Cn-down > Domestic news > News content

2022-06-13 来源:羽绒金网 浏览量:1747

summary

On the one hand, due to the pessimistic expectations of down consumption orders during the year, there are few buying orders; on the other hand, the settlement price of duck feathers has been raised again, increasing the cost of washed down. Under the hedging of the two factors, the current price has entered a relatively balanced area, and will continue to fluctuate sideways and gradually correct.

The growth rate of China's foreign trade rose significantly in May, sweeping away the downturn in April. Analysts believe that there is a "spring effect" in the current development of foreign trade, and some orders backlogged in April have been transferred to May. In the context of weakening external demand and outflow of orders, the stable growth of foreign trade is still facing challenges.

With the gradual lifting of the restrictions on the new crown epidemic in the main producing areas, the price of ducklings in June has an upward trend. In addition, the temperature rises, and the egg production rate and fertilization rate of breeding ducks are reduced. It is expected that the production capacity of ducklings will decrease in the next few months.

Exchange rate of USD to RMB: 6.6691

Exchange rate of USD to RMB: 6.6649

Exchange rate of USD to RMB: 6.6634

Exchange rate of USD to RMB: 6.6811

Exchange rate of USD to RMB: 6.6994

good news

The General Administration of Customs announced on June 9 that in the first five months of this year, the total value of my country's foreign trade imports and exports was 16.04 trillion yuan, a year-on-year increase of 8.3%. my country's foreign trade imports and exports achieved steady growth, and the foreign trade structure continued to be optimized.

Among them, the import and export of May increased by 9.6% year-on-year and month-on-month respectively by 9.6% and 9.2%. Especially in the Yangtze River Delta region, imports and exports increased by nearly 20% month-on-month, and imports and exports in Shanghai and other related regions recovered significantly.

Market participants pointed out that the current national supply chain and production chain are gradually recovering, which provides a guarantee for export supply. In addition, the periodic depreciation of the RMB exchange rate and price factors in May played a supporting role in exports, superimposing the low base effect, which jointly promoted the recovery of exports in May.

In addition, the recent policy of stabilizing foreign trade has continued to increase, and efforts have been made to improve the efficiency of port transshipment and customs clearance, which is also an important reason for the unexpected rebound of foreign trade data in May. The short-term export growth rate may remain in double digits.

Talking about the next foreign trade situation, Wang Shouwen, Vice Minister of Commerce and Deputy Representative of International Trade Negotiations, said that foreign trade is still facing a series of uncertainties, including the impact of some international and domestic factors, and foreign trade enterprises are also encountering difficulties in production and operation. It can be said that There is still a lot of pressure to maintain stability.

On the positive side, first of all, the epidemic situation in our country is showing a downward trend, and the resumption of work and production is progressing in an orderly manner. Secondly, my country has more and more partners in free trade agreements, and tax reduction and trade facilitation will also play a very important role in promoting the development of my country's foreign trade.

For the 618 e-commerce promotion, clothing merchants in previous years began to place orders at least one month in advance, but this year's clothing factories hardly received orders. In contrast, leading merchants are still enthusiastic about the 618 promotion because their resources are more secure.

Under normal circumstances, according to the platform rules, winter-related seasonal categories cannot participate in mid-year pre-sale, but Tmall opened additional pre-sale places for the down jacket brand "Ya Ya" on 618.

Even in the off-season, Ya Ya's 618 sales are expected to break at least 100 million yuan this year. Liu Yongxi, head of the Ya Ya brand, said that although the full reduction rules have been adjusted this year, Ya Ya is still relatively optimistic. "We are more willing to participate. 618 is an important marketing node of the e-commerce platform, and it is also a part of the company's healthy operation throughout the year."

Ya Ya said that under the influence of the uncertainty of the epidemic, Ya Ya's supply chain has not been fully put into production. Their factory in Changshu, Jiangsu Province, was officially lifted in mid-May after a short-term suspension.

