Cn-down > Domestic news > News content

2023-04-02 来源:金绒 浏览量:1732

summary

The market has been stable this week.

Recently, exhibitions and orders in the textile and clothing industry chain have been relatively active, and as March passes, clothing companies may gradually recover from their spring down purchases. However, in the market environment where down and feather prices are high, transactions cannot be scaled up.

The supply of duck seedlings is currently recovering, but the growth rate of the number of seedlings is slower than expected in the industry. Reflecting the upstream of duck farming, the settlement price of duck feathers has also increased significantly, indicating a significant price stabilization. However, feather factories generally say that due to the cost increase, business is difficult to do.

According to the PMI data released on March 31st, although various indicators of the manufacturing industry have declined, they are basically better than the same period in history. However, the decline in the index of new export orders on a month-on-month basis may indicate that insufficient orders will be a continuing challenge for the foreign trade industry this year.

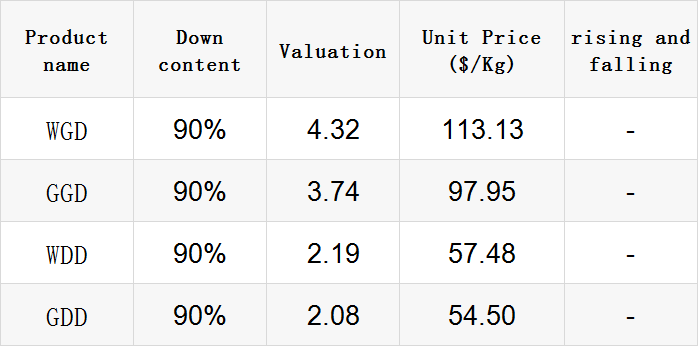

Exchange rate of USD to RMB: 6.8714

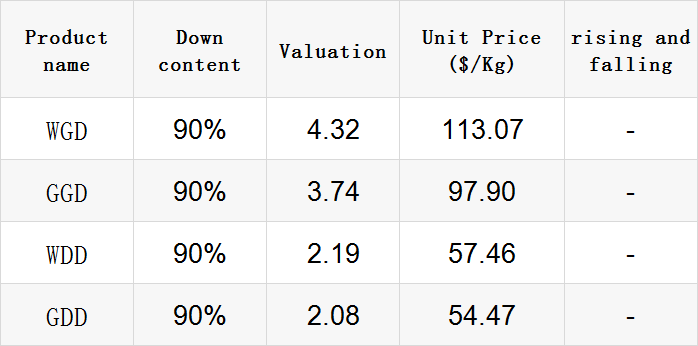

Exchange rate of USD to RMB: 6.8749

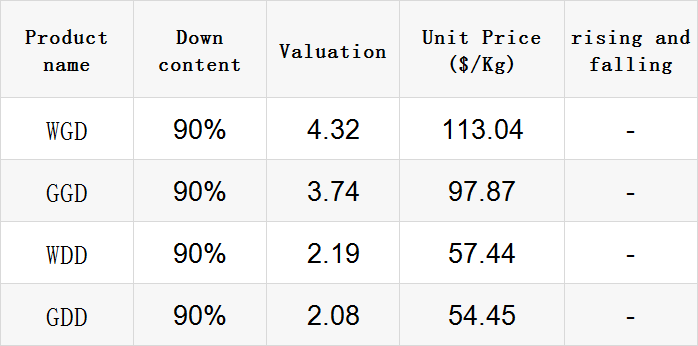

Exchange rate of USD to RMB: 6.8771

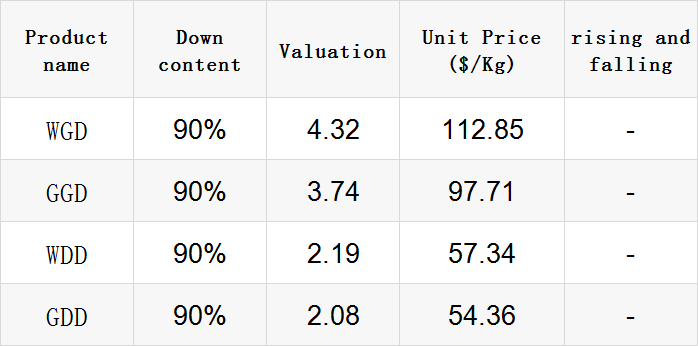

Exchange rate of USD to RMB: 6.8886

Exchange rate of USD to RMB: 6.8717

good news

On March 29 local time, the Brazilian Ministry of Foreign Affairs quoted a statement from the Brazilian Trade and Investment Promotion Agency (Apex Brasil) announcing that Brazil has reached an agreement with China to conduct bilateral trade transactions in its local currency instead of the US dollar.

