Cn-down > Domestic news > News content

2022-07-11 来源:羽绒金网 浏览量:1952

summary

On July 6, the World Health Organization (WHO) released data saying that the number of new infections worldwide has increased by nearly 30% in the past two weeks. Since June 30, Shandong, a major duck breeding province, has also begun to add locally confirmed cases, and Linyi has now become the most serious area. Compared with previous years, this year's down raw materials have been relatively reduced by 30%-40%. If the impact of the epidemic is added, I am afraid that the output will still be reduced.

With the arrival of the production season of down products, downstream enterprises began to enter the market to inquire and place orders. Judging from the situation in previous years, July is the peak season for the sales of finished down products. Driven by the top brands Bosideng and Duck Duck, many down product order fairs have been held recently. It can be said that the current market has loosened, but there are also crises.

Recently, news about the imminent announcement by the United States to adjust tariffs on China has been frequently reported, and has repeatedly triggered a rise in the apparel and home textile sector. And with the drop in shipping prices, foreign customers are now more willing to place orders, and the situation of "difficulty in ordering containers" has also been greatly improved. However, since the middle of the year, domestic and foreign commodities have frequently experienced crash-like declines, reflecting expectations of a recession in the global economy.

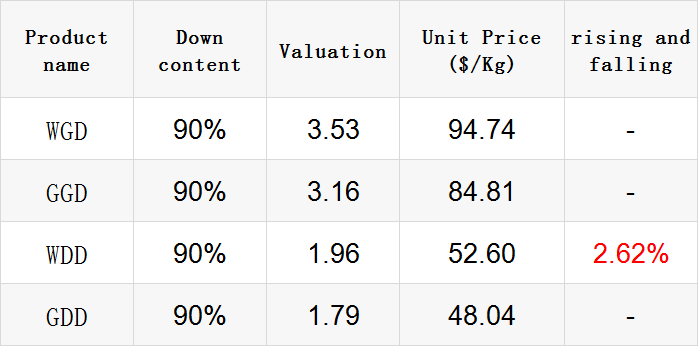

Exchange rate of USD to RMB: 6.7071

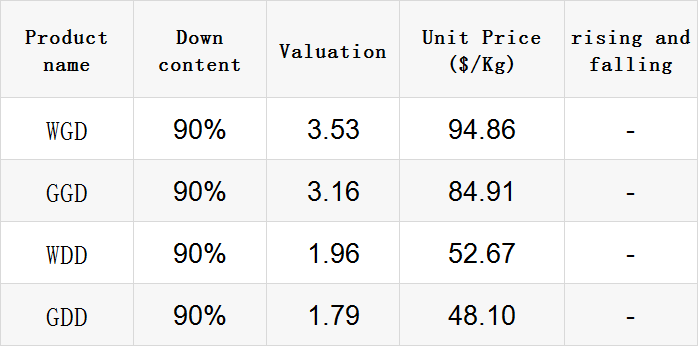

Exchange rate of USD to RMB: 6.6986

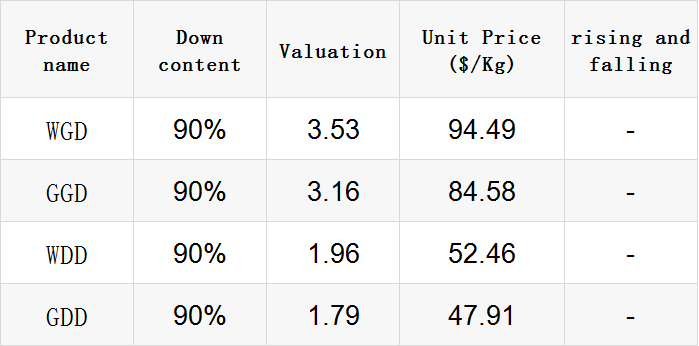

Exchange rate of USD to RMB: 6.7246

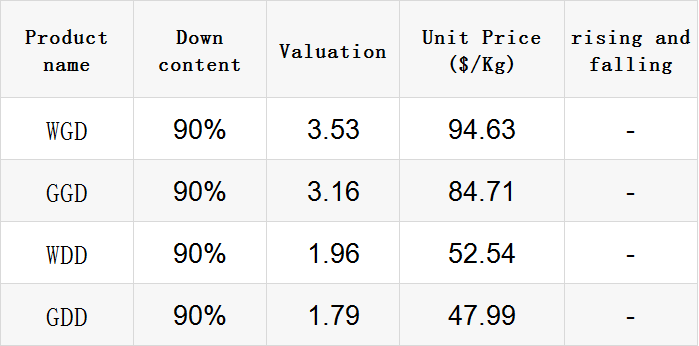

Exchange rate of USD to RMB: 6.7143

Exchange rate of USD to RMB: 6.7098

good news

In 2018, Bosideng’s chief financial officer publicly stated that the average price of Bosideng down jackets increased by 20%-30% that year, and the average product price exceeded 1,000 yuan for the first time, reaching around 1,200-1,300 yuan. In the past four years, the retail price of Bosideng down jackets is still climbing.

At the online performance meeting on June 24 this year, Rui Jinsong admitted that in recent years, the prices of Bosideng products have been "desperately going up", which will put pressure on some consumers to buy Bosideng down jackets.

