Cn-down > Domestic news > News content

2023-11-06 来源:金绒 浏览量:1392

Summary

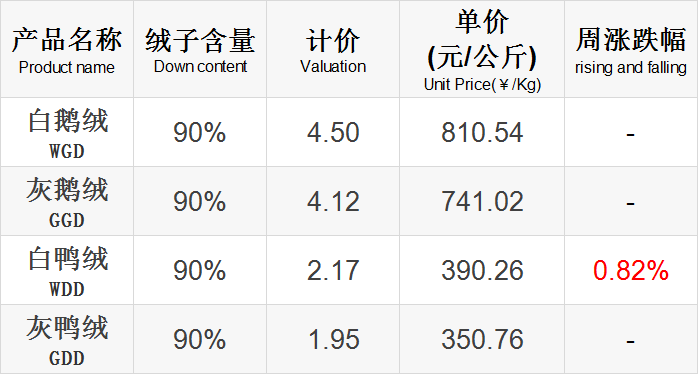

In the 45th week of 2023 (10.30-11.5), the market is generally stable, with white duck down rising slightly.

Under the Double 11 promotion, down products began to sell well in China, and some overseas customers have also been slow to complete the first wave of down jacket purchases this winter. Therefore, with the small increase in domestic sales, pure white duck down has also experienced a slight increase.

On November 3, the China Meteorological Administration held a press conference for November 2023.Jia Xiaolong, deputy director of the National Climate Center, said temperatures are expected to be high in most parts of the country in November. The five cold air processes are: moderate in the early part of the first ten days, weak in the late part of the first ten days, moderate in the early part of the middle part of the month, weak in the late part of the middle part of the month, and weak in the late part of the last ten days.

For the winter of 2023/2024, the climate prediction bulletin issued by the National Climate Center shows that the intensity of the cold air affecting our country in the previous winter (December 2023) was weak, and the temperature in most parts of the country was higher than the same period in normal years;Cold air activities will become more active in late winter (January to February 2024).

Good news this week

Yike Food recently accepted an institutional survey and stated that the industry has good expectations for the breeding market next year.

From the perspective of the supply side, the sales of parent ducklings will decrease in the second half of this year, and the supply is expected to decrease next year; from the perspective of breeding seasonality, summer affects the egg production performance and fertilization rate of ducks, so the supply side is expected to shrink in the second half of next year It is more obvious that the breeding market is relatively optimistic.

At present, the number of ducklings emerging on the supply side is gradually decreasing, and the balance is slightly tight; on the processing side, meat duck slaughtering has continued to suffer losses in the recent stage, and slaughterhouses in the same industry have experienced varying degrees of production reductions, and even stopped production.

However, as winter enters, peak seasons such as Double Eleven, Double Twelve and Southern Winter Cured Meat Pickling will arrive. At the same time, consumption of snack foods such as duck tongue and duck paws, and hot pot ingredients such as duck blood and duck intestines will increase. Coupled with the return of live pig prices, it is expected to bring about growth in consumption demand for meat ducks.

The company's duck slaughter volume in the third quarter was 80-90 million, and duckling sales were 70-80 million. From a revenue perspective, the company's operating revenue in the first three quarters of 2023 was 16.572 billion yuan, a year-on-year increase of nearly 24.50%; from a revenue structure analysis, the revenue share of the duck slaughtering segment has declined.

The company's performance fluctuations in the third quarter mainly came from the meat duck slaughtering process, whose losses accounted for about 90% of the current losses; ducklings basically broke even. This year's annual chicken and duck slaughter volume is expected to be around 600 million, and the company's meat and duck slaughtering investment project during the IPO period has basically reached full production.

source |

益客食品投资者关系活动记录表

After autumn, the temperature in the northern hemisphere drops, and the country ushered in the first wave of purchasing of thermal products.

In South Korea, which has a similar climate to China, buyers in the market have also begun to sell cotton-padded jackets and down jackets.

Li Ling, the proprietress of the AKCN cotton and down jacket factory store, said that customers who order customized styles will come in advance from July to August. At this stage, customers from South Korea, Canada and other countries have completed the first wave of purchases of down jackets this winter.

Taking the Korean market as an example, the number of winter coats purchased by customers in the Korean market this warm season has reached about 2 million pieces. For the U.S. market, AKCN mainly supplies classic light down jackets, lock-down stitching and high-quality craftsmanship to prevent fleece and fade, allowing the company to sell more than 500,000 down jackets every year.

