Cn-down > Domestic news > News content

2022-06-27 来源:羽绒金网 浏览量:2173

summary

Extreme weather has been frequent recently, with high temperatures in the north and severe flood conditions in the south. For this reason, the shipment of duck feathers has been shrinking, the down content of raw material feathers has continued to decline, and the difficulty and loss of down separation by down factories are also increasing. Under the high cost, some factories sold their inventories at a rate lower than the market price at that time, striving for the return of cash.

The overall rise in textile and clothing raw materials has compressed the profit margins of product companies, and the overall downstream demand is still sluggish. In addition, the impact of the new round of Sino-US trade war on Xinjiang on textile foreign trade cannot be ignored, which has added uncertainty to the down market in the second half of the year.

The export of down feathers and their products in May this year has exceeded expectations, especially the growth of down clothing is even more surprising. But among them, the export of down bedding has declined, which always reflects the decline in consumption power under high inflation.

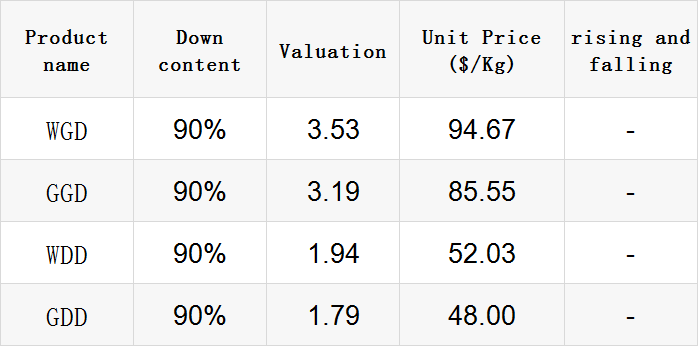

Exchange rate of USD to RMB: 6.712

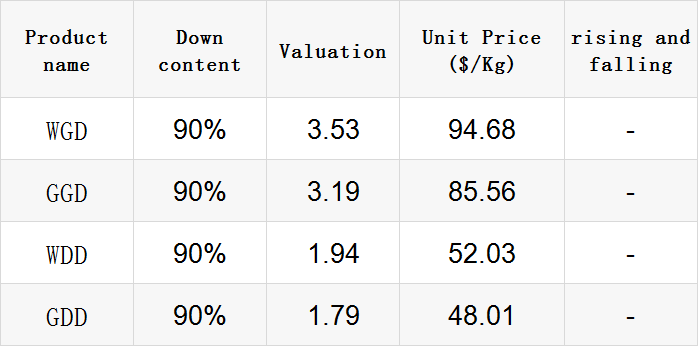

Exchange rate of USD to RMB: 6.6851

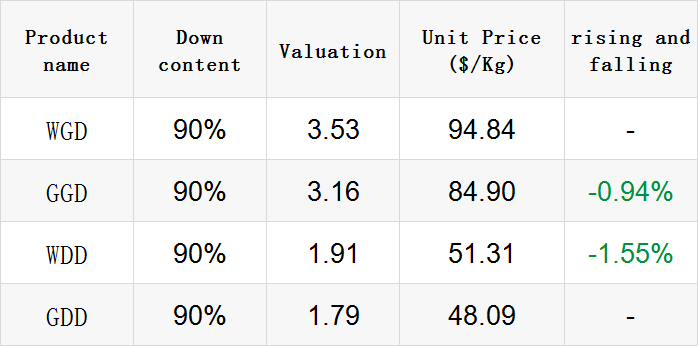

Exchange rate of USD to RMB: 6.7109

Exchange rate of USD to RMB: 6.7079

Exchange rate of USD to RMB: 6.7000

good news

In May 2022, a total of 6.851 million pieces of down garments were exported, an increase of 180.3% from the previous month; the export value was 1.15 billion yuan, an increase of 176.0% from the previous month.

