tons (6.34 million pieces) of "down quilts" were exported, an increase of 26% year-on-year; the export value was 1.527 billion yuan, an increase of 18% year-on-year.

In December 2023, 1,422.5 tons (530,000 pieces) of "down quilts" were exported, a decrease of 5% year-on-year; the export value was 132 million yuan, a decrease of 9% year-on-year.

In December 2023, the United States continued to be my country's largest trading partner for "down quilt" exports, accounting for 38% of total exports this month, a slightly smaller share. Among them, the export quantity was 546.7 tons, an increase of 52% year-on-year and 6% month-on-month; the export value was 51 million yuan, an increase of 42% year-on-year and 5% month-on-month.

Germany was the second largest trading partner during the month, accounting for 9% of total exports; followed by the United Kingdom at 8%, South Korea at 7%, and Australia at 6%.

Other down bedding:

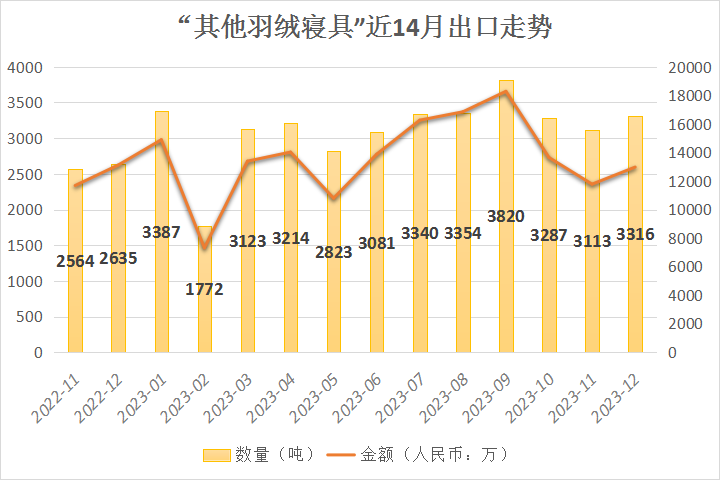

According to China Customs data, a total of 37,600 tons of "other down bedding" were exported from January to December 2023, a decrease of 11% from last year; the export value was 1.641 billion yuan, a decrease of 22% from last year.

In December 2023, 3,316.4 tons of "other down bedding" were exported, an increase of 26% year-on-year; the export value was 130 million yuan, a decrease of 1% from last year.

In December 2023, the United States was still my country's largest trading partner for exports of "other down bedding", accounting for 50% of total exports this month, a slightly higher proportion. Among them, the export quantity was 1,658.4 tons, a year-on-year increase of 39%; the export value was 59 million yuan, a year-on-year increase of 34%.

The UK was the second largest trading partner in the month, accounting for 9% of total exports; followed by Canada at 7%, Australia, Germany, Sweden and Japan at 6%, 4%, 2.4% and 2.3% respectively.

Down bedding (quilt + other bedding)

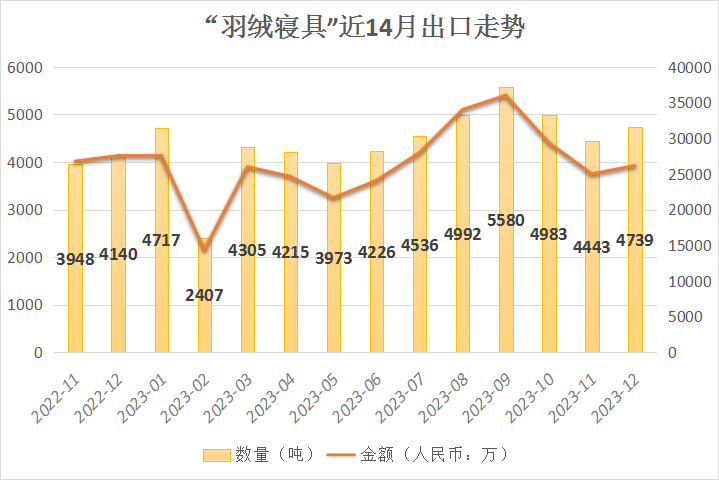

From January to December 2023, a total of 53,100 tons of "down bedding" were exported, a decrease of 3% year-on-year; the export value was 3.168 billion yuan, a decrease of 7% year-on-year.