At the same time, he also said that Bosideng really lacked research in the mid-end market of the company's basic market.

According to the financial report, 30% of the retail outlets of Bosideng brand down jacket business are located in first- and second-tier cities, and 70% of the stores are located in third-tier and below cities. "If it runs too fast, the new business can't be caught, and the old business may be lost." Rui Jinsong said bluntly.

However, he pointed out that there are still people willing to pay for Bosideng's 3,000-yuan windbreaker down jacket and 6,000-yuan haute couture down jacket. While continuing to improve its brand power, product prices will continue to rise, especially for innovative products such as windbreaker and down jackets.

It is understood that the 1000 yuan down jacket is only the starting point of Bosideng's high-end development. After the price continues to rise, this domestic down jacket brand is trying to bring its products into the light luxury field of 10000 yuan.

On July 4, Tiktok E-commerce released the "2022 Douyin E-commerce Clothing Autumn and Winter Trend Report" (hereinafter referred to as the "Report"). The report shows that national style and national tide have become the key words leading the trend, showing young people's dressing attitude of advocating freedom of dressing, paying attention to dressing comfort, and taking into account fashion and quality.

Data shows that from January to December 2021, both the consumer population and sales orders of the Tiktok e-commerce apparel industry have shown a strong growth trend. The scale of consumers has increased by 1.8 times compared with the beginning of the year, and the growth rate of orders is 50% higher than that of consumers. The spending power of apparel consumers has been fully released.

The report disclosed that in the autumn and winter of 2021, the per capita clothing consumption of Tiktok e-commerce clothing consumers exceeded 1,000 yuan, and the per capita consumption frequency was as high as 8 times. 48.9% of consumers still plan to spend more than 1,000 yuan on clothing this year. Among consumers whose consumption expenditure exceeds 1,000 yuan, down jackets are still the main consumption force.

18-23-year-olds must enter the top 3 in autumn and winter: down jackets, sweater pants, hats/scarves/bags/jewelry and other accessories; 24-30-year-olds especially prefer boots; 31-40-year-old consumers have mature consumption Habits and spending power. Consumers over 40 years old pay more attention to keeping warm in autumn and winter.

The survey data shows that 11% of consumers start to consume autumn and winter items from July to August, while nearly 30% of apparel consumers choose to buy autumn and winter products from September to October, and 36% of users say they do not. specific consumption time.

Since the outbreak of the global epidemic, the textile foreign trade market has been seriously affected, and the market has taken a turn for the worse. However, since June, foreign trade orders have been placed one after another, and the foreign trade market at this time has already started the production of autumn and winter clothing.

It is understood that some autumn and winter clothing orders in European and American countries have just been placed. In the weaving market, there are many orders with high quality, which are mainly used for the production of foreign trade orders.

As a market vane, the printing and dyeing factory also reported that the market is mostly supported by foreign trade orders, and domestic sales orders are seriously lacking. In terms of products, it is mostly used in the production of down jackets and cold-proof clothing.

A person in charge of a foreign trade company that mainly exports to Europe and the United States said: "In the past few weeks, there were a lot of proofing and finding samples, and I was too busy. This week is obviously less, but the list has also begun to come down. At present, the autumn and winter of 2023 Clothing orders are slowly starting, and 23 years of summer clothing is drawing to a close.”

He also said that the current orders are relatively strong, and there is no window period, so the machines in the factory have no chance to reduce production and will continue to be fully opened.

bad news

In the second quarter, my country's home textile exports turned from rising to falling. The decline in exports is mainly affected by three factors: first, the domestic epidemic has recurred in many provinces and cities, and the operating rate of enterprises has declined; second, the domestic transportation supply chain is not smooth, and goods in and out are delayed; third, some main enterprises report that procurement Orders are gradually moved out.

From January to May 2022, China's home textile products exported US$12.6 billion, a slight decrease of 0.13% year-on-year, and the growth rate fell by 26 percentage points compared with the whole year of last year. From the perspective of specific products, the export of the first category of commercial bed products was US$550 million, a decrease of 3.3%, accounting for 43.9% of the total export value.

Zhejiang, Jiangsu, Shandong, Guangdong and Shanghai ranked the top five in the country's textile exporting provinces and cities. From January to May, exports from Zhejiang, Shandong and Guangdong maintained steady growth, with an increase of 1.3%, 7.8% and 9.9% respectively; exports from Jiangsu and Shanghai declined, with a drop of 6.3% and 19.5% respectively. In another single month of May, Shanghai's exports dropped by 25.7%.

According to the recent survey of American home furnishing retail, the passenger flow of the entire American home furnishing retail industry continued to decline after increasing by 8.6% in September last year, until the decline reached -20.0% in May this year.

The report from Placer.ai warns of market conditions, as rising U.S. inflation, coupled with a downward trend in homeownership rates, will have a greater impact on retailers such as home furnishing.

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

2017羽绒原料价格一路上涨,究竟为何?

你的羽绒服为什么钻绒?涨知识了

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

2017羽绒原料价格一路上涨,究竟为何?

你的羽绒服为什么钻绒?涨知识了

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展