Cn-down > Domestic news > News content

2023-05-28 来源:金绒 浏览量:1588

summary

The market remained stable this week.

As brand merchants gradually resume purchasing and placing orders, the upstream down industry is also eager to try. However, the downstream market is still not prosperous enough, and the expectation of a warm winter has increased, making it difficult for industry customers to completely break out of pessimistic expectations. The factory price index (PPI) of industrial producers in China has been experiencing negative growth for 7 consecutive months year-on-year, while international commodity prices have continued to decline since May.

The export volume of down jackets in April this year hit a new high for that month, making it the most exported month in nearly 9 years. Compared to April 2019, which ranked second, it was also 9% higher. Affected by the ban on overseas circulation of Chinese cotton, previously unsold cotton down jackets are still being sold at a discount this month, but their export proportion is slowly returning to a normal range. Perhaps the export peak season for down jackets can be eagerly awaited.

Since the beginning of this year, exports from major clothing suppliers in Southeast Asia have generally declined, but after entering April, they have started to expand their imports of down filling materials. The down jacket OEM factory will enter the peak season of production and shipment in the second season, and future orders are expected to gradually warm up.

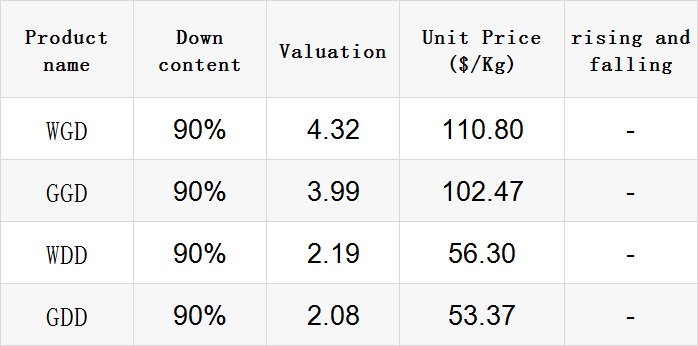

Exchange rate of USD to RMB: 7.0157

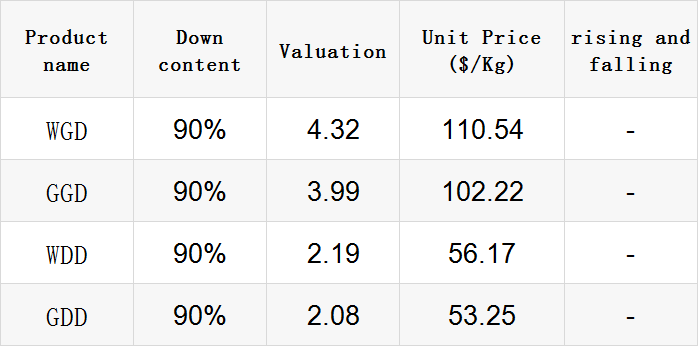

Exchange rate of USD to RMB: 7.0326

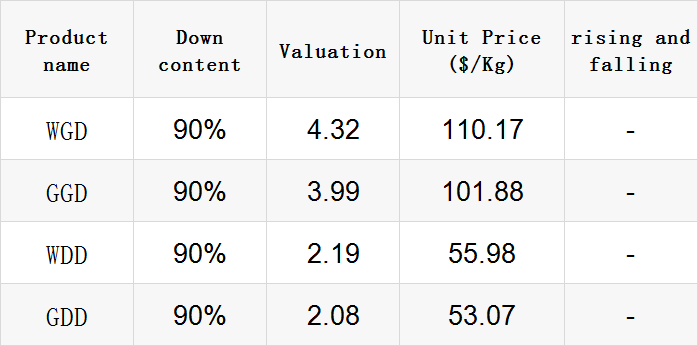

Exchange rate of USD to RMB: 7.0560

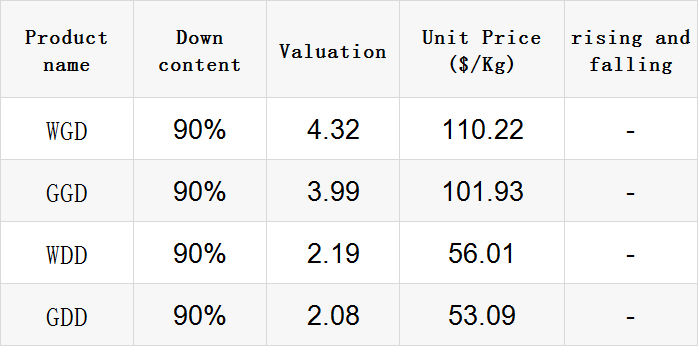

Exchange rate of USD to RMB: 7.0529

Exchange rate of USD to RMB: 7.0760

good news

In April 2023, a total of 3.171 million pieces of down clothing were exported, an increase of 10.5% compared to March this year; The export amount was 570 million yuan, an increase of 22.3% compared to March this year.

