Cn-down > Domestic news > News content

2023-12-17 来源:金绒 浏览量:2664

Summary

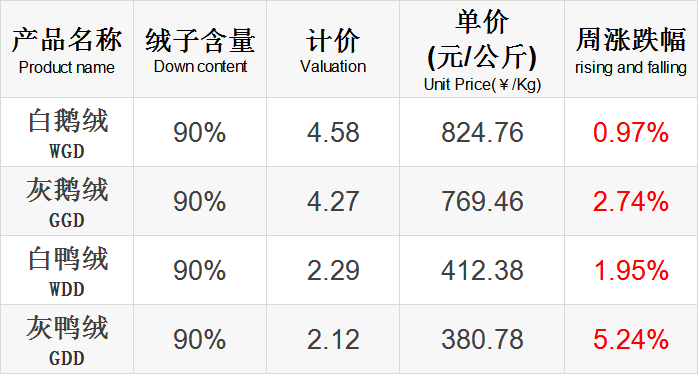

In the 51st week of 2023 (12.11-12.17), the market generally rose, with gray duck down and gray goose down increasing significantly.

The expectation of a warm winter has caused down jacket merchants to generally have insufficient stockings this year. However, several strong cold air events after the peak season has ushered in an explosion in order volume.As a result, merchants' inventories were rapidly depleted in a short period of time. Under the strong demand for replenishment orders, the price of down and down continued to rise. At the same time, it caused a shortage of raw materials in the market, which also caused the rise of gray goose down and gray duck down.

As the temperature drops again, sales of down products are still showing an upward trend. After this cold wave with the highest warning level moves southward, two strong waves of cold air will follow around the 18th and 24th, which may keep most of our country cold until the end of December. Nowadays, the situation of warm winter has become a bit blurry.

On the 14th, Federal Reserve Chairman Powell issued a dovish signal, saying that the tightening cycle may be over and that interest rate cuts have been taken into consideration. Driven by this news, the U.S. dollar fell sharply, and Chinese assets experienced a collective explosion. Both onshore and offshore RMB rose sharply and hit a six-month high. Analysts predict that the USD/CNY exchange rate may remain at 7.1 during the year.

Good news this week

Yuan Song, the person in charge of a garment factory in Zhejiang, clearly feels that the down jacket market has become more and more popular in recent years. Half an hour ago, the channel dealer hoped that he could supply another batch of goods in early January, and maybe there would be another wave of sales boom before New Year's Day and Spring Festival.

He said that his factory mainly produces low-priced down jackets priced around 400 yuan. Due to factors such as low prices and low visibility, business was originally very average. Now, with the explosion of the market and changes in consumer purchasing concepts, business has grown even more.

"In the past, we could sell a few hundred orders at most every year, but since last year, orders and sales have continued to increase." Yuan Song said that even though the ex-factory price is one or two hundred yuan higher than in previous years, many partners still place orders. "More than 10,000 pieces have been sold this year, and many channel dealers are still asking for more. It is estimated that the number will exceed 20,000 pieces. "

Many clothing factory owners also said that the factory has hardly considered other products in recent times, and all orders and peripheral arrangements revolve around down jackets.Li Fei, who runs a garment factory in Shandong, said: "Almost all my colleagues have been missing recently and are basically staying in the factory 24 hours a day. "

In order to ensure sufficient output, Li Fei not only spent a lot of money to purchase a new production line, but also reached cooperation with a number of upstream factories that produce goose down, zippers and other materials to ensure the smooth production of down jackets. He said: "Now not only the business of down jacket factories is exploding, but upstream factories are also very busy. "

Affected by the off-season effect and the slowdown in terminal demand, the operations of major outdoor functional clothing and down jacket manufacturers in November were not as expected. Quang Viet's consolidated revenue in November was 707 million yuan, a year-on-year decrease of approximately 48%; KWONG LUNG's November consolidated revenue was 445 million yuan, a decrease of 7.1% from the previous month, and a year-on-year decrease of approximately 41%.

However, both Guanglong and Guangyue pointed out that with the end of the customer adjustment period and market demand recovering, coupled with plans to expand new products and introduce new brand customers next year, they will strive to return to the growth track next year.

