Cn-down > Domestic news > News content

2022-06-05 来源:羽绒金网 浏览量:1787

summary

The recent high temperature in the North continues, and the price of ducks continues to rise. Affected by seasonal factors and the shortening of breeding time, the down content of raw feather decreased by 1-2%, which increased the purchasing cost of down enterprises, so the market price rose slightly.

Foreign down products industry has strong orders, but with the soaring inflation and the sharp rise in raw material prices, there is a risk of downward deterioration. However, the prosperity of the domestic down products market is still sluggish, and most suppliers are still waiting and waiting.

Recently, it was reported that Saudi Arabia would change its previous position and increase efforts to improve crude oil production capacity. The huge cost pressure being encountered by the textile industry is expected to be relieved.

Exchange rate of USD to RMB: 6.7048

Exchange rate of USD to RMB: 6.6607

Exchange rate of USD to RMB: 6.6651

Exchange rate of USD to RMB: 6.7095

good news

In 2021, Bangladesh will surpass Vietnam to regain its position as the world's second largest apparel exporter after China. The total exports of woven and knitted garments and clothing accessories accounted for 81.58% of Bangladesh's total exports ($43.344 billion).

At the 12th Bangladesh Denim Expo on May 11, several international apparel retailers and brands said that Bangladesh will remain the preferred sourcing destination for ready-to-wear products for a long time to come.

Dolly Thay, managing director of buyer Cloths "R" Us, said that as Bangladesh's production capacity has grown significantly in recent years, clothing orders are shifting to the country from China, Vietnam, Sri Lanka and Myanmar.

With new investments and increased capacity, the Bangladesh Manufacturers and Exporters Association vice-president said it is confident that the Bangladeshi garment industry will reach a new height in the next five years. "We have enough orders and buyers have confidence in us, and we are very keen to retain the second position while widening the gap with Vietnam."

He believes that in order to maintain the second position, Bangladesh must first attract investment from China, as well as buyers who are relocating their sourcing destinations.

According to estimates by several international research institutions, Bangladesh may need 9.5 million bales of textile raw materials this year in order to meet the huge textile industry demand. The figure three years ago was 7 million bales.

According to customs data, from January to April this year, my country exported 541.8 tons of high-quality down to Bangladesh, a year-on-year increase of 40%, with an export value of 203 million yuan.

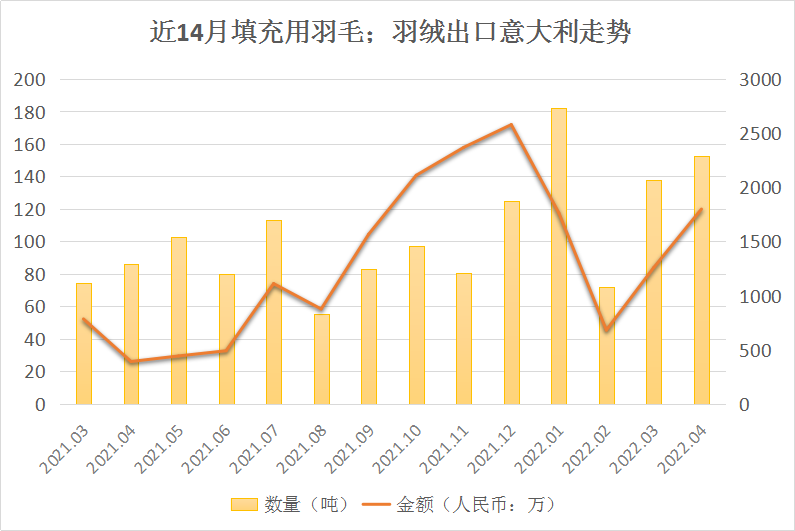

Exports from the Italian fashion industry rose 23.5 percent last year to 67.5 billion euros, with France, Germany, China and the United States the top performers, the Federation of the Italian Fashion Industry said.

2021 Italian fashion industry data shows that from January to July 2021, Italian men's clothing exports will see a strong growth of 81% in the Chinese market. In this aspect of consumption, the Chinese market is almost equal to that of the United States.