Down jacket export list in May 2022

| product name | quantity | RMB | Quantity YoY | Amount YoY |

| cotton men's down jacket | 148.2 | 1.79 | 10.2% | 7.1% |

| chemical fiber men's down jacket | 172.8 | 3.29 | 50.3% | 62.2% |

| women's cotton down jacket | 113.9 | 1.65 | 154.7% | 186.2% |

| chemical fiber women's down jacket |

250.3 |

4.79 | 106.4% |

103.4% |

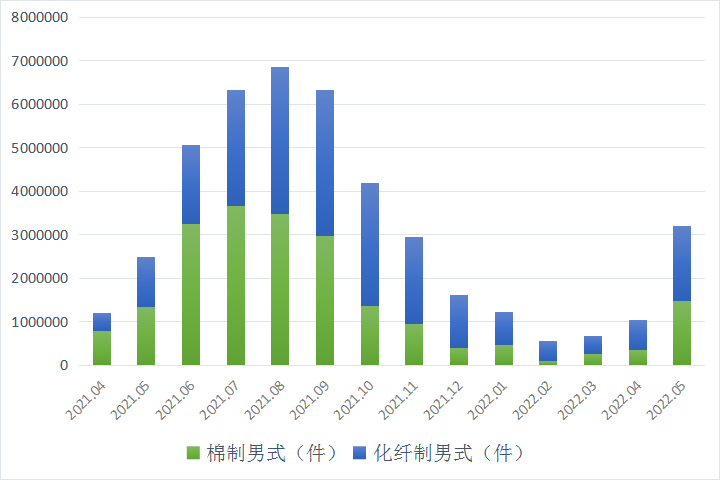

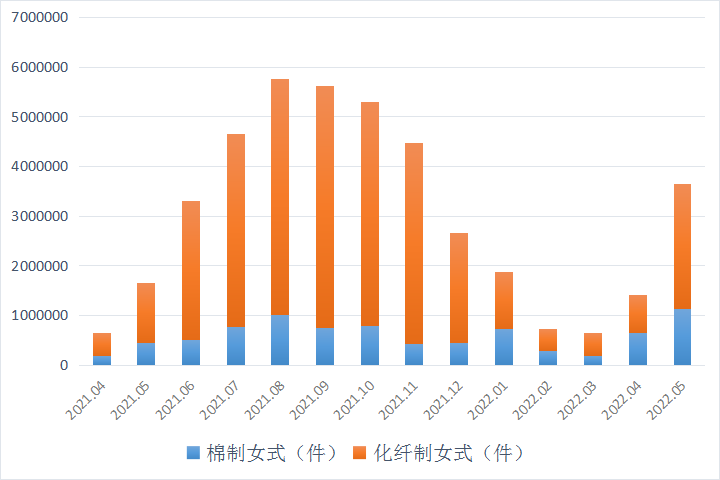

Export of men's down jackets in the past 14 months

Export of women's down jackets in the past 14 months

It can be seen from the data that the export of down jackets has gone out of the off-season, and the export volume has increased significantly compared with last year. The export volume of women's down jackets in May even exceeded that in June last year. Chemical fiber down jackets are more popular, but the export proportion of cotton men's down jackets has increased significantly.

In terms of imports, in May 2022, a total of 183,000 down garments were imported, an increase of 110.3% from the previous month; the import value was 193 million yuan, an increase of 177.0% from the previous month.

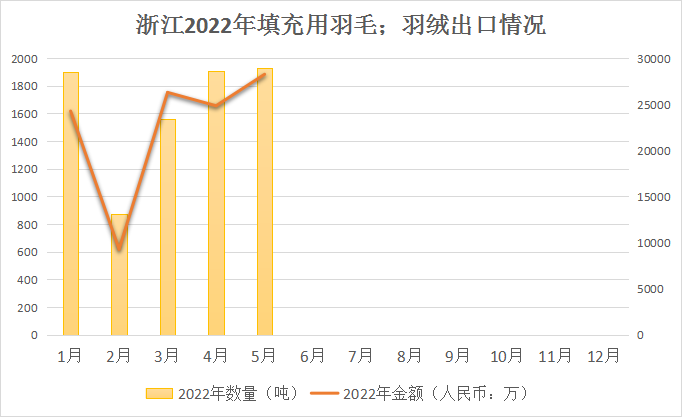

From January to May, the export volume and export value of down and feathers in Zhejiang ranked first in the country, and the export value was the highest in the province since 2017.

According to China Customs data, Zhejiang Province exported 8,170.2 tons of down and feathers from January to May, a year-on-year increase of 26.3%; the export value was 1.129 billion yuan, a year-on-year increase of 51.0%.

Zhejiang Province exported 1931.2 tons of down and feathers in May, with an export value of 282 million yuan.

Anhui previously maintained the country's first export volume during the year, but it was overtaken by Zhejiang in May.

Anhui Province exported 7,874.3 tons of down and feathers from January to May, a year-on-year increase of 20.8%; the export value was 704 million yuan, a year-on-year increase of 67.9%.

Anhui Province exported 1570.3 tons of down and feathers in May, with an export value of 162 million yuan。

Exports from Jiangsu province fell.

