Cn-down > Domestic news > News content

2023-09-17 来源:金绒 浏览量:1477

Summary

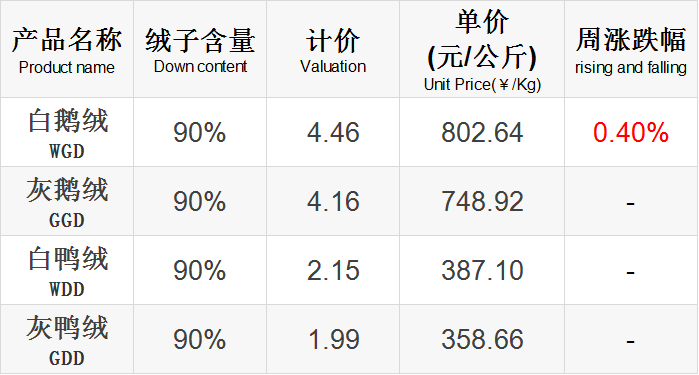

In the 38th week of 2023 (9.11-9.17), the market was generally stable, with white goose down rising slightly.

Data related to the national economy in August released by the National Bureau of Statistics on the 15th showed that the added value of industries above designated size actually increased by 4.5% year-on-year, and industrial production continued to recover. In terms of industries, the textile industry grew by 1.4%. At the same time, China's retail sales of consumer goods accelerated its recovery, with retail sales of "clothing, shoes, hats, and knitted textiles" increasing by 4.5% year-on-year.

As the prices of textile raw materials continue to rise and the deadlock in fabric quotations is broken, the number of dyeing factories entering warehouses has also begun to increase recently.

At present, new down products in the women's clothing and home textile categories are gradually being launched, which has led to an increase in the activity of the down market. However, due to the large demand in these categories, the price of white goose down has increased steadily.JD.com's "Early Autumn Clothing Consumption Observation" shows that women buy down jackets home earlier, and sales of light down jackets have increased.

Good news this week

Autumn is getting stronger, and the duck industry has plummeted like an autumn wind.. Due to the general economic environment, the consumption of duck products has been weak for most of the year. From the perspective of existing slaughtering companies, there is indeed overcapacity. The industry, from slaughtering to market sales, is in deep involution.

After nearly a month of continuous price decline, the price of big ducks has reached a freezing point in recent years, and the cost of stocking ducks at this stage is higher than the current comprehensive selling price.

Regarding the duck industry market in early September, most dealers hold different opinions and still have a wait-and-see attitude.

At present, it seems that the slaughter volume of each manufacturer in August is insufficient, and the overall slaughter volume in September is also limited. After serious losses, each manufacturer will be more cautious in stocking in the near future.According to incomplete statistics, the number of breeding ducks that have been eliminated recently has reached 1.5-1.7 million, which indicates that the total number of ducklings will decrease to varying degrees in the future.

source |

佳合食品集团

CCTV cited South Korean media reports that according to results confirmed by US weather satellites, huge ice holes, known as polynyas, have appeared in the Arctic glaciers. It is speculated that the area of this Polynya is equivalent to 70% of the area of South Korea.

South Korean experts say that when Arctic temperatures rise, the jet stream that prevents cold air from flowing to the Korean Peninsula will weaken, so South Korea may encounter a rare cold wave this winter.

So for our country, does it also mean that we will encounter a rare extreme cold? In addition, our country has recently experienced a large-scale cooling, with the temperature drop reaching more than 10 degrees in some areas, and the Northeast region will be in a low temperature state in the next few days. Does this indicate that this winter will be cold?

As for whether there will be extreme cold this winter, meteorological experts say they cannot yet make a conclusion.

Although the cold air has already become more active at the beginning of autumn and seems to be starting to show its force earlier, this does not mean that this winter will definitely be very cold. Winter climate change is affected by many factors, such as ocean circulation, polar vortex, El Niño, etc., and requires comprehensive analysis to make predictions.

