Cn-down > Domestic news > News content

2023-07-09 来源:金绒 浏览量:1737

summary

The overall market remained stable this week (0702-0708), with the price of duck down slightly decreasing.

Although the production season for domestic down products is approaching, expectations for foreign trade and domestic demand are beginning to weaken, and down enterprises are showing signs of caution and increasing desire to reduce inventory. However, the small supply of some varieties in the market has led to a slight decline in prices at a stable level.

Due to the fact that the quantity of duck seedlings is still below the overall balance point of the industry, the overall supply of duck seedlings remains increasing. However, the increasing number of hot weather conditions has a significant impact on the production performance of breeding ducks, and there is a high pressure on downstream slaughtering end prices to maintain capital, making it difficult to continuously put them at full load.

The export orders of Vietnam's textile and clothing industry continued to decline, with the exception of Down jacket OEM. Driven by the traditional peak shipping season, the down garment factory is expected to see the industry boom climb from the bottom of the second quarter, and holds a cautious and optimistic attitude towards the operation in the third quarter.

Exchange rate of USD to RMB: 7.2157

Exchange rate of USD to RMB: 7.2046

Exchange rate of USD to RMB: 7.1968

Exchange rate of USD to RMB: 7.2098

Exchange rate of USD to RMB: 7.2054

good news

In June, the quotation for white feather meat duck seedlings was basically above 3 yuan/piece. Regarding this, Shandong duck breeder Ma Fazhi stated that due to factors such as busy farming and high temperatures, June is the off-season for duck fry sales. However, this year's prices are really good, and this has not happened in three or four years, as they fell below 1 yuan/piece last year.

Liu Changsheng, Chairman of the Shandong Duck Breeding Alliance, stated that the rise of duck seedlings in June was unprecedented. Mainly because a large number of low-end production capacity breeding ducks have been discontinued, and in addition, a large number of mid end production capacity breeding ducks have not yet emerged, resulting in a relatively small number of seedlings.

Regarding the later trend of duck seedlings, He Liming, a duck industry analyst at Shanghai Steel Union Agricultural Products Business Unit, believes that the price of duck seedlings continues to rise and faces resistance, but the quantity of seedlings is still below the overall balance point of the industry, exacerbating the supply-demand game. However, the increasing number of hot weather conditions has a significant impact on the production performance of breeding ducks.

In terms of terminal products, the head of Huaying Marketing Department stated that the performance of the terminal market in the second quarter was average, and the downturn in pork prices had a significant impact on duck meat products. The staff of Yike Food Securities Department stated that the overall performance of duck meat products was better than the same period last year.

bad news

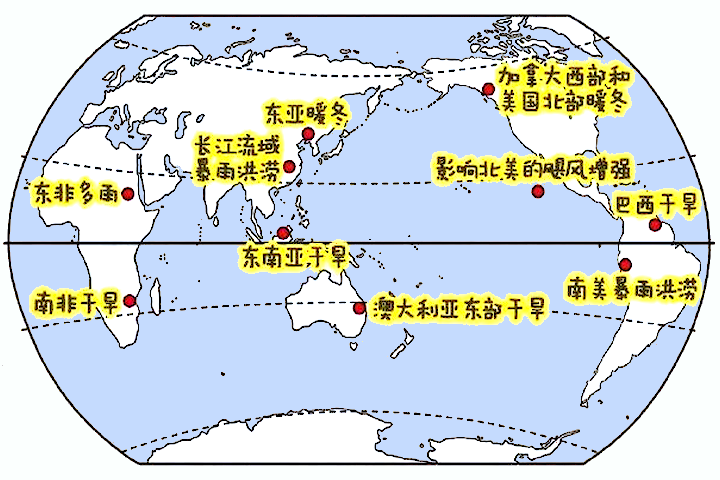

On July 3rd, the global average temperature 2 meters above the Earth's surface reached 17.01 degrees Celsius, making it considered the hottest day on record on Earth. But just one day later, the daily average temperature on the Earth's surface reached 17.18 degrees Celsius, setting a new record for high temperatures.

According to American media, July 4th has become the highest average temperature recorded on Earth so far. Some scientists even believe that July 4th may be the hottest day on Earth in approximately 125000 years.

Although this average temperature figure may not seem high, considering that it also takes into account the temperatures of the polar regions and sea levels, behind the record breaking numbers, many land countries or regions have experienced sustained heatwaves, which also represents an increase in melting ice area.

And experts warn that this record may be broken several times in 2023. Robert G. Roeder, a geophysicist at the University of California, Berkeley, said that "the world is likely to have hotter weather in the next six weeks." With the return of the El Nino event, the northern hemisphere is being swept by a rare heat wave.

Recently, maritime container giant Maersk released a low water surcharge table, stating that as the Rhine River water level drops, the cost of fully loaded containers will increase, and loading cannot even be guaranteed. The Panama Canal also fell into low water level due to months of historical drought in History of Central America.

Agricultural product futures will also be affected by the El Ni ñ o event. For cotton, when El Ni ñ o reaches a super strong level, the global production is likely to decrease; When reaching a moderate level, global production changes are not significant, but most regions mainly reduce production, while China, Pakistan, and Brazil tend to increase production slightly.

