Cn-down > Domestic news > News content

2023-03-12 来源:金绒 浏览量:1809

summary

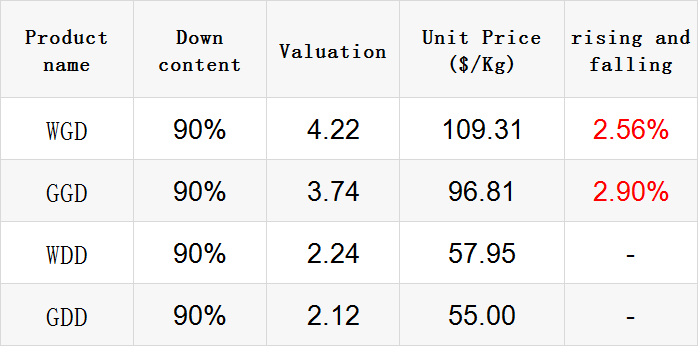

This week's market was generally stable, with the price of goose down rising.

The rise of down price after the Spring Festival is mainly related to the insufficient quantity of geese and ducks sold. In addition, the settlement price of duck feather of breeding enterprises has increased significantly, resulting in an increase in the purchase cost of the washing down factory, which has to raise the price. At present, the supply of duck seedlings is still tight, and the price of feather down fluctuates at a high level.

For the launch of down orders, garment factories are still waiting and waiting, and it is more difficult to accept the high price of finished down. When the economic situation is not clear, the enterprises in the middle and lower reaches mostly adopt cautious strategies, but the domestic clothing autumn and winter ordering meeting has quietly begun.

In 2023, China's foreign trade exports achieved a stable start, without a precipitous decline in online transmission. In recent years, China and ASEAN have joined the RCEP. China's exports to Japan, South Korea and Southeast Asia still have great potential for growth, and the tariffs on down products will be further reduced.