According to the agreement, foreign trade and financing between Brazil and China can be conducted by converting the real into RMB, and vice versa. This business will be specifically handled by BBM Bank of Brazil, which is controlled by Bank of Communications of China, and Industrial and Commercial Bank of China (Brazil).

According to Apex Brasil, China is Brazil's main trading partner. In 2022, the bilateral trade volume between China and Pakistan reached 150.5 billion US dollars, setting a historical record.

In 2023, against the backdrop of the upcoming visit of Brazilian President Lula to China, hundreds of representatives of Brazilian enterprises arrived in Beijing in advance to seek cooperation with China. The Brazilian government also hopes to focus on seeking investment and diversifying bilateral trade relations between Brazil and China through this visit.

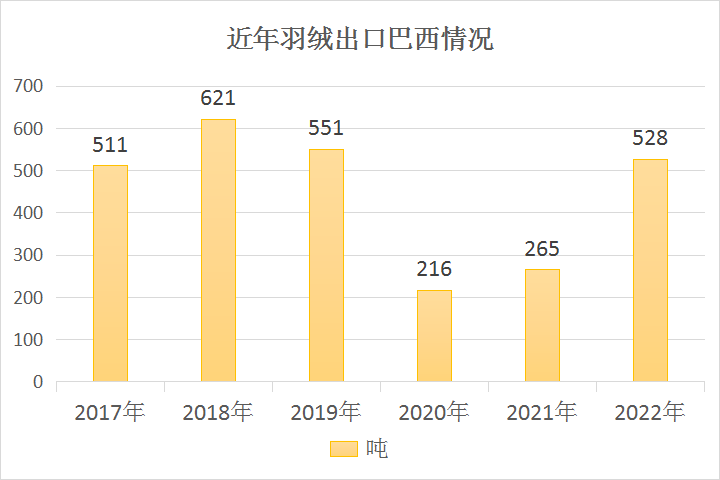

Previously, due to the long journey and high tariffs, the Brazilian market has scared Chinese suppliers. In 2020 and 2021, China's export of down and feather to Brazil significantly decreased, but in 2022, it rebounded significantly.

However, in recent years, Brazil has purchased a large amount of down from our country. Most are concentrated around January, June, August, and October. Since August, Brazil in the southern hemisphere has entered winter and is about to enter the school season. Therefore, the sales of thermal products such as down jackets will rise sharply!

In March, the meat duck industry chain entered a significant profit stage. Recently, the national average prices of breeding eggs and duck seedlings are still at a relatively high level, while the average prices of feather ducks have slightly rebounded after adjusting for a slow decline.

The supply of duck seedlings is still recovering, and the market reaction is that there have been more duck illnesses recently, resulting in a slower growth in the number of duck seedlings nationwide.

At present, the main positive points in the upstream are from the perspective of supply: the growth rate of duck seedlings is lower than industry expectations, and the supply pressure is conservatively expected to be at the end of April. The tight supply from the end of March to the beginning of April is basically a foregone conclusion.

In the medium to long term, high launch costs and operating profits require products to maintain a strong trend, and the turning point is not yet clear. As the Qingming Festival approaches, as the weather warms and leisure consumption improves, practitioners maintain confidence in the normalization of high product prices.

With the arrival of spring, the meat duck breeding market has also welcomed a rebound. In Huai'an, Jiangsu Province, it was learned that the supply of duck seedlings was seriously insufficient during this period.

A duck breeder in Guiwu Town, Xuyi County, Huai'an City, Jiangsu Province, said that his reservation of more than 4000 duck seedlings arrived late, nearly a month late. In order to ensure the survival rate of this batch of duck seedlings, he and his wife sealed and heated the breeding shed early.

In addition to Huai'an, Xuzhou, Suqian, and other places, many breeding enterprises are in a shortage of duck seedlings.

"The person in charge of a swimming duck breeding base in Sihong County, Suqian City, Jiangsu Province said, 'We plan to raise 100000 ducks. Originally, our source of duck seedlings was Nanchang, and we have traveled many places, but now we have only purchased 30000 ducks.'"