The new 'Developing Counties Trading Scheme, DCTS' in the UK takes effect on June 19th. After the implementation of this new system, the tariffs on imported bed sheets, tablecloths, and similar products from developing countries in the UK will increase by 20%.

These products will be levied at the 12% most favored nation tariff rate, rather than the 9.6% universal preferential measure tax reduction rate. It is estimated that the implementation of the new system will result in an increase of approximately £ 27000 in annual tariff expenses for British importers.

A spokesperson for the UK Department of Commerce and Trade stated that after the implementation of the new system, many tariffs will be reduced or cancelled, and the rules of origin will be simplified for developing and least developed countries that benefit from this measure.

However, a British textile import trader stated that the industry has not yet been widely aware of the imminent change in tariffs, and many textile importers, many of whom are small and medium-sized enterprises, may be caught off guard.

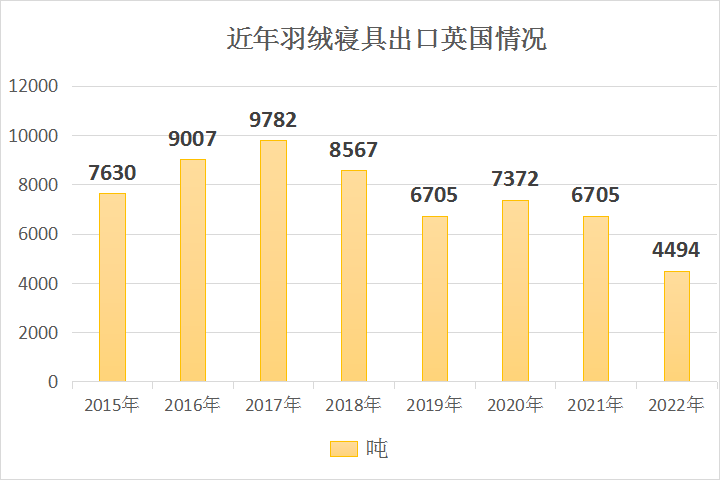

Since 2017, the import of down bedding in the UK has been declining year by year. Nevertheless, Britain is still the main export country of China's down bedding, second only to the United States, and equal to Germany, Australia, Japan and Canada.

From January to May this year, Britain imported 1578 tons of down bedding including Duvet, a decrease of 15% over the same period in 2022 and 36% over the same period in 2021.

At the same time, in the context of sustained high inflation in the UK and continuous interest rate hikes by the Bank of England, there will be more British people falling into poverty in the future. By January this year, the number of British adults struggling to pay their bills had climbed to 12.8 million.

There is a clear cyclical nature in the textile market. The off-season of demand from June to August every year is approaching, and textile orders are prone to shrinkage. According to the monitoring data of Silk Metropolis, due to the textile market entering the off-season mode, some enterprises are insufficient to follow up new orders, and the maintenance of Down jacket fabric orders is also inadequate.

The research results show that the textile market is currently in a critical period of changing seasons for summer and autumn fabrics, with orders mainly focused on developing samples and replenishing bulk orders. The polarization between textile enterprises is becoming increasingly evident. Overall, textile orders in June showed a steady but declining trend.

Mr. Huang, who specializes in Nisi spinning, introduced that they mainly focus on domestic sales. Since June, the total number of orders has been almost the same as in May. Trade orders are issued intermittently, mainly for 480T nylon spinning, with downstream entering the autumn and winter fabric stocking cycle being the main reason.

Mr. Shen, who specializes in Chunya Textile, said that the current factory's operating rate remains around 90%, and the total order volume has significantly decreased compared to May, with a decrease of approximately 30%. The order composition is mainly composed of small orders, and high elastic fabrics are better in stock.

According to data from the National Bureau of Statistics, from January to May 2023, the industrial added value of enterprises above designated size in China's clothing industry decreased by 8.6% year-on-year, and in May, it decreased by 6.3% year-on-year, which is 4.3 percentage points narrower than in April; Enterprises above designated size completed a clothing production of 8.453 billion pieces, a year-on-year decrease of 1.91%.

From January to May, the total retail sales of consumer goods in China reached 18763.63 billion yuan. Among them, the retail sales of clothing products by units above the designated size reached 414.84 billion yuan, a year-on-year increase of 17.4%. Among them, the retail sales of clothing products in May increased by 21.2% year-on-year, a slowdown of 18.7 percentage points compared to April.

From January to May, the actual completed investment in China's clothing industry decreased by 4.2% year-on-year, a decrease of 1.5 percentage points compared to January to April.

From January to May, there were 13637 enterprises in China's clothing industry with an annual main business income of 20 million yuan or more, achieving a revenue of 462.36 billion yuan, a year-on-year decrease of 7.52%. The total profit was 17.5 billion yuan, a year-on-year decrease of 8.2%. The operating revenue profit margin was only 3.78%, a year-on-year decrease of 0.37 percentage points.

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

2017羽绒原料价格一路上涨,究竟为何?

你的羽绒服为什么钻绒?涨知识了

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

2017羽绒原料价格一路上涨,究竟为何?

你的羽绒服为什么钻绒?涨知识了

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展