Liu Yongxi also said that this year, "Ya Ya" will have more layouts in warehousing, and will establish consumer front warehouses. "If there is an epidemic control situation in the warehouse near the industrial belt, we can quickly transfer the goods to the consumer's front warehouse to ensure the timeliness of logistics."

The Canadian Food Inspection Agency (CFIA) reported three more farm outbreaks of bird flu in British Columbia in early June, bringing the total number of affected farms in the province to 15. The agency's website showed about a 10-day respite at the end of last month.

The Canadian Food Inspection Agency conducted a mass culling of poultry on the farms involved. Thompson, vice president of sales and marketing for King Cole Ducks, Ontario's largest duck farm, said: "This year's bird flu hit ducks the hardest, mainly due to the infection of migratory birds.

Thompson noted that currently, 10 of the 17 duck farms require quarantine; we have slaughtered more than 200,000 ducks and lost 86% of our ducks under the Canadian Food Inspection Agency regulations to control the spread of the virus. For the first time in our 72 years of business, our company has suffered such a severe loss.

Thompson emphasized that the bird flu virus has destroyed 85%-90% of the country's total, and the duck industry in the United States and Europe has also been severely hit, resulting in a shortage of duck meat in the entire world market. At present, the supply of duck meat is in short supply, and the price will inevitably rise.

Thompson also said that we can still rebuild the supply chain with the remaining ducks, but it is estimated that we will need to wait until around December this year before we can supply ducks to the market again. For now, the country will continue to rely on European ducks to rebuild the supply chain.

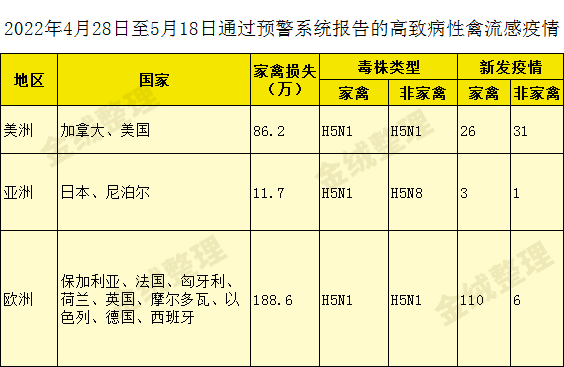

According to the latest report of WOAH (World Organization for Animal Health), from April 28, 2022 to May 18, 2022, a total of 139 new cases of (poultry) highly pathogenic avian influenza were reported worldwide, an increase of 9% from the previous report. %.

But in poultry losses, the new report was down 62% month-on-month. Among them, the Americas decreased by 85%, while Europe increased by 144%.

During the reporting period, a total of 139 new poultry outbreaks were reported in 10 countries (Bulgaria, Canada, France, Hungary, Japan, Moldova, Nepal, Netherlands, United Kingdom and United States).

bad news

The White House announced on the 6th that it will stop imposing tariffs on solar panels in four Southeast Asian countries (Thailand, Vietnam, Malaysia, and the Philippines) in the next two years as part of a plan to promote clean energy.

Industry insiders believe that "tariff exemption" may benefit related Chinese photovoltaic companies exporting through Southeast Asia. However, the good news is only there, and trade barriers to US exports still exist.

On the same day, White House Press Secretary Carin Jean-Pierre issued a statement at a press briefing: The U.S. government believes that it is too early to talk about the possibility of lifting U.S. tariffs on Chinese goods.

A White House spokesman said the president has not yet decided to lift those restrictions. She also answered a question about whether Chinese authorities could lift tariffs on U.S. goods if Washington did the same.

On the 5th, U.S. Commerce Secretary Raimondo said in an interview with CNN that the Biden administration has decided to keep some Trump-era tariffs, such as the steel industry, because it wants to "protect American workers."

The tariffs have cost U.S. importers $71.6 billion since July 2018, Reuters previously reported. The agency said the tariffs forced companies to break supply chains, caused stock market volatility and slowed U.S. economic growth long before the coronavirus pandemic.

