Cn-down > Domestic news > News content

2024-01-01 来源:金绒 浏览量:1564

Summary

In the 53rd week of 2023 (12.25-12.31), the market was overall stable, with goose down falling slightly.

This week has entered the final stage of 2023. Clothing and product factories are gradually closing down. Therefore, the purchase demand for down is slowly declining, and the stocking of washing factories is also nearing completion.

The weather in January still has a significant impact on the down products market, but temperatures are currently rising in most parts of the country

Recently, the proportion of new coronavirus JN.1 mutant strains has increased rapidly around the world and has become the main epidemic strain. In China, as the New Year and Spring Festival are approaching, the Spring Festival transportation is approaching, and the movement of people and gathering activities have increased, which may increase the risk of spreading infectious diseases and help the JN.1 mutant strain develop into the dominant epidemic strain of the domestic new coronavirus.

Good news this week

On December 26, local time, the Office of the United States Trade Representative (USTR) announced that it would once again extend the "Section 301" tariff exemption period for 352 Chinese imported goods that have resumed tariff exemptions from December 31 this year to May 31, 2024.

A statement from the Office of the U.S. Trade Representative stated that it will solicit public opinions on whether the scope of specific exemptions needs to be further extended starting from January 22, 2024, and the window for soliciting opinions is scheduled to close on February 21. The final decision could affect whether to extend tariff exemptions beyond May 31.

In October 2021, U.S. Trade Representative Dai Qi announced that it planned to re-exempt 549 Chinese imported goods from tariffs, but in the end only 352 of the 549 Chinese imported goods were confirmed. These include three products: "feather filling", "down filling" and "cotton pillows filled with duck down or goose down".

| 税号及产品描述 |

美国税号: Feathers(Meeting both test standards 4 and 10.1 of Federal Standard 148a promulgated by the General Services Administration) 羽毛(符合总务管理局颁布的联邦标准148a第4和10.1条的试验标准) |

美国税号: Down(Meeting both test standards 4 and 10.1 of Federal Standard 148a promulgated by the General Services Administration) 羽绒(符合总务管理局颁布的联邦标准148a第4和10.1条的试验标准) |

| 美国税号: Pillow shells of cotton, each filled with goose or duck down 填充鸭绒或鹅绒的棉质枕头 |

In addition, among the 549 imported commodities that are not included in the 352 exemption lists, there is still 0505.10.0060 goose and duck feathers for filling (cleaned, disinfected or preserved without further processing).

source | 美国贸易代表办公室

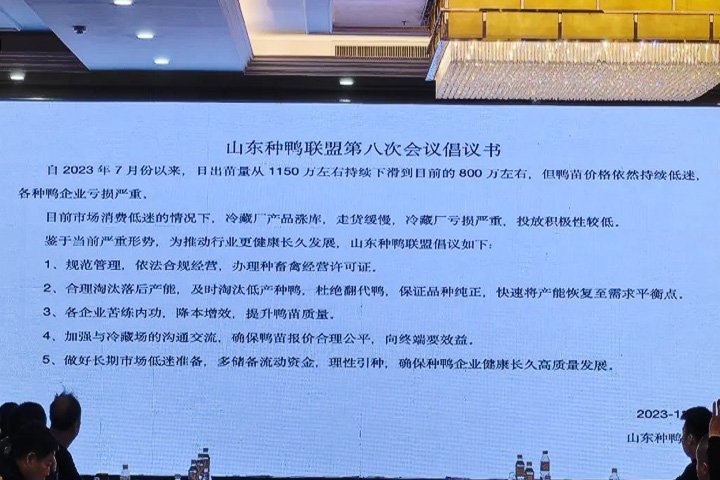

From December 18th to 19th, the eighth exchange symposium of the Shandong Breeding Duck Alliance was held in Weifang.On December 18th and 19th, the meeting focused on improving the quality of ducklings, appropriately reducing production capacity, as well as the next steps of the alliance’s work focus and the alliance’s reelection. A total of more than 90 people attended the meeting.

Liu Changsheng, chairman of the Shandong Breeding Duck Alliance, recalled that under normal circumstances, the number of seedlings emerging per day is around 8 million, and duck breeding companies should be profitable. The second half of each year is the peak consumption season for duck products, but this year consumption continues to be sluggish, the cold storage plant is also suffering serious losses, and the entire industry chain has entered a "cold winter."

Sun Yetao, the marketing director of Qiangying Group, said that the daily sprouting volume in July was around 11.5 million, and currently there is still a loss of around 8 million, which reflects that the current situation is very serious. In addition, the amount of eggs in stock is still relatively large, and it may take some time to digest. It is recommended to reduce the stock of hatching eggs.