However, experts also remind that although we are in the context of global warming, it does not mean that there will be no cold wave. In fact, under global warming, extreme weather events are increasing, and the probability of extreme cooling processes in winter will increase.

source|

央视网、中国气象爱好者

Douyin's e-commerce rankings in various dimensions in August show that the demand for summer products has begun to transition to autumn and winter products. The emergence of hot products such as down jackets has prompted changes in related category lists. For example, under the women's clothing category, new products such as Snow Flying were born. A dark horse brand.

The women's clothing industry brand list in August has undergone some changes compared with July. The top three are Yaya, Aiyifu, and Xuezhongfei, among which Xuezhongfei has jumped from never being on the list to third place. Xuezhongfei’s Douyin e-commerce cumulative GMV in August exceeded 106 million, a year-on-year increase of 274%, and the unit price paid by customers increased by 183% year-on-year.

The relevant person in charge of Xuezhongfei believes that the competition in the down jacket market is fierce, and differentiation and competitiveness between brands are crucial. High quality and high warmth are the core requirements of consumers for down jackets, and quality control has become a key factor for success.

In terms of store rankings, Zhouzhou Treasure Store, CO CO ZONE Clothing Flagship Store, and CocoHerben rank in the top three;In terms of the most popular items, Snowy Down Jacket, Jiaoxia Sun Protection Jacket, and I Am a Capricorn Woolen Coat rank in the top three, with down jacket products occupying the majority of the list.

source |

TopKlout克劳锐

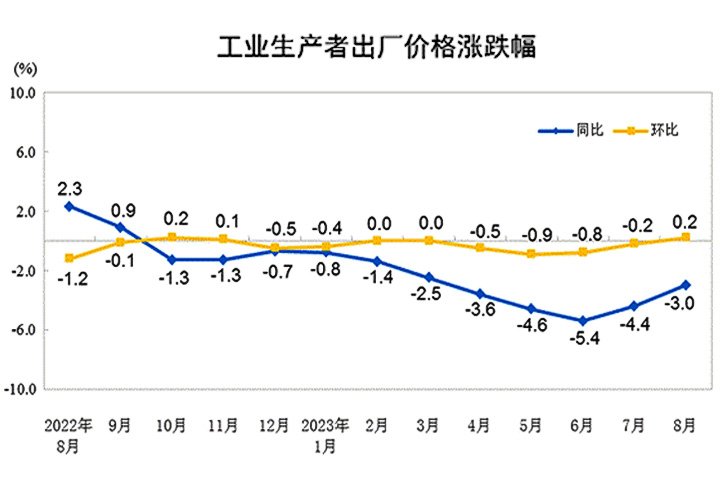

On September 9, the National Bureau of Statistics released data showing that due to factors such as improved demand for some industrial products and rising international crude oil prices, the year-on-year decline in PPI (Producer Price Index) narrowed, and the month-on-month decline turned to increase, ending the decline since April. The chain continues to show negative growth.

From a month-on-month perspective, PPI increased by 0.2% from a decrease of 0.2% in the previous month. Among them, the price of means of production increased by 0.3% from a decrease of 0.4% in the previous month; the price of means of living increased by 0.1%, an increase of 0.2 percentage points lower than that of the previous month.

From a year-on-year perspective, PPI fell by 3.0%, and the decline narrowed by 1.4 percentage points from the previous month. Among them, the price of means of production fell by 3.7%, the decline narrowed by 1.8 percentage points; the price of living materials fell by 0.2%, the decline narrowed by 0.2 percentage points.

Among the purchasing prices for industrial producers, the price of textile raw materials increased by 0.1% month-on-month and decreased by 2.4% year-on-year. Among the ex-factory prices of major industries, the textile, clothing and apparel industry fell by 0.1% month-on-month and increased by 0.7% year-on-year.

Researchers said that since August, policies to stabilize growth have been issued intensively. As the effect of the policy combination continues to appear, and September enters the traditional construction peak season, downstream terminal demand is expected to boost.

source |

国家统计局、21世纪经济报道

Bad news this week

Quang Viet, a major down jacket OEM, announced that its consolidated revenue in August was 2.189 billion yuan, a monthly increase of 4.65%, and the peak shipping season effect continued.At the same time, Guangyue has entered the Lululemon supply chain, and its revenue is still increasing month by month.