The responsible person's breeding foundation slaughters and processes more than two million duck feathers annually, and only 30000 duck seedlings were purchased this time. He said, "The cost of ducks has now reached over 40 yuan, and our breeding (plan) this month has reached 150000 to 200000, with a gap of 100000 seedlings."

It is understood that since July last year, there has been a tight supply of duck seedlings, which has also led to rising prices of duck seedlings. A farmer said, "The white feather meat duck should have been around 3 yuan per duck in the second half of last year, but now it has risen to 7-8 yuan per duck."

The consumer market has warmed up, with meat ducks taking the lead. On March 16-17, the 8th China Meat Duck Industry Health Development and Disease Control Summit Forum of Xinde Technology was grandly opened in Tai'an to discuss the ways to improve and upgrade the industry.

Li Chaoyang, Chairman of Xinde Technology, analyzed the potential crisis of the industry from multiple perspectives such as the profitability of the industry chain, industry maturity, and consumer development, and put forward breaking suggestions such as improving the overall value of the industry chain and developing market applications.

Official data show that in 2019, there were 4.8 billion white feather broilers and 4.2 billion white feather ducks. In 2022, the number of white feather broilers soared to 7.5 billion, while the number of white feather broilers fell to 3.1 billion, and the size of the meat duck industry decreased by nearly 30%.

Li Chaoyang said that the overall profitability of the meat duck industry chain has declined. Meat ducks seem to have slightly increased and improved compared to meat, but there is less duck down and smaller gizzards. White feather broilers pursue more meat production, but the value of duck feathers, duck intestines, and other parts of the meat duck is higher, even exceeding the value of duck meat.

Currently, the slaughtering, processing, and duck breeding processes in the meat duck industry are highly concentrated, lacking industrial synergy and mutual benefit consensus, and the degree of mutual harm is deepening. Slaughtering enterprises often limit prices, while duck seedling production enterprises raise prices when they find opportunities.

He believes that 60% of the value of meat duck comes from its by-products, such as duck neck, duck down, duck gizzards, etc. It is misleading to completely learn from the meat chicken model. The urgent task is to establish a breeding standard for maximizing the value of the meat duck industry chain according to market demand, which should include by-products such as duck down and environmental protection.

"The order situation is good, and production and sales are balanced every day." This is probably the most frequently heard sentence from the textile owner this week. At the same time, there is another sentence: "Our business is very good, but the market is not very good."

"The orders in March are a bit less than those in February, and the overall order can reach May." Mr. Li, who specializes in down jacket fabrics, said, "At present, the price of grey fabrics is mainly stable. We do not have a situation of losing money on sales, and the number of orders is shrinking, and it is estimated that it will be difficult to increase the price of grey fabrics in the future."

At present, it seems that many textile bosses have a good order situation, with only a few slightly worse, but even if there are not many, there are hot varieties. Perhaps the textile boss thinks the market is poor, mainly in terms of profits.

The head of a textile enterprise said, "Recently, the sales of double-layer matting checked T8 fabric have been excellent." It is said that this fabric is commonly used for autumn and winter down jackets, and the hot sales are due to the increased demand for this type of fabric due to the recovery of the foreign trade market.

bad news

On the 28th, Quang Viet, a major manufacturer of down jacket, was invited to hold a ceremony. General Manager Wu Chaobi frankly stated that due to the impact of declining demand and major customer inventory adjustments, it is expected that the revenue will decline in 2023, but "the business is not as bad as originally expected."

Wu Chaobi said that due to the impact of trade war and inflation, customers began to adjust inventory in the second half of last year, and the momentum of ordering slowed down, which will be reflected in this year's shipment volume. Among various product categories, sports products performed poorly, while outdoor brand customer demand remained stable.

He pointed out that among the four major customers, Adidas and NIKE performed poorly, with order demand decreasing by 30% and 20% respectively this year, which had a significant impact on Guangzhou and Vietnam. However, among the six large and medium-sized potential customers, Under Armour and New Balance have increased their demand by 20% and 1.5 times this year, respectively, which can fill some of the gaps.

Wu Chaobi emphasized that this year's business does not appear to be as bad as originally thought, and overall, it is estimated that this year's revenue will decline by about 10%. In addition, due to the decrease in market demand, Quang Viet's expansion range has been revised this year, with only 6 lines expected to be expanded.

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

2017羽绒原料价格一路上涨,究竟为何?

你的羽绒服为什么钻绒?涨知识了

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

2017羽绒原料价格一路上涨,究竟为何?

你的羽绒服为什么钻绒?涨知识了

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展