Cn-down > Domestic news > News content

2023-10-16 来源:金绒 浏览量:1256

Summary

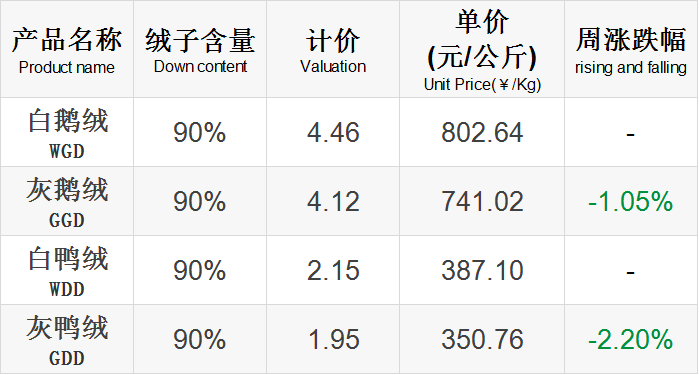

In the 42nd week of 2023 (10.9-10.15), the market was generally stable, with gray duck down and gray goose down falling slightly.

Due to the sluggish export situation and weakening domestic demand, the trend of gray duck down and gray goose down was weak.

Customs data shows that in September this year, our country's total import and export value fell by 0.7% year-on-year, but the scale hit a new high in a single month during the year, and imports and exports to traditional markets such as the EU and the United States also improved significantly.

Recently, the U.S. Climate Prediction Center warned that there is a three-in-ten chance of a "historically strong" El Niño event occurring from November this year to January next year, and this has only been seen four times since 1950.

Good news this week

According to statistics from the General Administration of Customs of China, the total import and export volume between China and Russia from January to August was US$155.1 billion, a year-on-year increase of 32%.Russian Prime Minister Mishustin predicted that this figure will reach a record high of 200 billion US dollars in 2023. For the full year of 2022, it will be $190.2 billion.

From January to August, China’s exports to Russia were US$71.8 billion, a year-on-year increase of 62%. In terms of categories, automobiles and parts increased to 4.5 times, accounting for approximately 20% of the total, and footwear and related products increased by 54%.

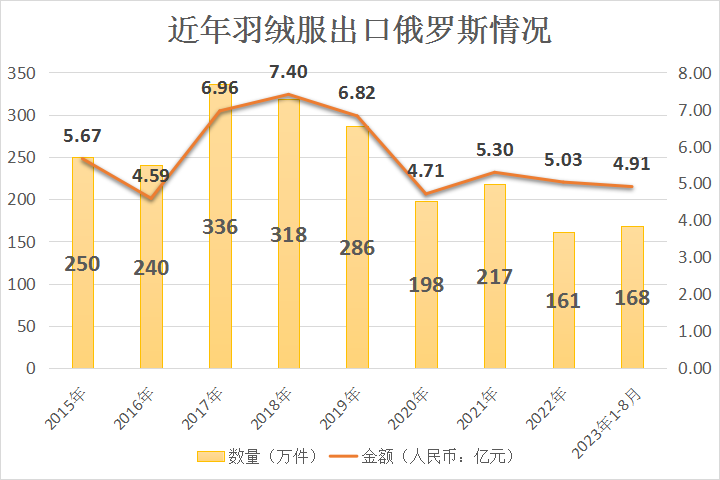

In terms of down jackets, a total of 1.68 million pieces were exported during this period, a year-on-year increase of 80%, and exports were 491 million yuan, a year-on-year increase of 84%.However, the export situation so far this year is still nearly half the gap compared to before 2019, and the export trend will weaken month by month after September every year.

In Russia, 16 new foreign retailers have opened this year, mostly in the clothing, footwear and homewares industries, mainly from Turkey, but also from Belarus, Kyrgyzstan, Australia, South Korea and Estonia. Competitors of our country's shoes and clothing in Russia are increasing day by day.

As a multi-category comprehensive e-commerce platform in the Russian market, OZON is preparing for the peak season. Data shows that on the OZON platform, the proportion of people purchasing clothing and footwear categories is the highest. After China’s supply chain entered OZON, the clothing category has experienced exponential growth.

September is the back-to-school season in Russia, and it coincides with the change of seasons. The weather has cooled down and snowed, and corresponding shopping demand has arisen. Therefore, warm clothing products are expected to explode.In addition, according to the practice of previous years, Double 11 is the peak period for OZON platform promotions, and this year is no exception.

source |

金绒采编来自海关总署、参考消息、雨果跨境

Recently, cooling has become a high-frequency word in weather forecasts in many places. Cold wave warnings have been issued in some areas in the north, and cold air is increasingly moving southward.As a result, the "warm economy" has heated up significantly. For example, a recent data released by JD.com shows that many consumers purchased warm clothing in advance, and sales of down jackets increased significantly.