Wu Chaobi, chairman of Guangyue, said that the peak season effect continued and operating performance increased month by month, but it decreased by 14.44% compared with the same period last year. In addition to the strong demand for customer orders in 2022, which is higher than the base period, it is also due to the fact that major sports brand customers in 2023 will be affected by the slowdown in the terminal consumer market and adjust inventory orders to reduce.

Overall, the garment industry environment will be severe and changing rapidly in 2023. In addition to keeping track of existing customer orders and continuing to optimize its product portfolio, Guangyue is also actively developing new brand customers to maintain competitiveness and prepare for a reversal in the industry boom.

KWONG LUNG, another down jacket OEM, pointed out that as garment clients have become more cautious in placing orders this year, the peak season for garment shipments has also ended early. In August, consolidated revenue was 687 million yuan, a monthly decrease of 16% and an annual decrease of 42.8%. Among them, garment revenue fell by more than 50% in a single month.

Guanglong said at a recent press conference that its revenue in the third quarter of this year is expected to decrease slightly by about 10% from the previous quarter, but it will gradually recover from the fourth quarter, and revenue will return to normal after November. annual growth trajectory. The outdoor brand customers newly introduced this year have successively shipped shipments and contributed to revenue, and other new customers are currently being developed.

In addition, Guanglong is still optimistic about the development of the outdoor functional clothing market, and has also seen that more and more brand customers are accelerating their search for OEM production bases outside mainland China. Guanglong will continue to expand its overseas garment factories, with 10 more in Vietnam and 6 planned in Indonesia, both of which are planned to be put into production in the fourth quarter. The scale of its own production lines will be expanded to more than 80 by the end of the year.

source |

中时新闻网

After entering September, the polyester raw material market suddenly became popular! International oil prices have been playing a triumphant song all the way, PTA has surged strongly in response, ethylene glycol has also risen rapidly, and polyester filament has grown by leaps and bounds.

Compared with the excitement of the raw material market, the textile market appears to be quite "calm". Through research, it is found that the current textile market is recovering slightly, but the trend in the later period is not yet clear; in terms of orders, the polarization among enterprises is becoming increasingly serious, and there is a feeling of "some earth cracks in drought, while others flood in rain.".

Monitoring data from Silkdu.com shows that since August, the weaving companies in the sample have achieved significant destocking results. Most of the best-selling fabrics on the market are autumn and winter fabrics, which are seasonal products. As for the reason for the hot sales, it is generally believed that it is driven by the demand for autumn and winter clothing.

Taken together, whether it is genuine demand or genuine stocking up, orders have at least really come in during this period. Among them, domestic sales orders have picked up significantly, while the performance of the foreign trade market has been mediocre.

source |

布工厂

Market news situation

This week’s news is more positive than negative.

The consumption of duck products has been weak for most of the past six months. It is estimated that the duck slaughter volume in September will still be limited, while the duckling production continues to decline compared with the previous week, and the overall number of ducklings may continue to decrease. This may support the price of duck down.

Douyin e-commerce rankings in various dimensions in August show that demand has begun to transition to autumn and winter products, and down jacket products have begun to occupy most of the seats in various lists of women's clothing. Urban white-collar workers and student groups have the highest consumption growth in sports and outdoor clothing, with sales of sports down jackets and jackets increasing by more than 120%.

Affected by cautious orders from European and American garment brands and the slowdown in the end consumer market, the revenue and shipments of overseas down jacket OEMs shrank significantly in August. However, major OEMs are still optimistic that the garment industry will gradually recover in the fourth quarter.

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

2017羽绒原料价格一路上涨,究竟为何?

你的羽绒服为什么钻绒?涨知识了

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

2017羽绒原料价格一路上涨,究竟为何?

你的羽绒服为什么钻绒?涨知识了

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展