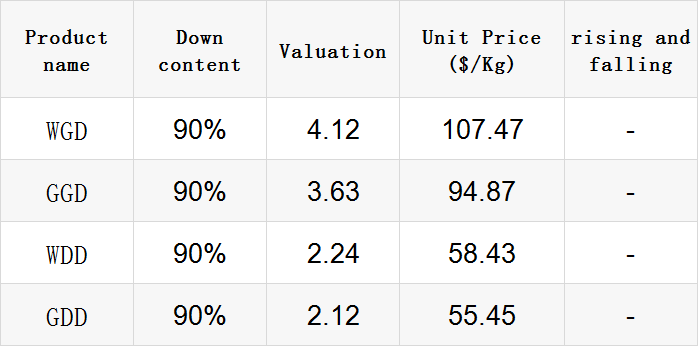

Exchange rate of USD to RMB: 6.8951

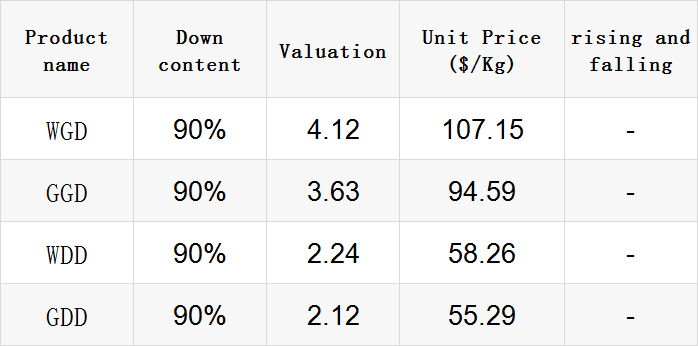

Exchange rate of USD to RMB: 6.9156

Exchange rate of USD to RMB: 6.9525

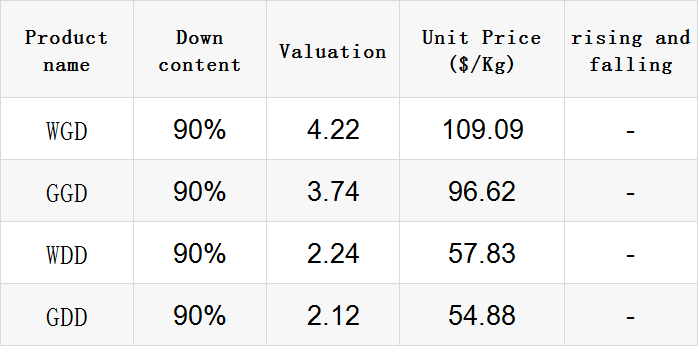

Exchange rate of USD to RMB: 6.9666

Exchange rate of USD to RMB: 6.9655

good news

According to the data released by the General Administration of Customs of China on March 7, in the first two months of 2023, South Korea maintained its position as the fourth largest trading country of China for one year in 2022, which was taken away by Japan and fell to the fifth place again.

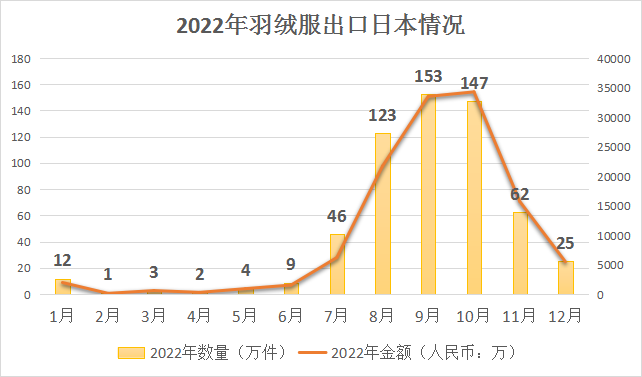

However, in terms of down jacket trade, Japan has always been a little larger than South Korea. In addition, the cold wave last winter has also had a great and continuous impact on Japan. It can be thought that the down products are generally well digested in Japan.

In 2022, China exported 5.234 million down jackets of all kinds to South Korea, down 0.5% from 2021; The export value was RMB 990 million, up 20.8% year on year in 2021.

In 2022, China exported 5.858 million down jackets of all kinds to Japan, down 31.4% from 2021; The export value was 1.223 billion yuan, down 14.7% from 2021.

According to the performance report released by Fast Retailing Group, Uniqlo Japan's same-store sales rose 10.9% in January, and its total sales, including online sales, rose 14.9%, mainly due to the continuous cold weather, which greatly increased consumer demand for warm clothing.

Okazaki, the chief financial officer of Fast Retailing Group, also disclosed that the performance of its brands in China in January also recovered rapidly and is expected to return to the growth track.

The General Administration of Customs announced on March 7 that in the first two months of this year, China's total import and export value was 6.18 trillion yuan (RMB, the same below), down 0.8% year on year. Among them, exports reached 3.5 trillion yuan, up 0.9%; Import was 2.68 trillion yuan, down 2.9%; The trade surplus was 810.32 billion yuan, an increase of 16.2%.

Lv Daliang, Director of the Statistics and Analysis Department of the General Administration of Customs, said that since this year, China's foreign trade has faced difficulties, overcome the impact of the weakening of foreign demand and the high base of last year, and achieved a stable start on the whole, and exports have achieved positive growth, and continue to play a supporting role in the national economy.

The United States is China's largest single export market, which has a great impact on China's overall export situation. However, in the first two months, China's exports to the United States fell by 15.2% year on year, and remained in a sharp downward state, which is an important reason for the decline of exports at the beginning of the year, and it is very difficult for China's exports to the United States to turn to positive growth in the short term.

In the first two months, China's textile and clothing exports to the world amounted to 282.3 billion yuan, down 11.6% year on year. Among them, textile exports amounted to 132.41 billion yuan, a year-on-year decrease of 15.9%; Garment exports amounted to 149.89 billion yuan, down 7.5% year on year.

