Cn-down > Domestic news > News content

2023-02-19 来源:金绒 浏览量:1752

summary

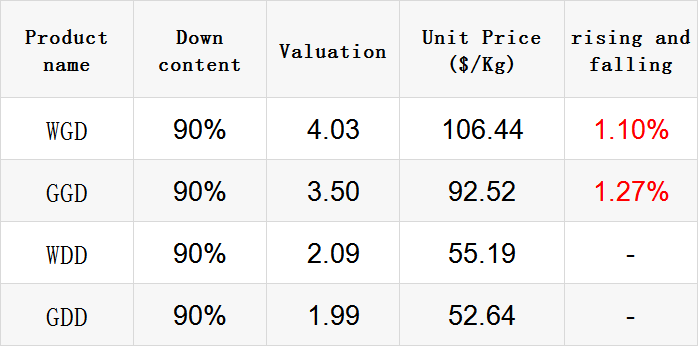

The price of goose down and white duck down rose this week.

Due to the decrease in the number of white ducks sold, the rising price of upstream raw materials, and the low willingness of some raw material manufacturers to ship, the price of finished down has risen rapidly. At the same time, most of the orders on the hands of traders have to be delivered from March to April. Because they are worried that the price of garment raw materials will continue to rise, they continue to purchase to supply production.

In January 2023, the volume of U.S. container imports ushered in a "good start", while China's exports to the United States increased by 11.0%, accounting for 36.9% of the total volume of U.S. container imports. January is usually the month when China's export of down to the United States is booming. In 2018 and 2020, even the peak of the whole year, both exceeded 1300 tons.

Early prediction shows that the El Ni ñ o climate phenomenon may return later this year. The impact of this phenomenon tends to reach its peak in December, but it usually takes a period of time to spread to the world. This lag effect makes the prediction that 2024 may be the first year when the global temperature rises by more than 1.5 degrees Celsius.

Exchange rate of USD to RMB: 6.8151

Exchange rate of USD to RMB: 6.8136

Exchange rate of USD to RMB: 6.8183

Exchange rate of USD to RMB: 6.8519

Exchange rate of USD to RMB: 6.8659

good news

At the beginning of January, a duck seedling was still 1.7 yuan, but by February, it had risen to 7 yuan, or more than 300%. However, compared with December last year, the price of feather duck in January this year increased by about 1 yuan per kilogram, so both small farmers and large farms are actively replenishing the fence at present.

Li Xiujun, a small-scale farmer, and his wife jointly operate three meat duck breeding sheds. He said that the market was good this year, and a meat duck could earn 1.5 yuan more than last year, so although the price of the duck seedlings rose, he was still scrambling for the seedlings to supplement the fence.

The head of a meat duck slaughtering and processing enterprise in Bengbu, Anhui Province, said that the downstream demand has increased rapidly recently, and the price of duck products has also continued to rise, such as the daily increase of duck wings at 300-500 yuan/ton. Recently, the workers have also been busy packing and delivering goods. Sometimes they are very busy, and even deliver goods to the early morning.

The demand for downstream duck products is growing rapidly, but the supply of upstream duck seedlings is a little behind. Experts analyzed that in the past three years, the emergence of white-feathered meat ducks has declined significantly, and the breeding period of duck seedlings is long, and it is difficult to increase rapidly at the supply side, which has caused the current tense supply of duck seedlings.

Liu Changsheng, the head of a poultry breeding enterprise in Weifang, Shandong Province, said that the entire incubation process, from the purchase of the early generation of ducklings by parents to the breeding of ducklings, also needs to go through many links, such as egg production, incubation of the commercial generation of ducklings, and quality testing, and the incubation time is up to 8 months.

Cheng Haoliang, Deputy Secretary-General of the Waterfowl Branch of the China Animal Husbandry Association, said that about 12 million duck seedlings a day is a balance point of the industry, while only 8 million are available now, and the supply is tight. In July, August and September of 2022, there will be relatively more introduction, and the number of seedlings will gradually increase after seven or eight months (after March of this year).

For many home textile export enterprises that mainly focus on the U.S. market, a "difficult" word can be used to summarize the U.S. market situation in 2022. After the general commodity surplus at the beginning of the year, the subsequent inflation continued to increase, resulting in consumer spending reduction, and the entire 2022 slump.

According to the data released recently by the US Department of Commerce OTEXA (Office of Textiles and Clothing), the import of household textiles in the main categories of the United States will fall sharply in 2022. As the import volume of major home textile products decreased, almost all major exporters to the United States were affected.

According to China's customs data, in 2022, China exported 22900 tons of down bedding to the United States, a year-on-year decrease of 43.5%; The export value was 1.094 billion yuan, down 23.9% year on year.

At the Frankfurt International Home Textile Exhibition in January this year, most of the American buyers who attended the meeting believed that the consumption of the American home textile market in the second half of this year would turn to growth, and some buyers had begun to prepare for purchase.

In January 2023, U.S. container imports stopped falling and rebounded, with a month-on-month growth of 7.2%, and the transportation delays at ports on the East Coast of the United States also continued to improve. The senior American freight forwarder said that if American retailers are optimistic about the sales prospects in 2023, they will start to replenish a lot of goods on the basis of "de-stocking" and usher in a new peak season.

Recently, in Anhui Chuntian Feather Co., Ltd., a batch of down quilts were neatly stacked in the warehouse, waiting for the Lu'an Customs of Hefei Customs to complete the customs clearance procedures for them, and then set off for Italy.

