Cn-down > Domestic news > News content

2024-01-21 来源:金绒 浏览量:1315

Summary

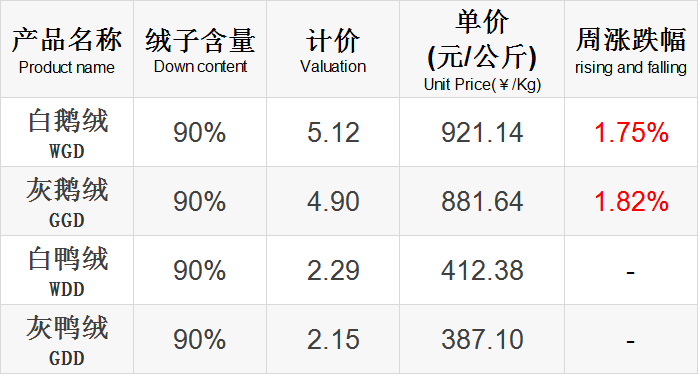

In the third week of 2024 (1.15-1.21), the market for duck down was stable and goose down surged.

High-end goose down clothing has been favored by consumers this winter. In order to follow the market trend, many clothing companies have started preparation and production of this category.

On January 20, our country ushered in the last of the twenty-four solar terms - the Great Cold. Coincidentally, the first cold wave in 2024 will affect most areas of our country at the same time, bringing strong winds and cooling weather.As the weather turns colder and the Spring Festival approaches, sales of down products may pick up. And according to the forecast of the Central Meteorological Observatory, there will be another strong cold air process after the 27th.

According to customs data, clothing exports stabilized and improved in December, with an increase of 4.7% in RMB terms. Unfortunately, the export of down clothing is still stagnant, while the export of down filling is barely maintained. Only the export of down bedding has rebounded, showing good market prospects.

Good news this week

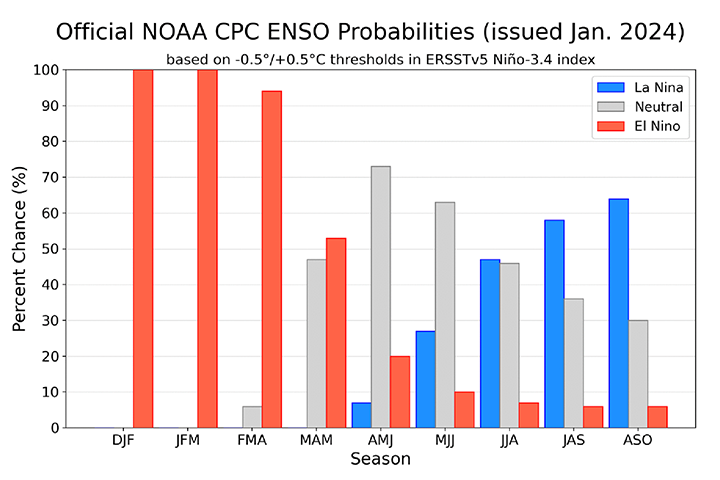

On January 11, local time, the National Oceanic and Atmospheric Administration (NOAA) Climate Prediction Center reported that the El Niño phenomenon will gradually weaken and then transition to ENSO neutral in the spring of 2024.

Some climate models report that El Niño can transition to ENSO neutral as early as March to May 2024, but the climate agency prefers to postpone this time and strongly supports a time of April to June 2024. Although El Niño will weaken, its impact on global climate will continue in the coming months.

At the same time, the probability of La Niña also increases in the seasons following the transition to neutral ENSO. With many computer climate models predicting the development of La Niña, there will be a greater than 50-60% chance of La Niña occurring by late summer/autumn in the Northern Hemisphere.

Climatologist Cordero said that according to the natural El Niño-Southern Oscillation phenomenon cycle, the La Niña phenomenon will begin to appear. He also pointed out that the intensity of La Niña is generally lower than that of El Niño, but it may also occur for several consecutive years, and La Niña has a regulating effect on temperature.

source | 金绒采编自NOAA、ENSO博客

Quang Viet, a major down jacket OEM, announced that its consolidated revenue in December 2023 was 806 million yuan, an annual decrease of approximately 48.19%, mainly due to the off-season effect; consolidated revenue in 2023 was 16.55 billion yuan, an annual decrease of approximately 17.51%

Chairman Wu Chaobi recently said that the first quarter of this year is "budding and the flowers have not yet bloomed", but it will gradually get better from the second quarter and resume annual growth, and is expected to grow in 2024.

