Cn-down > Domestic news > News content

2022-09-18 来源:金绒 浏览量:1863

summary

As the weather turns hot again, the down market has gradually become a stalemate. Although there are rumors that Europe's energy supply crisis will benefit the export of down and its products to Europe this winter, the industry has not acted rashly for this under the circumstances of the unknown situation.

At present, various international meteorological agencies believe that La Niña has been firmly prevalent, but this year's winter in our country may not become cold. The National Climate Center believes that this winter, most of my country's temperatures will be close to the same period of the year or slightly higher.

Recently, the exchange rate of offshore and onshore RMB against the US dollar has fallen below the integer mark of "7" for the first time since August 2020. However, due to the continued strength of the renminbi against a basket of currencies, its export-pulling effect is weakening.

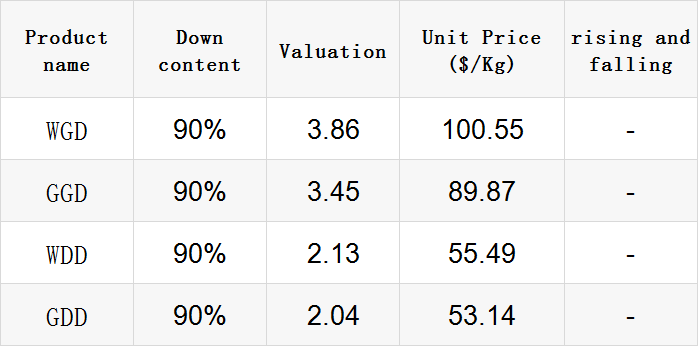

Exchange rate of USD to RMB: 6.9098

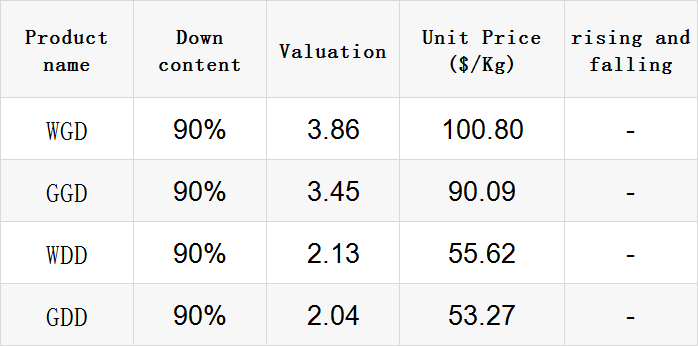

Exchange rate of USD to RMB: 6.8928

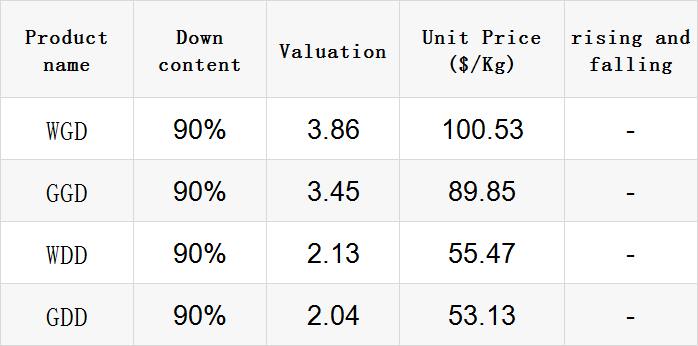

Exchange rate of USD to RMB: 6.9116

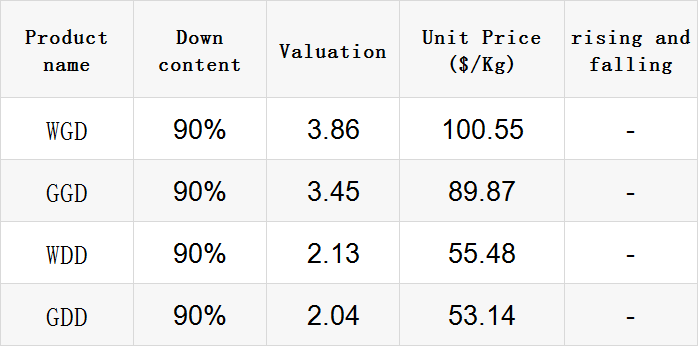

Exchange rate of USD to RMB: 6.9101

Exchange rate of USD to RMB: 6.9305

good news

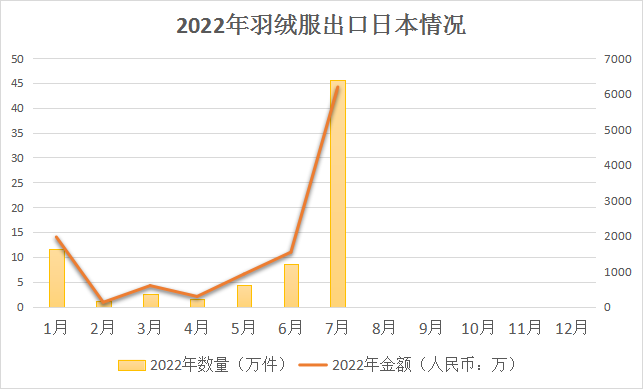

Since the beginning of this year, as Japanese consumers have cut their spending on clothing, and the continued weakening of the yen has pushed the already high import cost even higher, in the first half of the year, the export situation of my country's down and its products to Japan has remained constant. Unsatisfactory.