From January to May, Jiangsu Province exported 2,427.5 tons of down and feathers, down 11.5% year-on-year; the export value was 396 million yuan, up 36.5% year-on-year.

Jiangsu Province exported 435.0 tons of down and feathers in April, with an export value of 82 million yuan.

From January to May, Guangdong Province exported 1,367.6 tons of down and feathers, a year-on-year increase of 53.7%; the export value was 144 million yuan, a year-on-year increase of 4.3%.

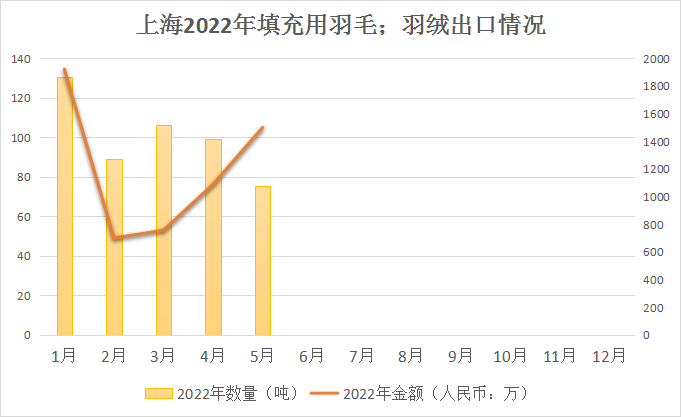

From January to May, Shanghai exported 500.1 tons of down and feathers, an increase of 597.3% year-on-year; the export value was 60 million yuan, an increase of 182.1% year-on-year.

From January to May, Shandong Province exported 558.2 tons of down and feathers, a year-on-year increase of 45.1%; the export value was 81 million yuan, a year-on-year decrease of 7.4%.

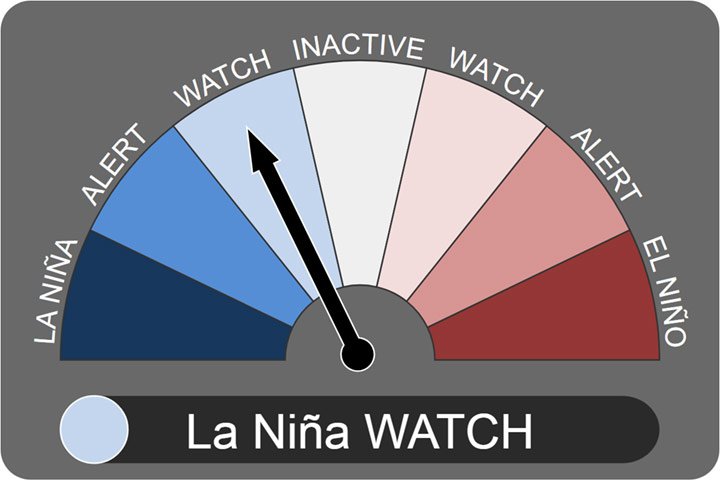

The La Niña for 2021-22 is over and most indicators are now at neutral levels. However, some modelling outlooks suggest that La Niña could re-form later in 2022.

As a result, the bureau's ENSO outlook status has been transferred to La Niña WATCH (La Niña Watch). This means that there is about a 50% chance that La Niña will form later in 2022.

Four of the seven models surveyed by the bureau suggest that La Niña may return in autumn in the northern hemisphere, while the rest remain at neutral ENSO levels. Three-year La Ninas in a row are less common and have occurred only three times since 1900: 1954-57, 1973-76, and 1998-2001.

Although La Niña in 2021-22 is over, the bureau's long-term climate outlook remains wetter than average - ENSO is an oscillation between El Niño and La Niña states in the Pacific, El Niño usually produces drier seasons in Australia, And La Niña can lead to wetter years.

bad news

Down bedding:

