Cn-down > Domestic news > News content

2023-08-28 来源:金绒 浏览量:1434

Summary

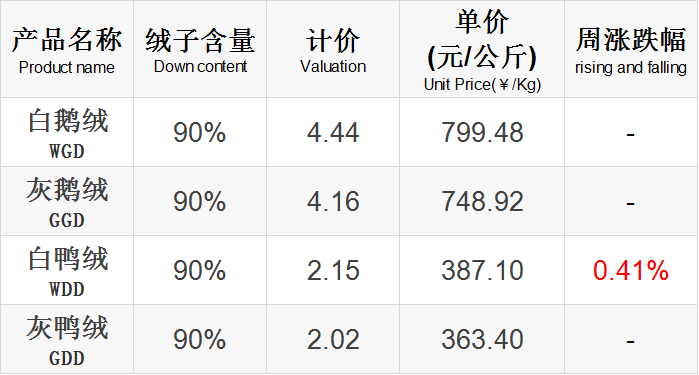

In the 35th week of 2023 (8.21-8.27), the market is generally stable, with white duck down rising slightly.

Recently, the production and sales rate in the slaughtering process has been low, and the supply of raw material wool has been reduced, which has also led to higher quotations in the downstream finished cashmere market. However, the Zhongyuan Festival is approaching, which will usher in the peak of duck consumption, and the supply of raw wool may increase again in September.

Since the beginning of this year, the export of down raw materials and products has rarely experienced a sustained downturn, with data declining significantly year-on-year. Especially for down jackets, although July is the peak export period, its export volume cannot even compare with June, which is an abnormal situation.

