Cn-down > Domestic news > News content

2022-05-23 来源:羽绒金网 浏览量:1687

summary

Due to the prevention and control of the epidemic and the obstruction of logistics, terminal consumption has been greatly affected, and the production and sales of spring clothing are difficult. In order to avoid further expansion of losses, textile and garment enterprises in various places either reduce the operating rate or extend the holiday time to tide over the difficulties. Due to sluggish domestic demand for washed white duck down, the market transaction price was low, and the cautious sentiment spread.

The U.S. dollar recently hit a 20-year high, and triggered a depreciation of the renminbi, the euro and the Japanese yen to varying degrees. The "double-edged sword" of the exchange rate does not benefit Chinese companies in all export markets. The rapid depreciation of the euro and the yen against the yuan has reduced trade profits and increased the cost of grey duck down exports.

From May, the traditional peak season of down orders for garment factories is about to start, but whether the market outlook will improve depends on the downstream procurement. At present, there are obvious signs of export recovery of domestic enterprises, while foreign merchants have advanced the procurement period in view of the instability of the shipping cycle.

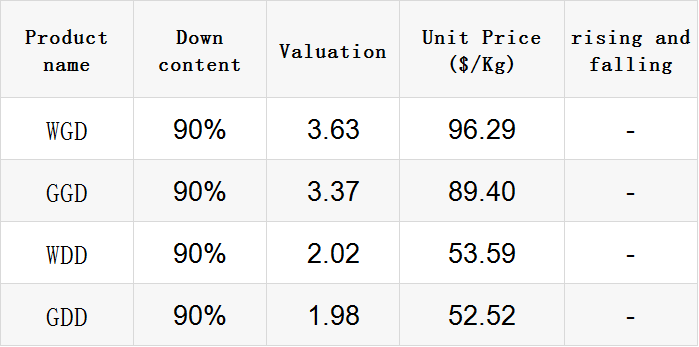

Exchange rate of USD to RMB: 6.7898

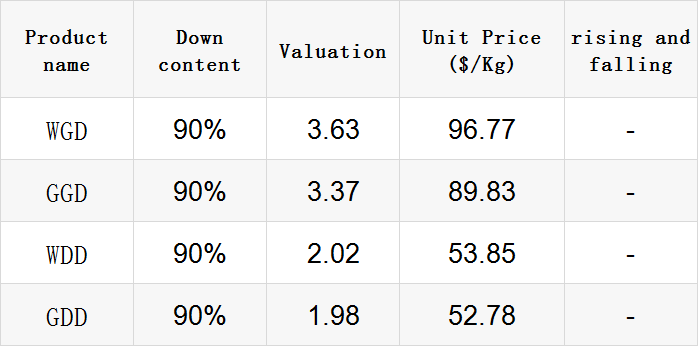

Exchange rate of USD to RMB: 6.7871

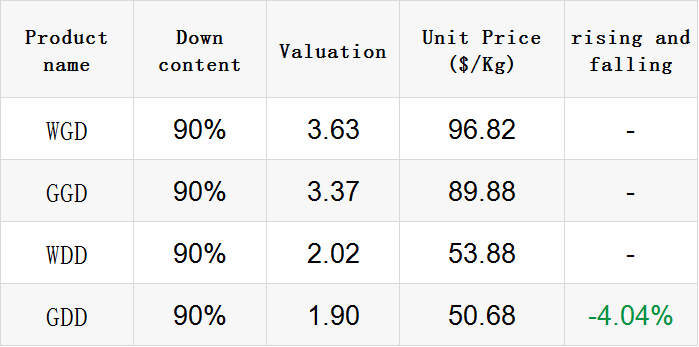

Exchange rate of USD to RMB: 6.7854

Exchange rate of USD to RMB: 6.7421

Exchange rate of USD to RMB: 6.7487

good news

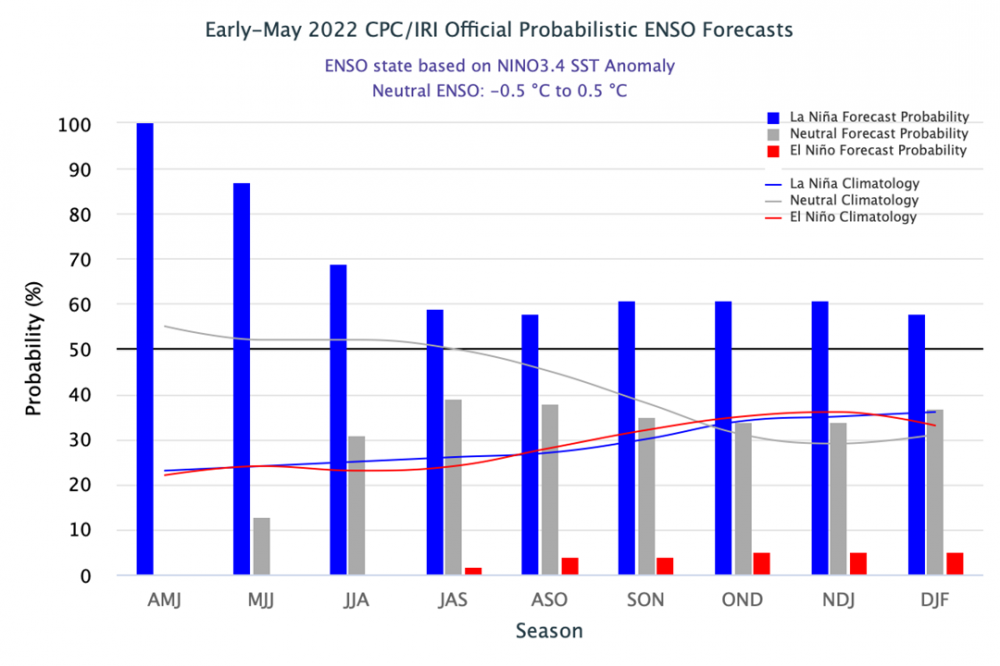

The down jacket did not expect that it can still see the outside world in May. In the context of La Niña this year, 6 times of cold air have frequently affected my country since April, 3 of which reached the standard of cold wave, resulting in extreme cooling events in many places.

In April, sea surface temperatures remained below average across much of the central and eastern equatorial Pacific. Over the past month, the Niño index values have even declined, with the latest weekly values between -1.1ºC and -1.5ºC. There is ample evidence that La Niña is still going strong.

Similar to last month, NOAA forecasters unanimously predict that the Niño-3.4 index value will weaken in the summer, but remains below the La Niña threshold (Niño-3.4 value equal to or less than -0.5ºC ).

Most current climate models predict that La Niña will intensify again in the fall (61% chance).

