Cn-down > Domestic news > News content

2023-05-20 来源:金绒 浏览量:1397

summary

The overall market has remained stable this week, with gray goose down rising again.

The domestic demand market for down clothing has been sluggish this year, but with the arrival of the traditional peak season for down orders in May, brands that had been on the sidelines have already taken action, and procurement and ordering will slowly begin. However, the outlook for downstream demand in the near future is still not optimistic, and the dilemma between upstream and downstream will continue for some time.

The supply of feathers this year is relatively low, and the output of duck seedlings has been continuously decreasing again recently, which has strengthened the determination of duck factories to raise the price of feathers. In addition, due to weather conditions, the down content of duck and goose feathers has decreased, resulting in increased costs for down enterprises and a difficult state of operation.

Due to sluggish demand in Europe, America, and emerging economies, textile and clothing foreign trade orders are very pessimistic. However, the RMB has recently fallen below the "7" level against the US dollar, which is theoretically beneficial for export business. The market for gray goose down, which is mainly exported, has risen again, narrowing the price gap with white goose down.

Exchange rate of USD to RMB: 6.9654

Exchange rate of USD to RMB: 6.9506

Exchange rate of USD to RMB: 6.9748

Exchange rate of USD to RMB: 6.9967

Exchange rate of USD to RMB: 7.0356

good news

At the finished product warehouse of a textile enterprise in Changshu, Jiangsu, boxes of well coded clothing have been tested and are about to be shipped to North America. The person in charge of the enterprise stated that entering March, with the stability of raw material prices and the increase in operating rates, the export volume of the enterprise is gradually increasing.

Gu Hongwei, the chairman of a textile enterprise in Changshu, Jiangsu Province, introduced that their orders had already been scheduled for September of this year. The growth of order volume is inseparable from the intensive and proactive efforts of enterprises. In the past six months, the company's sales team has gone abroad four times to meet and negotiate with customers.

Li Xinjun, Deputy Director of Changshu Customs under Nanjing Customs, introduced that from January to April 2023, clothing exports under the jurisdiction of Changshu Customs exceeded 1.5 billion yuan, a year-on-year increase of 22.1%.

Not only clothing, but also home textile foreign trade enterprises are actively expanding the market. At a company in Wujiang District, Suzhou City, workers are rushing to make 10000 pillowcases, which will be shipped to the Netherlands by the end of the month. This year, the export destination countries of this company's products have increased by 8, with the Netherlands being one of them.

Since the beginning of this year, with the efforts of consumption promotion policies in various regions and the gradual recovery of consumer demand, the clothing and home textile consumption market has continued to recover. According to Vipshop, there has been a significant increase in clothing sales on the platform in the past three months.

In addition, the recovery trend of consumption in the home textile category is also very obvious. Data shows that in the past three months, the overall sales of home textile products have increased by more than 25% year-on-year, with bed kits, quilts, pillows, and other products becoming the most favored by consumers.

On the other hand, the data on clothing consumption in April and May Day also continued to show a high growth trend. According to the Ministry of Commerce's big data monitoring, sales of key retail and catering enterprises in China increased by 18.9% year-on-year, while sales of gold, silver, jewelry, and clothing increased by 22.8% and 18.4% respectively.

In this context, many securities firms are optimistic about the prospects for further recovery in the clothing and home textile industry in the future. Bank of China Securities believes that the fundamental situation of clothing consumption is expected to improve in the long term, and looking forward to the whole year, it is optimistic about the sustained recovery of the clothing consumption market.

On the morning of the 17th, the offshore RMB/USD exchange rate broke 7 for the first time this year; In the afternoon of that day, the onshore RMB/USD exchange rate briefly fell below "7" and closed at 6.9985.

From the perspective of reasons, the depreciation pressure on the RMB exchange rate in this round mainly comes from short-term fluctuations in the pace of economic recovery, as well as the recent sustained strength of the US dollar index. Market participants also pointed out that this is likely to be a periodic depreciation range, and the depreciation rate will not return to the high point of July 30th last year. The RMB exchange rate is expected to maintain appreciation in stable fluctuations throughout the year.

"Although there is a possibility of breaking the '7', it will not depreciate to a large extent, nor will it return to the low point of last year's 7.30." Experts said that from the external perspective, the possibility of the dollar index rebounding to close to the 115 high point last year is very small, and the risk of hard landing caused by the U.S. economic recession is high, which cannot support the sharp rebound of the dollar index.