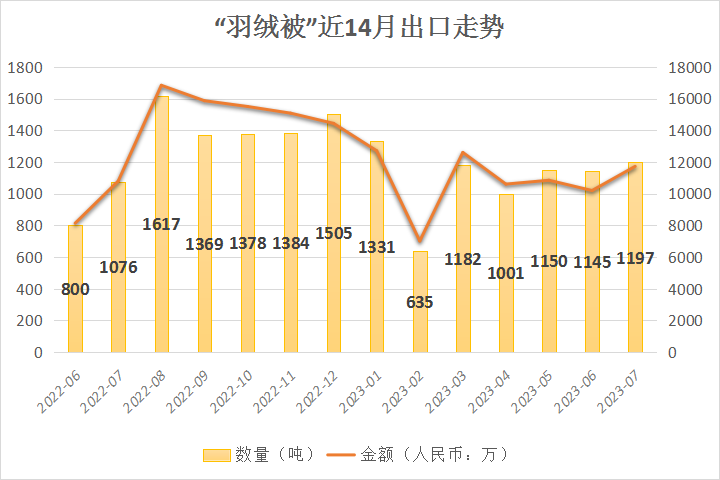

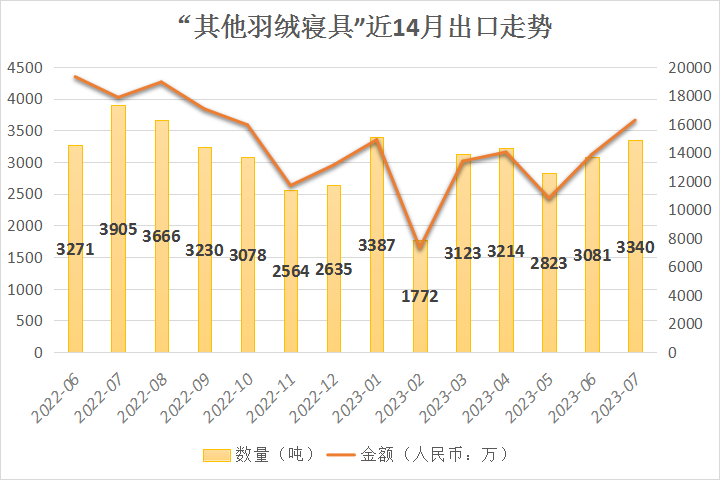

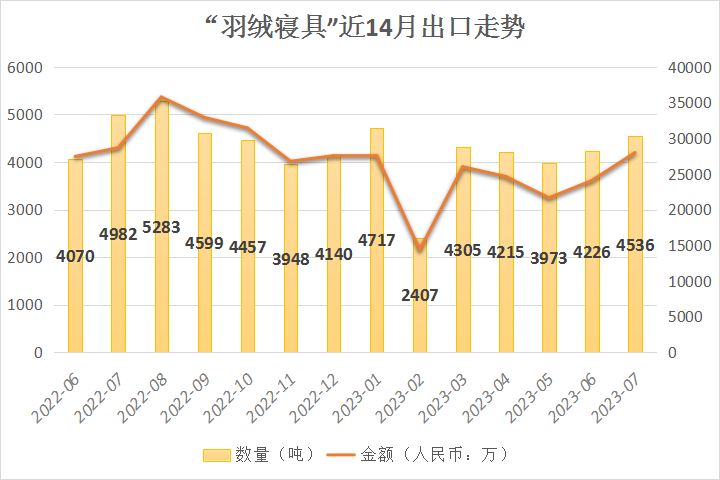

However, the export of down bedding has ushered in the seasonal demand of European and American consumers, with month-on-month growth for two consecutive months from June to July, and is expected to continue the growth trend in the third and fourth quarters. Among them, the export of down quilts still maintained growth year-on-year, and August to November last year was the peak season for exports of this category to the United States.

Good news this week

Starting from 2022, the tariffs related to down bedding have been adjusted, and a new subheading of "down and feather quilts and bedspreads (hereinafter referred to as down quilts)" has been added. The scope of "other bedding and similar products filled with down or feathers (hereinafter referred to as other down bedding)" will be adjusted accordingly, and only products such as cushions, back cushions, and pillows will be counted.

Duvet:

From January to July 2023, a total of 7,640.5 tons of "down quilts" were exported, a year-on-year increase of 50.5%; the export value was 757 million yuan, a year-on-year increase of 46.6%.

In July 2023, 1,196.6 tons of "down quilts" were exported, an increase of 11.2% year-on-year; the export value was 117 million yuan, an increase of 8.6% year-on-year.

In July 2023, the United States continued to be my country's largest trading partner for "down quilt" exports, accounting for 35% of total exports this month.Among them, the export quantity was 423.3 tons, a year-on-year increase of 83.1%, and a month-on-month increase of 21.3% in June; the export value was 42 million yuan, a year-on-year increase of 58.2%.

Germany was the second largest trading partner in the month, accounting for 9.2% of total exports; followed by the United Kingdom at 9.1% and Japan at 8.1%.

Other down bedding:

According to China Customs data, a total of 20,700 tons of "other down bedding" were exported from January to July 2023, a decrease of 23.8% compared with last year; the export value was 906 million yuan, a decrease of 32.6% compared with last year.

In July 2023, 3,339.8 tons of "other down bedding" were exported, a decrease of 14.5% compared with last year; the export value was 163 million yuan, a decrease of 8.9% compared with last year.

In July 2023, the United States remained my country's largest trading partner for "other down bedding" exports, accounting for 51% of total exports this month. Among them, the export quantity was 1,717.0 tons, a decrease of 14.9% year-on-year; the export value was 63 million yuan, a decrease of 8.4% year-on-year.

The UK was the second largest trading partner during the month, accounting for 7% of total exports; followed by Canada at 5% and Germany at 4.5%.

Down bedding (down quilt + other bedding)

From January to July 2023, a total of 28,400 tons of "down bedding" were exported, a year-on-year decrease of 12.1%; the export value was 1.662 billion yuan, a year-on-year decrease of 10.6%.

Down bedding is expected to see growth in the third quarter due to the changing seasons of European and American consumers.

source |

金绒 整理自海关数据

Catman (International) Hong Kong Co., Ltd. (referred to as Catman) was established in 1998. As one of the brands that has experienced online impact along with Nanjiren, Hengyuanxiang and Beijijing traditional brands, Catman has not fallen into the trap of trademark authorization. Instead, it has grown into a "new underwear species" comparable to cutting-edge brands.

On August 22 this year, at the launch of the "Meili City" technology apparel strategy and the signing ceremony of the first batch of partners, Meili City signed the "Wuhan Covenant" with 5 partners on site. This time, Meili City is targeting Uniqlo and wants to be an upgraded version of China's Uniqlo.

It is understood that the main category promoted by Meili City this winter is high-tech down jackets. The down jackets on site are mainly in low-saturation colors, combined with healing dopamine colors, including pear sorbet, glacier blue, Barbie pink, opal, technical black, etc. You can feel the fashion and high-end in minimalism when you come across it. .