At present, the risk of recession in the world economy is rising, the growth of foreign demand is significantly slowing, the international supply chain pattern is accelerating to restructure, and the foreign trade development environment is extremely severe.

Speaking of the trend of foreign trade in the next stage, Lv Daliang said that after entering February, China's import and export overall trend has improved, especially in the late February, with a significant increase. The monitoring of relevant leading indicators shows that this good trend is expected to continue.

Heilongjiang Helong Down Co., Ltd. created 9 million output value in the first quarter of Dulbert County Deligor Industrial Park.

On March 1, Zhang Mingjun, a goose farmer, drove his truck again to send goose down to Heilongjiang Helong Down Co., Ltd. This time, he pulled two tons of goose down. After weighing and quality inspection, the goose down is put into the warehouse.

"The price of goose down has risen this year, and it's hundreds of thousands of dollars." Zhang Mingjun smiled. Since supplying the goose down to Helong, 100000 geese have become his "bank". 20 tons of goose down a year makes him earn a lot.

In the down production workshop of Helong, employees have started the "fight mode". The lightweight down is ex-factory after a series of fine processing. It is in hand with famous domestic brands such as Yichun, Lilang and Jiumu Wang, and in "marriage" with foreign brands such as Molina in Italy, Rohdex in France and Canada Goose.

Ding Guangjue, the general manager of the company, said: "In order to meet the needs of customers, the company has made full preparations early before the festival to ensure continuous production. Every October to April and May of the next year is the peak season for down processing, because this period is a season with sufficient down materials."

In the past, Helong's down products were mainly exported. Affected by the international epidemic situation, the company changed its thinking and changed its sales market to domestic. Now it is mainly sold to Jiangsu, Zhejiang and Shanghai. The total annual sales volume can reach about 700 tons.

bad news

At the end of February and the beginning of March, the start-up rate of the downstream texturing, weaving, printing and dyeing industries increased significantly, some businesses bought at bargain prices, and the days of raw material stocking increased. However, overseas orders have not been released in large quantities.

According to the survey, a small number of branches believed that the market demand increased in March or April, while most enterprises believed that the overall economic environment was not good. Foreign trade orders were not released in large quantities in the first half of the year, while China was still facing the risk of a second outbreak of the epidemic in the second quarter, so the overall market expectation in the first half of the year was cautious.

At the beginning of March, the cost side still had some support, but as the bottom-up inventory continued to increase, the market supply pressure was highlighted, and there was still downside risk in the market. The recovery of demand has become the key crux affecting the market.

It is understood that the retail sales of clothing in the United States last year were fair, reaching the highest point in the past five years, while the inventory also reached the highest point in the past five years. In the latest financial reports released by international brands such as SKECH, Columbia Outdoor, The North Face, etc., it was pointed out that high inventory has become the main difficulty faced by the company.

According to the Cambodian China Times, nearly 500 factories in Cambodia have closed down and 60000 people have lost their jobs due to the impact of the reduction of orders in the European and American markets. The spokesman of the Ministry of Labour of Cambodia, Xing Suo, disclosed that most of the factories that closed down or stopped production were garment factories.

"In all major garment producing countries, it is normal for factories to close down or stop production." Xingsuo said that the weak demand in the European and American markets has become an important trend impacting the global economy. Several major garment producing countries, such as Vietnam, Bangladesh and Sri Lanka, are also facing the impact of the contraction of the European and American markets.

The data of the rest of Asia are also not optimistic. Most of the countries with manufacturing products as the main products fell in January. The decline of South Korea, Vietnam, Taiwan, China and other countries and regions even exceeded 10%.

On March 7, China will release its foreign trade data for January-February 2023. The economic community is generally pessimistic about the growth of foreign trade.

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

2017羽绒原料价格一路上涨,究竟为何?

你的羽绒服为什么钻绒?涨知识了

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

2017羽绒原料价格一路上涨,究竟为何?

你的羽绒服为什么钻绒?涨知识了

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展