Manager Xu Kai of Hemei Group said that the current average inventory of cold storage plants is about 2,000 tons, which is equivalent to one month's production capacity. At present, the delivery of goods is slow. Although the price of ducklings is low, farmers are not very enthusiastic. For now, the contract policy of farmers is the lowest.

During the meeting, colleagues in the industry reached a consensus on measures to reduce production capacity in response to the current industry status, and jointly drafted and released the "Proposal for the Eighth Meeting of the Shandong Breeding Duck Alliance"

The "Proposal" proposed that we should rationally eliminate backward production capacity and eliminate low-yielding breeding ducks in a timely manner; eliminate overturned ducks to ensure the purity of the breed; quickly restore production capacity to the demand balance point, and prepare for long-term market downturns;

source | 山东种鸭联盟信息平台

Data compiled by Descartes Datamyne, an American research company, show that in November, Asia’s maritime container transportation volume to the United States increased by 13% year-on-year to 1.493964 units (converted to 20-foot containers). The transportation volume exceeded the previous year for three consecutive months.

In the United States, import demand, which has slowed down due to excess inventory in the retail industry and other reasons, is currently recovering, and consumer goods, which declined significantly in 2022, are also picking up. All the top 10 categories by transportation volume exceeded the previous year, especially toys, sports equipment (up 30%) and clothing (up 12%).

Although transport volumes maintained a recovery trend, this was largely due to the low base of comparison in the previous year. Executives of large shipping companies said that it is not expected that full recovery of cargo transportation will occur until the second half of 2024.

From the perspective of loading areas, transportation volume from mainland China, which has the highest share, increased by 13%; followed by South Korea, which increased by 10%; Vietnam, which increased by 32%; and Singapore, which increased by 19%. Taiwan, Malaysia, Hong Kong and other places were lower than the previous year.

source | 日本经济新闻社

Bad news this week

Duvet:

From January to November 2023, a total of 14065.5 tons (5.81 million pieces) of "down quilts" were exported, a year-on-year increase of 30%; the export value was 1.395 billion yuan, a year-on-year increase of 21%.

In November 2023, 1,330.3 tons (530,000 pieces) of "down quilts" were exported, a decrease of 4% compared with the same period last year; the export value was 132 million yuan, a decrease of 12% compared with the same period last year.

In November 2023, the United States continued to be our country's largest trading partner for "down quilt" exports, accounting for 39% of total exports this month, a sharp reduction in its proportion. Among them, the export quantity was 518.0 tons, an increase of 8% year-on-year, and a decrease of 36% from October; the export value was 49 million yuan, a decrease of 4% from the same period last year, and a decrease of 25% from October.

The UK was the second largest trading partner during the month, accounting for 11% of total exports; followed by Germany at 8%, Japan and South Korea both at 6%.

Other down bedding:

According to China Customs data, a total of 34,300 tons of "other down bedding" were exported from January to November 2023, a 14% decrease from last year; the export value was 1.511 billion yuan, a 24% decrease from last year.

In November 2023, 3112.6 tons of "other down bedding" were exported, an increase of 21% over last year; the export value was 118 million yuan, an increase of 0.8% over last year.

In November 2023, the United States was still our country's largest trading partner for exports of "other down bedding", accounting for 47% of total exports this month, a slightly smaller share. Among them, the export quantity was 1,465.5 tons, a year-on-year increase of 29%; the export value was 47 million yuan, a year-on-year increase of 27%.

The UK was the second largest trading partner during the month, accounting for 11% of total exports; followed by Germany at 7%, Australia, Canada, South Korea and Japan at 5%, 4%, 3% and 2% respectively.

Down bedding (quilt + other bedding)

From January to November 2023, a total of 48,400 tons of "down bedding" were exported, a decrease of 4% year-on-year; the export value was 2.906 billion yuan, a decrease of 7% year-on-year.

According to data from the U.S. Department of Commerce, affected by the Thanksgiving and Black Friday shopping festivals in November, U.S. retail sales growth turned from negative to positive, with a month-on-month increase of 0.3% and a year-on-year increase of 4.1%. This once again shows that although the economy is showing signs of cooling, U.S. consumer demand remains resilient.

source | 金绒 整理自海关数据

Due to the sudden drop in temperature some time ago, the down jacket market in Pinghu was extremely hot, with express delivery even delivering more than 1 million pieces a day! But this time, Pinghu Express stopped accepting orders because the return packages could not be delivered at all!

Because it is online shopping, the quality and upper body effect of the clothes cannot be intuitively felt. It is easy for the picture to be inconsistent with the actual product or the upper body effect is not good. Therefore, in the era of e-commerce, clothes sold by clothing companies are likely to be returned to their hands soon after.