The Federation of Italian Industrialists pointed out that China has become the most potential emerging market in the Italian luxury fashion industry, with a total value of 8.6 billion euros, and 40% of the growth potential has yet to be developed, about 3.9 billion euros.

Cirillo Marcolin, president of the Federation of Fashion Industries, said: "The data show that the fashion system has emerged from the quagmire associated with the pandemic." As the second largest industry in Italy, the fashion industry has an economic volume of more than 100 billion euros and employs more than 1.2 million people.

As the Italian fashion industry continues to improve, so does the demand for the quantity and quality of down. In 2021, my country will export 1,073.6 tons of down and feathers to Italy. Although it is still down by 8.2% compared with 2019, it has shown a growth trend from the fourth quarter to April of the following year.

However, the chairman of the federation believes that rising raw material and energy costs and the conflict between Russia and Ukraine have weakened consumer confidence and stability and will put pressure on corporate profits.

Revenue growth is expected to slow in the second quarter of 2022, according to his survey, noting that 49% of companies expect second-quarter sales to be in line with the previous quarter, while 43% are at risk of further deterioration.

bad news

On May 27, local time, the US "New York Times" website published an article discussing how international brands weigh commercial interests and the so-called "moral reputation" on the Xinjiang cotton issue.

In the article, the US media continued to spread rumors about Xinjiang-related issues, exaggerating that some companies stopped using Xinjiang cotton as a result. Among them, the American outdoor clothing manufacturer Patagonia (Patagonia) decided to end the 20-year cooperation relationship in China, and also declared that it is "willing to share the experience of moving its cotton supply chain out of China".

Patagonia's business in China is relatively small, and it considers it "worth the risk" compared to the characteristics of its corporate image. However, after leaving the Chinese supplier, it immediately faced a shortage of fabrics and had to remove some products that had been on the market for more than ten years.

Patagonia is certainly not an unfamiliar name for outdoor enthusiasts. In the industry, it is the largest outdoor products company in the United States, and is known as the "GUCCI" of the outdoor sportswear industry, frequently topping the list of American outdoor brands.

Each product in the Patagonia Tmall flagship store has a corresponding certification mark, including "Global Traceable Down". At the same time, it launched a used clothing recycling project in 2012 to reduce the amount of waste by recycling pillows, quilts and jackets with down-filled down.

American media claimed that for international brands, it may either affect its so-called "reputation" in the West, or it will suffer huge business losses in China. Companies such as H&M and Nike have lost hundreds of millions of dollars in sales as they anger Chinese consumers over Xinjiang.

However, the US media also mentioned that many brands choose to avoid the Xinjiang issue. And, with soaring cotton and shipping costs, and even more competition, finding new partners isn't easy.

In May, some autumn and winter fabric products began to sell well, such as T400, four-way stretch, spring Asian spinning, nylon spinning and so on. Mr. Shen, the owner of the weaving enterprise, revealed: "The overall market is not bad, mainly because the old customers are maintained, so there are always orders and there are not many stocks."

"The number of grey fabrics shipped is good, an increase of 70%-80% compared with April, and now the machines in the factory are fully open." Mr. Weng, the boss of Chunya Textile, said, "Basically there are 0.01-0.02 yuan / The discount of rice, the current market can only run the volume to ensure that the factory can operate.”

But by the end of May, the market showed signs of weakening, and the number of goods sold by manufacturers and weaving enterprises was slowly decreasing. Especially as the Dragon Boat Festival is approaching, manufacturers have plans to reduce the burden around the holiday.

It is reported that a large part of the recent sales of autumn and winter fabrics is for stocking, not for substantive order production. After all, the domestic epidemic has not been completely cleared, domestic demand is still limited, and foreign turmoil coupled with the global epidemic will restrict clothing demand.

Therefore, for the market outlook, textile people do not dare to hold too much hope, and the traditional off-season will be faced next. Mr. Shen said: "It can be maintained. The future market mainly depends on whether the price of raw materials can drop, whether the epidemic situation can improve in the second half of the year, and limited production. If the factory is not affected, the demand will rise slowly. "

Affected by the supply chain crisis over the past two years, major U.S. retailers have been on a buying spree recently, stepping up investment in a range of goods to prepare enough supplies for cash-rich American consumers.