In terms of product research and development, we pay attention to the combination of art and technology. For example, volcanic rock fabrics that can self-heat can give down jackets a warmer space; down jackets with memory, because the fabric used has memory, even if it is rubbed, it will quickly smooth out. These qualities are very suitable for people who like to live a light life.

Brand Chairman You Lin said that Maoren has ranked first in the market in terms of underwear, but underwear only accounts for about 8% of the clothing market. Therefore, Meili City focuses on all categories of technological clothing, and down jackets are a major category in clothing. We will definitely make it bigger.

The person in charge of the Meili City Down Jacket Business Department said that the brand refuses to be involved in involution and does not engage in price wars. The products are planned by the headquarters and empowered to develop and manufacture the domestic leading supply chain.The person in charge once operated a leading down jacket brand in China, and the project was a great success. This time he landed in Meili City and brought a group of high-quality supply chains and many outstanding talents.

source |

每日经济网

With the approval of the State Council and the Central Military Commission, starting from August 1, 2023, primary militiamen and full-time people's armed cadres across the country will gradually be issued and activated Type 21 combat training uniforms.

The allotment objects are organized and registered basic militiamen and full-time people's armed cadres selected and appointed in accordance with regulations. The types of distribution are mainly jungle camouflage summer training uniforms, desert camouflage winter training uniforms, desert camouflage training coats and matching logo clothing.

The coats distributed this time are designed with waterproof and wipeable fabrics, and the interior is made of down material. Compared with the coats distributed before, they are lighter, more comfortable and warmer.

On August 21, Jihua Group responded to investors’ questions about 21-style training uniforms on the investor relations platform, saying that the company will strictly abide by the information disclosure rules and fulfill its information disclosure obligations, and the relevant order contracts will be given to the company for undisclosed information. The company brings in revenue and profits and improves company performance.

source |

央广军事、证星董秘互动

According to feedback from several cotton spinning companies in Jiangsu, Shandong, Henan and other places, since August, some weaving companies and middlemen in Guangdong, Jiangsu, Zhejiang and other places have been picking up the price inquiry and purchase of C40S cotton yarn, and the transactions are much smoother than in June and July.

A textile company in Suzhou said that the peak season of the "Golden Nine and Silver Ten" in the domestic textile and clothing market is coming, and consumption of mid-to-high-end home textiles and bedding products with a count of C40S and above is expected to rebound.

The weaving factory currently has a lot of orders, the workshop is busy, and the delivery time is very tight. Especially for small batch orders, late delivery is increasing. As the gap between domestic cotton and foreign cotton narrows, factories now begin to purchase imported raw materials to produce traceable products.

Export orders are being placed one after another. The prices of raw materials and gray fabrics have been slightly increased. Orders from dyeing factories have increased significantly. Some dyeing factories have already scheduled their delivery dates to September. It is expected that there will be a small explosion of orders in September.

source |

中国棉花网

Good news this week

In July 2023, a total of 7.033 million pieces of down clothing were exported, a decrease of 8.3% from June this year; the export value was 1.512 billion yuan, an increase of 1.9% from June this year.。

Down jacket export list for July 2023

|

商品 名称 |

数量 (万件) |

人民币 (亿元) |

数量同 比去年 |

金额同 比去年 |

|

棉制男 羽绒服 |

109.6 | 1.51 | -32.0% | -31.6% |

|

化纤制男 羽绒服 |

190.2 | 4.59 | -41.1% | -34.4% |

|

棉制女 羽绒服 |

49.1 | 0.78 | -17.7% | -27.8% |

|

化纤制女 羽绒服 |

354.3 | 8.24 | -24.9% |

-27.0% |

Export situation of men's down jackets in the past 14 months

Export situation of women's down jackets in the past 14 months

It can be seen from the data that the export of down jackets has exited the off-season, but after four months of continuous growth, there has been an extremely obvious decline. Export volume in July fell by 31% overall compared with last year.

Looking at the situation in the past nine years, the export volume in July can often be the highest in the whole year. However, the export volume of down jackets in July this year was not only reduced by more than half compared with previous years, but was even less than the volume in June. It can be said that an abnormal situation has occurred.

