Cn-down > Domestic news > News content

2023-12-03 来源:金绒 浏览量:2418

Summary

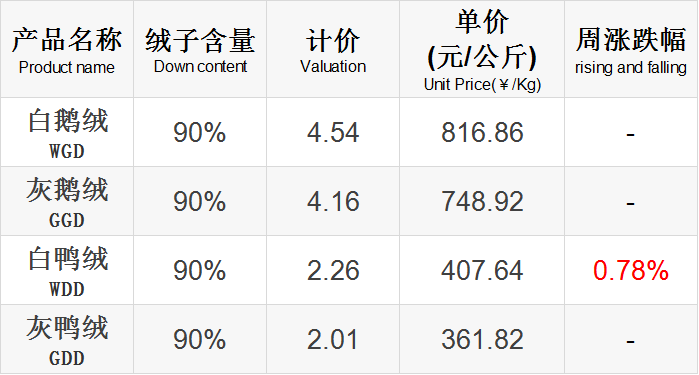

In the 49th week of 2023 (11.27-12.3), the market is generally stable, with white duck down rising slightly.

At this time in previous years, the sales of down jackets have basically ended in the northern region, but this year they can still be seen in Hebei and other places; and in the down jacket wholesale markets in Jiangsu and Zhejiang, the busy figures disappeared earlier, and there were fewer packages waiting to be shipped away. This decisive decline in performance indicates that the market surge has come to an end and the market will be temporarily stable.

This round of explodes sales of down jackets comes and goes quickly, which fully reflects the "depending on the weather" characteristics of the textile and apparel industry.However, the cold air has gradually entered a period of intermission, and the temperature in most parts of the country will gradually warm up.Although two strong waves of cold air moved southward from the 5th to the 9th, the subsequent warming is expected to intensify.

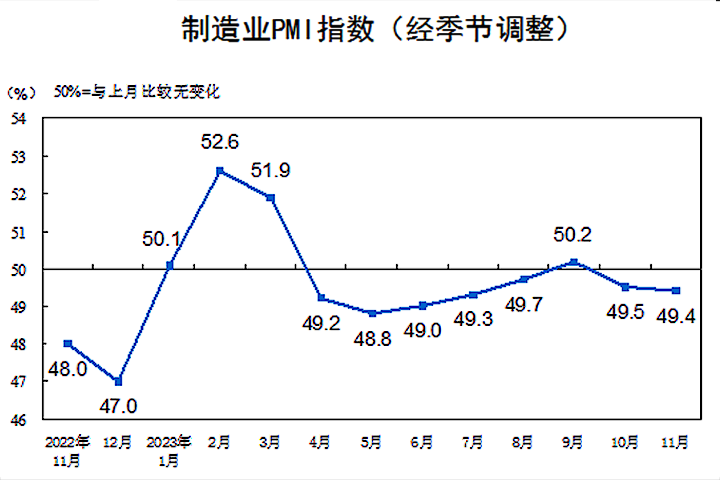

The Caixin China PMI (Manufacturing Purchasing Managers Index) in November was 50.7, returning to the expansion range. However, this trend is inconsistent with the official PMI data.

Good news this week

As the weather turns colder, demand for down jackets rises, and various topics related to rising prices of down jackets have become hot searches on the Internet. Many netizens complained that down jackets now cost thousands of yuan, making them warm on the body but cold on the heart. So, why did the price of down jackets rise this year?

CN-DOWN is an interactive platform for China's down industry and has high authority and credibility among the down trading community. Its operations director Wu Yu said that the overall price of down jackets has indeed increased since last year. The overall price of down jackets this year has increased by about 30% compared with the same period last year.

He also said that the price of down jackets has risen this year. First, it is mainly affected by the rising prices of raw materials duck down and goose down. The use of goose down filling in brand clothing has further increased the cost of down jackets. Second, starting from 2022, the new down clothing standards will have improved down quality requirements, which will increase the procurement cost of raw materials.

So, why have the prices of duck down and goose down increased this year? Wu Yu said that the rise in duck down prices is mainly affected by the reduction in production on the breeding side, resulting in a reduction in raw material sources. According to information he learned from a duck slaughtering factory, the daily slaughter volume is now 20% less than before, and the raw materials for duck down have also been reduced accordingly.

The price increase of goose down this year is mainly due to the increase in market demand for goose down this year, which has caused the price increase of goose down to be greater than that of duck down.

Xiong Guoguang, chairman of Huaxin Poultry Co., Ltd., Bengbu City, Anhui Province, briefly analyzed that the overall number of breeding geese nationwide this year has increased by about a quarter compared to last year, which means that the number of geese this year is more than last year.

Generally speaking, an increase in goose prices will drive up goose down prices, but what is different from previous years is that this year, the increase in goose down prices has driven up goose prices to a certain extent.

source| 农视网

Insufficient production of meat ducks makes down prices expensive? There are many reasons for the rise in down prices this round.