Unexpectedly, in July, this situation ushered in a turning point. The first is that down jackets exported 456,000 pieces to Japan, an increase of 428% from June and a 35% increase from last year. However, compared with previous years, July-December is the peak season for export of down jackets to Japan, and the peak value can even reach 2 million pieces.

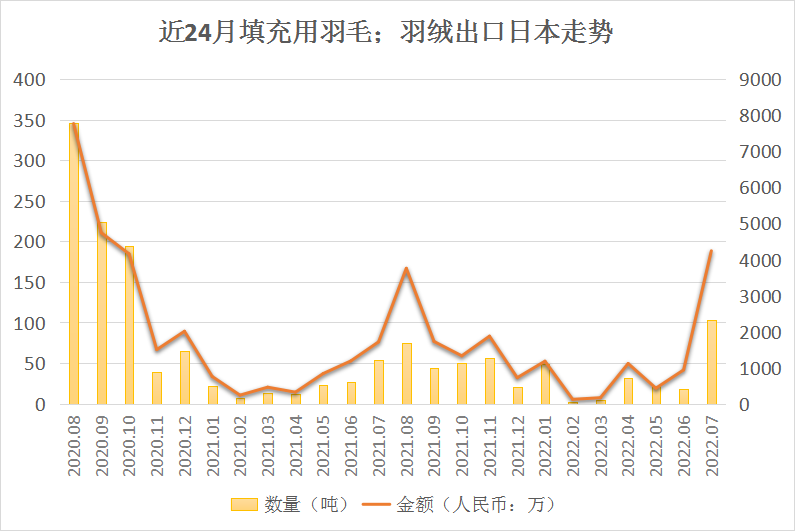

Secondly, my country exported 103 tons of down to Japan, an increase of 490% compared with June and an increase of 93% compared with last year; the export value was 42.37 million, an increase of 147% compared with last year. And this export volume and export value, among all trading partners, are enough to rank among the top ten of the month.

In fact, in the past two years, Japan has been vigorously promoting "Regenerated down", so the export of my country's down to Japan continued to be sluggish.

In Japan's view, the popularity of down jackets in China, coupled with the unexpected challenges faced by the waterfowl farming industry, will lead to a sharp rise in down prices.

Moreover, there is basically no large-scale goose and duck breeding in Japan, which means that all down in the Japanese market must be imported from overseas. The high reliance on imported down has given Japan sufficient motivation to find alternatives to fresh down.

The Japan Badminton Association will also formulate definitions and labelling standards for regenerated down and feathers, and has established a down bedding transformation system to issue "transformation labels" to transformation factories that meet certification standards.

However, the explosive growth of down export in July shows that Japan still has a large demand for fresh down, which is even surprising. Is "Regenerated down" not enough? Will this be a weathervane event?

Quang Viet (4438), a large down jacket OEM, announced on the 8th that its consolidated revenue in a single month in August was 2.559 billion yuan, setting a new record for a single month. The third quarter is the traditional peak season for high-priced autumn and winter clothing shipments. Coupled with the strong ordering force of brand customers in 2022, Quang Viet's 2022 order visibility has reached the fourth quarter, and its operation is stable and growing.

Looking forward to the future, Quang Viet said that the order development in the first quarter of 2023 has been started. In addition to continuing to master the cooperative relationship with existing brand customers, it is also actively deploying new brand customers. In addition, the Jordanian production base is also continuing to expand.

Quang Viet's main customers include sports brands Adidas, Nike, UA, NB, and outdoor brands The North Face, Patagonia, Aritzia, etc. The legal person pointed out that although there are many variables in the consumer market and the economy, it is still optimistic that this year's operating results will reach a historical peak.

Another down jacket OEM, KWONG LUNG (8916), said that the benefits of transforming from a down factory to a ready-to-wear factory have emerged, and it will actively expand its outdoor ready-to-wear business in the future. As for the issue of inflation, since the brand's ordering mode has changed from "one-time large-volume orders" to "small-batch orders and then additional", it is beneficial to Guanglong, which has a more flexible production line, and can obtain more orders.

Looking forward to the second half of the year, KWONG LUNG is still optimistic about the performance of ready-to-wear. It pointed out that the visibility of orders has reached the first half of next year, and the number of orders placed by old customers in hand is flat, but four to five new customers have placed orders in North America and Oceania, and they have been testing orders one after another.

