Cn-down > Domestic news > News content

2023-03-05 来源:金绒 浏览量:1922

summary

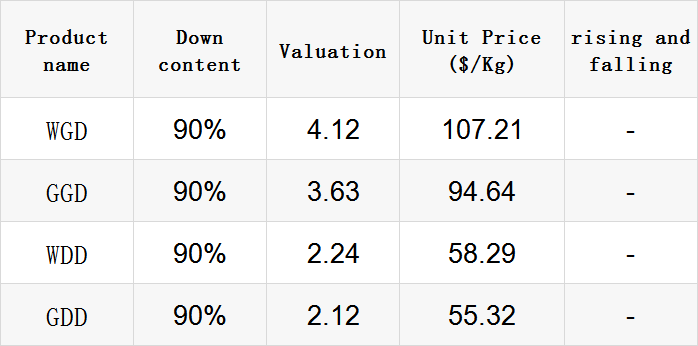

The overall market rose this week, with the rise of grey goose down even higher.

Although the winter just passed was warm, due to the continuous cold air and cold wave in the early winter, the inventory of down products was finally digested well, and the processing enterprises in the upstream of the supply chain were also optimistic about the market this year.

At the same time, the duck market in the first quarter of this year is generally scarce, so the supply of raw wool is insufficient in the short term, and there is a phenomenon of raw wool rush purchase in various markets, which has increased the raw wool by 2 to 3 yuan/catty, and the price of raw wool has increased by more than 10%.

In March, the spring down purchase in the clothing market is approaching, but the brands are in a strong wait-and-see mood at the current price. At present, the market of finished down products is in the off-season, and there is no support for transaction.

