Cn-down > Domestic news > News content

2023-06-11 来源:金绒 浏览量:1489

summary

The market has slightly increased this week, but the price of white duck down remains stable.

Earlier, due to the rapid rebound in white duck production, the price of raw duck wool fell negatively. However, the supply side holds reservations about the decline in this price. In addition, as the temperature increases, the egg production rate and fertilization rate of breeding ducks will be affected, and it is expected that the production capacity of duck seedlings will decrease in the coming months.

In May of this year, China's total export value decreased by 0.8%, but one of the main reasons is that the data base for the same period last year was relatively high. The same is true for clothing exports in May. In the past five years, the actual export amount in that month is only second to last year. It is worth noting that the market share of China's exports in the United States has recently declined rapidly.

As "520" came to an end, brand merchants immediately began to compete with "618". According to relevant statistics, winter goods have entered a off-season sales trend since May, with a significant year-on-year increase in sales. On June 1-2, the turnover of Down jacket increased by 95% year on year.

Exchange rate of USD to RMB: 7.0904

Exchange rate of USD to RMB: 7.1075

Exchange rate of USD to RMB: 7.1196

Exchange rate of USD to RMB: 7.1280

Exchange rate of USD to RMB: 7.1115

good news

The largest news media in Iceland said that the Chinese Down jacket brand "YAYA" will purchase the world's most expensive down this year - Icelandic goose and duck down, to design Down jacket. And this will also mark a strong mark for YAYA's marketing this year.

Local children put on YAYA's Down jacket, and under the guidance of musician Olafur Eliasson, they sang the brand song of Duck in Chinese, warmly welcoming the Chinese brand. The lyrics are very simple, I have fallen in love with YAYA, "the interviewee said happily.

It is understood that Icelandic goose duck down is a kind of rare down, which is usually used to make Duvet. Its price can reach hundreds of thousands of yuan in China. Due to the fact that this wild goose duck is a key protected species in Iceland and hunting is not allowed, collectors can only pick down from abandoned nests of wild goose ducks, with an annual yield of only 2000 kilograms.

In order to bring better products, YAYA spent a lot of time in the local area to deeply understand the natural environment of Iceland, and became the world's first Down jacket brand to sign a contract with Iceland goose duck down. As this year's new Down jacket, it will also be sold worldwide.

ST Huaying announced on June 5th that the company's stocks will be suspended for one day on June 6th and will resume trading from the opening of the market on June 7th. At the same time, the company's stock has revoked other risk warnings from June 7th, and the abbreviation of the securities has been changed from "ST Huaying" to "Huaying Agriculture". The daily limit on stock prices has been changed from 5% to 10%.

With the accelerated promotion of breeding duck production and the upgrading and reconstruction of breeding farms, the sales volume and capacity utilization rate of Huaying commercial ducks are gradually increasing, and the Unit cost is expected to further decline. In the first quarter of 2023, Huaying achieved a turnaround from losses to profits, so it is optimistic about the situation in the second quarter of this year.

Huaying disclosed that the Company and the People's Government of Huangchuan County planned to jointly build Huaying Industrial Park in Huangchuan City. The purpose is to further expand the company's existing food and down industry scale and achieve the upgrading and transformation of the two major industries by optimizing industrial clusters, leading open innovation, and coordinating factor resources.

The down business sector is an important pillar of Huaying's future development. The company will tilt towards the down sector in terms of manpower, funds, and policies in accordance with its strategic development plan for the next five years, to support its further expansion and strength.

Weaving enterprises have reported that they currently have a large number of executable orders on hand, most of which can be maintained until July to August, and the startup rate is also maintained at 100%. In addition to the good order receiving situation, the workshop inventory is also within a reasonable range, so the intention to reduce production is not obvious.

From the monitored sample enterprises, it can be seen that the overall transaction volume of fabrics and lining has slightly decreased compared to last week. The quantity of goods sold in domestic demand has decreased, and orders for spring and summer fabrics are nearing the end, while there has been a surge in autumn clothing fabrics. Foreign trade orders have slightly improved, and overall market transactions have rebounded compared to the beginning of the month.

Autumn clothing fabrics are showing a trend of high volume, with the most active transaction in the high elasticity fabric market. Weaving manufacturers are gradually showing a thriving production and sales, especially the sales of the 50D series of high elasticity PONGEE series have increased. In addition, some Simulation Silk sales remain unchanged.

President Ye, the owner of the weaving factory that produces functional fabrics, said: "At present, Down jacket and outdoor fabrics are mainly used. This year, the national style outdoor fabrics are popular. This year, they are popular. It is expected that there will be many additional orders later."

"At present, the operating rate of our factory is 100%, and the orders have been placed until November." Li Pengcheng, the head of Jiaxing Chenghong Trade Co., Ltd., said that the lining was basically purchased by garment enterprises, mainly used to make the lining of Down jacket and cotton padded clothes, but now automobile accessories also need lining.

"It is expected that the market will improve in the second half of the year, "said Zhang Lihua, the person in charge of Shaoxing Woli Needle Textile Co., Ltd." Firstly, raw material prices have started to rise in recent times. Secondly, as the weather turns cooler in the second half of the year, the demand for warm clothing increases and lining consumption increases. Furthermore, there has been an increase in foreign trade orders in the market."

bad news

On June 7th, the General Administration of Customs announced that in the first five months of this year, China's total import and export value was 16.77 trillion yuan, a year-on-year increase of 4.7%, measured in RMB (the same below). Among them, exports reached 9.62 trillion yuan, an increase of 8.1%; Import reached 7.15 trillion yuan, an increase of 0.5%; The trade surplus reached 2.47 trillion yuan, an increase of 38%.

