Cn-down > Domestic news > News content

2022-07-04 来源:羽绒金网 浏览量:2136

summary

June should be the traditional peak season for domestic and foreign trade procurement of down, but the down market that has entered July is still sluggish. Down enterprises are cautiously on the rise, and their desire to reduce inventory is increasing.

However, with the increased exposure of brands such as Bosideng and Ya Ya, the leaders in the down jacket industry, it may lead to the gradual expansion of the domestic finished down jacket market.

From the perspective of raw material supply, output in the second half of the year will also shrink. Although July-August is the peak season for meat duck consumption, and the rising pork price can also provide some support, the long-term low price has caused serious losses for poultry companies, and the production of little duck has decreased significantly.

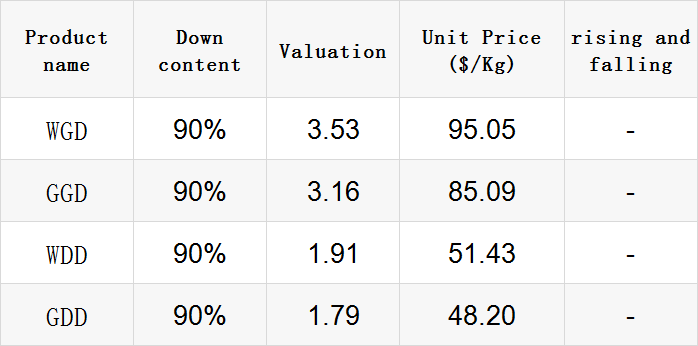

Exchange rate of USD to RMB: 6.6850

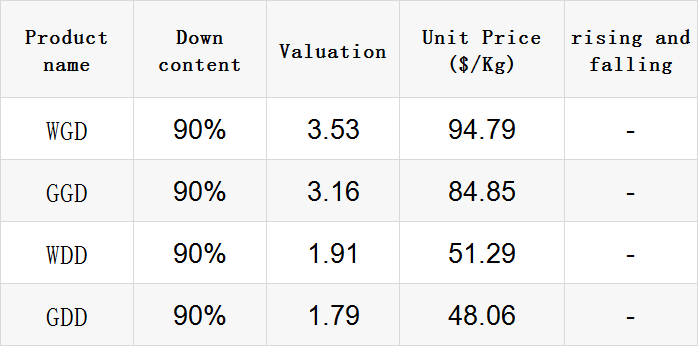

Exchange rate of USD to RMB: 6.6930

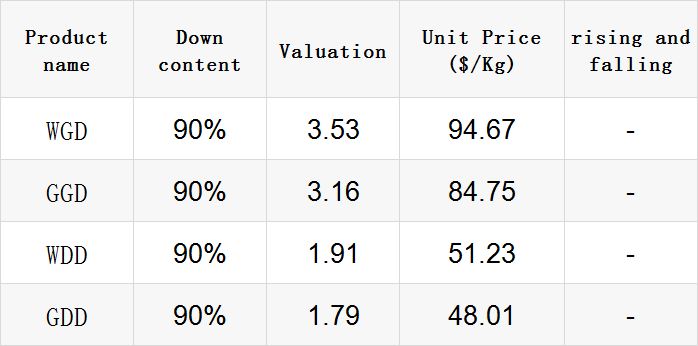

Exchange rate of USD to RMB: 6.7035

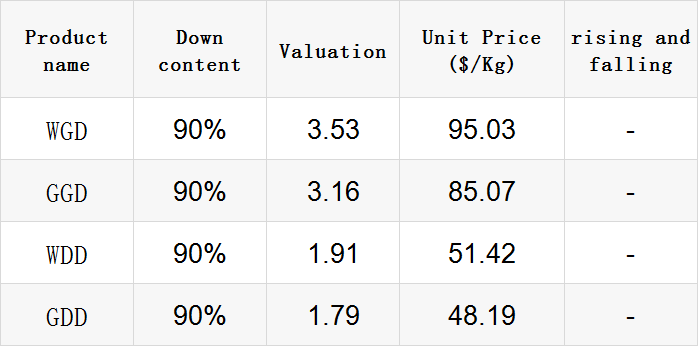

Exchange rate of USD to RMB: 6.7114

Exchange rate of USD to RMB: 6.6863

good news

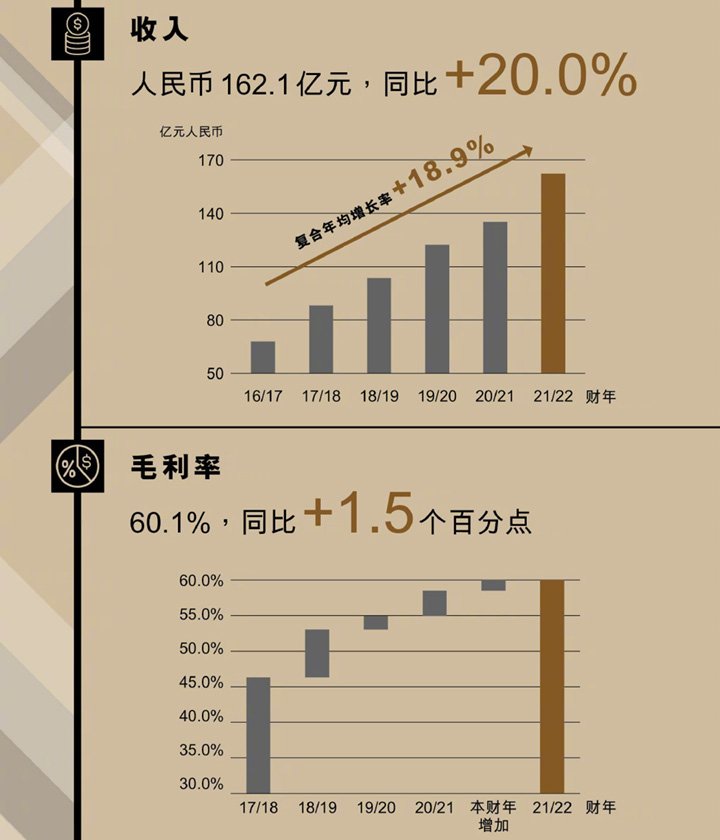

On the evening of June 23, Bosideng disclosed its 21/22 annual results. As of March 31, 2022, Bosideng's annual revenue increased by 20.0% year-on-year to 16.214 billion yuan; gross profit margin increased by 1.5 percentage points year-on-year to 60.1%. This is the best result in Bosideng's history.

After handing over a financial report with a record high revenue and profit, down jacket giant Bosideng held a performance briefing on June 24, and made a judgment on the store opening plan this year and the consumption situation in the second half of the year.