Industry insiders believe that exports of home textile products are expected to recover faster.

Source | 金绒 整理自海关数据

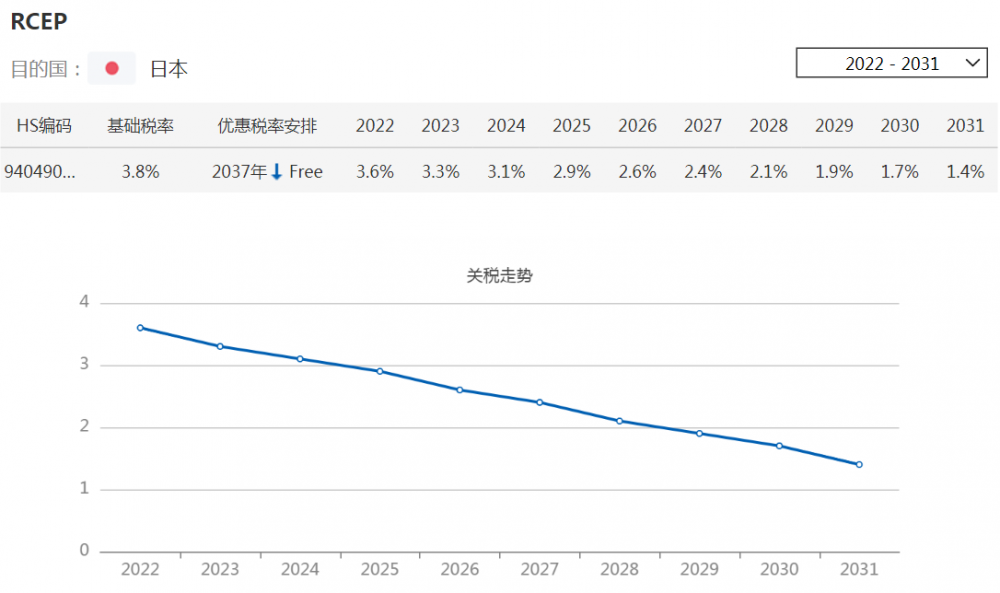

RCEP will come into effect in January 2022, and as the last member state, the Philippines, officially completed the entry into force process in June 2023, RCEP has taken effect for all 15 agreement member states, and the scope of benefits has been further broadened.

Last year, the export value of Nanjing Customs RCEP visa was 33.303 billion yuan, ranking first in the country. Relevant enterprises can enjoy 499 million yuan in tariff concessions from other RCEP member states. The export goods that enjoy the benefits mainly include clothing, chemicals, plastics and their products.

The traditional clothing and textile industry has benefited the most in Changzhou.Taking exported down jackets as an example, the tariff reduction in Japan under RCEP has been expanded from 0.8% in the initial implementation to 2.4%. It is expected that Japan will launch the fourth round of RCEP tax reductions from April this year, and the prospects for enjoying preferential treatment for clothing products exported to Japan are good.

In addition to down clothing, other down products will also have varying degrees of reductions and exemptions again after April this year.

The tariff on down quilts exported from China to Japan is reduced from the basic tax rate of 3.8% to 3.1%. Since the agreement came into effect, tariffs on products under this tax code have been reduced in equal proportions 16 times each year, and will be reduced to zero after 16 years.

The tariff on sleeping bags exported from China to Japan is reduced from the basic tax rate of 3.8% to 2.8%. Since the agreement came into effect, tariffs on products under this tax code have been reduced in equal proportions 11 times each year, and will be reduced to zero after 16 years.

source | 南京海关发布、RCEP关税查询平台

This winter, "cold" ice and snow continue to release "hot" vitality and are serving as a new growth point for consumption, driving "hot" multiple industrial chains. Among them, the consumption of winter clothing such as down jackets and ski suits has surged, injecting development vitality into the textile industry chain in Jiangsu, Zhejiang and other places during this winter.

"The recent booming ice and snow economy has boosted the polyester end industry chain.Clothing downstream generally reported that orders increased before the year, on the one hand, spring clothing orders, and on the other hand, ski clothing. Some factories said that due to the large number of orders, factory operations will continue until the year before." Analysts said.

Polyester fiber, also known as polyester. According to reports, consumer clothing categories such as down jackets and ski suits are end applications of polyester fiber, and the ice and snow economy has boosted demand for this product. Analysts said that since the end of November 2023, there has been an "explosion" in down jacket linings, and the prosperity of the lining industry has reached its peak in the past few years.