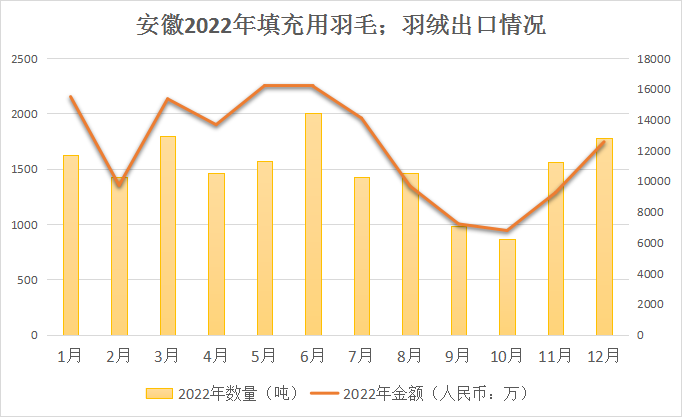

"Now, the trade and business environment for the export of down feather is getting better and better. Many facilitation reform measures have greatly improved the efficiency of customs clearance, reduced the cost of enterprises, and we are also developing better and better," said Chen Daqing, head of Anhui Chuntian Feather Co., Ltd. According to the data, in 2022, Anhui's total export value of down and feather was 1.5 billion yuan, up 26.8% year on year, and the export value reached a new record.

Relying on natural endowments and characteristic resources, Hefei Customs, in line with local conditions, helps local enterprises to continuously strengthen their advantages, solve development problems, help import and export enterprises to strengthen the leading role, supplement the chain, establish the business status and brand, continue to promote the integrated development of the first, second and third industries, and constantly enhance the foreign trade competitiveness and sustainable development ability of the down and feather industry.

"I used to work in other places. Seeing that my hometown has superior resources, good policy conditions, and the whole industrial chain is developing well, I decided to go back home and start a business. I founded Anhui Furiya Down Co., Ltd. in Huoshan County to mainly develop foreign trade business." Zuo Dengyou, the company's head, said, "Last year's export value increased by more than one time over the same period last year, and I believe this year will be better and better."

bad news

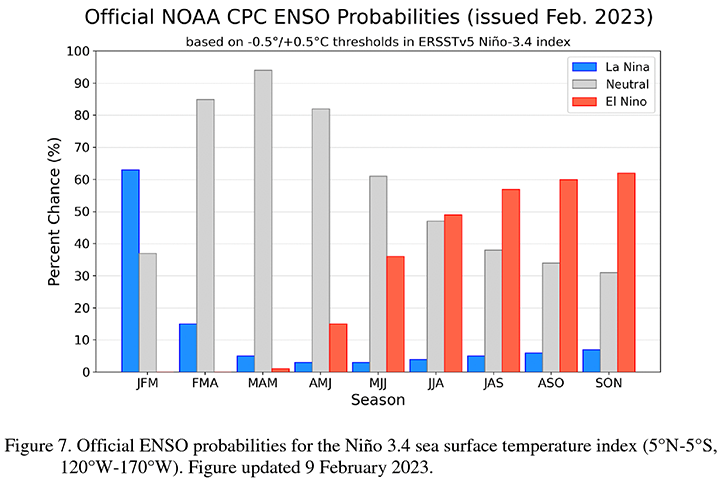

Recently, researchers from the National Oceanic and Atmospheric Administration (NOAA) pointed out that the current La Nina has begun to weaken.

They believe that the probability of returning to neutral state between February and April is as high as 85%. This means that since 2020, a long wave of triple La Nina has finally come to an end.

At the same time, many climate models pointed out that after the transition to neutral state, the tropical Pacific has a trend of significant warming in the second half of the year, which does not rule out the possibility of El Nino. Like NOAA, the probability of El Ni ñ o in the second half of this year is about 60%.

El Ni ñ o events are usually conducive to warmer winters, and the intensity of the East Asian winter monsoon may be weaker.

However, in the winter of El Ni ñ o's peak period, the sea surface temperature of the North Atlantic, Indian Ocean and Kuroshio have an impact on the key circulation system in winter, and the cold air activity is also affected by the dynamic process in the atmosphere. Therefore, there will still be a staged cold air process in winter in China.

Quang Viet, a major manufacturer of down garment, announced that the consolidated revenue in January was 967 million yuan, down 11.82% from the same period last year.

Wu, General Manager of Quang Viet, said that compared with the explosive growth of the group's operation in 2022, the attitude of some brand customers to place orders in the first half of this year turned conservative. At present, orders in the second half of this year are still under development, and the product portfolio is optimized to maintain profitability.

KWONG LUNG, another large down garment OEM factory, had a revenue of 518 million yuan in January, a decrease of 24% over the same period last year, but an increase of 7.9% over the same period last month, mainly due to the continuous warming of the momentum of ready-to-wear shipments.

Looking forward to the first quarter, KWONG LUNG has new customers and the original orders are stable. The first quarter of ready-to-wear can continue to grow and surpass last year. KWONG LUNG has successfully turned into a garment enterprise after eliminating the low-profit trade sector business, and the proportion of ready-to-wear will also rise to more than 60%.

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

2017羽绒原料价格一路上涨,究竟为何?

你的羽绒服为什么钻绒?涨知识了

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

2017羽绒原料价格一路上涨,究竟为何?

你的羽绒服为什么钻绒?涨知识了

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展