With a good trade atmosphere and convenient logistics and other services, coupled with the promotion of the Yiwu Gou e-commerce platform, the warm season has just begun, and the warm-keeping supplies merchants on the platform are very busy.Liling said that the first wave of orders for down jackets has begun, and Hu Bin also said that the factory's orders have been scheduled until the end of the year.

Yiwugou data shows that keywords such as “down jacket” have continued to rise in the hot keyword rankings in the past two weeks.

It can be seen from the trend chart of the keyword "down jacket" purchased in Yiwu: From October 1st, the search index for this keyword began to show signs of increase, and on October 27th, it rose to 48th on the popular keywords (30 days) list with 13,487 searches.

source |

义乌购

Tmall data shows that within 4 hours after the "Double 11" pre-sale was officially launched, the transaction performance of bedding used to keep out the cold and warm has increased by more than 100% year-on-year.

On the social platform, a user shared his experience of purchasing the above-mentioned Luolai goose down quilt while taking advantage of the "Double 11" discount.

In the Luolai Tmall official flagship store, the goose down winter quilt starting from 2,409 yuan after the above-mentioned pre-sale coupon has been pre-sold for only two days, and the number of pre-orders has exceeded 20,000 pieces, becoming the "sales king" among the store's "Double 11" pre-sale products. ".

According to the customer service staff, this goose down quilt is a new product launched this winter and has outstanding performance in terms of cleanliness and fluffiness. “1000mm cleanliness, 5A level cleanliness”, “high loft and full heat preservation rate of 81.6%”… the official promotional page reads this.

Down quilts, silk quilts, cotton quilts, fiber quilts...the careful selection of quilt types and fabric materials reflects that consumers are increasingly pursuing higher-quality quilts to cover their bodies. Use the "warmth economy" to welcome the arrival of winter.

According to information provided by the textile and apparel research team of Soochow Securities, the GMV (gross merchandise transaction) growth rate of the home textile industry has turned positive since September, becoming the only segment in the textile and apparel industry to achieve positive growth in online sales. This result may be related to the demand for home textiles brought about by the "season change between autumn and winter" is closely related.

source |

中国商报

On October 31, JD.com joined forces with Chinese apparel brands such as Bosideng, CABBEEN, Govan, Heilan House, Jingdong Made, Septwolves, Semir, Tambor, NetEase Select, Xuezhongfei, Yalu, Yaya and other Chinese clothing brands (by initial letter) Sorting), jointly launched the "Rising China Down" activity.

The event joins hands with many Chinese clothing brands to go deep into the country's down origins, discover high-quality down in China, and bring more comfortable and warm domestic down jackets to every consumer. At the same time, JD.com has launched an exclusive venue for domestic down products. You can go directly to the venue by opening the APP and searching for "China Down Quality Improvement".

In recent years, consumers have gradually increased their demand for quality and cost-effective clothing. According to the latest data from JD.com, in the past three years, the platform has sold more than 40 million domestically produced down jackets. On Double Eleven in 2023, the overall transaction volume of JD.com's down category increased by 120% year-on-year, ranking TOP 1 in the apparel category.

The data also shows that in 2023, Bosideng will become the TOP1 brand in JD.com’s men’s and women’s down jacket dual-category sales; Gaofan will become the TOP1 brand in JD.com’s women’s goose down jacket rankings in 2023. In the second half of 2023, YaYa will be on the TOP1 sales list of JD.com’s down jacket category in 2023.

来源source |

新浪时尚

Bad news this week

"It's already November! I've been wearing T-shirts and sun protection clothes these days. It's too hot to wear just a T-shirt during the day. "Xiaonian, a girl from Hangzhou, said, "So I didn't even think about buying winter clothes during Double 11. I bought a few sweaters and even a short skirt. "

The weather is too hot. Are the winter clothes that should have entered the "hot-sale" category forgotten by everyone?

In Hangzhou Wulin Yintai, most of the brand counters in the women's clothing area still sell sweaters, sweatshirts and small coats in the C position, and there are relatively few down jackets.

"On such a hot day, anyone who can get a down jacket is a true love..." On October 30, Xiao Cheng, who runs a clothing wholesale business in Sijiqing, posted a message on WeChat Moments.

