Cn-down > Domestic news > News content

2023-03-20 来源:金绒 浏览量:1803

summary

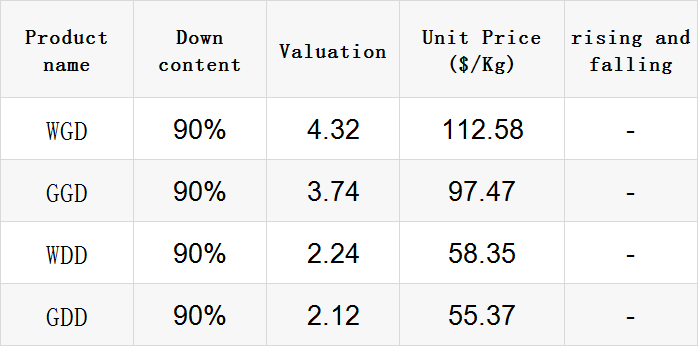

This week, the market generally remained stable, with the price of white goose down rising again.

Recently, the supply of duck seedlings has been increasing, but the overall situation is still significantly tight, and the supply of down materials is still in short supply. Due to the high price of down and the high risk of collection and storage, both upstream and downstream parties hold a wait-and-see attitude. Although some brands have placed small orders, their prices are still less than the cost price of raw materials.

The successive bankruptcies of Silicon Valley Bank and Signature Bank in the United States have caused severe shocks in the financial market. The crisis caused by this round of US dollar interest rate hikes has already erupted. The most worrying thing is that some financially fragile countries, such as India, Vietnam, and some Latin American countries, are likely to be affected in the future, and China cannot be immune to it.

Many foreign trade enterprises report that their orders are decreasing, and the Ministry of Commerce has also stated that the decline in orders is the biggest challenge facing foreign trade development this year, and is studying policies to stabilize foreign trade. However, some scholars believe that the achievements of overseas exhibitions in the past few days will be reflected in the foreign trade data in March.

