Cn-down > Domestic news > News content

2023-11-26 来源:金绒 浏览量:1584

Summary

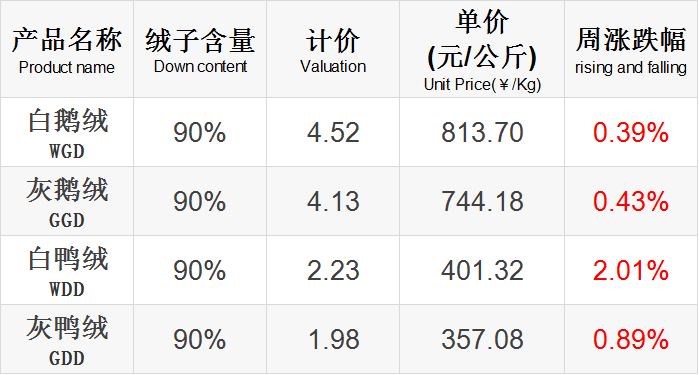

In the 47th week of 2023 (11.13-11.19), the market generally rose, and white duck down increased significantly.

With the help of colder weather, the sales of down products during this year's "Double Eleven" exceeded expectations.The resulting short-term and concentrated demand for replenishing orders has caused a rapid increase in raw material prices, especially the volume of fabrics driven by the popularity of down jackets, which has caused quite a stir in the market.

After the current round of cold air, most of the country will usher in a recovery, but from the 21st to the 24th, there will be stronger cold air affecting most areas of our country.

In addition, Sino-US relations have shown signs of easing recently, which may lead to a pickup in Sino-US trade to some extent.Judging from the situation in previous years, November to January of the following year is usually the peak season for exports of down and feathers to the United States.

Good news this week

The 15th Double 11 has finally come to an end, but this is still a Double 11 that has not announced its GMV, and it seems that it has not yet created a great promotion atmosphere.Industry insiders said that autumn and winter are the peak seasons for ready-to-wear consumption, and down jackets are priced on the high side and are often regarded as the benchmark for ready-to-wear brands.

According to Star Map data, from 20:00 on November 10 to 24:00 on November 11, the total sales of comprehensive e-commerce platforms were 277.7 billion yuan, of which Tmall channels accounted for the highest proportion at 60.02%, and JD.com accounted for 27.86%.The GMV of the live streaming e-commerce platform is 215.067 billion yuan, and the order is Douyin, Kuaishou, and Diantao.

During JD.com’s 11.11, the sales of men’s and women’s down jackets both increased by more than 100% year-on-year, ranking TOP 1 in the clothing category.

The GMV of Kuaishou's down jacket category increased by 103% year-on-year, and the GMV of women's clothing brands' down jacket category increased by 87% year-on-year.

Vipshop data shows that since the launch of 11.11, sales of sports down jackets have increased by 108% year-on-year, sales of children's down jackets have increased by 85% year-on-year, and sales of men's down jackets have increased by 54% year-on-year.Sales of Xuezhongfei surged by 206% year-on-year, Yaya sales increased by 77% year-on-year, and Bosideng sales increased by more than 60% year-on-year.

In Douyin’s e-commerce women’s clothing category TOP 20 brand list, Chinese brands account for the majority.Among them, the down jacket brand YaYa has been ranked TOP 1 in the category list for three consecutive years, with a year-on-year increase of 110%; Bosideng and its sub-brand Xuezhongfei have sales exceeding 100 million, with a year-on-year increase of over 100%.

In Douyin's e-commerce men's clothing category TOP 20 brand list, Romon, Woodpecker, Pierre Cardin, Yalu, and Jeanswest all have sales exceeding 100 million, leading the category list.

In addition, domestic brands still account for the majority of the list. Compared with last year's list, the rankings of Pierre Cardin and Heilan House have increased, while the rankings of JeansWest, Yalu, and SHANSHAN/Shanshan have declined. The four new faces in the TOP 10 are Classic Car, Dragon Ya, Flying in the Snow, and Yaya.

source | 综合网络信息

Since entering the third quarter, China's home textile foreign trade exports have reversed the downward trend and gradually stabilized and rebounded. However, my country's foreign trade exports of down bedding (down quilts + other bedding) still show negative growth.

From July to September, my country's total exports of down bedding reached US$137 million, a year-on-year decrease of 5%. Among them, down quilts exported US$65 million from July to September, a year-on-year increase of 0.9%.

In the third quarter, the top four markets for my country's down bedding exports were the United States, the European Union, Thailand and Japan. Among them, exports to the United States were US$48.66 million, a year-on-year increase of 14%; exports to the EU were US$23.3 million, a year-on-year decrease of 31%; exports to Thailand were US$16.2 million, a year-on-year increase of 1027%; exports to Japan were US$13.03 million, a year-on-year decrease of 24%.

Zhejiang, Jiangsu, Shanghai, Anhui and Guangdong rank among the top five provinces and cities in the country for exporting down bedding.