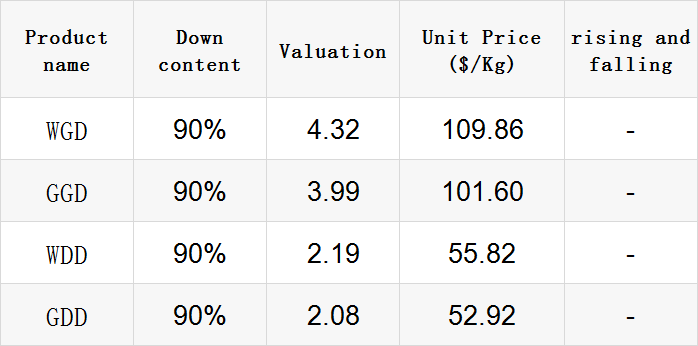

Aprile 2023 export list of down jackets

| name | Quantity (Ten thousand) |

RMB (hundred million) |

Quantity YoY | Amount YoY |

| cotton men's jacket |

99.5 | 1.19 | 176.9% | 140.4% |

| chemical fiber men's jacket |

63.4 | 1.57 | -6.0% | 40.9% |

| cotton women's jacket |

64.3 | 0.88 | -1.5% | -16.1% |

| chemical fiberwomen's jacket | 89.8 | 2.07 | 18.5% |

36.1% |

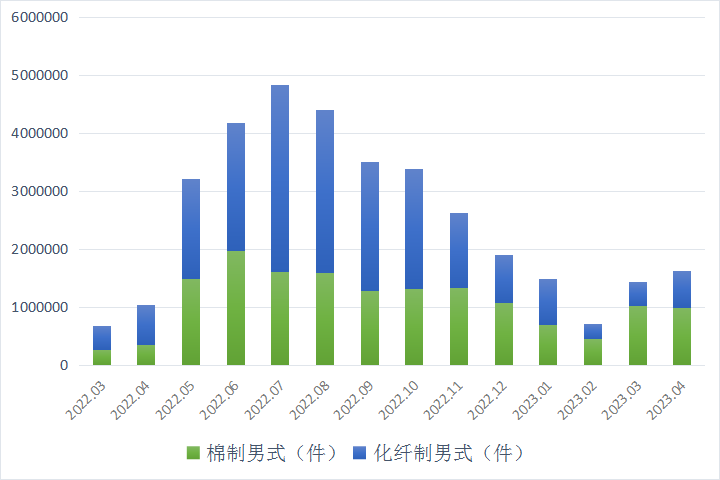

Export of men's down jackets in the past 14 months

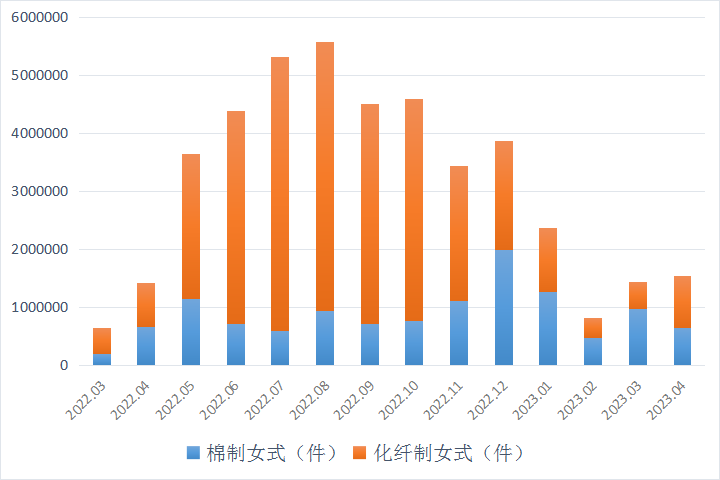

Export of women's down jackets in the past 14 months

From the data, it can be seen that the export of down clothing is currently in the traditional off-season. However, as the peak season in May approaches, the export of down clothing still shows signs of tilting.