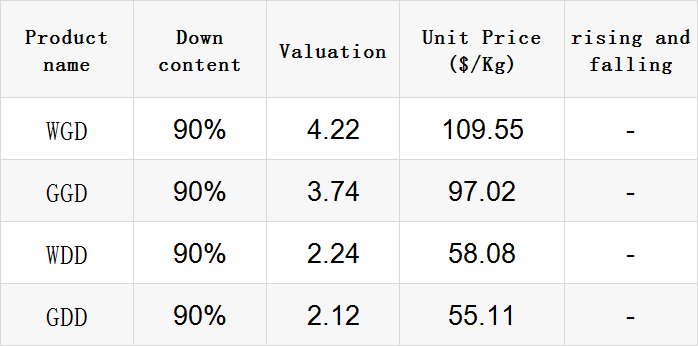

Exchange rate of USD to RMB: 6.9375

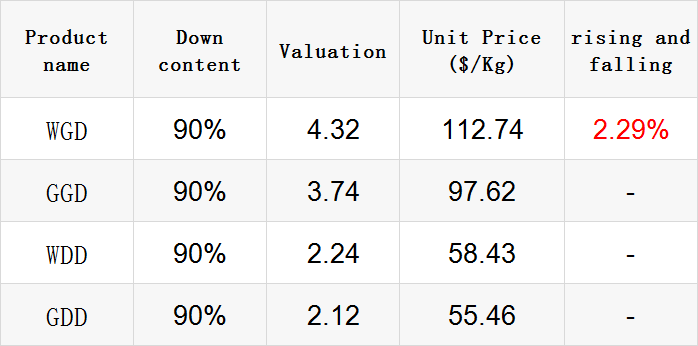

Exchange rate of USD to RMB: 6.8949

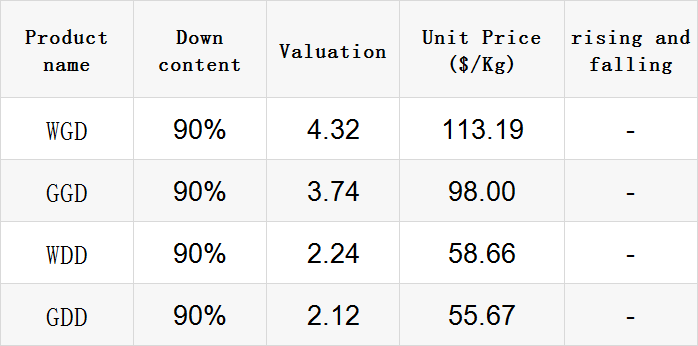

Exchange rate of USD to RMB: 6.8680

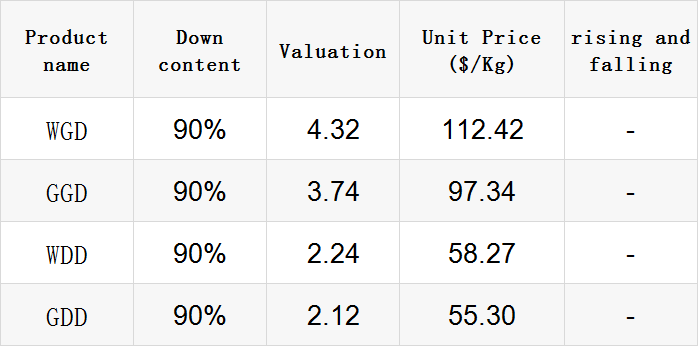

Exchange rate of USD to RMB: 6.9149

Exchange rate of USD to RMB: 6.9052

good news

In 2022, Asian suppliers accounted for 75.8% of European clothing imports, which remained stable compared to 2019. After experiencing stagnation in 2020 and 2021, clothing imports from China, a major supplier, surged 32% in one year, up 7.7% from 2019 levels.

The export of Chinese down jacket to the EU has also increased again after 2020 and 2021. In 2022, China exported 18.97 million pieces of various types of down jackets to the EU, an increase of 4% over 2021. The export value was 4.417 billion yuan, an increase of 18% over 2021.

However, the export situation in that year is still far from that of the years before the epidemic, indicating that there is still room for significant growth.

It is worth noting that Russia, a major customer of EU clothing exports, only imported 1.41 billion euros worth of European clothing in 2022. This figure has decreased by 37% in one year, down 42.7% from the pre crisis level.

According to a survey by the Russian e-commerce platform Ozon Global, the number of orders that Russian buyers purchased online from China before the March 8th holiday was five times that of 2022. On Women's Day, Russian men traditionally give gifts to women.

According to a survey, in February 2023, the total sales volume of Chinese sellers on the Amazon platform was four times that of last year, with an average amount of 3000 rubles per order.

On March 6th, Juewei Food Co., Ltd. announced its intention to go public in Hong Kong, and its stock price fell by over 9%. Some analysts believe that this may be related to factors such as poor performance and increased financial pressure. If it succeeds in landing in Hong Kong stock market, Juewei Food Co., Ltd. will become the first "A+H" share company in the halogen industry.

During the three years of the epidemic, the catering industry has been one of the industries that have been hardest hit, and the net profits of the three giants of braised food have all experienced a precipitous decline. They have the same opinion, which is due to the rise in the price of ducks. Currently, the three giants still rely heavily on duck products, with relevant business revenue accounting for more than 50%. Zhou Hei Ya International Holdings Company Limited even approaches 80%.

In the 2022 performance forecast released by Juewei Food Co., Ltd., the net profit attributable to shareholders of listed companies last year was 220 million to 260 million yuan, a year-on-year decrease of 73.49% to 77.57%. The company explained the impact of the epidemic and the increase in raw material costs.

The other two of the "three giants of braised food", namely, Jiangxi Huangshanghuang Group Food Co., Ltd. and Zhou Hei Ya International Holdings Company Limited, also reported a significant decrease in net profit last year. Jiangxi Huangshanghuang Group Food Co., Ltd. saw a year-on-year decrease of 79.25% to 72.33%, and Zhou Hei Ya International Holdings Company Limited saw a year-on-year decrease of more than 94%.

On the cost side, Tianfeng Securities released a research report on March 9, stating that duck by-products are currently at a high level, and upstream aquaculture costs are high, making it difficult to quickly start large-scale production. Currently, there is no obvious downward signal of cost.

Netizens also complained that they could not afford to eat duck necks, and they also went to hot search.

Shanghai Fashion Week in the autumn and winter of 2023 will open on March 23, with the theme of "New Nature Together". The debut of new products at the show, exhibition ordering, and a series of themed activities will sound the industry's "rallying point".

Liu Min, Deputy Director of the Municipal Commission of Commerce, said that Shanghai Fashion Week is an important platform for various consumer promotion activities throughout the year to lead fashion and define trends. The fashion information released by Shanghai Fashion Week will help the industry launch more debut new products, and promote the opening of more buyer stores and brand flagship stores.

In the Xintiandi show, brand cooperation has become the main theme. Outdoor functional brands and environmentally friendly materials work together to create a new series. Down jacket enterprises and independent designers have launched joint efforts to showcase their strengths in various ways, providing consumers with new and premium products with "beauty price ratio" and "quality price ratio".