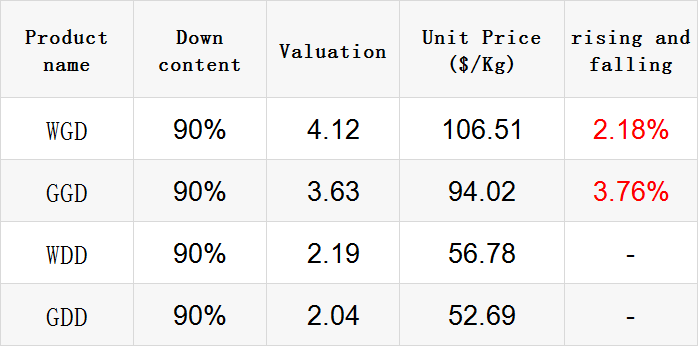

Exchange rate of USD to RMB: 6.9572

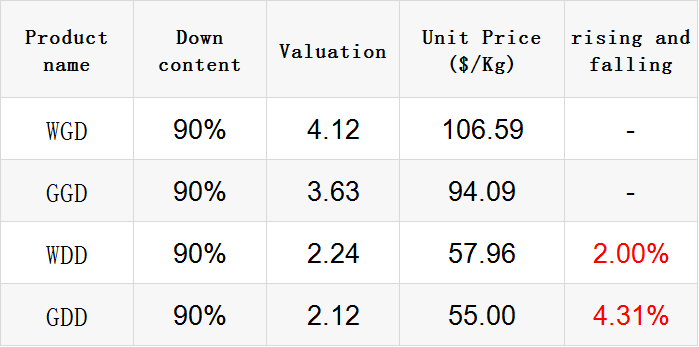

Exchange rate of USD to RMB: 6.9519

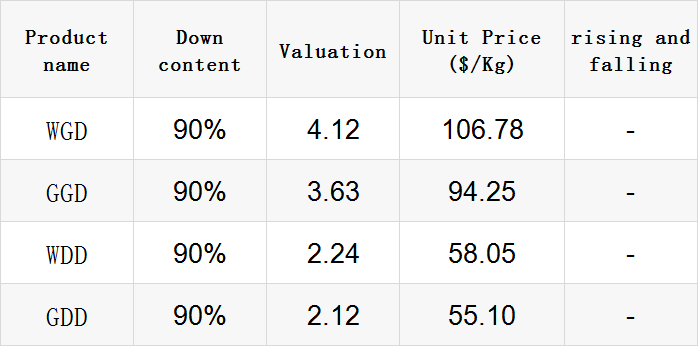

Exchange rate of USD to RMB: 6.9400

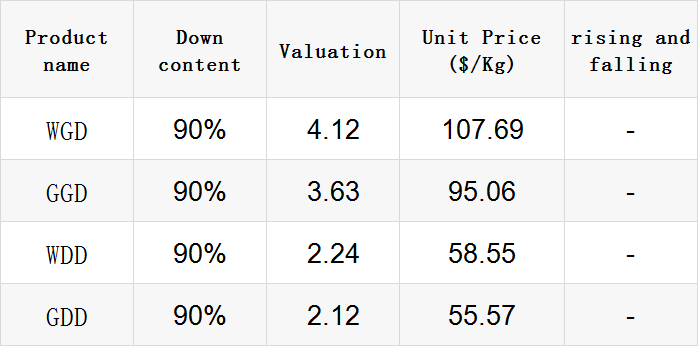

Exchange rate of USD to RMB: 6.8808

Exchange rate of USD to RMB: 6.9117

good news

Recently, the prices of duck eggs and duck seedlings have been rising continuously, and have again risen to high levels. In the south, the breeding plan has been accelerated, and the future marketing has cost support. Recently, duck cooked food products have risen rapidly, and the pace of distribution and stocking has accelerated, but the performance of terminal consumption is still recovering, limiting the rise of products.

According to the statistics of Mysteel's agricultural product data, the prices of downstream products are falling and leaving the warehouse slowly. The farmers are not optimistic about the market in the later stage. They think that the current market has reached a high level and there will be a downward expectation in the future. Although the price of breeding eggs in the near future has followed the upward trend of the seedling price, the heat has decreased significantly.

Recently, some small seedlings have begun to join the deal in some regions, and will enter March, which will be the centralized seedling stage of introduced breeding ducks around July 2022. It is expected that the short-term seedling price fluctuation will be adjusted mainly, and the sharp rebound will be limited.

In recent weeks, the average daily emergence of ducks in the country was about 7.8 million, and the overall number of ducks in the market in the first quarter was less. Finally, slaughtering enterprises have gradually entered a period of suspension, which is relatively longer than that in previous years. With the recovery of terminal consumption, slaughtering enterprises have increased the purchase of market duck orders.

On the afternoon of February 27, Hu Xuan, the general manager of Nanjing Shangpuyi Import and Export Co., Ltd., landed at Nanjing Lukou Airport. The nearly one-month "overseas business trip" ended successfully.

On February 2, Hu Xuan flew to Europe with new products and special products of the company such as down jacket, participated in the Paris Fashion Purchase Exhibition and the London International Fashion Exhibition, and visited new and old customers in France, Britain, Germany, the Netherlands and other countries.

"The products we brought are very popular with foreign customers. We received 50 or 60 business cards at the French exhibition, and many interested customers are negotiating."

Speaking of the business development this year, Hu Xuan was full of confidence. This trip abroad also gave her a deeper understanding of the new demands and trends in foreign markets.

"At present, the European market is more interested in products with low carbon, environmental protection, high quality and design sense. We will adjust and upgrade the products according to the new needs of the market."

bad news

On February 28, ecolovo Group announced that its wholly-owned subsidiary leased the infrastructure of meat duck, and Dongming Branch signed the Rural Land Transfer Contract, leasing 345 mu of land for livestock and poultry breeding.

The reasons for the continuous investment of ecolovo Group in the upstream. Earlier, Ecolovo Group said that since the fund-raising and investment projects in the slaughtering sector have been put into operation, although the production will be reached in 2023, the slaughtering volume in 2022 will increase compared with that in 2021.

In the next few years, ecolovo Group will further expand its production capacity, mainly to promote the production of the projects that have been put into operation. It is not ruled out that it will give priority to the asset-light operation modes such as holding, equity participation and asset leasing to further improve its production capacity.

In addition, in 2022, the sales of duck seedlings of ecolovo group could not reach 50% of the demand for cooperative breeding seedlings at the slaughtering end, and the growth space of poultry seedlings was still large. In order to improve the matching degree of the industrial chain, the company has been seeking to improve the production capacity of the breeding poultry sector through cooperation, leasing and other modes since the end of 2022.

Ecolovo Group also accepted the institutional survey on February 27, 2023 and said that with the continuous production of the leased breeding poultry farm in 2022, the company's duck seedling production capacity will increase compared with last year. This year is mainly about the gradual production and production of new projects, and the subsequent increase of the company's production capacity of duck seedlings gradually matches the company's production capacity of duck slaughtering end.

In view of the high breeding cost caused by the current high seedling price and feed price, it is expected that the price of duck meat may rise under pressure. There is a certain degree of substitution between pork and duck. At present, the price of pork is at a low level, which has a certain impact on the rise of duck price. However, it is expected that the impact will not be large. The change of duck price is largely affected by its own industrial factors.