The fillings of down jackets are duck down and goose down. Goose down has lower yield, lighter smell, and much higher price than duck down. It is generally used in mid-to-high-end down jackets. Generally speaking, whether the price of down jackets can be reduced depends on the duck down.

New Hope Liuhe is a listed duck breeding company. According to relevant sources, in the past few years, the price of duck down has been between 130-640 yuan/KG. The price fluctuation of down is mainly affected by the supply and demand relationship within a certain period of time. Especially the changes in demand on the consumer side.

The above-mentioned person added that the sudden price drop in 2020 is special and is mainly caused by the impact of the epidemic.

However, the main reasons for this round of increase in down prices come from many aspects.

The above-mentioned person explained that during the three years of the epidemic, the entire industry has placed risk management and control as the top priority. Many down products have a backlog of inventory. Down is bought as needed, and inventory is generally kept low. Once the temperature drops sharply, there will be more urgent orders for products. , it is easy for the down market to turn into a seller's market in the short term, causing down prices to skyrocket.

The reduction in raw material sources is a major factor in the current rise in duck down prices. New Hope Liuhe data shows that due to the downturn in the pig industry, the slaughter volume of white-feathered ducks has been reduced for three consecutive years. The supply of poultry and ducklings from October to November this year was only 9-10 million per day, and production capacity has dropped significantly.

此外,近年来肉鸭的造肉成本日趋改善,令单只毛鸭的出绒率有所减少。

Huaying Agriculture is a listed company focusing on the two industries of meat ducks and down. It mentioned in its semi-annual report that the increase in down prices after the Spring Festival in 2023 is mainly related to the insufficient slaughter volume of meat ducks, coupled with the shortage of breeding enterprises.The settlement price of duck feathers has increased significantly, which has caused the washing manufacturers to increase their procurement costs and have to increase their quotations.

In the second quarter, the overall supply of raw wool was still tight due to multiple factors, and down prices remained sideways.

As the northern hemisphere enters winter, Jiangsu's down jackets and other cold-resistant clothing have entered a golden period of sales, with exports rising sharply. Recently, a batch of down jackets from Changshu Tianyi International Trading Co., Ltd. successfully arrived in the hands of Italian cargo owners.

General Manager Ji Yi said: "Often after the production of goods is completed, we have to arrange for shipment. The health certificate is also a necessary import customs clearance certificate for traveling to Italy. It needs to accompany the goods. The customs handles urgent matters and issues the certificate in time to help us avoid This reduces the risk of cargo being stranded at the port. ”

Due to the recent drop in temperatures, the time window for air export of overseas orders for down jackets and other cold-proof products is relatively short. Zhang Yi, deputy chief of the Inspection Section of Changshu Customs, said, "Currently, we have issued more than 40 health certificates for 7 down jacket companies, helping domestic down jackets to pass customs smoothly abroad. "

The textile and clothing industry is Jiangsu's traditional advantageous industry. It is understood that Nanjing Customs will guide enterprises to make full use of preferential customs policies, create high-quality fast lanes for textile and clothing exports, help textile and clothing open new space in the global market, and deliver "winter warmth" to the world faster.

source | 南京海关发布

The United States has ushered in the annual "Black Friday" shopping season. From Thanksgiving on the 23rd to Cyber Monday on the 27th, 182 million Americans are expected to shop offline and online. This number is not only higher than last year's 166 million, but will also reach the highest record since statistics began in 2017.

Strong discounts are one of the important reasons for the increase in the number of consumers. For example, online clothing prices dropped by 9% throughout October this year from the beginning of the month, but in the same period in 2021 and 2022, they only dropped by 2% and 5% respectively.

At the same time, analysis predicts that compared with the retail inflation rate of 6.1% in 2022, the price increase during this year's "Black Friday" shopping season will be only 0.5%. At present, consumption during this year’s “Black Friday” shopping season across the United States has exceeded expectations.

During Black Friday, "Made in China" has undoubtedly become the biggest highlight. According to Korean online shopping platform Wemakeprice, the growth rate of overseas shopping sales by region this month shows that China has a growth rate of 801%, far exceeding the United States and Europe (136%) and Japan (79.8%).

In Yiwu, this year's "Black Friday" online sales are in the warm-up stage, with Christmas supplies, thermal products and other categories experiencing overwhelming orders. Currently, cross-border e-commerce is rapidly becoming a new engine for Yiwu’s export growth.

Statistics from the US research company Descartes Datamyne show that in October, Asia’s maritime container transportation volume to the United States was 1.653444 units (converted into 20-foot containers), a year-on-year increase of 11%. Looking at the place of departure, China, which accounts for nearly 60% of the total, grew by 15%.