According to industry insiders, the reason behind the enthusiasm of the textile industry to follow "Erbin" is that the demand at the end of the industrial chain is "not weak in the off-season." In the long run, as domestic and foreign demand is expected to improve, the profitability of midstream and downstream products in the textile industry may improve.

source | 新华财经

With the arrival of multiple rounds of cold air, the country has started a quick-freezing mode, while the down industry is "heated up". As the "Hometown of Down in China" and the largest feather and down distribution center in the country, Wuchuan's sales of down products have surged, and the price of goose down has increased year-on-year.

"According to statistics, this winter, the sales volume of Wuchuan down products has increased by about 50% year-on-year." Wu Yu, operations director of CN-DOWN, said excitedly. Down Gold Network is a senior domestic down industry website, and the latest industry information it provides has become a benchmark for the world's down market.

"The price of goose down raw materials has been rising, by about 30%." Wu Yu analyzed, "In addition to the cold weather this year, it is also because consumers are more pursuing quality and tend to choose better quality down, especially goose down. "

Providing high-quality down is the "specialty" of Wuchuan's down industry. Wu Yu said: "Wuchuan mainly deals in the high-quality down raw material market, while the finished down products tend to be in the down home textile market, such as down quilts. "

The quality of down is directly proportional to the breeding time of ducks and geese. If the breeding time is longer, the feathers will be plumper, the quality of the down produced will be better, and the fluffiness of the down will be higher.

Chen Wenjian, president of the Wuchuan Down Association, said that the commonly used duck feathers in Wuchuan are those of Muscovy ducks. The breeding time of Muscovy ducks is generally 90 to 95 days, and the breeding time of local geese is also more than 90 days, which is the highest quality of duck and goose feathers. Quality has laid the foundation. "It is understood that the only large-scale Muscovy duck breeding is in western Guangdong. For example, the number of Muscovy ducks in Zhanjiang and Maoming has exceeded 100 million. "

source | 南方日报

The Spring Festival is approaching. Although it is raining and snowing outside, the Huangyuan Clothing Market is a bustling scene, and citizens are very enthusiastic about buying new clothes. The person in charge of the market said: "Since New Year's Day, more and more citizens have chosen to buy new clothes for the New Year in the market. "

Ning Yan, a business owner who has been doing women's clothing wholesale business, said that currently all long down jackets are on sale in the store. The average retail price is only more than 200 yuan, and more than 900 pieces can be sold in wholesale in a day. "Now all the down jackets are in clearance. We are preparing for new models to be launched in subsequent stores. ”

The men's clothing market also ushered in a sales peak before the Spring Festival. “The temperature has just cooled down recently. Now our brand’s store in Huangyuan Market can sell thirty or forty down jackets a day, and the promotional products hanging outside the store can also sell seventy or eighty pieces. We strive to basically clear out all winter styles before the Lunar New Year. "Operator Lin Fangqin said, very busy.

This year's "national trend" fashion has also been "blown" into the design of children's clothing. In the children's clothing area on the fifth floor, business owner Ye Lili said that the price of "national fashion" children's clothing is slightly higher and many customers like it, but it is not considered a hot-seller in the store. Thick coats such as down jackets are still more popular.

"There is a new red Chinese-style down jacket that has become a hot item. I have replenished it more than 10 times, and ordered at least more than 200 pieces in a single replenishment." said Zhu Xiaoqing, who runs women's clothing in Yiwu Huangyuan Clothing Market, in addition to retail sales business, many merchants from surrounding counties and cities are also rushing to restock before the market closes.

Chen Zhisheng, marketing manager of the market, said: "It has not yet reached the peak retail period. When schools and companies start holidays, the peak passenger flow of the year will be ushered in, and the average daily passenger flow in the market is expected to reach about 40,000. "

source | 爱义乌、金华日报

Bad news this week

In December 2023, a total of 2.362 million pieces of down clothing were exported, a decrease of 37% from November this year; the export value was 450 million yuan, a decrease of 32% from November this year.