At the same time, cotton down clothing still maintains a high export share, but women's clothing has basically returned to normal.

In terms of imports, in April 2023, a total of 153000 pieces of down clothing were imported, an increase of 0.8% compared to the previous month; The import amount was 122 million yuan, an increase of 43.7% compared to the previous month.

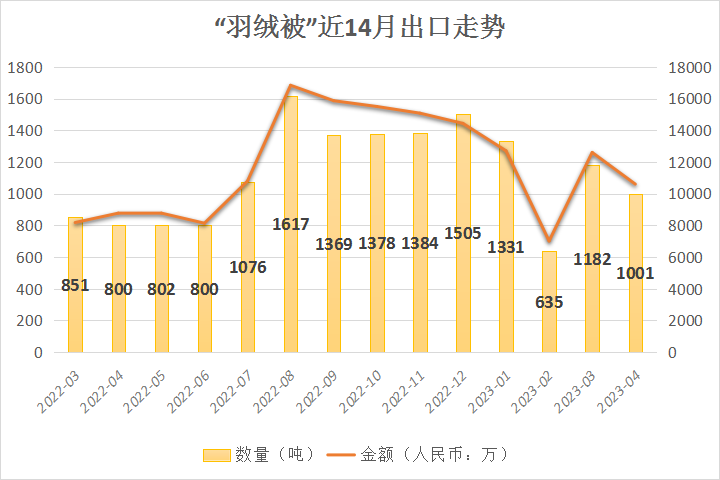

Duvet:

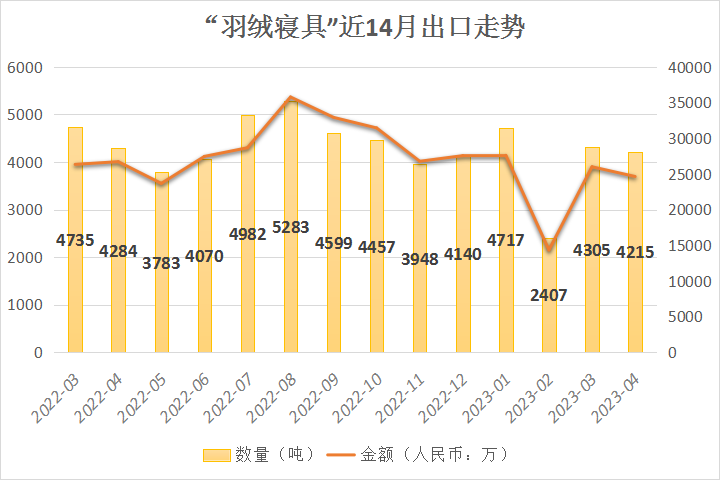

From January to April 2023, a total of 4148.3 tons of "down jackets" were exported, an increase of 73.0% year-on-year; The export amount was RMB 429 million, an increase of 79.3% year-on-year.

In April 2023, 1000.7 tons of "down jackets" were exported, an increase of 25.0% year-on-year; The export amount was 106 million yuan, an increase of 20.9% year-on-year.

In April 2023, the United States continued to be China's largest trading partner in the export of "down jackets", accounting for 29% of the total export volume this month. Among them, the export quantity was 286.4 tons, an increase of 23.8% year-on-year; The export amount was 30 million yuan, a year-on-year increase of 21.5%.

Japan was the second largest trading partner for the month, accounting for 23% of total exports, followed by Germany with 8% and the UK with 7%.

Other down bedding:

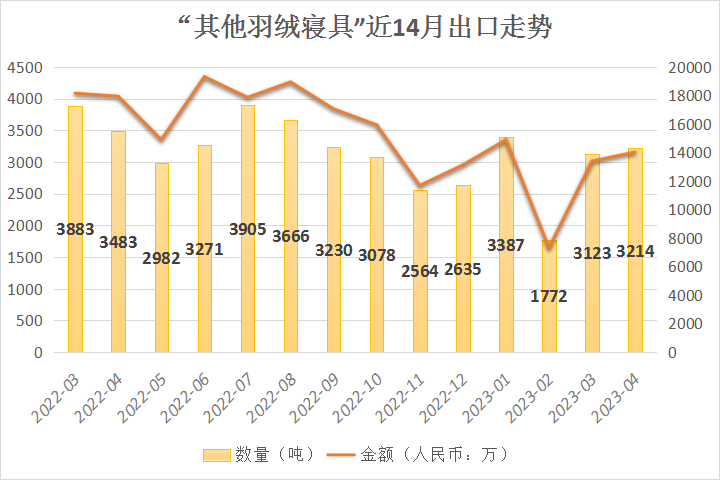

According to Chinese customs data, a total of 11500 tons of "other down bedding" were exported from January to April 2023, a year-on-year decrease of 32.6%; The export amount was RMB 496 million, a decrease of 39.7% compared to last year.