Zhu Gaofeng, chief financial officer and vice president of Bosideng, pointed out that in order to support the development of franchisees, Bosideng has given a lot of policy support to the third- and fourth-tier markets this year. It is expected that there will be more than 300 franchise stores opening plans, and more than 200 have been confirmed so far. .

"More and more expensive" has become the general perception of consumers for Bosideng down jackets in recent years. However, Bosideng, which has seen a compound increase of 17% in the tag price for five consecutive years, will start its sixth year of price increases in the winter of 2022.

Zhu Gaofeng pointed out that Bosideng's long-term positioning is a mid-to-high-end brand, and the price of Bosideng's down jackets will be "steady and rising" this year. This means that the prices of Bosideng's products will continue to rise this year.

Rui Jinsong, president of the brand business department, said that this year, raw materials (costs) will rise by about 10%, and the company will hedge by planning and improving efficiency.

In addition, Bosideng will also make efforts in children's clothing. "The current penetration rate of Bosideng children's clothing in the entire market is only 5%, while some leading brands have a 20% penetration rate in children's clothing. Bosideng will also set up a special children's clothing department this year to operate and develop the children's clothing sector."

The global epidemic has slowed down, and brand apparel factories have resumed ordering momentum. Quang Viet (4438), a major down jacket manufacturer, pointed out that in response to brand customers expanding orders in duty-free areas, Jordan has acquired a new factory in the Middle East and continued to expand production lines. Lines will be increased from the existing 20 to 60.