However, a depreciation of the exchange rate is a good thing for export-oriented enterprises, as the price of exported products decreases and competitiveness increases. At the same time, more and more foreign trade enterprises are actively promoting cross-border trade in RMB settlement to better avoid exchange rate risks.

bad news

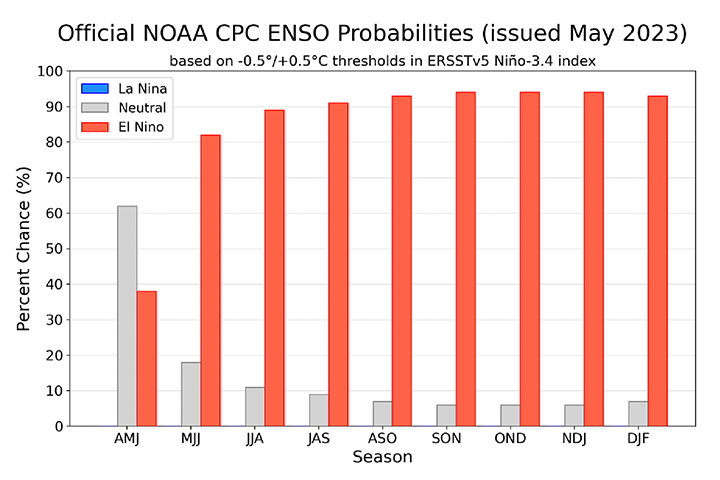

On May 11th local time, the US Climate Center (NOAA) released a new issue of "El Ni ñ o Observations". It is expected that in the next few months, ENSO will undergo a neutral transition to an El Ni ñ o phenomenon, with a probability of over 90% lasting into winter in the Northern Hemisphere.

The probability of an El Ni ñ o phenomenon occurring between May and July 2023 is 82%, higher than the 62% expected one month ago; The probability of an El Ni ñ o phenomenon occurring from December 2023 to February of the following year is 93%.

The possibility of major El Ni ñ o events is also increasing. The current probability of a strong El Ni ñ o phenomenon (Ni ñ o-3.4 greater than 1.5 ° C) is approximately 55%, an increase of nearly 15% compared to last month.

The abnormal warmth of the global ocean has become the recent headline news, and data shows that the global ocean surface in April 2023 is warmer than any previous April. Considering that the developing El Ni ñ o phenomenon will continue to increase global ocean temperatures, this may have serious ecological consequences.

Various analyses indicate that 2023 or 2024 is highly likely to set a new global record for the warmest season. At present, some countries and regions around the tropical Pacific are the first to be affected by El Ni ñ o globally, and countries in North America, East Asia, and South Asia will also be affected. The sustained warm water makes the climate anomaly last longer.

El Ni ñ o may bring warmer weather to China in winter, while precipitation in the Yangtze River basin may increase in summer.

In the first quarter of 2023, the production growth rate of China's clothing industry continued to decline, and the industrial added value and clothing production of enterprises above designated size showed negative growth, with the decline deepening compared to 2022.

According to data from the National Bureau of Statistics, from January to March, enterprises above designated size produced 5.035 billion pieces of clothing, a year-on-year decrease of 9.7% and a decrease of 2.5 percentage points from January to February. From the perspective of sub categories, the production of woven clothing was 1.882 billion pieces, a year-on-year decrease of 9.97%, among which the production of down clothing decreased by 31.01%.

In the first quarter, with the further effectiveness of consumption promotion policies and measures, coupled with factors such as the fading impact of the epidemic, China's domestic clothing market achieved a change from decline to increase, market vitality continued to rebound, and consumer demand gradually released.

The scale of China's clothing exports has slightly decreased, and monthly exports have shown significant fluctuations. From the perspective of export categories, the export of cold resistant clothing such as coats and down jackets, as well as household clothing such as pajamas, showed a slight negative growth, with export amounts decreasing by 1.8% and 6.2% year-on-year, respectively.

The United States Department of Commerce announced on Tuesday that retail sales in April increased by 0.4% from March, following the decline in March and February, but adjusted for seasonality rather than inflation. According to Reinitiv's data, this growth is still lower than the 0.8% expected by economists.

Matthew Shay, President and CEO of the Retail Federation of America (NRF), said, "The slowdown in price levels, continued strength in the labor market, and rising wages have increased consumer spending power. However, they still remain cautious and concerned about the current economic environment."

However, among the nine retail categories, the categories related to textiles and clothing decreased year-on-year.

After adjusting for seasonal factors, clothing and clothing accessory stores decreased by 0.3% month on month, while unadjusted stores decreased by 4.1% year-on-year; Furniture and household goods stores decreased by 0.7% month on month after seasonal adjustments, while unadjusted stores decreased by 8.8% year-on-year; After adjusting for seasonal factors, sports goods stores decreased by 3.3% month on month and unadjusted by 9.1% year-on-year.

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

2017羽绒原料价格一路上涨,究竟为何?

你的羽绒服为什么钻绒?涨知识了

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

2017羽绒原料价格一路上涨,究竟为何?

你的羽绒服为什么钻绒?涨知识了

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展