Wu Chaobi, chairman of Guangyue, said that the estimated order demand is expected to gradually turn positive from the second quarter of 2024, and the overall operating outlook for 2024 is currently viewed with caution; In addition to grasping existing customer orders, Guangyue will continue to optimize product portfolio and actively develop new brand customers to maintain competitiveness.

In response to future demand, Guangyue will launch production expansion plans at its Long An plant in Vietnam and Jordan plant starting from the first quarter of next year, with an overall capital expenditure of approximately US$20 million. In response to the expected strong growth in market demand in 2025, it is expected that order intake will have the opportunity to return to last year's high level. Guangyue pointed out that in terms of the four major customers next year, The North Face's performance will be relatively flat, and Patagonia, Adidas, and Nike are expected to resume growth.

Guanglong Chairman Zhan Hebo said at the 70th anniversary press conference of the Taiwan Feather Export Industry Association that as the northern hemisphere enters winter, especially in North China and Northeast China, "cliff-jumping" cooling blizzards have been observed, and demand momentum for down jackets has been observed. Down products include down raw materials and down jackets, and the current order visibility is as far as the third quarter of next year.

Guanglong will launch production expansion plans in Indonesia and Vietnam, both of which are expected to be put into production from the fourth quarter of this year to the first half of next year. Among them, the new joint venture expansion factory in Central Java Province, Indonesia, is divided into four phases, with six to ten production lines in the first phase; the new factory expansion in Vinh Long Province, Vietnam will expand ten garment production lines.

source | 中时新闻网

"Our business depends on the weather." Xing Hao, a down jacket buyer, said that the sales of down jackets are closely related to the weather. "To put it exaggeratedly, if it snows today, the warehouse will be empty tomorrow. "

In the busiest week this year, Xing Hao received more than 50,000 orders. "If we couldn't get the goods, we sent out more than 10,000 pieces." Xing Hao, who has been a buyer for many years, lamented the good sales this year: A hot-selling down jacket, the inventory of 200,000 pieces was gone in two or three days.

"Out of stock!" Lian Jinke, the store manager of an original down jacket brand, mentioned that the temperature dropped some time ago, and for more than ten days, almost every store in the wholesale market was out of stock. In this regard, Chen Jie, market operations director of Pinghu China Garment City, explained that merchants generally have insufficient supplies this year.

In the past, merchants would prepare goods in advance during the off-season. However, due to the economic conditions in the past few years, many merchants have been conservative in stocking this year. After the peak season came, there was a cold air attack in November, so the order volume exploded, and the inventory was consumed rapidly in a short period of time, which required factories to step up production.

The supply exceeds demand, which is first reflected in the increase in workers' wages. In fact, labor costs rise in the second half of every year. "Compared with the first half of the year, the labor costs during this period have increased by nearly 50%." Chen Jie said that based on feedback from merchants, a down jacket that previously cost 780 yuan has now increased to 112 yuan.

When talking about the reasons for price increases, both Chen Jie and Xing Hao mentioned the imbalance between supply and demand. The new national standard for down clothing, which has been implemented since last year, has put forward higher requirements for the quality of down, which has affected the price of down. This year, the export volume of meat ducks and meat geese has decreased, which has reduced the supply of down. The imbalance between supply and demand has led to an increase in down prices.

source | 齐鲁晚报

Inbound cargo volumes at major U.S. container ports peaked later than expected in the fall, according to the Global Port Tracker Report. The system shows that the throughput of U.S. ports in October reached 2.03 million TEUs, an increase of 1.3% from September, and the first year-on-year increase since June 2022.

The National Retail Federation (NRF) said: "We originally thought the peak season would arrive in August, but imports continued to increase in September and October." In seven of the past 10 years, the peak period occurred in August or earlier to avoid possible supply disruptions as the holidays approach.

The port has not released data for November, but throughput for the month is expected to be 1.96 million TEU, an increase of 10.5% year-on-year, while December throughput is expected to be 1.93 million TEU, an increase of 11.5% year-on-year.

At the same time, it is expected that throughput will continue to grow in 2024.January is expected to be 1.93 million TEU, a year-on-year increase of 6.6%; due to the Asian Lunar New Year factory shutdown, February is expected to be 1.77 million TEU, a year-on-year increase of 14.5%; March is expected to be 1.75 million TEU, a year-on-year increase of 7.7%;April is expected to be 1.8 million TEUs, a year-on-year increase of 1%

source | SGB MEDIA

Bad news this week

On December 12, two topics about the COVID-19 epidemic, #COVID19 variant JN.1# and #experts said there may be a peak of COVID-19 infections around New Year’s Day, were trending on Weibo, attracting the attention of netizens.