In April 2023, 3214.5 tons of "other down bedding" were exported, a year-on-year decrease of 7.7%; The export amount was 140 million RMB, a decrease of 21.8% compared to last year.

In April 2023, the United States remained the largest trading partner for China's exports of "other down bedding", accounting for 51% of the total export volume this month, with a significant increase in the proportion. Among them, the export quantity was 1629.5 tons, a decrease of 14.5% year-on-year; The export amount was 58 million yuan, a year-on-year decrease of 11.6%.

The UK was the second largest trading partner for the month, accounting for 7.5% of total exports; Subsequently, Germany accounted for 6.9% and Canada for 6.3%.

Down bedding (Duvet and other bedding):

From January to April 2023, a total of 15600 tons of "down bedding" were exported, a year-on-year decrease of 19.6%; The export amount was RMB 925 million, a year-on-year decrease of 12.9%.

Compared to previous years, although the export volume of "down bedding" from January to April this year is still less than about 26%, it has narrowed the gap with past records since this month and is better than in 2020. In addition, the export situation of down jackets is also better than last year.

Recently, with the liberalization of the market and the continuous decline in sea freight prices, overseas customers have come to Yiwu to purchase in advance, marking the beginning of this year's Christmas procurement season, which is at least two months ahead of previous procurement seasons.

In the booth of Yiwu International Trade City Zone 1, several buyers from Lebanon signed an order for 2 million yuan in less than ten minutes. They stated that their last visit to Yiwu was in 2019, and they have been conducting online transactions since then. This year, they can return to offline procurement, so they set out early and expanded their procurement scale.

In another stall selling Christmas crafts, the operator has rearranged the placement of the shelves and expanded the new product display area in order to facilitate customer selection. There have been introductions from business owners, and there have been many new customers. Colombia, Israel, India, and many overseas merchants have also returned.

It is reported that in the first quarter of this year, the daily average number of foreign businessmen in Yiwu International Trade City exceeded 1600, a year-on-year increase of about 30%. The early arrival of the Christmas procurement season has also made manufacturers busy ahead of schedule, with many manufacturers scheduling orders three months later. It has become the norm for factories to rush orders at full throttle.

Although May may not be as good as the traditional "Golden Three Silver Four" peak season, it also has its own name in the market - "Red May". May not only continues the unfinished orders in April, but also welcomes orders during the shopping festival.

The orders for the 618 Shopping Festival have started to be placed one after another, with a significant increase in order volume, especially in the area of sports functional fabrics. As the time for the shopping festival is approaching, orders are being expedited and are about to be delivered, "said a boss who specializes in knitting trade.

Manager Wang, who specializes in nylon products, said, "Recently, the sales of Nylon taffeta have been good, and there is almost no inventory. The two most popular specifications, 380T and 400T, need to be booked in advance. Currently, sun protection clothing, skin clothing, and other products are very popular in the market, and the demand for Nylon taffeta is also very good."

The dyeing factory, which had previously seen a decrease in the number of incoming goods, has resumed operations and has recently continued to focus on down jacket fabrics such as Simulation Silk, stretch fabric, Nylon taffeta, and PONGEE. At present, the dyeing factory is operating well, indicating the recovery of foreign trade orders.

