Cn-down > Domestic news > News content

2022-08-08 来源:羽绒金网 浏览量:2011

summary

In recent years, brand down jackets have been developing towards high-end, and the production and sales of down quilts have increased every year, which has brought great demand for white goose down. And this demand is especially obvious in the second half of the year.

However, the production of white goose down has always been relatively small, and the number of breeding this year has declined, coupled with the recent improvement in orders for down products, so this week's market for white goose down and white duck down has improved.

With the spread of a new subtype of the Omicron strain, outbreaks in some countries have become severe again. According to WHO data, there were more than 6.6 million new confirmed cases worldwide in the past week, including more than 960,000 in Japan and 860,000 in the United States. There are reports that the epidemic in the northern hemisphere may increase significantly this autumn and winter.

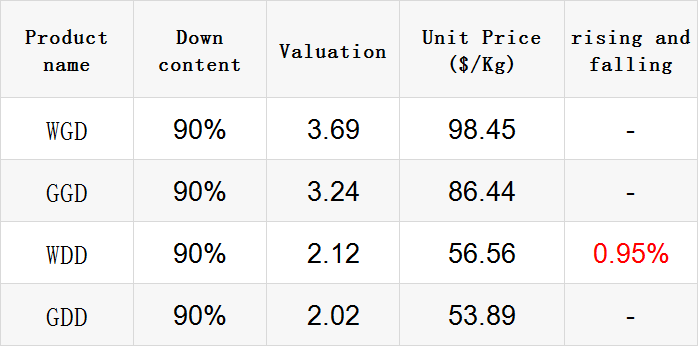

Exchange rate of USD to RMB: 6.7467

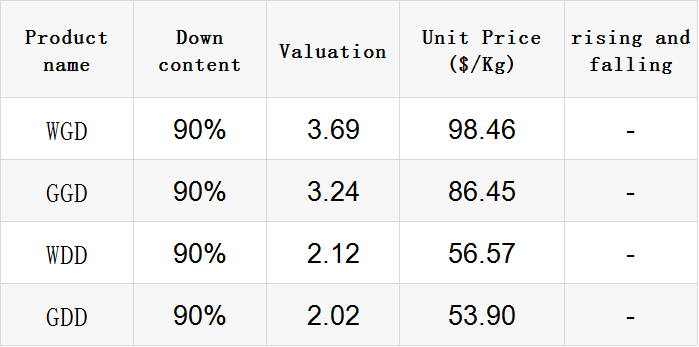

Exchange rate of USD to RMB: 6.7462

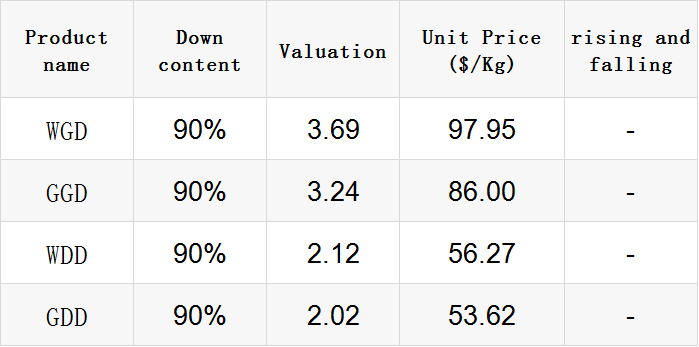

Exchange rate of USD to RMB: 6.7813

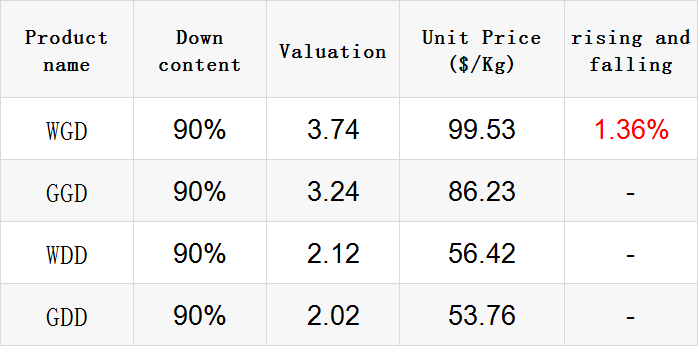

Exchange rate of USD to RMB: 6.7636

Exchange rate of USD to RMB: 6.7405

good news

Following the "YaYa" brand winter new product launch conference at the end of June, on July 30, the 2022 YaYa Jiangxi District Winter New Product Order Fair was held in Gongqing City, Jiangxi Province.