In the first half of the year, Zhejiang's exports were US$76.11 million, a year-on-year decrease of 0.5%; Jiangsu's exports were US$23.79 million, an increase of 269%; Shanghai's exports were US$17.49 million, a decrease of 49%; Anhui's exports were US$10.99 million, an increase of 4.3%;Guangdong exported US$5.09 million, down 9.8%.

Taken together, the international home textile market has gradually returned to normalcy after about half a year of adjustment after the global epidemic. Inventory digestion in the US and European markets has basically ended, and relatively obvious purchasing signals have been released since the third quarter.

source | 金绒 数据来自海关

As the temperature drops, sales of down jackets in various places begin to pick up, and Shengze, as one of the production bases of down jacket fabrics, has also experienced a rebound in the market. A textile trading businessman revealed: "When the market has been good recently, the warehouse has been empty and is being replenished one after another. "

"We continue to be out of stock and have no time to produce. Some orders have been made by friends in the same industry." said a factory owner who specializes in finishing down jacket fabrics. Not long ago, I was lamenting that the inventory could not be sold, but in the blink of an eye, the market came.

According to feedback from textile enterprises, an increase in orders has been clearly felt, especially for down jacket fabrics, such as pongee, nylon, taslan, gallbladder and other linings. It can be said that the gallbladder is selling like crazy, with the price increasing by more than 50%! This wave of market conditions is fast and violent, which is unexpected.

There is also feedback from enterprises that during this period, some dyeing factories have experienced warehouse explosions. The type of warehouse explosions is nylon yarn, and the daily warehouse volume can reach hundreds of thousands of meters. At the dyeing factory site, gray fabrics were not only piled up in the factory area, but even lined up on the roadside. According to a rough estimate, there are at least several million meters of undyed white blanks piled up.

It is understood that the orders currently accepted by the dyeing factory are all domestic orders, and from a product perspective, nylon is an ideal fabric for making autumn and winter clothing such as down jackets.

However, there are also many textile people who believe that the market cannot be maintained for a long time.A boss who sells spot goods said: "Actually, many people are betting on the market and weather this year. They have been preparing down jacket fabrics since August. The current wave of market prices has only cleared the previous inventory. And there are still some.Many people are stocking up, but in the final analysis, many goods have not reached the terminals. "

source | 绸都网、布工厂

Data released by the U.S. Department of Commerce on Tuesday showed that the trade deficit in goods and services expanded 4.9% month-on-month to $61.5 billion in September, higher than economists' expectations of $59.8 billion. Mainly because U.S. consumer demand for foreign goods remains strong, while the U.S. trade deficit with China has increased slightly.

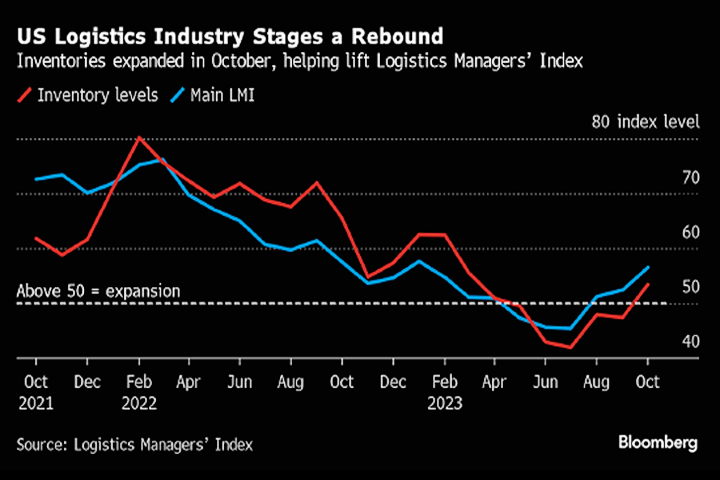

The latest monthly Logistics Managers Index (LMI) in the United States showed that inventory expanded in October after shrinking for five consecutive months. The report also showed that inventory levels rose 6 points to 53.4, rising above the 50 mark that separates booms from contractions.

"If inventories continue to expand, it will indicate that the large commodity bubble that plagued the economy throughout 2022 has not only disappeared, but that companies are now ready to start rebuilding inventories." The report said.

Still, the U.S. economy faces mounting headwinds in the final three months of the year. Economists expect consumer spending to slow significantly after a stunning rise in the previous quarter as the labor market begins to cool.

source | 金融界

"Hangzhou Sijiqing's down jackets are selling out!" Recently, the temperature in Hangzhou has experienced a steep drop in temperature, and the sales of Sijiqing's down jackets have also reached a peak. This place seems to be a sea of winter clothing, with wholesalers coming from all over the country and even Russia to purchase goods.