KWONG LUNG's current customers include Montbell, Marmot, Burton, Columbia, Mountain Hardwear, etc., and it is expected to increase 4-5 more next year. Therefore, in terms of production capacity layout, in addition to planning to expand 10 own production lines in Vietnam, KWONG LUNG is also negotiating to build a second production area in Indonesia, which may start production in the fourth quarter of next year.

In midsummer August, the "Douyin 818 Discovery of Good Things Festival" made the e-commerce business even hotter. Coupled with a wave of assists such as the Qixi Festival and the opening season, the good things of interest ushered in new growth and showed new business trends.

Due to the advantage of off-season and low prices for down jackets, YAYA set off a rush to buy down jackets, and reached the top 1 of the industry's hottest models. Bosideng, which launched new lightweight down jackets, also entered the top ten.

The "Douyin 818 Discovery Good Things Festival" meets the summer vacation, and the "double buff" is stacked to stimulate the parent-child business. Among them, children's "wear and use" demand drives consumption, and Disney's new double-sided down jacket ranks first in the trend list.

September is approaching, and scenes of autumn renewal, Mid-Autumn Festival gifts, and National Day travel preparations will emerge in a concentrated manner, and it is believed that a new wave of growth momentum will be released.

As soon as the Mid-Autumn Festival holiday ended, the price of goose became "restless" again. The biggest change is the price of Magang geese and lion-headed geese - from goose seedlings to young geese, and from fattening geese to culling old geese, prices are rising without exception, and the increase is not small.

For example, the wholesale price of lion head goose is basically more than 12 yuan for 75 days, and more than 15 yuan for more than 100 days. What is even more exaggerated is that the price of lion head goose seedlings has risen to more than 60 yuan apiece.

The price of white geese is even more "crazy" than grey geese. For example, the 120-day-old Zhedong white goose has exceeded 18 yuan per catty, while the price of other breeds and days of white goose is basically around 13 yuan. It can be said that the price of goose across the country is on the rise.

Because the overall goose raising market in the first half of the year was not as good as expected, since the second half of the year, the number of finished goose stocks has dropped a lot from the previous month. After the consumption stimulus of the Mid-Autumn Festival, the supply of finished goose is even more stretched. In addition, the supply of goose seedlings after the second half of the year was in a state of shortage, and to restore the supply on a large scale, at least until the peak egg laying period in winter.

bad news

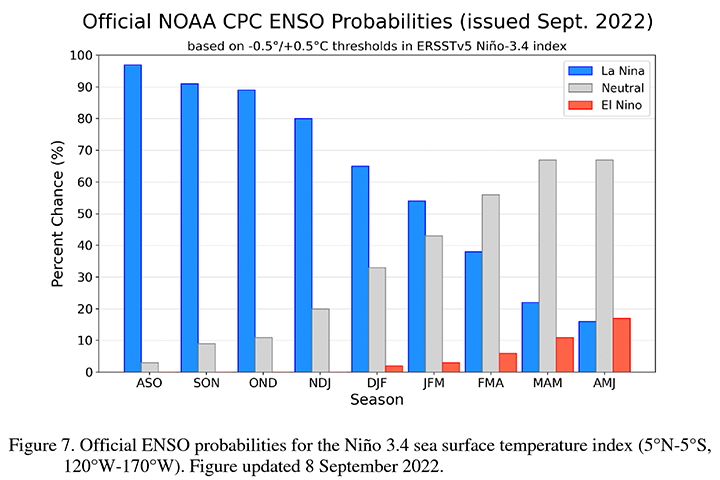

Oceanographic and atmospheric conditions tell us that La Niña is now firmly prevalent in the tropical Pacific. Predictions suggest that La Niña has a 91 percent chance of continuing from September to November, and an 80 percent chance of continuing from November to January.

But there is still a lot of uncertainty about how long this La Niña will last. Based on computer models, current projections agree that La Niña is still weakly dominant (54%) in the January-March period, but has a 56% chance of being ENSO-neutral in the February-April period.

In the historical record, only one La Niña winter (2000-01) turned neutral between February and April, so it is difficult to find a real similar event to give people a guide to the next climate trend.

Or it is precisely because La Niña may pass early this time, so the prediction of its strength is also weak. (In fact, this intensity is not directly related to whether it is cold or warm in winter.)

The numerical model of the National Climate Center believes that in the winter from December 2022 to February 2023, the temperature in most parts of my country will be close to the same period of the year or slightly higher, among which the temperature on the Qinghai-Tibet Plateau and the northeast line will be significantly higher. Judging from this forecast, my country may not be particularly cold this winter.

In addition, in the forecasts of many climate models around the world, most of them also predicted that the temperature in most parts of my country this winter will be close to normal or slightly higher, and only a few have given a colder. It just needs to be noted that under the influence of La Niña, the periodic cold wave process may still appear more and earlier.

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

2017羽绒原料价格一路上涨,究竟为何?

你的羽绒服为什么钻绒?涨知识了

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

2017羽绒原料价格一路上涨,究竟为何?

你的羽绒服为什么钻绒?涨知识了

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展