Quang Viet is expected to invest US$20 million this year to add 8 new production lines at the Long An factory in Vietnam, 5 new production lines at the Cu Chi factory and Tien Giang factory in Vietnam, and 2 new production lines each at the Romanian factory, Jinhong factory and Jinhan factory in Vietnam.It is estimated that 24 new production lines will be added in 2024. In 2025, the Jordan plant and the Long An plant in Vietnam will be the focus of expansion, with 10 new production lines each.

KWONG LUNG, another major down jacket OEM, had consolidated revenue of 386 million yuan in December 2023, a monthly decrease of 13.2% and an annual decrease of 21.1%. In the fourth quarter of last year, consolidated revenue was 1.309 billion yuan, a quarterly decrease of 40%. A decrease of 39.2%. Last year’s consolidated revenue was 7.708 billion yuan, an annual decrease of 25.2%.

For this year, Guanglong Garment will add 6 new customers. One of them is a large European sports chain distributor (similar to Decathlon) and is expected to start increasing sales in the second half of the year. The performance of existing major customers, including ski clothing brand BURTON and Japan's largest functional clothing brand mont-bell, is expected to increase by 10% to 20% compared with last year. At present, 50% of garment orders have been received, and it is expected that performance will recover more significantly in the second half of the year.

In addition to the progress in production capacity expansion, Guanglong's new production lines in Vietnam and Indonesia will be added to the production line in the first quarter of this year. Among them, the Indonesian production line has a production cost advantage and mainly targets large-scale distributor customers, which is advantageous for obtaining larger orders.

source | 中时新闻网

According to news from the General Administration of Customs on January 12, calculated in RMB (the same below), in 2023, china's total import and export value of goods trade will be 41.76 trillion yuan, a year-on-year increase of 0.2%. Among them, exports were 23.77 trillion yuan, an increase of 0.6%; imports were 17.99 trillion yuan, a decrease of 0.3%.

In December this year, china's total import and export value was 3.81 trillion yuan, a year-on-year increase of 2.8%. Among them, exports were 2.17 trillion yuan, a year-on-year increase of 3.8%; imports were 1.63 trillion yuan, a year-on-year increase of 1.6%.

Wang Lingjun, deputy director of the General Administration of Customs, said that last year, china's import and export scale increased quarter by quarter, reaching 9.69 trillion yuan in the first quarter, and more than 10 trillion yuan in the second, third and fourth quarters. Among them, the three months in the fourth quarter increased by 0.8%, 1.3%, and 2.8% year-on-year respectively, and the growth rate expanded month by month. In December, imports and exports reached 3.81 trillion yuan, and the monthly scale hit a record high.

Analysts said that multiple data show that external demand is still under pressure. Before the global inventory cycle resonates upward, the trend of trade demand changes in various regions will continue to be quite different for some time. However, considering that china's export share advantage is still there, and the base is low in the same period last year, export growth continued to pick up in December.

For 2024, analysts generally expect that export growth is expected to turn slightly positive. Cinda Securities believes that judging from global economic trends, global GDP growth may continue to slow down in 2024, but trade growth is expected to bottom out and rebound. With the resonance of the U.S. replenishment and global manufacturing bottoming out, the factors that suppressed China's exports last year are expected to be alleviated in 2024.

In December, china's textile and apparel exports to the world were 181.19 billion yuan, a year-on-year increase of 5.5% and a month-on-month increase of 6.7%. Among them, textile exports were 80.35 billion yuan, a year-on-year increase of 6.4%, and a month-on-month increase of 0.7%; clothing exports were 100.84 billion yuan, a year-on-year increase of 4.7%, and a month-on-month increase of 12.0%.

source | 金绒采编自海关总署、界面新闻

A wave of year-end orders has kept weaving factory owners busy. A boss said: "228 Taslan has been selling very well these days. The raw material price has increased by 1,000 yuan/ton, and the fabric price has also increased by 1 cent. Now it costs 4.34 yuan. Nylon silk is also easy to sell, with 380 yuan per ton. It used to be two dollars and a half, but now it’s two dollars and a half.”