Starting in 2017, Shanghai Fashion Week proposed to create the "Asia's largest ordering season", providing a one-stop ordering service platform for professional buyers from all over the country and even the world. Various fashion exhibitions and clothing ordering fairs with MODE exhibition as the main carrier are spread throughout the central urban areas of Shanghai.

bad news

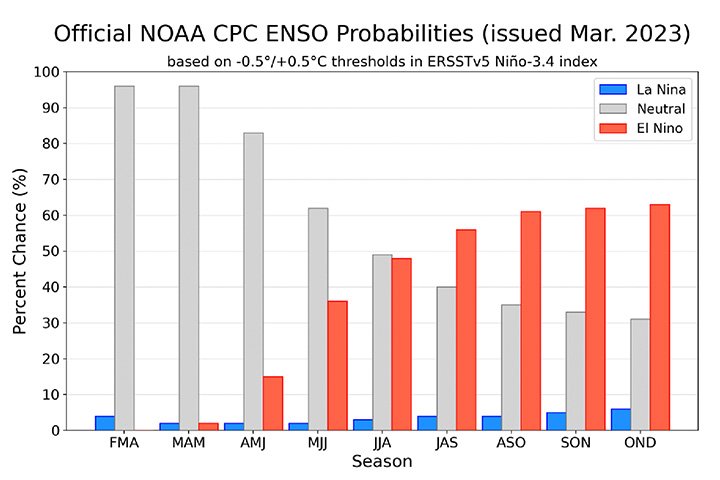

On March 9th local time, the US Climate Center (NOAA) again released a description of the change process of the La Nina and El Nino phenomena. Currently, the La Ni ñ a phenomenon has ended, but its lasting effects still exist for a short time.

According to the index monitoring of the La Nina phenomenon, the average sea temperature index in the key Ni ñ o 3.4 region has risen to - 0.2 ℃, while the threshold of the La Nina phenomenon is below - 0.5 ℃.

Forecasters agree that ENSO will be neutral until the summer of 2023, after which the possibility of the development of the El Ni ñ o phenomenon will increase. It is worth noting that strong warming near South America may indicate a faster evolution of the El Ni ñ o phenomenon.

Forecasters agree that the probability of El Ni ñ o occurring in autumn is about 60%. Another interesting little message is that in historical records dating back to 1950, El Nino always occurs within four years.

From the data of previous years, whenever an El Ni ñ o occurs, there is a high probability of a "warm winter" occurring in China. In addition, it is also more prone to floods and extreme drought.

Of course, even if an El Ni ñ o occurs this year, it does not mean it is really so terrible, because there are also differences in intensity, and extreme high temperatures may not necessarily occur.

Quang Viet, a major manufacturer of down garment manufacturing, recently announced that its consolidated revenue for a single month in February was 785 million yuan, a decrease of 18.52% compared to the same period last year. This was mainly due to the fact that the revenue for the same period in 2022 included deferred revenue due to the impact of the closure of Vietnam in 2021, which was higher compared to the base period.

The first quarter is the traditional off-season for Quang Viet, with a low proportion of revenue contribution to the full year's revenue. In response to the 2023 operating outlook, the general manager stated that some sports brand customers have adjusted their inventory in the first half of this year, and their attitude towards placing orders has turned conservative. Currently, orders for the second half of this year are still under continuous development.

KWONG LUNG, another large down clothing OEM factory, was affected by the adjustment of the delivery time of down raw material customers. Its revenue in February was 503 million yuan, a monthly decrease of 2.9% and an annual decrease of 8.4%. For the first quarter, KWONG LUNG's sales momentum in the two departments of down materials and home textiles was weak, except that the revenue of ready-to-wear clothing remained growing.

KWONG LUNG plans to invest more than $8 million this year to expand production lines in Vietnam and Indonesia, respectively. It is expected that 20 new production lines will be opened in succession in the second half of this year, and Indonesia is the newly established second production area in the world.

According to feedback from several cotton textile enterprises in Zhejiang, Shandong, Henan, and other regions, due to the launch of domestic sales orders in autumn and winter (mainly for home textiles, denim, labor protection products, and household demand recovery) and the support of short and bulk orders for export sales, most of the orders can be arranged until the end of March and the beginning of April.

However, the contraction rate of orders in April was still faster than expected, especially the decrease in overseas orders from Europe, the United States, Japan, and South Korea. Most cotton mills judge that the entire "Golden Three Silver Four" campaign may start late or end early, and there is a high probability that orders in April will encounter a "cold spell in late spring.".

A medium-sized textile factory in Zhejiang stated that since March, the issue of "traceability" of export orders has again been strictly enforced by buyers and resellers in Europe, the United States, and East Asia. Traceability orders account for about 70% of the new export orders, and the contract requires the use of imported cotton yarn or imported cotton yarn processing.

Although export orders for waterproof fabrics (mainly used for assault suits, etc.) and home textiles have come in succession, almost all of them require imported cotton yarn or imported yarn, and very few even explicitly require the use of American cotton yarn or cotton yarn produced in the United States. Currently, export traceability orders such as non large orders and medium to long term orders have relatively low profits.

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

2017羽绒原料价格一路上涨,究竟为何?

你的羽绒服为什么钻绒?涨知识了

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

2017羽绒原料价格一路上涨,究竟为何?

你的羽绒服为什么钻绒?涨知识了

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展