In terms of imports, in July 2023, a total of 535,000 pieces of down clothing were imported, an increase of 89.5% from the previous month; the import value was 607 million yuan, an increase of 110.4% from the previous month.

source |

金绒采编 数据来自海关

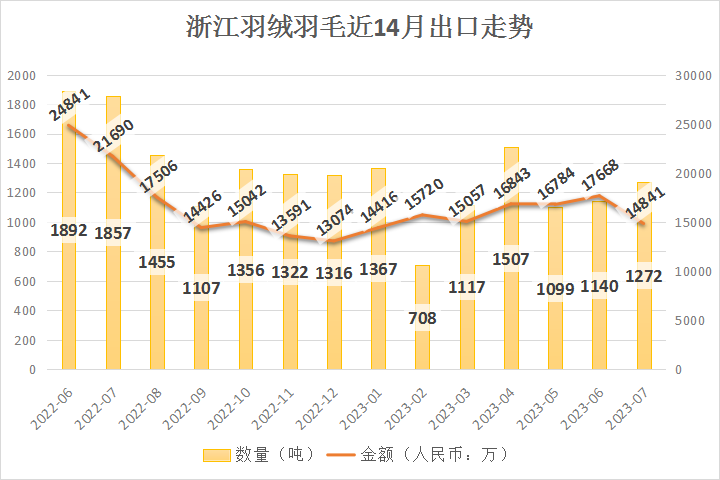

According to China Customs data, from January to July 2023, Zhejiang Province ranked first in the country in terms of export volume and export value of down and feathers. However, export volume fell sharply from May to July and was far less than in previous years.

From January to July, Zhejiang Province exported 8,210 tons of down and feathers, a decrease of 31% year-on-year; the export value was 1.113 billion yuan (RMB, the same below), a decrease of 30% year-on-year.

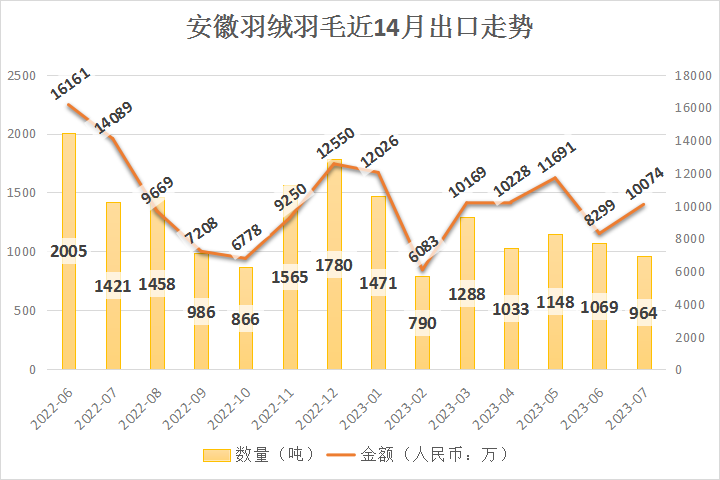

In the first half of 2023, Anhui Province ranked second in the country in terms of export volume and export value of down and feathers.

From January to July, Anhui Province exported 7,763 tons of down and feathers, a decrease of 31% year-on-year; the export value was 686 million yuan, a decrease of 32% year-on-year.

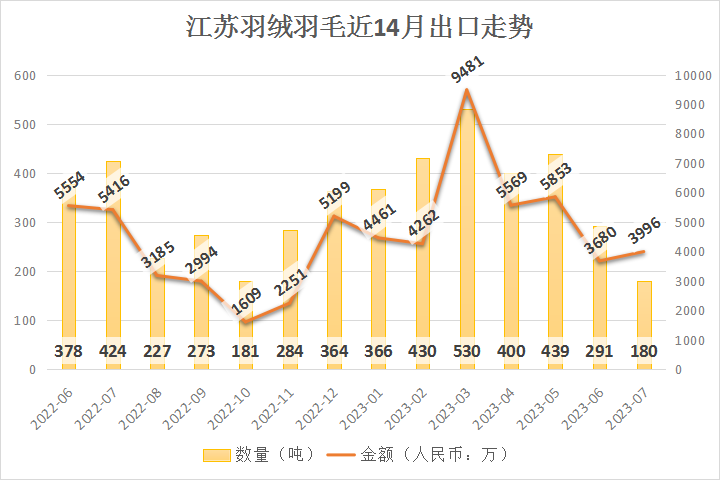

From January to July, Jiangsu Province exported 2,637 tons of down and feathers, a decrease of 18% year-on-year; the export value was 373 million yuan, a decrease of 26% year-on-year. In July this year, Jiangsu Province's down and feather exports continued to slide toward lows.