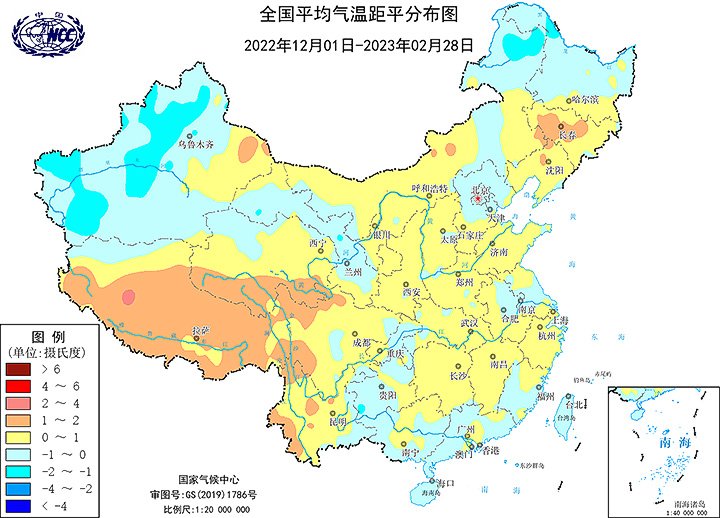

In December of last year, due to the continuous cold air and cold wave, China experienced a wide range of low temperatures. Among them, the temperature in Xinjiang, North China, South China and other places is significantly lower, and the national temperature in December is 1.19 degrees lower. At that time, it seemed that it would be cold winter!

However, after January, the weather pattern in China began to change, and the warm air began to become stronger, with the national temperature higher by 0.41 degrees. In February, the cold air is even more exhausted, making the temperature in China higher by 1.59 degrees, which is the sixth warmest February since the complete observation.

Finally, this winter (from December 1, 2022 to February 28, 2023) is slightly warmer, 0.19 degrees higher than the normal. Although La Nina can make the climate colder and has lasted for three years, it still seems unable to resist the trend of global warming.

On March 1 local time, the World Meteorological Organization released a report predicting that the "triple" La Ni ñ a phenomenon, which lasted for three years, was about to end, and that the El Ni ñ o phenomenon, which would cause climate warming, might occur in the coming months.

The World Meteorological Organization points out that the cooling effect of La Ni ñ a has temporarily restrained the global temperature rise, but the past eight years are still the hottest period on record.

According to the previous report released by NASA, 2022 has become one of the hottest years on record, and the global average temperature is about 0.89 degrees higher than before industrialization.

On February 27, the Hong Kong Statistics Office released statistics on foreign trade in goods, which showed that Hong Kong's exports fell by 36.7% in January 2023 compared with the same period last year, the largest drop since September 1953 (that is, in 70 years).

After recording a year-on-year decline of 28.9% in December 2022, the overall export value of Hong Kong commodities in January 2023 was 290.9 billion yuan, down 36.7% from the same month in 2022.

Hong Kong is the largest trade transit port in the Mainland, and its import and export business is mainly transit trade. For example, in 2022, Hong Kong's exports amounted to US $577 billion, of which US $297.5 billion of goods were imported by Hong Kong from the mainland, and most of them were to be re-exported to the world.

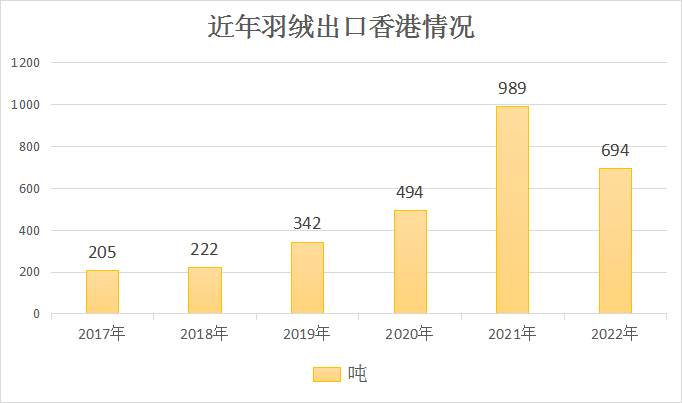

In recent years, Hong Kong has gradually become a major destination for China's down and feather exports. In 2022, China's exports to Hong Kong were 694 tons, which was 29.8% lower than that in 2021. The export value was 32800 yuan, which was 23.9% lower than that in 2021.

It can be said that one of the major reasons for the decline of Hong Kong's data is the drag of the decline of the mainland's export data.

A spokesman for the Hong Kong government said that the weak external environment and the early Chinese New Year dragged down the export performance. It was expected that the mainland economy would accelerate growth. In addition, the restrictions on cross-border land freight between Hong Kong and the mainland had been lifted, which should alleviate some of the pressure.

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

2017羽绒原料价格一路上涨,究竟为何?

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

你的羽绒服为什么钻绒?涨知识了

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

2017羽绒原料价格一路上涨,究竟为何?

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

你的羽绒服为什么钻绒?涨知识了

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展