Merchants in Sijiqing have said that they are not worried about selling this year's down jackets, but they are worried about not being able to keep up with the production. "We don't have enough down jackets to sell right now. More than ten models are sold out, and the production can't keep up. We can sell tens of thousands of pieces a day. "

Ms. Xing, a salesperson at the "Wuxingshui" specialty store, said that the store now sells short down jackets for 200 to 300 yuan a piece and long ones for 300 to 400 yuan. There are thousands of orders a day and sales of hundreds of thousands of yuan.Merchants at the Senssse store said that they have been able to sell out as soon as new products are released recently. “This year’s sales have been particularly good, and we have enough stock. We need to prepare thousands of pieces for each style, and they are basically sold out.”

The person in charge of Xinyifa Shopping Mall said that because the temperature has dropped rapidly recently, the demand has suddenly exploded, “Now many merchants have almost sold out their inventory.Factories are expediting orders and it is expected that winter clothing sales will hit a new high this year. Merchants are very optimistic about this year's market conditions. "

source | 浙江在线

Bad news this week

Quang Viet (Guangyue Group), a major down jacket OEM, recently held a board meeting to approve its third quarter consolidated financial statements. The cumulative consolidated revenue in the first three quarters was 13.924 billion yuan, a decrease of 1.692 billion yuan from the same period last year; operating gross profit was 2.223 billion yuan, a decrease of 513 million yuan from the same period last year.

The operating performance of Guangyue Group in the third quarter still maintained the traditional peak season model, with stable profits, but a decrease compared with the same period last year. The main reason is that the garment industry will be affected by inflation in 2023 and the strength of the end consumer market will slow down. Guangyue's major sports brand customers were also affected by environmental factors, resulting in reduced orders.

Overall, Guangyue Group remains cautiously optimistic about future development. Looking forward to 2024, as customer inventory adjustments gradually come to an end, order demand is expected to recover and turn positive.

Another down jacket OEM, KWONG LUNG, had revenue of 479 million yuan in October, a decrease of 29.6% from the previous month and a decrease of 47.3% from last year. The consolidated revenue in the first ten months was 6.878 billion yuan, a year-on-year decrease of 24.1%.

The decrease in shipments is the main reason for the decline in garment revenue this year. Clients are conservative in placing orders, mainly as a precautionary response to concerns about the impact of inflation on consumption power.

Guanglong pointed out that he is still optimistic about the future development of ready-made garments. In addition to the continued expansion of new production lines, it is expected to introduce three to five new brand customers next year, adding growth momentum to its operations next year and the year after. The revenue of ready-made garments in the first three quarters of this year was 3.934 billion yuan, a decrease of 13.2% compared with last year, but the revenue proportion continued to rise and exceeded 60%.

source | 中时新闻网

At Linyi Huafeng Clothing Wholesale Market, clothing dealer Ms. Niu is hanging her new down jacket in the most conspicuous place in the store. She said that sales were not good this year. There were many people coming to see her, but few pieces were sold. She felt that the main reason was that the price of down jackets had increased.

"The purchase price of down jackets in the market is rising. With the same quality and consumer audience, purchasing one this year will cost more than 30 yuan more than last year. For new models or ones with higher down filling, the purchase price will increase even more. "Ms. Niu said that this is only the wholesale price, and the increase is expected to be higher when consumers go to terminal physical stores to purchase.

At the Bosideng store on Tongda Road in Linyi City, the clerk said that there are currently few down apparels priced at less than 1,000 yuan in the store. Basic styles with around 2,000 yuan are the best-selling ones, and medium-quality ones cost more than 4,000 to 5,000 yuan. But few customers come in to try on and shop.

In contrast to down jackets, which are rising in price, military coats, which are regarded by netizens as "an alternative to down jackets," have continued to become popular recently. More and more college students and office workers are paying attention to military coats.

At Linyi Jiuhong Labor Protection Products Store, owner Liu Changhong said that since November, people have been calling every day to inquire about the sales price, delivery channels and other issues of military coats. In his store, the sales of military coats alone have tripled compared with previous years. "I, who sell labor protection supplies, almost became a clothing store owner this year." Liu Changhong said.

source | 大众报业·齐鲁壹点

Market news situation

This week’s news is more positive than negative.

The number of duck seedlings on the supply side continues to decrease. During the 46th week (11/6-11/12), the industry estimates that duckling production capacity averages about 9.1-9.2 million birds per day. At present, the impact of a 20% reduction in slaughtering capacity is beginning to gradually appear, reducing the supply of raw material wool.

Recently, down jacket fabrics and gallbladder fabrics have clearly seen an increase in orders, and the price of gallbladder fabrics has increased by more than 50%. However, some industry insiders believe that the market cannot be maintained for a long time, and many goods have not yet been truly "prepared" for terminals such as clothing factories.

The inventory adjustment by U.S. companies appears to be over, and the big commodity bubble that plagued the economy throughout 2022 has disappeared. Some analysts believe that the recovery in demand for non-durable goods represented by textiles and clothing has resonated with low inventories, and the prosperity of related industries is expected to be the first to improve.

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

2017羽绒原料价格一路上涨,究竟为何?

你的羽绒服为什么钻绒?涨知识了

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

2017羽绒原料价格一路上涨,究竟为何?

你的羽绒服为什么钻绒?涨知识了

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展