Cn-down > Domestic news > News content

2023-02-12 来源:金绒 浏览量:1825

summary

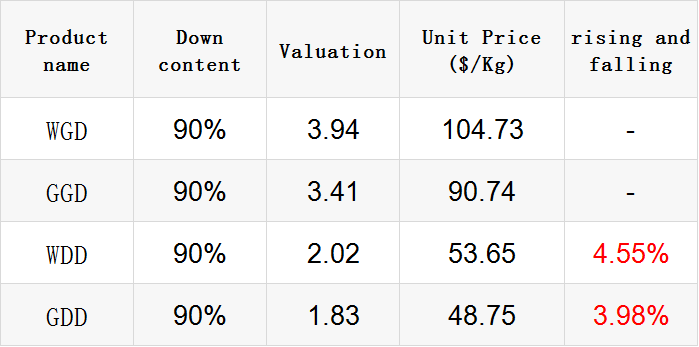

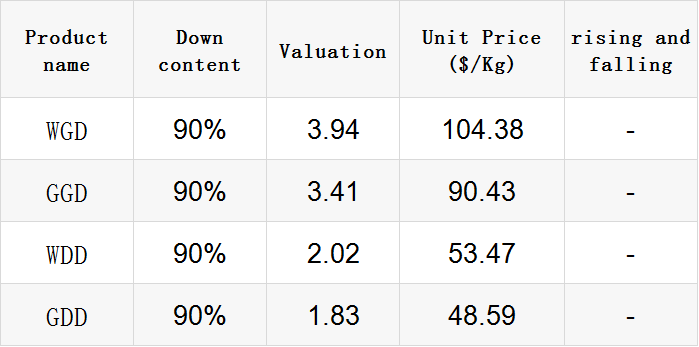

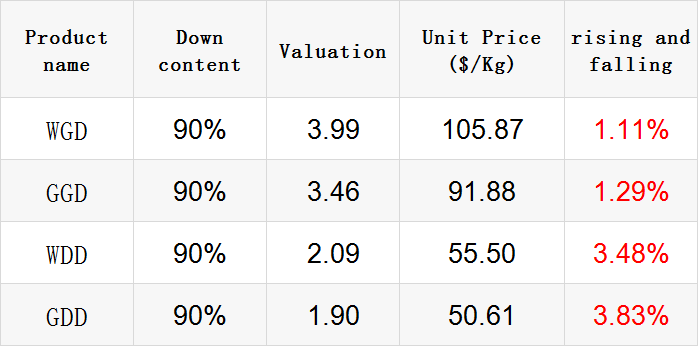

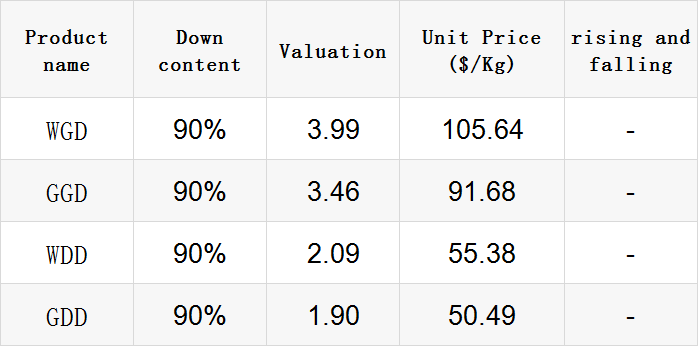

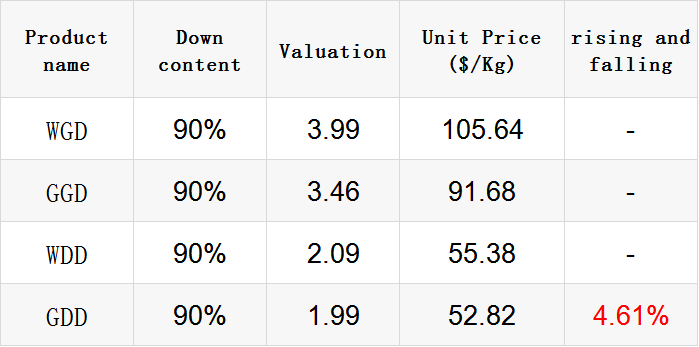

The overall price of the market rose this week, and the rise of duck down was even higher.

With the rapid increase in the price of duck seedlings, the delivery cost of feather ducks has also increased rapidly. However, it has been reported recently that the egg production rate of breeding ducks has dropped sharply due to various reasons. Under the chain reaction, the supply of raw wool will continue to be reduced passively, and the price increase from the raw end has extended to the finished down market.

Many product enterprises received orders at the end of last year, fearing that the price of raw materials would be higher in the future, so they had to rush to buy. At present, raw material manufacturers are selling less, while brand customers are waiting.