Next, the possibility of clothing companies repeating orders is very small. A large number of clothing packages have been returned, and basically all the market points this year have passed. The peak period of demand has ended. Many factories have even reduced their workload and production, waiting for next year's market situation.

In fact, consumers' consumption habits of down jackets are generally before the weather gets colder. To put it bluntly, the market situation in November should have been "Golden Nine and Silver Ten". However, the weather has not been cold enough, so it has been postponed to November. It seems that the peak season is not busy. It’s not as bad as the off-season.

source | 布工厂

"The impact of the weather is not just a little bit. When the weather gets cold, the number of people in the live broadcast room will immediately increase." After selling down jackets online and offline for more than ten years, Ajie, the owner of Xuemo Clothing, became more sensitive to temperature changes after switching to live broadcasting.

On December 17, 10 days had passed since the heavy snow festival, and the cold wave was "late but arriving." On social media, "Southerners finally bowed to down jackets" became a hot search topic. Ajie said that since the temperature dropped on the 13th, the number of people in the live broadcast room has increased three times, and orders have increased significantly.

In the perception of some small and medium-sized businesses, the impact of the early "warm winter" is relatively limited. Many Pinghu down jacket owners said that at present, the wholesale situation of stores is similar to previous years. In mid-December, a boss said bluntly: "Where is the warm winter? This year is a leap month. This is the beginning of November in the lunar calendar. "

For now, Zhang Feng, general manager of Pinghu Fulda Garment Co., Ltd., said that sales are good now, but a little lower than before, because their peak season is basically from mid-October to mid-November and there were many customers who came in before, but now they may have dropped back due to the temperature.

Lin Yiquan, the Pinghu person in charge of the wholesale store "Han Yue", said that December is not the time when there are the most people, and those who come now are basically for restocking. It was overcrowded in November, and he had to stand at the door to maintain order. When the store was full, he would not let people in. He had to wait for the previous batch of customers to come out before the next batch could enter.

The discrepancy between public perception and industry perception may stem from the different "winter time" this year from previous years. Uniqlo also mentioned that "winter in South China this year is later than usual, and new winter clothing is released two months later than nationwide."

source | 每日经济新闻

According to the "Nihon Keizai Shimbun" report, in Europe, the Christmas shopping season is ushering in changes. According to reports, the inflation caused by the Ukraine crisis has caused personal consumption to continue to be sluggish, and more and more people are beginning to worry that the pace of European economic recovery will become slower.

Forecasts show that as of the end of December, German retail sales fell by more than 5% year-on-year; in the UK, as people tend to live frugally, the trend of reducing shopping is spreading; the French, who spend the most down jackets every year, have an average budget for this Christmas: It decreased by 3% last year, with the largest proportion of people answering to cut clothing expenses, reaching 24%.

On Friday (December 22) local time, the White House stated that it was paying close attention to the Houthi armed forces’ attacks on ships in the Red Sea and that tensions in the Red Sea were not expected to have a major impact on the supply of products during the U.S. holidays. Starting from Thanksgiving in November, to Christmas in December, and then to New Year's Day, it is the holiday shopping season in the United States.

In recent times, Yemen's Houthi armed forces have repeatedly attacked ships in the Red Sea and nearby waters, forcing many shipping companies to choose to bypass the Cape of Good Hope at the southern tip of Africa. As a result, not only will transportation time increase, but fuel costs and insurance premiums will also increase significantly. Rising shipping costs have stoked fears of a resurgence in inflation.

source | 浙江贸促、参考消息网、财联社

Market news situation

This week’s news is slightly more negative than positive.

During the 52nd week (12/18-12/24), the industry estimates that the average number of ducklings emerging is approximately 4 million birds per day, which is a significant decrease compared to the previous week. Judging from the current time period, it is gradually approaching the suspension or parking period, and will continue to decline significantly.

China's textile and apparel market is "30% dependent on domestic demand and 70% dependent on exports." However, since this year, the ordering speed of foreign end customers has slowed down significantly. The good news is that the United States has extended tariff exemptions for 352 items of Chinese imported goods. In response to the previous tariff exemptions, the export situation of down, feathers and their products to the US market has improved.

Recently, the security situation in the Red Sea and nearby waters has been unstable, and the Suez Canal has been disrupted several times in history, which has lengthened shipping distances and pushed up freight rates. Asia may also be affected by a shortage of empty containers. Moreover, if there is a shortage of energy supply, it will lead to more serious inflation problems, which will ultimately affect the recovery process of global trade.

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

2017羽绒原料价格一路上涨,究竟为何?

你的羽绒服为什么钻绒?涨知识了

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

2017羽绒原料价格一路上涨,究竟为何?

你的羽绒服为什么钻绒?涨知识了

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展