“The weather is so hot this year, I’m still buying sweaters and sweatshirts. "A proprietress at Jiutian Zhongxing Market said, "We also come to pick up down jackets, but the quantity is not large. There are probably dozens of pieces every day, and a hundred pieces is considered too much. "

Aqi, who runs a wholesale stall specializing in down jackets in the Italian-French Apparel City, said frankly: "This year's peak seems to be a little later than usual, but judging from my own business situation, the shipment volume is still very good. "

Business is so good, any tips? "Probably just do something different from others. Business is not easy to do now. If you still sell products that follow the crowd, how can you stand out? "She said, "This year, I participated in two ordering fairs, and after making several popular items, the order volume immediately increased. "

source |

潮新闻

Time came to November, and the much-anticipated market rebound failed to appear after all, which meant that the "Silver Ten" sadly left the market. Some textile bosses even said bluntly: "The traditional peak season no longer exists!"

Mr. Lu, who specializes in outdoor functional fabrics, said that the nylon fabrics are OK, but they are not popular and cannot be sold at a high price. Mr. Pan, who specializes in down jacket fabrics, said that the sales of down jacket fabrics are pretty good, and the overall order volume is about 90% of last year.

The most important point is that the terminal has little demand for clothing. Especially in October, downstream fabric companies said that the number of orders received was not as good as in September. Recently, foreign trade orders have been generally issued, and domestic trade orders are mainly online and e-commerce orders for hard-demand winter fabrics. However, domestic trade brands and market orders still maintain the hard-demand mode, mainly for winter warm thick woven fabrics and down fabrics.

At present, there is still a large gap in order volume compared with previous years, and large goods are issued in a narrowed manner. Foreign trade orders are still mainly based on sporadic placement of small tanks for some brands, and fewer large goods are issued.

source |

绸都网、布工厂

On October 31, data released by the National Bureau of Statistics showed that China’s official manufacturing PMI (Purchasing Managers Index) fell to 49.5 in October from 50.2 in September, a decrease of 0.7 percentage points from the previous month, and fell back into the contraction range again.

In terms of enterprise size, the PMI of large enterprises was 50.7%, down 0.9 percentage points from the previous month and continuing to be higher than the critical point;

From the perspective of sub-indices, among the five sub-indices that make up the manufacturing PMI, the production index and supplier delivery time index are higher than the critical point, while the new order index, raw material inventory index and employee index are lower than the critical point.

Among them, the production index was 50.9%, a decrease of 1.8 percentage points, indicating that manufacturing production is still expanding, but the pace has slowed down;The supplier delivery time index was 50.2%, a decrease of 0.6 percentage points, indicating that the delivery time of manufacturing raw material suppliers continues to accelerate.

In addition, the new orders index was 49.5%, a decrease of 1.0 percentage points, indicating that manufacturing market demand has declined.;The raw material inventory index was 48.2%, a decrease of 0.3 percentage points, indicating that the inventory of major raw materials in the manufacturing industry continued to decrease;The employment index was 48.0%, a decrease of 0.1 percentage points, indicating that the employment prosperity of manufacturing enterprises has declined slightly.

In October, the comprehensive PMI output index was 50.7%, down 1.3 percentage points from the previous month, indicating that the production and operation activities of Chinese enterprises were generally expanding, but the expansion rate was slowing down. At the same time, the survey results show that the proportion of enterprises in the textile industry that reflects insufficient market demand exceeds 60%.

source |

国家统计局

Market news situation

This week's news is more positive than negative.

At present, the number of duck seedlings on the supply side is gradually decreasing, and the balance is slightly tight. During the 44th week (10/23-10/29), the industry estimates that the average duck seedling production capacity is about 9.5-9.7 million birds per day.

In October, China's official manufacturing PMI dropped to the contraction range again. In the textile industry, more than 60% of companies reported insufficient market demand. Some down jacket fabric companies said that the number of orders received was not as good as in September.Data from the National Bureau of Statistics show that the total cumulative profit of the "leather, fur, feathers and their products and shoemaking industry" dropped from an increase of 16.0% from January to August to an increase of 1.1% from January to September. The operating conditions of the enterprises are poor. .

On the evening of October 31st, the 11.11 sales on various platforms have been launched successively. Leading brands such as Bosideng, FILA, and Balabala have shown strong growth, and sales of autumn and winter clothing have increased sharply.

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

2017羽绒原料价格一路上涨,究竟为何?

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

你的羽绒服为什么钻绒?涨知识了

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

2017羽绒原料价格一路上涨,究竟为何?

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

你的羽绒服为什么钻绒?涨知识了

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展