Türkiye is located at the crossroads of the three continents of Europe, Asia and Africa, and has become the most important transportation route in Europe after the Russia Ukraine war. Therefore, the local earthquake has also hit the supply chain in Europe and even the world, which has led to the continuous rise in the price of oil and related raw materials.

Exchange rate of USD to RMB: 6.7737

Exchange rate of USD to RMB: 6.7967

Exchange rate of USD to RMB: 6.7752

Exchange rate of USD to RMB: 6.7905

Exchange rate of USD to RMB: 6.7884

good news

At the technical exchange meeting of duck breeders held in Weifang City, Shandong Province, in early February, all participants were smiling. "Recently, everyone has made money, and their morale has risen. In the first three years, 98% of the industry's practitioners have lost money. The purpose of attending the meeting is to cheer up. This time, we mainly focus on how long the market can last."

In January this year, there was a turnaround in the duck industry. The quotation platform of Shandong Duck Breeding Alliance showed that the price of duck seedlings rose from 2 yuan/feather on January 1 to 7 yuan/feather on February 6, with an increase of 250% in about one month. With the change of supply and demand, the supply of duck seedlings and duck products began to fall short of demand.

The person in charge of Cherry Valley Duck said that at present, the order of parents' substitute duck seedlings has been fully booked in April, and the price has risen sharply from 1600 yuan/unit to 2600 yuan/unit.

Meat duck supply has been declining in recent years. Cheng Haoliang, Deputy Secretary-General of the Poultry Branch of the China Animal Husbandry Association, said that according to the calculation of the national waterfowl industry technology system, the number of domestic meat ducks sold in 2022 (including white feather meat ducks, muscovy ducks and semi-muscovy ducks) was about 4 billion, a decrease of about 70 million compared with 2021.

Liu Changsheng, chairman of the Shandong Duck Breeding Alliance, predicted that the number of white-feathered meat ducks will be about 3 billion in 2023, and the number will be further reduced. Yike also said on the investor interaction platform that due to factors such as capacity reduction and domestic consumer market recovery, there may be a gap in duck meat supply.

Liu Changsheng recalled, "After 2019, the duck farmers suffered losses lasting for 30 months. Many people said goodbye to the industry, and five or six large enterprises with more than 1 million on hand withdrew, and numerous small and medium-sized production capacity closed down. Three years ago, the daily seedling yield in China was about 15 million to 16 million, and only 7 to 8 million at present."

With regard to the current market, Liu Changsheng believes that the high price of white duck seedlings and big ducks will continue for a period of time. According to his understanding, more than 98% of the practitioners in the duck seedling industry have not yet realized the transformation from loss to positive. "It is expected that by the end of the first half of 2023, at most half of the enterprises may turn from loss to profit".

Liu Changsheng's answer revealed a signal that at present, the enterprises on the market do not have much capital to expand production on a large scale. On the other hand, even if the over-the-counter capital is expanded on a large scale, it will take some time.

Song Xiangqing, vice president of the Government Management Research Institute of Beijing Normal University and director of the Industrial Economic Research Center, proposed a window period of about half a year. "The breeding cycle of white duck is relatively short, and once capital enters, it is easy to form a supply of considerable scale. The high level operation of white feather meat duck is expected to last from half a year to one year, and after one year, the price decline should be a high probability event".

On the evening of February 2, New Hope released an announcement, disclosing the operation of all business segments in 2022. In 2022, the net profit attributable to the parent company of New Hope is expected to lose 410 million to 610 million yuan, which is significantly lower than that in 2021. Among them, the poultry industry lost 100 million yuan, which is expected to improve relatively in 2023.

There are two main reasons for the loss of poultry industry: first, the rising cost of raw materials drives the increase of breeding costs. Second, after the release of the COVID-19 in December 2022, the circulation of the whole market, slaughtering, and the employment rate of workers have a great impact, resulting in a large loss in December.

In 2022, the company's poultry breeding and slaughter volume will decline. A total of 650 million chickens and ducks were slaughtered in the year, down 9% year on year; 390 million commercial farmed animals, down 11% year on year.

At the breeding end, the poultry industry has made great progress. In the past, we used to do self-cultivation through leasing and outsourcing. In the first half of 2022, we began to recycle the leased farms. The European index of ducks has improved by about 20% compared with 2020, and the overall stability is 440. The duck breeding capacity ranks among the top in the industry.

On the product side, the transformation of duck blood, duck intestines, meat and bone meal has made beneficial attempts, and it is expected to usher in breakthroughs and outbreaks in 2023.

According to customs statistics, China's import and export to Russia in 2022 will be 1.28 trillion yuan, accounting for 3% of China's total import and export value. From the perspective of scale, Sino-Russian trade maintained steady growth in 2022, and the bilateral trade volume reached a new high.

However, the export of Chinese down products to Russia has regressed. In the first half of this year, China exported a total of 240000 down jackets to Russia, which was 113.5% lower than that in 2021.