Recently, a new coronavirus variant called JN.1 is spreading rapidly around the world and has been discovered in 12 countries. Some experts expect JN.1 infections to peak in the coming weeks. However, it is expected that a scenario like the Omicron outbreak in November 2021 will not happen again.

According to top news reports, a new wave of new crown infections has emerged in many places around the world. Data in the United States for the past seven days as of December 2, 2023 show that the number of positive COVID-19 tests and hospitalizations increased by 11.5% and 17.6% respectively, and the number of deaths increased by 25%. A large number of infants, young children and the elderly were sent to the emergency room.

Similar situations also occur in countries such as Thailand, Malaysia, and Singapore that have or will soon exempt Chinese tourists from visas. Singaporean infectious disease expert Leong Ho-nam said that this round of new coronavirus infections may reach its peak in about one month. Monitoring data from many European and American countries show that this wave of new coronavirus infections may be related to the prevalence of the Omicron variant JN.1.

source | 财联社、顶端新闻

Just after the "heavy snow" season, the highest temperature in Hangzhou has reached over 20 degrees Celsius. In this warm winter, there are too few opportunities for down jackets to appear. Some people even found down jackets at 20% off stores while shopping: "It has just entered winter, and winter clothes are already on sale. How can I sell this down jacket?"

Just after the "heavy snow" season, the highest temperature in Hangzhou has reached over 20 degrees Celsius. In this warm winter, there are too few opportunities for down jackets to appear. Some people even found down jackets at 20% off stores while shopping: "It has just entered winter, and winter clothes are already on sale. How can I sell this down jacket?"

In addition to weather factors, down jackets have also been frequently complained about by consumers this year. Topics such as "The price increase of down jackets has given up the market to military coats" have become hot searches. Judging from the sales of well-known brands, after experiencing rapid growth in previous years, at least this winter, down jackets are no longer fragrant.

Xiaomeng has been selling women's clothing on Zhongshan North Road for five years, and she clearly feels that the market for down jackets this year is worse than in previous years. She said that the golden period for down jacket sales is coming to an end. "In previous years, November and December were the time when merchants rushed to sell winter clothes. After that, it was time to clear out inventory, especially for street stores like ours. "

Sales of down jackets cannot increase because there are so many competitors. Especially when the weather is not that cold, the warmth retention advantage of down jackets cannot be reflected. They can only compete on the same starting line with jackets, polar fleece, and this year's hot jackets, and the advantage is not great.

But the cold wave that has moved south should stimulate a wave of sales. An uncle was attracted into the store by the special offer advertisement at the door. He said that he was a regular customer of this store. "I heard that the temperature will drop to below zero. If the activity is suitable, I would like to buy one. "

Market news situation

This week’s news is more positive than negative.

During the 50th week (12/4-12/10), the industry estimates that the average number of ducklings emerging is approximately 9.1 million birds per day, which is generally stable compared to the previous week. At present, duck seedlings are affected by rain and snow, and the delivery of seedlings is restricted. In addition, incubation companies have successively entered the avoidance suspension period. This may limit the supply of raw material wool again.

As the weather turns colder, the down jacket market explodes rapidly, and "sky-high prices" have become a topic again. As consumers' purchasing concepts change, there will undoubtedly be more opportunities for small and medium-sized manufacturers focusing on low-priced down jackets. The hot sales in the market have naturally pushed the production of low-priced down jackets into a "white heat".

Recently, the new coronavirus mutant strain JN.1 has increased significantly around the world, causing widespread concern. According to the Economic Observer Network, considering the decline in antibody levels after the previous wave of infection, and the strong immune evasion ability of JN.1, it may spread in the country from January to March 2024, but it is difficult to judge the new wave. The propagation intensity of the wheel.

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

2017羽绒原料价格一路上涨,究竟为何?

你的羽绒服为什么钻绒?涨知识了

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

2017羽绒原料价格一路上涨,究竟为何?

你的羽绒服为什么钻绒?涨知识了

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展