Down jacket export list in December 2023

| 商品 名称 | 数量 (万件) | 人民币 (亿元) | 数量同 比去年 | 金额同 比去年 |

| 棉制男 羽绒服 | 16.8 | 0.30 | -87.4% | -82.7% |

| 化纤制男 羽绒服 | 66.9 | 1.57 | -48.7% | -51.7% |

| 棉制女 羽绒服 | 14.3 | 0.22 | -87.0% | -82.2% |

| 化纤制女 羽绒服 | 138.2 | 2.41 | -40.8% | -49.3% |

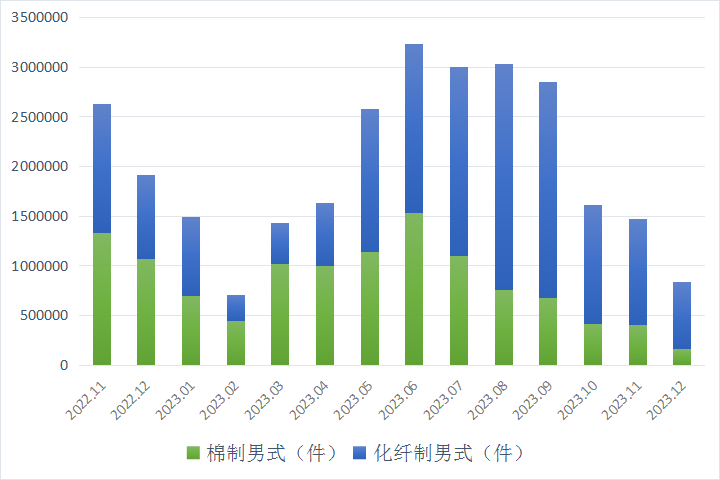

Export situation of men's down jackets in the past 14 months

Export situation of women's down jackets in the past 14 months

It can be seen from past data that the export of down clothing has exited the peak season, and the export volume in December fell by 61% compared to the same period last year.

Looking at the situation in the past nine years, September is basically the end of the annual export season, and the export volume of down jackets will decrease month by month thereafter. At the same time, the export of cotton down jackets has been affected by China's ban on the overseas circulation of cotton, and the overall export situation is not as good as in previous years.

In terms of imports, in December 2023, a total of 302,000 pieces of down clothing were imported, a decrease of 24.6% from the previous month; the import value was 450 million yuan, a decrease of 24.4% from the previous month.

source | 金绒采编 数据来自海关

According to a latest report from the Danish "Sea Intelligence" consulting company, the weekly Red Sea shipping capacity index fell by 57% in December last year compared with the annual average, exceeding the 47% decline in March 2020 at the beginning of the new crown epidemic.

The report believes that frequent attacks on merchant ships in the Red Sea have had a serious impact on the global supply chain, exceeding the initial impact of the COVID-19 epidemic.

The Red Sea has always been an important waterway connecting Asia, Europe and Africa. Shipping companies have changed routes, resulting in rising ocean shipping costs and weeks-long delays, disrupting the global logistics supply chain and affecting many industries.

According to the "Nihon Keizai Shimbun" report, on the routes connecting Europe, the United States and Asia, the transportation of about 47% of toys, 40% of home appliances and clothing may be affected by rising freight rates and delayed arrivals.

source | 维运网、搜航网

News situation

This week’s news is more positive than negative.

During the third week (1/15-1/21), the industry estimates that the average number of duck seedlings emerging is about 7.8-8.4 million birds per day, which is recovering rapidly compared with the previous week. In mid-December, the duck industry in the north was in a stagnation or parking period. During the corresponding period in late January, the number of meat ducks sold decreased accordingly, resulting in duck down being in short supply.

RCEP is about to usher in a new round of tariff reductions. At the same time, Japan, a key export market for down products, is expected to usher in an interest rate hike in April. As a result, the depreciation trend of the yen may not last long, which can promote the country's import business.

As the "throat" of international shipping, continued tension in the Red Sea has posed severe challenges to the global supply chain. In addition, it has indirectly impacted the supply chains in Europe and the United States, causing delays in product shipments and even forcing some factories to shut down. Currently, the impact of the Red Sea crisis is gradually emerging, including rising costs, supply cuts of raw materials, and extended delivery times.

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

2017羽绒原料价格一路上涨,究竟为何?

你的羽绒服为什么钻绒?涨知识了

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

2017羽绒原料价格一路上涨,究竟为何?

你的羽绒服为什么钻绒?涨知识了

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展