In May this year, China's import and export reached 3.45 trillion yuan, an increase of 0.5%. Among them, exports reached 1.95 trillion yuan, a decrease of 0.8%; Import of 1.5 trillion yuan, an increase of 2.3%; The trade surplus was 452.33 billion yuan, narrowing by 9.7%.

Lv Daliang, Director of the Statistics and Analysis Department of the General Administration of Customs, stated that a series of policy measures aimed at stabilizing the scale and optimizing the structure of foreign trade have helped foreign trade operators actively respond to the challenges brought by weak foreign demand, effectively capture market opportunities, and promote China's foreign trade to maintain positive growth for four consecutive months.

The Research Department of CITIC Securities said that the export growth rate dropped significantly, mainly because the export growth rate naturally fell after the release of export backlog demand in March. Currently, developed economies overseas, such as the United States, are still in the stage of inventory depletion, which to some extent hinders domestic exports.

The support of emerging countries such as the "the Belt and Road" for exports has gradually strengthened. In the first five months, imports and exports to ASEAN and the European Union increased, while imports and exports to the United States and Japan decreased. The total trade value with the third largest trading partner, the United States, was 1.89 trillion yuan, a decrease of 5.5%, accounting for 11.3%.

In May, China's textile and clothing exports to the world amounted to 174.07 billion yuan, a year-on-year decrease of 7.0% and a month on month decrease of 1.1%. Among them, textile exports amounted to 82.64 billion yuan, a year-on-year decrease of 8.0% and a month on month decrease of 5.5%; Clothing exports reached 91.43 billion yuan, a year-on-year decrease of 6.1% and a month on month increase of 3.2%.

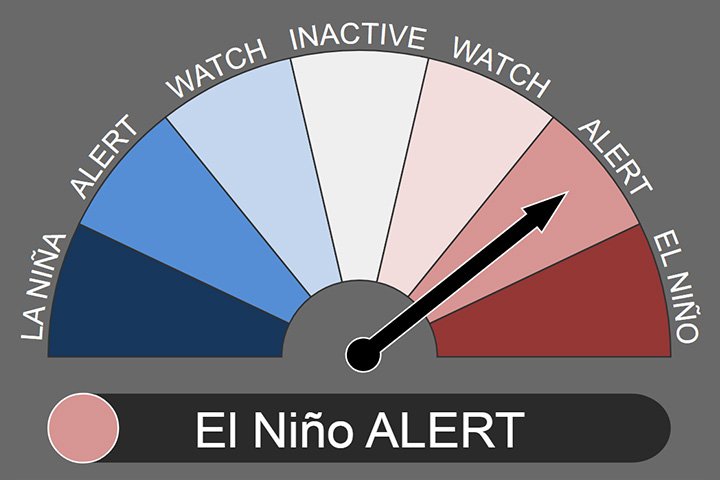

On June 6th, the Australian Meteorological Agency moved the ENSO outlook to the 'El Ni ñ o Warning'. This means that even though the El Ni ñ o Southern Oscillation (ENSO) is currently neutral, the likelihood of El Ni ñ o formation has increased to around 70% in the coming months.

The global sea surface temperature reached a record high in April and May, but the international Climate model shows that the central and eastern parts of the tropical Pacific are likely to become warmer. If the atmosphere responds to this warming, the El Ni ñ o event is expected to develop.

A recent study conducted by a university in the United States estimated that the El Ni ñ o phenomenon starting this year may cause up to $3.4 trillion in losses to the global economy over the next five years. The global economic productivity has been suppressed for much longer, not just a year after the El Ni ñ o phenomenon."

According to the Wall Street Journal, the El Ni ñ o phenomenon will not only have an impact on people's daily lives, but also have a widespread impact on global non fuel commodities, as well as products such as crops.

In recent weeks, the severe drought and the possible El Nino phenomenon are leading to the introduction of a series of draft restrictions on the Panama Canal, which has greatly impacted shippers on the east coast of the United States in terms of transportation costs and timeliness.

A consulting company stated that "if this issue cannot be resolved quickly, it is foreseeable that there will be a domino chain effect." According to its statement, ships will queue up on the west coast, and then strikes will become common and last for a long time, leading to a significant increase in shipping costs to the United States."

On June 2nd, the Shanghai Export Container Freight Index (SCFI) rose 45.34 points to 1028.7 points, expanding its weekly increase from 1.13% in the previous week to 4.6%. Among them, the freight rate of the US West Line has increased by nearly 20%. Industry insiders said that this reflected the efficiency of freight rate increase of Open-high-low-close chart in June.

At the same time, several major ports and docks on the West Coast of the United States have suspended operations due to labor actions, and contract negotiations between employers and dockworkers have reached an impasse. At present, the incident is still fermenting, and even insiders have stated that the port closure is expected to spread to the entire West Coast.

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

2017羽绒原料价格一路上涨,究竟为何?

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

你的羽绒服为什么钻绒?涨知识了

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

2017羽绒原料价格一路上涨,究竟为何?

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

你的羽绒服为什么钻绒?涨知识了

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展