But industry executives and analysts say the retailers' moves appear to have gone too far. With inflation soaring and fuel prices soaring, U.S. consumers have quickly become cautious, opting to cut back on items such as clothing.

Morris, managing partner of Cambridge Retail Consultants (CRA), believes that the epidemic has disrupted the supply chain model, and "just-in-time production" has become "just don't run out of stock".

But Macy's chief executive said "supply chain constraints have eased", resulting in shipments being received from overseas "earlier than we expected."

In its fiscal first quarter, Walmart stocked 32% more than a year earlier, Target jumped 43% from a year earlier, Best Buy had 9% more merchandise, May West Department Store's inventory is up 17% from the same period in 2021. O'Connell, chief financial officer at apparel brand Gap, said inventories surged 34%.

Mid-range department stores such as Macy's stepped up price promotions in mid-May, running sales on 57% of items, and apparel retailers discounted 36%, according to research firm StyleSage.

Walmart CEO MacMillan said on an earnings call that the company has begun "aggressively" cutting prices to boost sales of high-margin items such as clothing.

Affected by factors such as weakening external demand, rebound of the epidemic and transfer of orders, in a single month of April 2022, China's home textiles foreign trade exports fell sharply, driving the cumulative export trend from January to April to decline. Among them, bedding fell by 18.8% in a single month in April.

Due to the superposition of multiple factors, the export of home textiles in the second quarter faced greater downward pressure. On the one hand, the domestic epidemic has recurred at many points, and the logistics supply chain has not been running smoothly, which has caused the operating rate of enterprises to decline. On the other hand, the situation of order relocation shows that the production schedule of the company's on-hand orders has been shortened, from 4-6 months in the same period last year to the current 2-3 months.

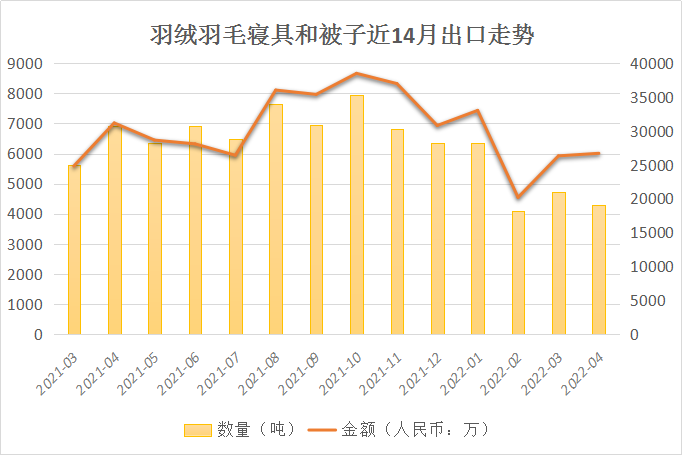

In terms of down products, from January to April 2022, a total of 19,500 tons of "down and feather bedding and quilts" were exported, a year-on-year decrease of 18.5%; the export value was 1.063 billion yuan, a year-on-year decrease of 1.3%.

On the whole, the second and third quarters of the previous year coincided with the peak export period. Combined with the current domestic and foreign situation and the order received by enterprises, it is expected that the downward pressure on exports in May and June this year will increase, and the export situation will still be relatively large in the second half of the year. Uncertainty.

In the first four months, the export of home textile products to the US and European markets maintained growth, but the growth rate declined month by month. Enterprises reflect that the recent US inflation rate has hovered at a high of 8%, and the people's spending power has declined, and they have received notices from some US and European customers to postpone shipments.

Among other markets, exports to ASEAN and Japan fell by 1.7% and 2.5%, respectively. Affected by the Russian-Ukrainian war, exports to Russia fell by 20%.

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

2017羽绒原料价格一路上涨,究竟为何?

你的羽绒服为什么钻绒?涨知识了

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

2017羽绒原料价格一路上涨,究竟为何?

你的羽绒服为什么钻绒?涨知识了

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展