This ordering fair continued the theme of "YaYa down , the glory of domestic products", and attracted more than 40 "YaYa" down jacket sales agents from the province to choose models. More than 70 new down garments, as well as some classic styles, were displayed on the spot.

On the same day, a total of 32 agents signed the contract on the spot, the order volume was about 18,000 pieces, and the contract amount was 9.5 million yuan.

The 2022 "Ya Ya" Jiangxi District Winter New Product Order Fair showcased the results of this year's "Ya Ya" clothing design, further expanded the offline market share, and effectively enhanced the "Ya Ya" brand awareness and influence.

In the past two years, "Ya Ya" has cooperated with the Wuhan Textile University Research Institute and the Communist Youth Branch of the China Textile Research Institute to jointly develop new fabrics and new processes, and collaborate with internationally renowned designers.

Wang Qiuhan, director of the Gongqingcheng Textile and Garment Industry Research Institute of Wuhan Textile University, said that 5,000 design products can be born in a year. The down jacket produced by "Ya Ya" is now the representative of the "New Country Trend".

According to the national livestock and poultry production in the first half of the year announced by the National Bureau of Statistics on July 15, the number of domestic poultry slaughtered in my country in the first half of 2022 reached 6.91 billion, a year-on-year decrease of 0.7%.

Among the 15 provinces that have released poultry slaughter data, 10 provinces including Shandong, Guangxi, Henan, Jiangxi, and Yunnan, including major poultry farming provinces, have negative growth in poultry slaughter in the first half of 2022.

Among them, Shandong Province saw a 6% drop in poultry production in the first half of this year, equivalent to 74 million fewer poultry than in the first half of 2021. In five provinces, including Guangdong, Jiangsu, and Shanxi, poultry slaughtering still maintained a certain growth rate. Jiangsu increased by 13.3% year-on-year, and Guangdong increased by 8.2%.

Among the 12 provinces in the statistics, Shandong's poultry meat production is far ahead of other provinces, nearly 1.87 times that of Guangdong, which ranks second. The poultry meat output of Shandong, Guangdong, Guangxi and Henan provinces in the first half of the year is equivalent to nearly 37.8% of the national poultry meat output of 10.67 million tons.

Among the above-mentioned provinces, Henan's poultry meat products experienced the largest year-on-year decrease of 9.5%, followed by Shandong, Guangxi, Shaanxi and Hainan. In the first half of the year, poultry meat production decreased by more than 5% year-on-year.

Although the off-season is not over yet, with the arrival of August, the market conditions have undergone subtle changes. Some new orders have started to be placed, including the release of orders for autumn and winter fabrics.

Many companies have improved as new orders are issued one after another. The senior manager, who specializes in mid-to-high-end fabrics, said: "The orders on hand are very good. Recently, we have received many orders of hundreds of thousands of meters. At present, the orders for autumn and winter fabrics are okay, and the orders are for domestic sales and exports to Europe and the United States. "

Mr. Sun, who owns 400 looms, said: "At present, Douyin and Taobao Live bring more orders, but they are only small orders of several kilometers. This year, the company's main focus is on developing customers, so it has been developing new products. At present, there are a lot of proofs, but most of the subsequent orders are actually small orders.”

According to market visits, the current operating rate of many weaving companies is around 70% or 80%, and some even remain fully open. But it also means that inventories are getting higher day by day. Many weaving companies said that although the off-season, they still have to feed their workers, and they always have hope for the autumn and winter market in the second half of the year.

"Booming", "Super-burning" and "Super Popular" are the words that appear most frequently among the industry population participating in the 2022 Hangzhou Textile Expo. Some people even sighed, "Everyone in the circle of friends is here today!"

From July 28th to 30th, in a short three-day period, the exhibition area of 53,000 square meters was enriched and compact, and a total of 65,714 professional visitors were welcomed. The scene was crowded with people, and the transactions were fruitful, not only for the harvest of the textile industry in 2022. The next period also opens a new chapter for the next journey.

Samsung Down, a local brand in Hangzhou, was invited to stand at booth 1CT08. The whole is mainly in the style of the Asian Games, and the floor adopts the design of the Asian Games circular runway, allowing visitors to directly experience the Hangzhou Asian Games culture, and the details are full of intentions.