Faced with this market change, Bosideng, as a scarce leading target in the industry, has received more attention.The brand's first show of "Redefining Lightweight Down Jackets" held at Leonardo da Vinci Manor in Milan also achieved massive exposure, greatly improving the efficiency and reputation of its brand communication, and laying a better foundation for this year's peak season sales.

Overall, this show can be regarded as a very influential brand event.Firstly, this is the first independent show held by a Chinese clothing brand in the international fashion capital Milan, making Bosideng comparable to international luxury brands;Secondly, Bosideng has become the first Chinese clothing brand to show in the Da Vinci Manor, the birthplace of Renaissance aesthetics, and it will also be the last (the manor will only be used for private purposes in the future).

According to current market feedback, this show has set off a craze for light down jackets around the world, favored by domestic and foreign celebrities and well-known overseas Instagram bloggers. There were even queues to buy at the Bosideng flagship store in London.Overseas authoritative media rushed to report on Bosideng's revolutionary significance to the entire down jacket industry.

This series of light down jackets further breaks through climate constraints and promotes sales in spring, autumn and winter. It is expected to bring additional revenue growth and weaken the seasonal fluctuations in Bosideng's performance.In terms of geographical dimension, Bosideng's market has further expanded to southern China and other national regions.

From last year's market data, we can see that consumers in the southern region are joining the booking regiment of down jackets.On the first day of Tmall's Double 11 pre-sales, Beijing, Shanghai and Chengdu ranked among the top three in the country in terms of the number of people buying down jackets, with southern cities accounting for two of the places.Bosideng’s new lightweight down jacket series can better meet these needs.

source |

东财choice

Autumn and winter are the peak production and sales seasons for fur products.During this period, as the weather gradually turns cooler, many fur companies in Chongfu Town have seized the opportunity to launch new products, rush orders, and actively expand production and sales.

On the morning of October 7, in the production workshop of Zhejiang Zhonghui Fur Co., Ltd., more than 400 workers were busy making orders for down jackets, fur coats, woolen sweaters and other products.These products are specially supplied to domestic and foreign brand customers such as Oushili, MO&CO, ONLY, COCOON, and Lilang.

"At present, many of our company's workshops are basically operating at full capacity, and the order volume can basically reach December."Sheng Jiping, the company's deputy general manager, said that due to the cooler weather and the impact of merchants preparing goods in advance, the company's daily shipment volume currently exceeds 4,000 pieces, a month-on-month increase of more than 200%.

In recent years, the market demand for fur products has shrunk. In order to break through development difficulties, companies have proactively adjusted their product structure, gradually expanding from traditional fur and fur collar products to down jackets and other categories;

source |

桐乡新闻网

Bad news this week

Quang Viet, a major down jacket OEM, had a consolidated monthly revenue of 2.233 billion yuan in September. The peak shipping season effect continued, with monthly revenue increasing by about 2% from the previous month, and operating performance improving month by month.Single-quarter revenue in the third quarter was 6.5 billion yuan, a quarterly increase of 37%.

However, revenue in the third quarter of this year decreased by 14% compared with the same period in 2022. Except for the explosive growth of Guangyue's operations in 2022, the comparison with the base period was higher;Secondly, due to the global economic downturn in 2023, Guangyue's major sports brand customers have been affected by the slowdown in consumer market demand and have adjusted inventory orders to shrink.

Guangyue said that the main outlook is 2024. As customer inventory adjustments gradually come to an end, order demand is expected to recover and turn positive.

Another down jacket OEM, KWONG LUNG, had consolidated revenue of 680 million yuan in September, a slight decrease of 1.1% from the previous month and a decrease of 30.8% from last year;Consolidated revenue in the third quarter was 2.185 billion yuan, a quarterly decrease of 11.5% and an annual decrease of 31.9%.

Mainly due to the severe freeze in North America at the end of last year, it was expected that additional orders would appear in the first quarter of this year. However, in the end, they did not appear. This also caused the peak season of ready-to-wear clothing to end one month earlier than in previous years, resulting in a weaker revenue performance in the third quarter than in the past. ; Consolidated revenue in the first nine months was 6.399 billion yuan, a year-on-year decrease of 21.5%.

As it enters the traditional off-season, Guanglong's revenue in the fourth quarter fell at the same rate as in previous years, maintaining around 30%. As for the long-term development of the outdoor functional product market, Guanglong is still optimistic. In addition to continuing to expand the scale of its garment production line, it plans to introduce 3 to 5 new customers next year.

source |

中时新闻网

The Northern Hemisphere is entering autumn, but the extreme hot weather continues unabated. The latest data shows that September this year was the hottest September in meteorological records, 0.93 degrees Celsius higher than the average September temperature from 1991 to 2020. This is also the fourth consecutive month of record high temperatures this year.