Fortunately, from the second half of the year, China's export of down jacket to Russia has returned to normal, but it is still 26% lower than that of the whole year of 2021. From January to December 2022, China exported 1.607 million down jackets to Russia, with an export value of 503 million yuan.

In addition, according to the customs department, Russia will open the import of Chinese down feather at the end of April 2022, allowing the import of down feather after heat treatment at 70 ℃ and above.

However, it was not until December 2022 that China's export of down and feather to Russia made a breakthrough. The export volume of this month was 18038 kg, and the export amount was 193547 yuan.

The potential of China's export trade with Russia is still considerable, because these goods are still in short supply in the Russian market. It is said that the market share of down jacket, overcoat and jacket made of synthetic fabric, down and feather has increased compared with the natural fur that Russians like.

On February 9, Wuhu held the "Huidong Global Sailing to the Sea and Wuhu Excellence" Sailing Action Promotion Meeting, and planned to organize more than 10 batches of enterprises to go to the sea to expand the market, seize orders, expand foreign trade and attract foreign investment this year. At present, the first batch of centralized enterprise sailing activities in the New Year are under preparation.

"I am looking forward to this trip. I have a lot of things to do, and I think there is a lot to do." Wei Penglin, general manager of Anhui Rongdi Down Products Co., Ltd., said that the long-awaited "going to sea" order grabbing will be realized in March.

The company mainly produces bedding such as down quilts and down pillows, with foreign trade accounting for more than 80% and domestic sales accounting for only 20%. Going to sea was a routine in the past. In the past three years, affected by many factors such as epidemic, the company has never gone abroad.

"On the one hand, to visit old customers, business is always to deal with people, communicate more and re-establish contacts; on the other hand, to develop new markets and seize some orders transferred to Southeast Asia." Wei Penglin has specific expectations in his mind, "it should be no problem to increase millions of overseas orders this year."

bad news

Not long ago, the Ministry of Industry and Information Technology announced the pilot list of industrial wastewater recycling in 2022. Select a group of enterprises with remarkable wastewater recycling effect and advanced water efficiency indicators as typical cases of water efficiency benchmarking and compliance, which will help promote more enterprises to improve water efficiency and achieve a new leap in water saving and pollution reduction.

The shortage of water resources has become a rigid constraint on China's economic and social development. On the one hand, it is the continuous high demand for industrial water, and on the other hand, it is the basic national condition of more people and less water. Accelerating the recycling of industrial wastewater and making wastewater "turn waste into treasure" has become the key to promote the green development of industry and alleviate the contradiction between supply and demand of water resources.

In the major water use industries such as textiles and food, the industrial water reuse rate in 2020 is only 73% and 60%. To further improve the level of industrial wastewater recycling, we still need to overcome the "hard bone". On the one hand, we should consolidate the technology base, on the other hand, we should give preferential treatment in tax policy, financial support and other aspects to mobilize the enthusiasm of more enterprises.

At present, relevant departments have issued an implementation plan for industrial wastewater recycling and put forward a clear timetable and road map. Focusing on key water use industries, giving play to the role of demonstration and driving, implementing policies by classification and pushing forward stubble pressing, further improving the reuse rate of industrial water and reducing the discharge of wastewater, will accelerate the formation of a new pattern of efficient recycling of industrial wastewater, and make green a bright background for high-quality development.

Recently, practitioners are more concerned about the current increase in the supply gap of meat ducks. At present, the national production capacity of duck seedlings may continue to decrease, and the number of seedlings will be between 7.6 and 8 million in the middle and late February. The specific supply gap depends on the proportion of refrigerated storage after the national consumption is recovering.

The supply gap caused by industrial de-capacity is mainly due to the reduction of seedlings in February due to the elimination of old ducks, and the reduction of passive production capacity due to the lack of breeding ducks to fill the gap, and the high incidence of diseases around the Spring Festival. From the perspective of the whole industry, two and a half years of continuous losses at the breeding end have led to the tightening of the capital market, and the rationality of feeding ducks is the main factor leading to the low production capacity.

It can be seen that in February 2022, the supply shortage of duck seedlings is inevitable, and the trend of continuous decline will be in the middle and late ten days. The supply side will continue to support the price of duck seedlings. However, at present, the high price of duck seedlings has caused great pressure on the slaughtered products in the later stage. After the year, the products sold less than expected, and the game between supply and demand intensified.

In March, the breeding ducks introduced around July 2022 will enter the concentrated seedling stage, and the seedling price may have a significant downward trend. The expected decline of white bars and split products is due to the following reasons: first, the school starts and the economic consumption recovers, which leads to the goods falling short of expectations, and the overall rise of the market starts to stabilize gradually; second, the price of pork continues to weaken, which is difficult to form a strong supporting role for the price of meat products.

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

2017羽绒原料价格一路上涨,究竟为何?

你的羽绒服为什么钻绒?涨知识了

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

2017羽绒原料价格一路上涨,究竟为何?

你的羽绒服为什么钻绒?涨知识了

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展