bad news

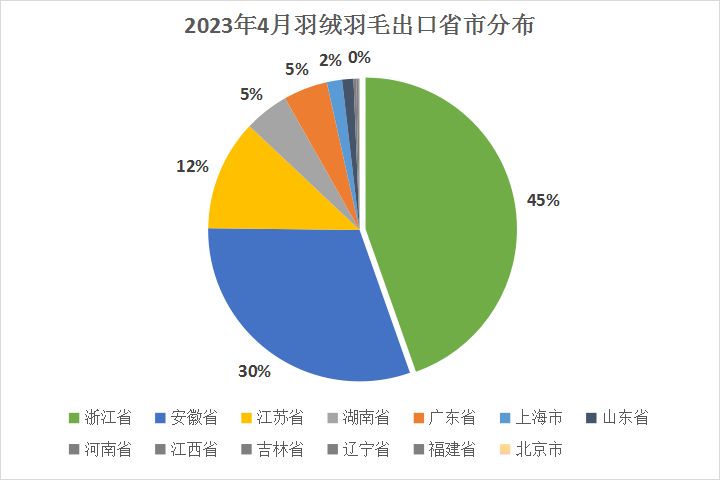

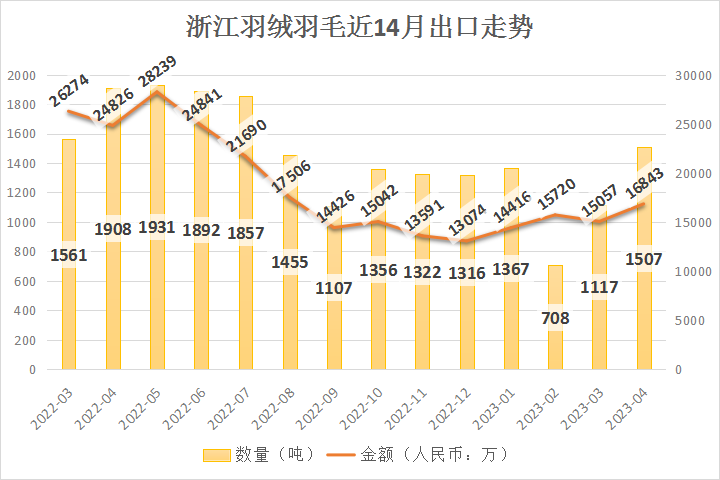

According to Chinese customs data, from January to April 2023, the export volume and value of down and feather in Zhejiang Province ranked first in the country. In April, Zhejiang Province, with a weak advantage, surpassed Anhui in terms of export volume.

Zhejiang Province exported 4699 tons of down and feather from January to April, a decrease of 25% compared to last year; The export amount was 620 million yuan (RMB, the same below), a decrease of 27% compared to last year.

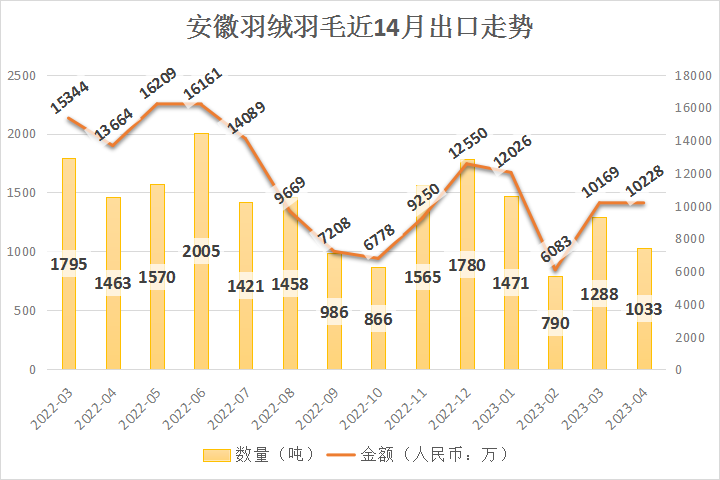

From January to April 2023, the export volume and value of down and feather in Anhui Province ranked second in the country.

Anhui Province exported 4582 tons of down and feather from January to April, a decrease of 27% compared to last year; The export amount was 385 million yuan, a decrease of 29% year-on-year.

Jiangsu Province exported 1727 tons of down and feather from January to March, a decrease of 13% year-on-year; The export amount was 238 million yuan, a decrease of 24% year-on-year. In April of this year, the export of down and feather in Jiangsu Province decreased significantly.

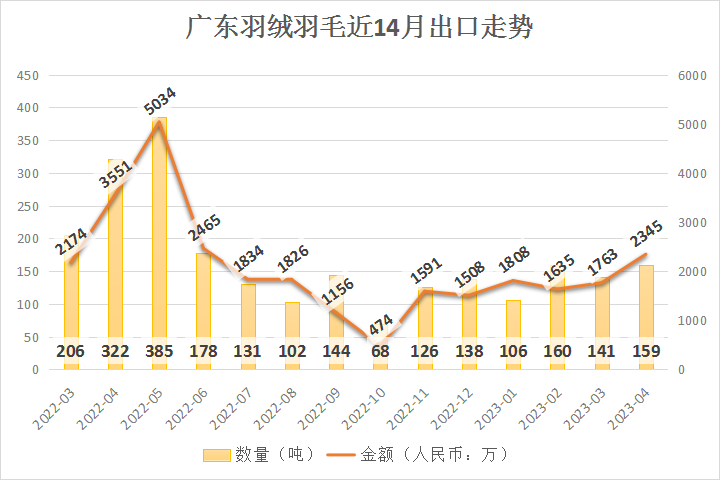

Guangdong Province exported 565 tons of down and feather from January to April, a decrease of 42% compared to last year; The export amount was 76 million yuan, a decrease of 19% year-on-year.