The NOAA's early subjective consensus held that there was only a 50-55% chance that La Niña would persist through the summer and fall.

The Central Meteorological Observatory forecasts that until May 23, the average temperature in most parts of the south will be lower than the same period of the year, and the temperature in most of the north will be close to the same period of the year to higher. As the season progresses, attention should be paid to the impact of high temperatures starting in June.

Due to the outbreak of the Russian-Ukrainian crisis, Russia has been subjected to a series of economic sanctions by Western countries, resulting in a large gap in the supply chain and market. On the other hand, the Sino-Russian trade market is in a rising trend.

"Because of international sanctions, many international merchant shipping companies have stopped sailing. At present, trade with Russia mainly relies on railways or highways." A sales manager of a freight forwarding company said, "Sea freight can hold several thousand to 20,000 containers, while a train has only 50 So ports like Manzhouli and Heihe are congested badly now.”

However, under the circumstance that the shipping is blocked, the China-Europe freight train has shown a blowout development. In the first quarter of this year, China-Europe trains operated 3,630 trains and transported 350,000 TEUs, an increase of 7% and 9% year-on-year, respectively. The comprehensive heavy container rate was 97.7%. The number of single-month trains remained above 1,000 trains for 23 consecutive months.

Against the background of the epidemic and the Russian-Ukrainian crisis, the China-Russia trade market data has risen again this year. In the first four months of this year, the Sino-Russian trade volume reached 51.093 billion US dollars, a year-on-year increase of 26%, equivalent to 324.9 billion yuan, of which exports to Russia reached 128.7 billion yuan, an increase of 11%.

With the sanctions imposed on Russia by countries such as Europe and the United States, Russia has shifted more purchasing needs to the Chinese market. In addition, since large Russian banks are excluded from the Society for Worldwide Financial Telecommunication (SWIFT) payment system, it will promote the volume of RMB settlement to a certain extent.

In an interview with the media, Vitaly Mankevich, chairman of the Russian-Asian Union of Industrialists and Entrepreneurs, said that the withdrawal of European companies from the Russian market has opened a historic window of opportunity for Chinese companies.