Foreign trade people who have survived the long Spring Festival holiday never thought that there would be another wave of "holidays" in the middle of the year. In previous years, this time of year is the peak season for foreign trade orders and production. The orders are full and overtime is in full swing.

Recently, a company in Dongguan, Guangdong issued a holiday notice, saying that domestic and foreign orders were seriously disconnected and fell off a cliff. Therefore, they decided to start unpaid leave on June 1, 2022, and tentatively scheduled to resume work in mid-October 2022.

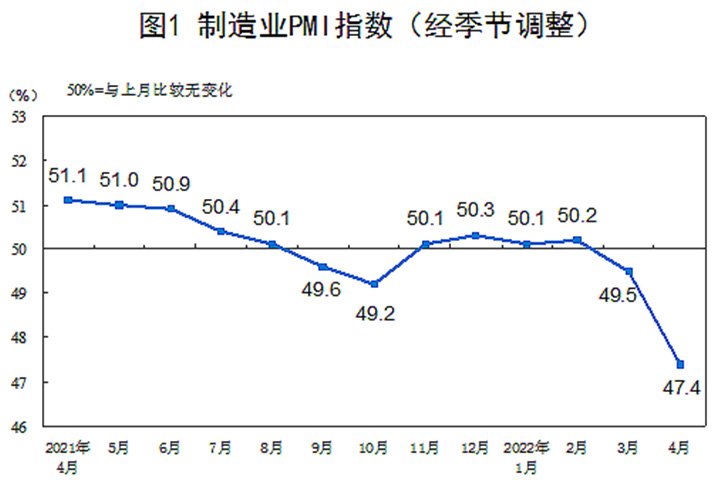

Whether it is the textile industry, or foreign trade units in the daily necessities, chemical industry and other manufacturing industries, the order volume this year has "shrinked" to varying degrees. According to data from the National Bureau of Statistics, in April this year, the manufacturing purchasing managers' index was 47.4%, down 2.1 percentage points from March and below the threshold.

Under this circumstance, many foreign trade companies choose to lie down during the holidays. Under the situation of meager profits or even upside down, they will lose money when they start work, and they are afraid of power consumption when breathing, so all employees have to lie down.

Recently, major Asian economies have experienced a general weakening of their currencies. Anyone who does export knows that when a country's local currency depreciates against the US dollar, the country's import cost will rise, which will hurt buyers' willingness to purchase.

On May 23, data released by the Bank of Japan showed that the real effective exchange rate of the yen fell to 60.9. That was the lowest level in nearly 51 years, according to estimates by the Bank of Japan. In April, Japan's imports increased by 28.2% compared with the previous month, but the import volume has decreased, which should be the effect of the depreciation of the yen.

The won has fallen 7.7 percent against the dollar this year, making it one of the worst-performing currencies in Asia. On May 12, the won fell 1 percent to close at 1,288.50 won per dollar, its lowest close since July 2009, when South Korea was in the throes of the global financial crisis.

A depreciation of the Korean won will lead to higher import prices, which will further exacerbate inflation. The Bank of Korea said the import price index in March was 148.80, the highest since the start of relevant statistics in January 1971, up 7.3 percent from February and 35.5 percent from a year earlier.

The euro has never fallen below one to one against the dollar in two decades. But since the beginning of this year, the euro has been falling against the dollar. Since the end of April, the euro/dollar exchange rate has been hovering around 1.05, and once fell to the lowest level of the euro-dollar exchange rate in five years.

In the past year, the exchange rate of sterling against the dollar has changed from 1 pound to 1.41 US dollars to 1.26 US dollars, and once fell below 1.22, reaching its lowest level since May 2020. The pound has fallen 8% against the dollar so far this year.

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

2017羽绒原料价格一路上涨,究竟为何?

你的羽绒服为什么钻绒?涨知识了

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

2017羽绒原料价格一路上涨,究竟为何?

你的羽绒服为什么钻绒?涨知识了

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展