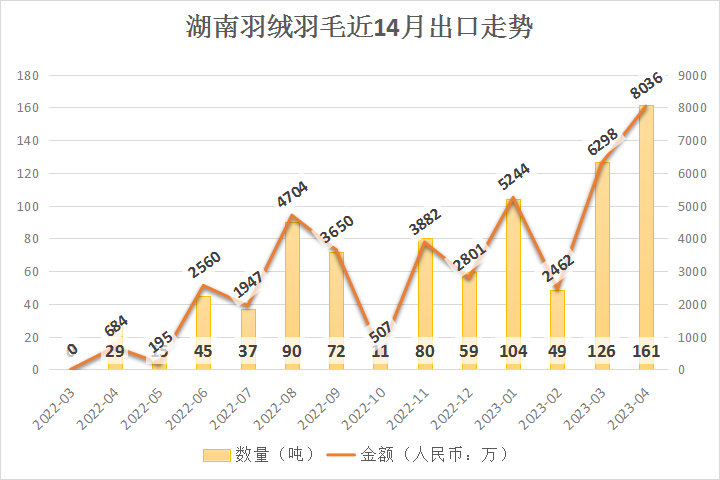

Hunan Province exported 440 tons of down and feather from January to April, a year-on-year increase of 120%; The export amount was 220 million yuan, an increase of 146% year-on-year.

In April, the upstream centralized elimination of breeding ducks resulted in a decreasing trend in the national seedling quantity compared to the previous month, and the supply of medium and long-term seedling quantity gradually became tight. According to a nationwide survey on the frequency of commercial duck seedlings, as of May 14th, the average number of ducks per day was about 10.6 million, a decrease of 7.02% compared to the previous week.

Considering that as the temperature gradually increases in summer, the difficulty of stocking will increase. As of mid May, downstream manufacturers have a higher enthusiasm for placing ducks, and the plan to arrange duck seedlings is gradually accelerating and showing an incremental state, in order to ensure the slaughter quantity of products in June. The stocking policy has been generally raised, continuously supporting the price of egg seedlings.

In terms of products, the decline has basically met the industry's psychological expectations. Starting from the 13th, market pickup has significantly accelerated, and manufacturers have placed multiple orders for leg products until the end of the month. Recently, small-sized white striped ducks have been relatively stable, medium to strong, while large-sized white striped ducks have been relatively popular, with a significant increase in demand. Gradually, the quotation has been raised, and there is still room for upward trend in the future market.

Terminal consumption is gradually improving with the rise of temperature, and the distribution process is currently starting, and the subsequent production capacity of each factory is still at a high level. It is expected that the slaughter volume of manufacturers will continue to increase to varying degrees next week, and shipments will be accelerated in the near future.

Recently, Canada Goose released its financial report for the fourth quarter of the 2023 fiscal year as of April 2, 2023. Its disclosed global total revenue increased by 31.4% year-on-year; The sales revenue in the Asia Pacific market increased by 65.4% year-on-year; The sales revenue in the mainland China market increased by about 40% year-on-year.

Although the fourth quarter performance was better than expected, the stock price of Canada Goose subsequently fell by about 11%. This is because as luxury consumption cools down, the company's sales in the United States have slightly declined.

During an analyst conference call, the Executive Vice President and Chief Financial Officer pointed out that although the United States has been "gradually improving" since its weakness at the end of the third and early fourth quarters, macroeconomic pressure is prompting Canada Goose to be cautious about the US market.

Morgan Stanley analyst Edouard Aubin bluntly stated in his latest report that the current performance of the US market is relatively sluggish, and consumer confidence has been weakened.

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

2017羽绒原料价格一路上涨,究竟为何?

你的羽绒服为什么钻绒?涨知识了

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

2017羽绒原料价格一路上涨,究竟为何?

你的羽绒服为什么钻绒?涨知识了

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展