The top ten varieties in terms of export volume were all higher than the same month last year, growing for two consecutive months. Among them, clothing increased by 14% year-on-year.

On the other hand, freight rates rebounded for a time as various container shipping companies reduced sailings, etc. However, due to the large supply of ships, the rebound is difficult to sustain for a long time. A large container shipping company said: "Due to the increased supply of ships, ships are still idle, which does not give the impression of active business."

source | 外跨研究中心、日经中文网

The impact of inflation on apparel consumption has weakened. Brand factories such as NIKE have reduced inventories, and garment OEMs have seen their order visibility increase. The revitalization of the apparel consumer market has driven small and medium-sized apparel brands around the world, becoming the best driving force for the operational growth of the garment industry next year.

Zhan Hebo, chairman of Guanglong, an outdoor functional clothing factory, believes that the textile industry is not in good shape this year and Guanglong's performance has declined, but it is expected to rebound significantly next year. Guanglong pointed out that 2-3 new customers are expected to add points to operational growth next year.

Guanglong's down-related products include down jackets, duvets and down raw materials, accounting for more than 50% of its performance. Guanglong pointed out that as the northern hemisphere gradually enters winter, consumer demand for warm clothing has gradually become stronger, and the operating bottom of garment factories has passed. Guanglong is very confident about next year's growth.

Guanglong pointed out that next year’s order visibility will reach as far as the third quarter. Due to the low base period this year, it is expected that operations in the second and third quarters of next year will recover significantly compared with the same period this year, and revenue is expected to grow by a double-digit percentage.

source| 中时新闻网

Good news this week

On November 30, data released by the National Bureau of Statistics showed that China’s official manufacturing PMI (Purchasing Managers Index) in November was 49.4%, down 0.1 percentage points from the previous month, and the prosperity level of the manufacturing industry dropped slightly.

In terms of enterprise size, the PMI of large enterprises was 50.5%, down 0.2 percentage points from the previous month, and continued to be higher than the critical point; the PMI of medium-sized enterprises was 48.8%, up 0.1 percentage points from the previous month, and below the critical point; the PMI of small enterprises was 48.8%, an increase of 0.1 percentage points from the previous month, and below the critical point; the PMI of small enterprises was 47.8%, down 0.1 percentage points from the previous month and below the critical point.

From the perspective of sub-indices, among the five sub-indices that make up the manufacturing PMI, the production index and supplier delivery time index are higher than the critical point, while the new order index, raw material inventory index and employee index are lower than the critical point.

Among them, the production index was 50.7%, a decrease of 0.2 percentage points, indicating that manufacturing production continued to expand; the supplier delivery time index was 50.3%, an increase of 0.1 percentage points, indicating that the delivery time of manufacturing raw material suppliers continued to accelerate.

In addition, the new orders index was 49.4%, a decrease of 0.1 percentage points, indicating that manufacturing market demand has declined; the raw material inventory index was 48.0%, a decrease of 0.2 percentage points, indicating that the inventory of major raw materials in the manufacturing industry has decreased; the employment index was 48.1% , an increase of 0.1 percentage points, indicating that the employment boom of manufacturing enterprises has recovered slightly.

In November, the comprehensive PMI output index was 50.4%, down 0.3 percentage points from the previous month, indicating that the overall production and operation activities of our country's enterprises continued to expand. Some manufacturing industries have entered the traditional off-season, and market demand is insufficient. However, the production indexes of textile, chemical fiber and other industries are below the critical point, and production activities have slowed down.

source | 国家统计局

Market news situation

This week’s news is more positive than negative.

The number of duck seedlings on the supply side continues to decrease. During the 48th week (11/20-11/26), the industry estimates that the average supply of duck seedlings is about 9 million birds per day. However, the mood for duck shopping has weakened, and the number of new breeding ducks has increased, and the number of ducklings may stop falling and rebound slightly. At the same time, the settlement price of duck feathers for breeding enterprises has increased significantly, which will cause the purchasing costs of washing manufacturers to increase.

The revitalization of the European and American clothing consumer markets has driven small and medium-sized clothing brands around the world to increase their sales. The operating bottom of garment manufacturing may have passed. In October, maritime container traffic from Asia to the United States increased by 11% year-on-year, with clothing increasing by 14% year-on-year.

Consumption during this year's "Black Friday" shopping season has exceeded expectations, with Christmas supplies, thermal products and other categories seeing explosive orders. U.S. financial media reported that compared with the soaring inflation, gasoline and food prices last year, prices have gradually stabilized this year, and consumers are more willing to spend money on shopping.

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

2017羽绒原料价格一路上涨,究竟为何?

你的羽绒服为什么钻绒?涨知识了

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

2017羽绒原料价格一路上涨,究竟为何?

你的羽绒服为什么钻绒?涨知识了

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展