Burgess, deputy director of the Copernicus Climate Change Service, said in a statement that after a record-breaking hot summer, September saw unprecedented high temperatures, breaking historical records. This could make 2023 the hottest year on record, with average temperatures around 1.4 degrees Celsius higher than in pre-industrial times.

Global temperatures last year were 1.2 degrees Celsius warmer than in pre-industrial times, but did not break the record; previous records were set in 2016 and 2020, when global temperatures were 1.25 degrees Celsius above average.

Meteorologists say this year's rise in temperatures is mainly the result of climate change caused by human activities and the El Niño phenomenon. Considering that the most serious impact of this El Niño phenomenon will be felt from the end of this year to the beginning of next year, this "unusual warmth" may not ease in the next three months.

source |

澎湃新闻、中央社

According to China Customs statistics, from January to August this year, my country's total exports of clothing (including clothing accessories, the same below) totaled US$107.11 billion, a year-on-year decrease of 9.4%, which was 3.8 percentage points higher than the 5.6% decrease in the country's total foreign trade exports. Since May this year, our country's clothing exports have continued to decline by double digits.

After experiencing a three-year growth bonus period due to the epidemic, our country's clothing export scale is currently returning to the pre-epidemic trend.The value of clothing exports in the first half of this year increased by 18.3% compared with the same period in 2019 before the epidemic.Entering the second half of the year, export volume gradually declined, and the single-month export volume in July was even lower than the same period in 2019.

The United States' "de-Sinicization" of cotton products not only seriously affects China's exports of cotton products to the United States, but also has a negative effect on major markets such as the European Union and Japan, thereby lowering our country's overall exports of cotton products.

In terms of down jackets, although the overall exports of cotton down jackets from January to August 2023 increased by 5% year-on-year, the export value decreased by 8% year-on-year. At the same time, exports to Europe, the United States, and Japan also fell sharply. However, the export of chemical fiber down jackets to the United States and Japan has increased slightly.

Among them, the cumulative exports of cotton down jackets to the EU were US$19.3 million, a year-on-year decrease of 49%; the cumulative exports to the United States were US$3.65 million, a year-on-year decrease of 74%; the cumulative exports to Japan were US$1.35 million, a year-on-year decrease of 63%.

From January to August, in addition to Fujian, the top five export regions of down jackets increased by 14% year-on-year, Jiangsu, Zhejiang, Shanghai, and Shandong decreased by 27%, 17%, 23%, and 18% year-on-year respectively. In addition, Anhui, Xinjiang, and Shaanxi increased by 68%, 7%, and 33% year-on-year respectively.

source |

金绒整理自海关总署、中国纺织品进出口商会

The overall transaction atmosphere in the first half of this year was acceptable, so the bosses predicted that the second half would be better, but the reality was not satisfactory.A fabric company said that in previous years, orders for down jackets were usually gradually issued from May to June, but this year due to the economic downturn, down jacket stalls were cautious in stocking up, and they only started to start in mid-September. Their fabric orders are mainly for 420T nylon and 300T pongee.

Not only were orders delayed, but quantities were also reduced. In previous years, a large number of market orders have flooded into the market since the end of August, but this year it seems that there are no market orders. In particular, dyeing factories are not occupied by market orders, delivery times are not as extended as in the past, and the degree of congestion is not obvious.

Recently, the news of a "warm winter" is likely to have intensified the hesitation of garment factories in placing orders and the cautious mentality of stocking up. As soon as October entered, the textile market became weak.t present, the gray fabric inventory of weaving enterprises in Shengze area is 34.8 days, which is indeed lower than the previous period, but still at a high level.

Clothing sales depend largely on the weather. Looking back on past mild winters, down jackets were unsaleable and clothing factories had high inventories, resulting in inability to pay for goods; while in cold winter years, down jackets sold well and fabric traders had no time to produce them. This is enough to show how important weather is to the sales of clothing and fabrics.

source |

布工厂

Market news situation

This week’s news is more positive than negative.

Affected by cautious orders from European and American ready-to-wear brands and the slowdown in the end consumer market, the revenue and shipments of overseas down jacket OEMs continued to shrink in September, and revenue in the fourth quarter may remain around 30%.

The highest temperature record in September this year has become a historic temperature high again. Behind this is not only global warming, but also the influence of the El Niño phenomenon. Under the new round of data, we have seen an even more intense warm winter trend.

The United States' "de-Sinicization" of cotton products has caused a sharp decline in the export of cotton down jackets to major markets such as the European Union and Japan. The continued decline in my country's textile and apparel exports to the world in September may indicate that the peak export season is almost over.

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

2017羽绒原料价格一路上涨,究竟为何?

你的羽绒服为什么钻绒?涨知识了

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

2017羽绒原料价格一路上涨,究竟为何?

你的羽绒服为什么钻绒?涨知识了

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展