Not only weaving manufacturers are very busy at the moment, but so are raw material manufacturers. A boss said that the cotton yarn in the factory is currently very tight, and the price is also rising. What’s even more exaggerated is that some manufacturers have even placed orders until April or May!

Generally speaking, orders are usually placed at the end of the year, and queuing up for price increases is really uncommon. Only the so-called "good start" after the year can usher in raw material prices and queues at weaving and dyeing factories. The price increase and queues came a bit early this year.

Although the size of most orders is still small, the quantity is quite considerable. Some textile companies have directly postponed their holidays and even announced a series of incentive measures. A pongee textile company said: "Our machines are currently fully operational and we are preparing to have holidays until the end of the year. The holiday time will be similar to previous years. "

source | 绸都网

Bad news this week

There are reports that as the situation in the Red Sea heats up, container freight rates on some "Asia-Europe" routes have soared nearly 600% recently. At the same time, in order to make up for the impact of the suspension of the Red Sea route, many shipping companies are moving ships on other routes to " Asia-Europe" and "Asia-Mediterranean" routes, which in turn drives up shipping costs on other routes.

According to reports on the Loadstar website, the price of space on the China-North Europe route in February was staggeringly high, with the freight rate per 40-foot container exceeding US$10,000. In addition, the shortage of empty container equipment and the drought in the Panama Canal have also pushed up the freight rates of the trans-Pacific route. Since the end of December last year, the average freight rate of "Asia-US East" has increased by 36%, reaching about US$4,200 per 40 feet.

Shippers are scrambling to place orders in advance to mitigate the impact of longer transit times from Asia to Europe. However, due to delays in the return voyage, the supply of empty container equipment in Asia is extremely tight, and shipping companies are limited to large-volume "VIP contracts" or shippers willing to pay high freight rates.

Even so, there is still no guarantee that all containers delivered to the terminal will be shipped before Chinese New Year on February 10. This is mainly because the carrier will give priority to spot goods with higher freight rates and postpone contracts with lower prices.

source | 海运网、央视财经

Recently, the Shandong Provincial Animal Husbandry and Veterinary Bureau released estimates of the cost and benefit of livestock and poultry breeding in the fourth quarter of 2023. Meat duck prices fluctuated and overall profits declined.

However, Yang Jingchao, an expert at the Shandong Provincial Animal Husbandry Station, predicts that meat duck prices are expected to strengthen seasonally in the first quarter of 2024.

He said that in January, driven by the demand for stocking during the Spring Festival, the price of meat ducks was more likely to rise; in February, affected by the Spring Festival holiday, the operating rate of slaughtering enterprises declined. In addition, the supply of meat ducks may be relatively sufficient, and the market supply exceeds demand, and the price of feather ducks may Showing a downward trend; the supply will tighten again in March, and the price of ducks may rise.

"With the start of stocking up before the Spring Festival, demand will be strong. Based on the changes in catering revenue in total social retail sales in 2023, the recovery trend of the catering side will be obvious in 2024." Yang Jingchao analyzed.

source | 齐鲁晚报网

Market news situation

This week’s news is more positive than negative.

During the second week (1/8-1/14), the industry estimates that the average number of duck seedlings emerging is about 3.1-4 million birds per day, which is on the rise compared with the previous week, and may return to 8 million per day in the next week. In addition, the meat duck market will enter the peak period of the year, which will increase the supply of raw wool again, which may affect the price of duck down.

Meteorologists predict that after three consecutive La Niña winters in the past turned to this year's El Niño, 2024 will quickly switch back to La Niña. If the prediction is accurate, the elevated global temperature will turn around in the next few months, and the prediction will also affect the business decisions of various industries around the world.

Although exports to the world have been hovering at low levels, Vietnam's current demand for down and feathers is rising. Major down jacket OEMs believe that starting from the second quarter of this year, they will gradually get better and resume production to the peak of previous years, and are expected to see positive growth in 2024.

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

2017羽绒原料价格一路上涨,究竟为何?

你的羽绒服为什么钻绒?涨知识了

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

2017羽绒原料价格一路上涨,究竟为何?

你的羽绒服为什么钻绒?涨知识了

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展