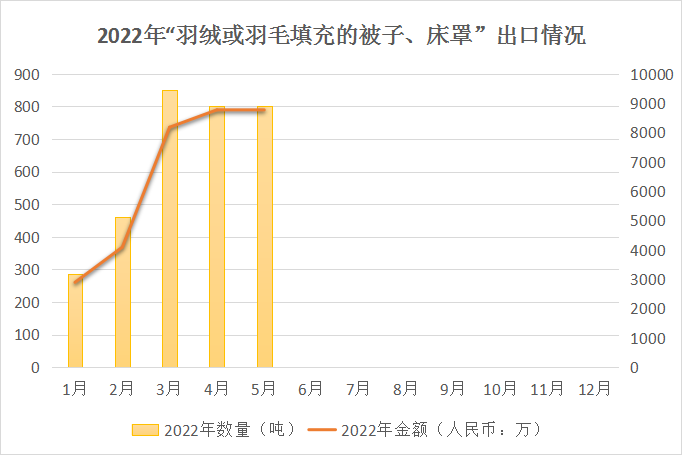

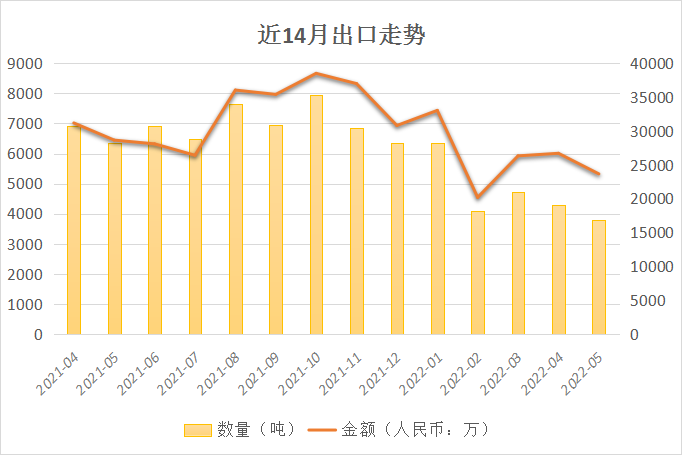

According to China Customs data, 2,981.6 tons of "down bedding" were exported in May 2022, a decrease of 14.4% from April; the export value was 149 million yuan, a decrease of 17.0% from April.

From January to May, a total of 20,000 tons of "down bedding" was exported, with an export value of 972 million yuan.

In May 2022, the United States is still my country's largest trading partner of "down bedding" exports, accounting for 42% of total exports. Among them, the export volume was 1243.8 tons, a decrease of 34.7% from April; the export value was 49 million yuan, a decrease of 26.6% from April.

The UK is the second largest trading partner, accounting for 11% of total exports; followed by Germany with 8%.

Duvet:

In May 2022, 801.6 tons of "down duvets" were exported, an increase of 0.15% from April; the export value was 88 million yuan, an increase of 0.02% from April.

From January to May, a total of 3,200.0 tons of "down duvets" were exported, with an export value of 327 million yuan.

From April 2022, the United States has greatly expanded the import of "down quilts", thus surpassing Japan and Australia, and becoming the largest trading partner of my country's "down quilt" exports. But Japan's imports are still very impressive.

Among them, the United States accounted for 38% of the total export, and the proportion increased significantly. The export volume was 308.2 tons, an increase of 33.3% from April; the export value was 32 million yuan, an increase of 31.6% from April.

While Japan accounted for 21% of total exports, there was little difference; followed by the United Kingdom at 9%.

Down bedding + duvet:

From January to May 2022, the export of "down bedding and quilts" totaled 23,200 tons, a year-on-year decrease of 23.1%; the export value was 1.299 billion yuan, a year-on-year decrease of 4.7%.

As of June 17, domestic high-end nylon yarn products were 20,500-21,700 yuan/ton, an increase of about 500 yuan/ton from last weekend. Wang Donghai, an industry analyst at Longzhong Information, said that although the price of nylon silk is currently rising, there are insufficient orders from downstream fabric companies, and the sales of high-priced nylon are not fast.

Relevant business people said that nylon raw materials have been tight in recent years, but the downstream demand is relatively weak due to the impact of the epidemic, which has a greater impact on the production of enterprises. At present, the high-end nylon inventory is relatively high, and the inventory pressure of low-end products is particularly high.

And high-end nylon, which is a fabric for down jackets, has also been restrained by downstream demand this year. According to the feedback from fabric and garment enterprises, this year's domestic 6.18 e-commerce festival, the sales of related jackets and down jackets did not meet expectations, and there was no popular return of orders in previous years, and domestic merchants were in a wait-and-see attitude.

From the perspective of foreign trade, foreign companies have pre-stocked new orders for autumn and winter by half compared with last year, and domestic and foreign trade is relatively weak at the same time. Nylon companies have to reduce the start of production to prevent corporate losses from increasing.

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

2017羽绒原料价格一路上涨,究竟为何?

你的羽绒服为什么钻绒?涨知识了

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

2017羽绒原料价格一路上涨,究竟为何?

你的羽绒服为什么钻绒?涨知识了

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展