From January to July, Guangdong Province exported 849 tons of down and feathers, a decrease of 49% from the same period last year; the export value was 121 million yuan, a decrease of 35% from the same period last year.

From January to July, Hunan Province exported 583 tons of down and feathers, an increase of 96% year-on-year; the export value was 285 million yuan, an increase of 108% year-on-year. Since May, Hunan Province's down and feather exports have lost the steady increase since last year.

source |

金绒 数据来自海关

U.S. economic data is “bad news” again. The latest data from S&P Global showed that the U.S. Markit manufacturing and services PMIs in August were both worse than economists expected and fell from July.

The preliminary value of the Markit manufacturing PMI in the United States in August was 47, a new low since February this year, which was lower than the expected 49. The value before July was 49. The Markit Manufacturing PMI has fallen into contraction territory in seven of the past eight months.

The initial value of the new orders sub-index for the manufacturing industry fell to 45.3, a new low since June this year and shrinking for the fourth consecutive month. The initial value of the employment sub-index fell to a new low since January this year.

Data showed that U.S. business activity showed little expansion due to weak consumer demand. Manufacturing has been weak for months, giving the services sector, which accounts for a larger share of the economy, the upper hand, but the latest data suggests services are also tracking the weakness in manufacturing.

Businesses report that demand looks increasingly weak in the face of high prices and rising interest rates. A decline in new orders received by companies in August is likely to lead to a contraction in output in September as companies adjust their operating capabilities in response to the deteriorating demand environment.

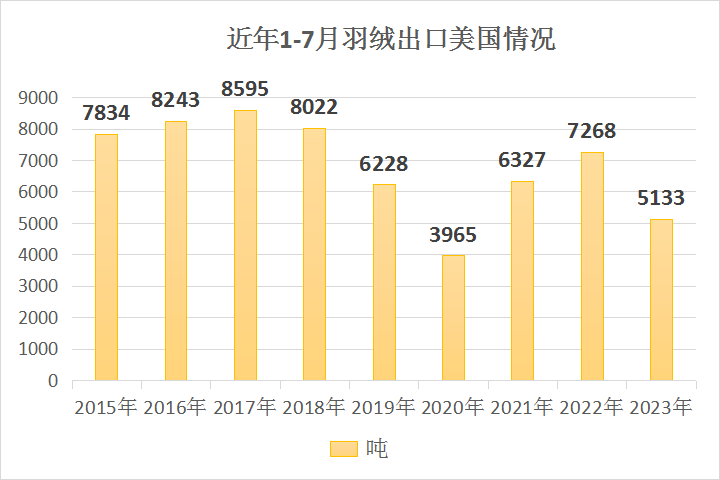

Our country's down exports to the United States have also hit a trough. The export volume in July was 539.5 tons, a year-on-year decrease of 45%, and the fourth consecutive month of decline. However, the total exports from January to July 2023 were 5,132.9 tons. Compared with the same period in the past nine years, it was only higher than 2020, which was severely affected by the epidemic.

source |

华尔街见闻、海关数据

Market news situation

This week’s news is more positive than negative.

This winter, the down jacket track has welcomed another challenger. The chairman of Maoren Group personally controls the Meilicheng brand and will create cost-effective high-tech down jackets suitable for Chinese consumption and become a disruptor in the industry - breaking high prices.

In August this year, militiamen and full-time people’s armed cadres across the country will be issued and activated Type 21 combat training uniforms. Among them, winter training uniforms and training coats are filled with down, and related orders may bring additional revenue to the industry.

The preliminary value of the Markit Manufacturing PMI in the United States for August showed that the entire industry was generally weak and new orders deteriorated further. The United States has always been my country's largest trading partner for down and feather exports, but this year, my country's down exports to the United States have declined for four consecutive months.

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

2017羽绒原料价格一路上涨,究竟为何?

你的羽绒服为什么钻绒?涨知识了

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

2017羽绒原料价格一路上涨,究竟为何?

你的羽绒服为什么钻绒?涨知识了

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展