Cn-down > Domestic news > News content

2022-08-21 来源:金绒 浏览量:2058

summary

Recently, with the popularity of white goose down, grey goose down has shown a compensatory increase. The strong rise in the grey goose down market just reflects the recognition of it by the downstream product market this year.

Looking back at the past August, product companies will be in the state of placing orders for purchases throughout the month, but this year's consumption is sluggish, and clothing companies are also sluggish, so it seems that this year's procurement season will be relatively urgent. The "Golden Nine Silver Ten" has entered the countdown, and it is about to usher in the most important node in the second half of the year-Double Eleven.

According to customs data, "processed feathers, down and their products; artificial flowers; human hair products" exported 7,708.5 million yuan in July this year, down 2 percent from June but up 8 percent from July last year. In this way, the export situation of down and its products in July is more optimistic.

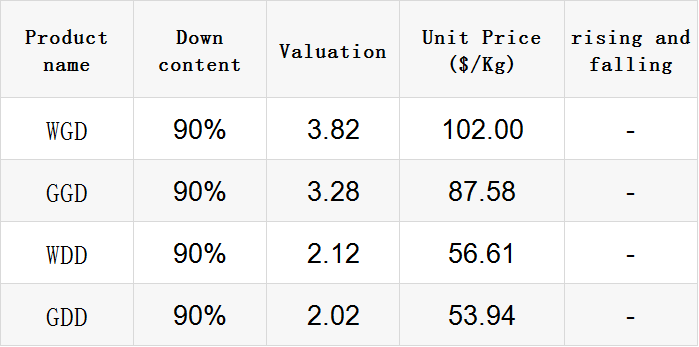

Exchange rate of USD to RMB: 6.7410

Exchange rate of USD to RMB: 6.7730

Exchange rate of USD to RMB: 6.7863

Exchange rate of USD to RMB: 6.7802

Exchange rate of USD to RMB: 6.8065

good news

Recently, the Japan Meteorological Agency and the US NOAA have successively released information on the development of the "La Niña" phenomenon. They all feel that La Niña appears to have been going on since last fall, and that a "triple" La Niña may be coming.

The Japan Meteorological Agency believes that La Niña is still going on and is likely to continue into early winter (60% chance). Due to persistent strong trade winds, sea surface temperatures in the El Niño monitoring area also continued to be below or close to reference values until the start of winter.

NOAA in the United States believes that there is an 86% chance that La Niña will last until early fall, and a more than 70% probability that it will last until early winter. Overall, NOAA's judgment on La Niña this time is actually similar to that of the same period last year.

However, most NMME models suggest that La Niña will transition to ENSO neutrality between January 2023 and March 2023. It is very rare for La Niña to end so early in winter.

Of course, for the down industry, January is actually past its peak sales season, so the demise of La Niña is irrelevant.

And the months that need the most attention from the industry should be October and November. According to statistics, these two months are the months with the most cold waves. Also, watch out for the extremes of "it can be hotter when it's hot and colder when it's cold".

The Ministry of Foreign Affairs reported on the 10th that on the same day, State Councilor and Foreign Minister Wang Yi held talks with visiting Nepalese Foreign Minister Khadgar in Qingdao, Shandong.

Wang Yi announced that China will use the aid to Nepal to support the feasibility study of the China-Nepal cross-border railway, and send experts to Nepal to conduct surveys within this year. The zero-tariff treatment for 98% of tax items granted by China to Nepal will come into effect on September 1, and support the Nepalese side to make good use of the dividends of this policy to expand exports to China.

Nepal is located in the southern foothills of the Himalayas. It is a landlocked country in South Asia. It is "sandwiched" between China and India. You can imagine how inconvenient the traffic is. Chinese experts have said that in order to build a railway, it must pass through the Himalayas, so a long tunnel through the Himalayas needs to be built.

Despite the difficulties, China and Nepal are serious about building the railway to the Himalayas. Prior to Foreign Minister Wang Yi's visit to Nepal, he signed nine cooperation documents with Nepalese officials, two of which are related to this railway, which is highly valued by the two countries.