According to the customs department, Russia has opened the import of Chinese down and feathers at the end of April 2022. According to reports from Russian down companies, Russian officials have lifted the ban on the import of down and feathers from China, Japan, South Korea, Cambodia, Taiwan, Vietnam and Indonesia, allowing the import of down and feathers that have been heat-treated at 70°C and above from the above countries and regions.

Early in the morning, the operators in the first district of Yiwu International Trade City started a video chat with customers from far away in Europe. Soon, an order of more than 100,000 yuan was placed on the other end of the video. According to the operator, since the outbreak of the new crown epidemic in 2020, foreign merchants who cannot come to Yiwu will use this method to purchase.

Last year, due to the instability of the shipping cycle, some Christmas supplies failed to arrive at the port on time, resulting in unsalable products. This year, foreign merchants have obviously advanced the procurement period. At present, many operators have already received orders for August, and it is expected that by the next month, they will stop accepting orders and fully deliver goods.

Although many overseas old customers place orders remotely, their business has been affected this year due to factors such as changes in international trade and rising shipping prices. The cost of some Christmas items, mainly composed of plastic and cloth, has generally increased by about 30% this year.

However, many operators said that although the profit has been compressed, for some old customers and customers who have already determined the price, the price increase has not been passed on to the downstream.

KWONG LUNG, a major manufacturer of down jackets, said that the market demand for outdoor functional clothing has grown significantly, and the group will actively expand its outdoor clothing business. In the second half of the year, Guanglong will go to Indonesia to build an additional garment production line with an initial investment of US$10 million.

Zhan Hebo, chairman of KWONG LUNG, said that this year's orders have been finalized, and the revenue outlook is optimistic.

At present, KWONG LUNG's ready-to-wear orders are as high as 140 million US dollars, and its visibility has reached the fourth quarter of this year, and it is continuing to increase the negotiation of new customers and new orders.

Zhan Hebo pointed out that the market demand for outdoor functional clothing will continue to grow significantly. According to Euromonitor, a well-known market research organization, the compound annual growth rate of the global outdoor functional clothing market will exceed 8% in the next three years.

bad news

Spring was originally the peak season for the textile and garment industry to carry out order fairs, but now it is almost summer quietly, but it is difficult to see the crowded order fair scene in the circle of friends.

"Most companies have canceled the offline order fair this spring, and some brands like Peacebird and Tangshi have held online order fairs, but the results are not good. Some companies have decided to put their spring products on sale in autumn. The investment in product research and development in autumn will be greatly reduced." said Mao Yihua, secretary general of Ningbo Garment Association.

She predicts that the production and sales rate of Ningbo clothing brands this year will be less than 40%. The spring clothing sales season is short, and the inventory backlog is serious. After April, the price will be greatly reduced, and the pressure of corporate losses will be highlighted. In this round of industry adjustment, brands and companies with low operational capabilities are at a disadvantage in the market and may be forced to withdraw.

At present, the physical stores of various clothing brands are scattered. The challenge brought by the epidemic to the clothing industry is not only the hard-to-find "ordering fair", but also the impact on the industrial chain and the decline in the willingness to consume in the terminal market.

Stalls in some wholesale markets have been dealt a fatal blow. A merchant in the wholesale market said: "The epidemic has caused our spring and summer models to be unable to sell as scheduled, and our overall revenue has dropped by at least 50%. At the same time, we are also facing a lag in the production of summer products, and the factory cannot be completed on time."

In the next stage, apparel companies may still face the impact of superimposed factors such as supply chain blockage and rising raw material prices after centralized resumption of work. From the perspective of consumption trends after the epidemic, consumers tend to pursue the ultimate product cost performance.

Reuters broke the news on May 17 that the White House was divided into two factions of the Treasury secretary and the trade representative, and there was a fierce dispute over the topic of "whether to cut tariffs on Chinese goods".

U.S. Treasury Secretary Janet Yellen and others want to slash those tariffs to cut inflation, while U.S. Trade Representative Dai Qi wants not to move quickly to protect U.S. jobs and target China’s behavior in global markets, the sources said.

In addition, in the face of the upcoming U.S. midterm elections, some political advisers believe that cutting tariffs on China will gain broad support, while others believe that cutting tariffs on China will spark dissatisfaction among labor unions and hawks.

The disagreement between Yellen and Dai Qi could force Biden to make a final decision until mid-summer, said a person in contact with U.S. administration officials.

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

2017羽绒原料价格一路上涨,究竟为何?

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

你的羽绒服为什么钻绒?涨知识了

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

2017羽绒原料价格一路上涨,究竟为何?

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

你的羽绒服为什么钻绒?涨知识了

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展