Quang Viet pointed out that the expansion of the Jordanian production base can diversify product categories and win orders from new brand customers. In the past, operations were affected by seasonality, and the disparity between low and high seasons is expected to be reduced.

Wu Chaobi, general manager of Quang Viet, said that the current order visibility has reached October, and the main customers in hand include sports brands Adidas, Nike, UA, NB and outdoor brands The North Face, Patagonia, Aritzia, etc. The price is mainly mid to high price.

The global apparel consumption market is booming, and the down factory KWONG LUNG (8916) is actively investing in various orders for ready-to-wear.

KWONG LUNG pointed out that with the gradual unblocking of countries, the market is optimistic about the future revenue growth of outdoor sports brands, and the group will continue to increase the proportion of the revenue of the ready-to-wear business in the next five years.

Zhan Hebo, chairman of KWONG LUNG, said that KWONG LUNG has successfully transformed into a large factory for outdoor functional apparel; in order to increase the production capacity of ready-to-wear garments, it will increase the existing production capacity in Vietnam, expand cooperation with Vietnam's third-party factories, increase outsourcing production capacity, and find an appropriate opportunity to deploy in Indonesia. Production line.

Poultry farming occupies an important position in my country's breeding production, and the output from 2017 to 2021 shows a steady growth trend. The data shows that in 2021, the number of domestic poultry in my country will reach 6.79 billion, which is basically the same as the same period of the previous year;

Poultry meat is the second largest meat consumer product in my country. In recent years, the per capita poultry meat consumption of residents has gradually increased. According to the data, chicken production will account for 66% of poultry meat in 2021, followed by duck meat, which will account for about 27%.

my country is a big duck meat producing country. Affected by the African swine fever epidemic in 2018-2019, some pork consumption demand shifted to poultry meat, resulting in a substantial increase in consumption.

However, in the past two years, with the gradual weakening of the substitution effect, the industry has turned from prosperity to depression, and the market share has declined. The data shows that in 2021, the number of commercial ducks sold in China will be about 3.501 billion, down 11.81% year-on-year, and its share in the poultry meat market will drop from 29% in 2014 to 27%.

bad news

The Wall Street Journal recently reported that according to the Baltic Sea Freight Index, the freight rate from China to the West Coast of the United States last week was US$8,934 per container, down 38.5% from the beginning of the year and nearly 50% from the same period last year, but still the same as in June 2020. four times the month.

As the main route of the container shipping market, the high freight rate of the US line has fallen, which has also caused the market to be bearish on the container shipping market. Analysts cite data showing containerized imports destined for the U.S. have fallen by more than 36 percent since May 24.

For now, some companies have cut back on orders with suppliers, and retailers such as Target and Walmart say they are dealing with excess inventory due to over-ordering. Moreover, inflation is depressing consumption more broadly. Container freight rates are expected to drop by 20-30% in the second half of the year, according to a new report from S&P Global Market Intelligence.

On the one hand, as the impact of the epidemic in the United States has weakened, physical consumption is gradually returning to service consumption; on the other hand, the issuance of consumer coupons in the United States has decreased, and the consumer confidence index has declined. According to the survey, the visibility of export orders in the second half of the year is limited, and we should be alert to the risk of demand inflection point.

Learned from the fashion Shenzhen organizer Huanyu Fashion Exhibition (Shenzhen) Co., Ltd.:

In view of the current domestic epidemic situation repeatedly, Shenzhen has experienced local confirmed cases after many days of zero new cases. The 2022 Fashion Shenzhen held in Shenzhen Convention and Exhibition Center (Futian) from July 7 to 9, 2022 will be postponed and the venue will remain unchanged.

来源 |

时尚深圳

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

2017羽绒原料价格一路上涨,究竟为何?

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

你的羽绒服为什么钻绒?涨知识了

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

2017羽绒原料价格一路上涨,究竟为何?

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

你的羽绒服为什么钻绒?涨知识了

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展