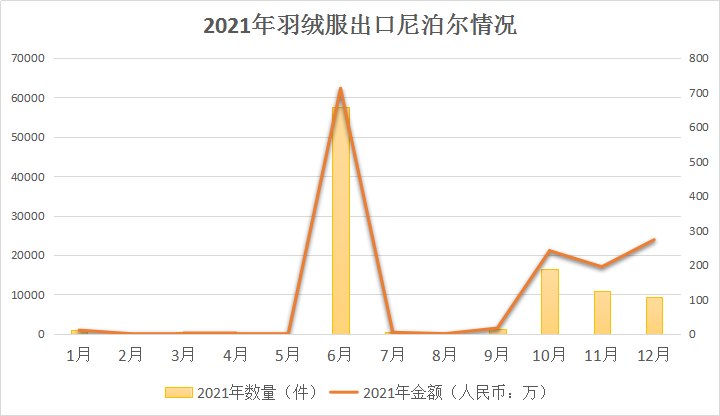

Nepal is a typical agricultural country, but the textile industry has developed a lot under the circumstances of economic reform. In the first half of 2022, Nepal has exported 3,565 down jackets to my country, and 9,202 down jackets in 2021.

Nepal once imported down raw materials from my country, but this year, due to the decrease in foreign exchange for tourism and huge energy expenditure, which led to financial constraints, it decided to stop importing luxury goods. At the same time, it also banned the import of garments, textile products, threads and feathers.

In addition, the spring from April to May every year is the main season for the country to climb the peaks of the Himalayas. There are a large number of shops selling down jackets and other professional equipment on the streets of the capital Kathmandu. The local cost of each climber is about 60,000 US dollars, or about 390,000 yuan.

Therefore, Nepal has a relatively large demand for down jackets. In 2021, my country will export 97,000 pieces of various down jackets to Nepal, mainly short tops, with an export value of 14.537 million yuan.

On August 19, the exchange rate of the onshore RMB against the US dollar dropped 180 points at the opening, falling below the 6.80 mark. At the same time, the offshore RMB against the US dollar plummeted, falling below the 6.81 and 6.82 marks. The central parity of the RMB against the U.S. dollar was reported at 6.8065 on August 19, which was the first time that the central parity of the RMB against the U.S. dollar fell below the 6.80 mark since September 2020.

The chief economist of CITIC Securities clearly believes that the downward pressure on the economy is relatively large, and the superimposed US dollar index, which is still at a high level, may be the main reason for the recent weak operation of the renminbi. After the release of emotions, the RMB may return to shock.

So does the devaluation of the renminbi mean that China's economic prospects are not good? The answer given by experts is no. Zong Liang, chief researcher of Bank of China, said that since June 2021, the US dollar index has approached 110 from around 90, reaching a new high in nearly 20 years.

In addition, under the background that my country's economy is facing downward pressure, a moderate depreciation of the RMB is conducive to increasing the scale of exports and enhancing the voice of my country's export enterprises, and will increase a certain cost for import enterprises.

bad news

In Hangzhou in midsummer, the surface temperature is far more than 40 degrees. However, in many live broadcast rooms in multiple business industrial parks, the anchors took turns wearing down jackets to appear on the camera, and the broadcast was in full swing.

In July, a veritable off-season month, ten live broadcasts and nine off-season marketing. According to the observation and statistics of Douyi data, in the Douyin women's best-selling list in the past 30 days, the 2nd, 3rd, 5th, 9th, and 10th are all off-season products such as down jackets and coats.

According to public data, the Kuaishou down jacket market in the past 30 days is mainly priced at 100-300 yuan, with 56% of the products put in, and 66% of the sales.

Compared with the data in 2020, the proportion of off-season marketing of down jackets in 2022 will increase significantly. Gecko look at the data shows that in July 2020, down jackets ranked first with an absolute advantage of 43.7%.

In addition, the average unit price of down jackets in 2020 is about 140 yuan, but nearly 60% of them are priced below 100 yuan. What is clear is that sales prices are getting higher in 2022.

There is a view in the market that in the face of low prices and clearance, consumers and brands seem to have reached a win together for the first time to some extent. However, is this really the case?