At this exhibition, Samsung Down also brought a blueprint for sustainable development - "Make the sky bluer and the water greener" reward down plan. It recycles down products and processes them safely, so that they can be used as regenerated down products for consumers.

bad news

According to feedback from some weaving enterprises and foreign trade companies in Zhejiang, Guangdong and other places, since mid-July, the traceability orders for all cotton grey fabrics have shown a trend of bottoming out and rebounding. Mainly for knitted garments and home textile orders exported to the United States and the European Union.

Some orders not only explicitly prohibit Xinjiang cotton in the contract, but also specify the proportion of US cotton content.

Textile companies in Yancheng, Jiangsu, Zibo, Shandong and other places said that in addition to European orders, fashion brands in North America have become increasingly active since July, but cotton traceability requirements are more stringent, almost only requiring traceability.

According to the survey, the traceability of cotton, cotton yarn, grey fabrics, fabrics, clothing, etc. has almost become an inevitable option for cotton-related enterprises to receive export orders. It is not only required by foreign trade companies and European and American buyers, but also by entrepot traders in Southeast Asia and ASEAN.

Recently, some branded apparel companies and buyers in Japan, South Korea, Canada and other countries have also asked Chinese suppliers to provide certificates of "non-Xinjiang cotton". But U.S. Customs scrutiny is unlikely to expand to apparel imported from third countries anytime soon because of capacity constraints, lawyers said.

According to a survey of 34 major U.S. fashion companies by Sheng Lu, an associate professor of fashion at the University of Delaware, from April to June, 86 percent of respondents said they would reduce their purchases of cotton apparel from China, while more than 92 percent People have no plans to reduce clothing purchases from Asian countries other than China.

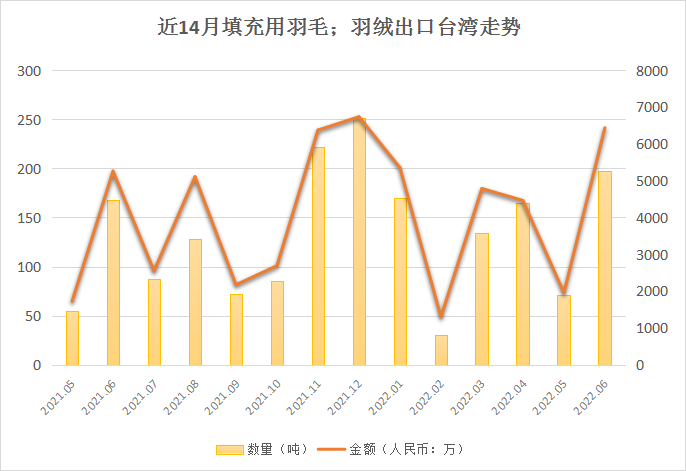

In 2021, although the import of some agricultural products from Taiwan is suspended, Taiwan's total exports to the mainland will not only not decrease, but will also increase by 10%. Among them, the export volume of down and feathers increased by 74% year-on-year, and the amount increased by 67% year-on-year.

However, in recent days, the General Administration of Customs and the Chinese Ministry of Commerce have successively issued statements, suspending the import and export of many products to Taiwan. At the same time, the Chinese People's Liberation Army announced that it will carry out important military exercises. Many Taiwanese media said that it is "like locking Taiwan by sea and air for 3 days."

It can be said that Pelosi's visit to Taiwan has brought considerable uncertainty to the economic and trade activities between the mainland and Taiwan.

In the first half of the year, my country's exports of down and feathers to Taiwan decreased by 8% year-on-year. However, the export volume in June hit a new high for the year, an increase of 177% from May. Therefore, the export situation in July-September could have been optimistic.

Taiwan, where the livestock and poultry industry does not account for a large proportion of the world, is the most important down supply area in the world. The export volume of down processing once ranked third in the world, and almost all of the exported down is supplied to the top international brands.

Today, Taiwan's down and down industry has established a closer relationship with its mainland counterparts and is firmly in the leading position in the world. However, due to the bird epidemic and the increasing emphasis on environmental protection in various countries, the supply of feather raw materials has decreased and the manufacturing cost has gradually increased, all of which have brought severe challenges to Taiwan's down industry.

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

2017羽绒原料价格一路上涨,究竟为何?

你的羽绒服为什么钻绒?涨知识了

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

2017羽绒原料价格一路上涨,究竟为何?

你的羽绒服为什么钻绒?涨知识了

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展