In fact, when the demand for down jackets in autumn and winter is large and the circulation speed is high, the capital link of manufacturers is relatively stable. If the down jackets are sold out of season, it is very likely to cause harm to the manufacturer behind the emptying of the inventory.

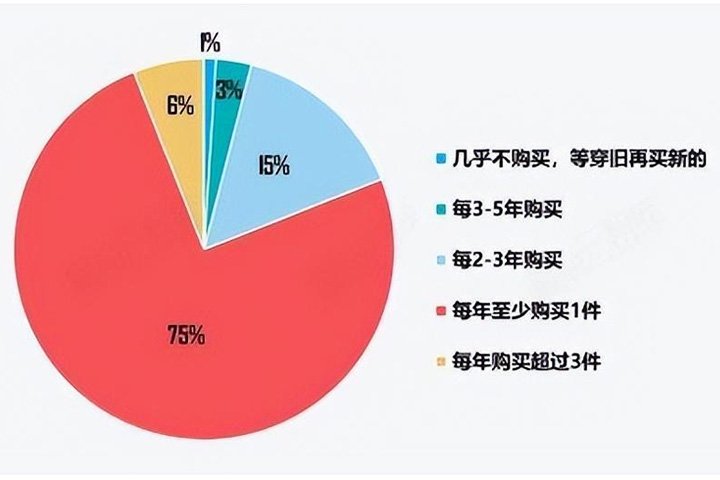

According to the survey data, the frequency of consumers buying down jackets has increased, and 75% of consumers buy at least one piece every year. If consumers fill the demand for down jackets in the off-season, manufacturers will lose most of their shopping needs when autumn and winter come.

On the other hand, the down jackets sold in season and off-season still take commuting, street and sweetness as the main styles. This means that consumers' willingness to spend twice or three times within a year is not high. To this end, from a certain point of view, the inertial off-season sales will disrupt the original law of the market.

If the off-season becomes a hot-selling period, in addition to the fact that the profit of the manufacturer is completely lower than that of the marketing in autumn and winter, it may also lead to more tailstocks in the season. It is worth noting that the profit of manufacturers is limited behind the low-cost inventory clearance in the off-season. So from a longer-term perspective, off-season marketing is not a win-win.

According to customs statistics, the trade volume between China and Russia from January to July 2022 was US$97.714 billion, a year-on-year increase of 29%. Among them, China's exports to Russia were 36.267 billion US dollars, an increase of 5.2%.

In July alone, the trade volume between the two countries reached US$16.79 billion, with China's exports at US$6.77 billion and imports at US$10.02 billion.

However, the export of Chinese down products to Russia has experienced an unexpected setback. In the first half of this year, my country exported a total of 240,000 pieces of down jackets to Russia, down 113.5% year-on-year in 2021; down and down bedding exported 131.1 tons, down 91.2% year-on-year.

As for the export of down filling to Russia, even in recent years, it is almost nothing.

Of course, from another perspective, it can also be said that the export potential is huge. Moreover, according to the customs department, Russia has opened the import of Chinese down and feathers at the end of April 2022, allowing the import of down and feathers that have been heat-treated at 70°C and above.

At present, the Russian and Chinese authorities have set the task of bringing the bilateral trade volume to 200 billion US dollars per year. In June, Russian Federation Deputy Foreign Minister Igor Morgulov said that by the end of 2022, the bilateral trade volume between Russia and China is expected to reach 200 billion US dollars ahead of schedule.

In addition, Chinese down products may find a new group of customers in Russia. According to immigration statistics from the Ministry of Internal Affairs, in the second quarter of 2022, more than 222,000 people came to various regions of Siberia in Russia to register as immigrants for the purpose of "work", which exceeded the target of the same period last year by 31%.

The source said: “The influx of labor migrants has grown particularly markedly, from Uzbekistan (up 36.9%), Vietnam (up 58.3%), China (up 32.8%), the Philippines (up 4.3 times), India (up 26.6%) ).”

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

2017羽绒原料价格一路上涨,究竟为何?

你的羽绒服为什么钻绒?涨知识了

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

2017羽绒原料价格一路上涨,究竟为何?

你的羽绒服为什么钻绒?涨知识了

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展