Cn-down > Domestic news > News content

2022-05-16 来源:羽绒金网 浏览量:1866

summary

In recent days, the number of newly confirmed local cases and asymptomatic infections in my country has continued to decline, but local transmission has not been completely blocked in some places, and the situation of epidemic prevention and control is still severe and complicated. The good news is that Shanghai has put forward the goal of achieving social zero in mid-May, and the resumption of work and production has achieved phased results.

Under the influence of the epidemic, there is no obvious sign of improvement in the textile market after the holiday. Textile enterprises are under pressure, domestic trade orders are significantly weaker than the same period in previous years, and foreign trade orders are difficult to perform well under the trend of shipping difficulties and orders being transferred to Southeast Asia.

At present, the raw material wool market is relatively stable, and the sales market of finished down products is starting, and downstream enterprises have begun to inquire about prices. However, the recent price increase is mainly due to the increase in raw material prices, which is difficult to transmit downstream.

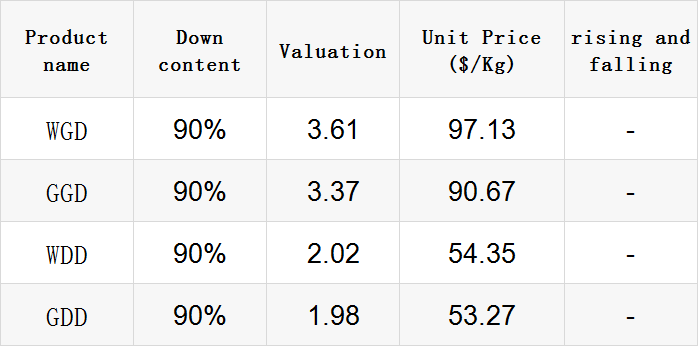

Exchange rate of USD to RMB: 6.6899

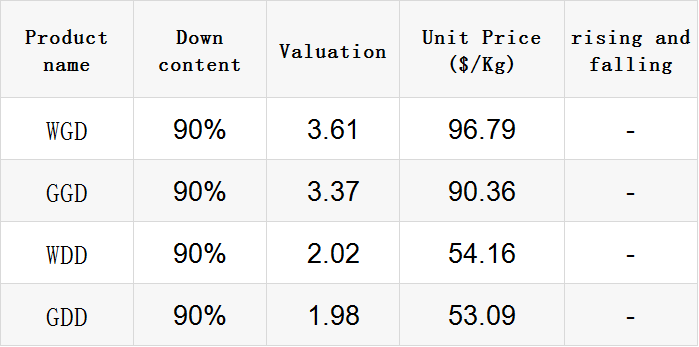

Exchange rate of USD to RMB: 6.7134

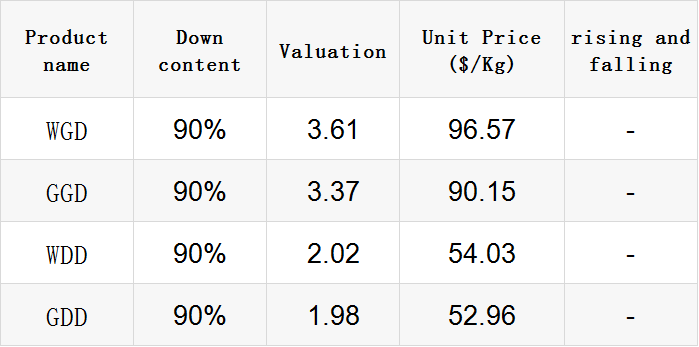

Exchange rate of USD to RMB: 6.729

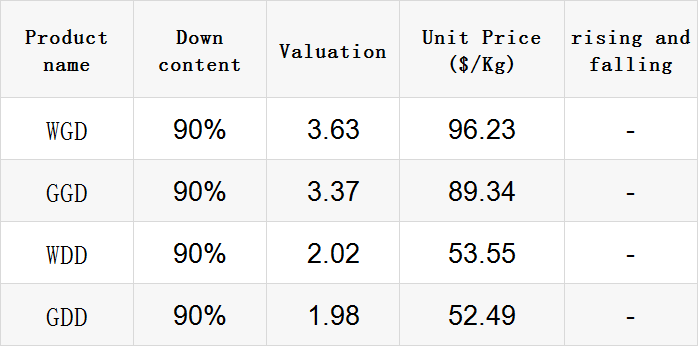

Exchange rate of USD to RMB: 6.7292

Exchange rate of USD to RMB: 6.7898

good news

Addressing the nation in Washington on May 10, Biden said the White House was looking at "punitive measures" imposed under former President Donald Trump that raised prices on everything from diapers to clothing and furniture.

When asked by reporters "whether to choose to lower or cancel (imposing tariffs on China)", Biden said that this issue is still under discussion and no decision has been made yet.

On the evening of the same day, White House press secretary Psaki also confirmed that Biden is evaluating whether to ease tariff sanctions on China, and the U.S. government will make more comments on this in the coming weeks.

CNN analysis said that with the soaring inflation rate in the United States, the business community is putting increasing pressure on the Biden administration to cancel the tariffs imposed on China, thereby alleviating some of the inflation pressure faced by importers .

Externally, Biden has promised to make the issue a "top priority." "I know families across America are hurting by inflation," he stressed. "I want every American to know that I take inflation very seriously and that it is my number one priority at home."

CNN also pointed out that the American people are facing "the highest inflation in 40 years".

Quang Viet, who specializes in down jacket OEM, pointed out that global down jacket boutique brands with high unit price, such as Arc'teryx and Moncler, have always been customers of Guangyue. Benefiting from the strong demand for orders from brand customers, Quang Viet's first-quarter after-tax net profit hit a new high for the same period, making a profit in the first quarter for the first time.

Quang Viet pointed out that according to past experience, when inflation is high, high-unit price products are less affected by the boom, and after two years of epidemic disruption, outdoor brand customers have relatively low inventory, and the momentum of placing orders is relatively stronger than that of general ready-to-wear accessories.

KWONG LUNG, another OEM manufacturer of down jackets, announced the first quarter financial report, with a combined revenue of 2.11 billion yuan, an annual increase of 24.8%; after-tax net profit of 145 million yuan, an annual increase of 13.2%, both revenue and profit hit a new high in the same period.

Continuing to cooperate with internationally renowned outdoor and sportswear brands, KWONG LUNG said that Burton, Columbia, Fjallraven, Montbell, etc. are all their customers.

KWONG LUNG's down department also saw a significant recovery in its operations this year. In the first quarter, its revenue was 405 million yuan, an annual increase of 12.4%.

On May 12, the offshore RMB against the U.S. dollar, which reflects the expectations of international investors, fell below the 6.8 yuan mark during the session, and the last time it fell below the 6.80 mark was back on September 30, 2020.

Sun Fu, chief macro analyst at Huaxi Securities, said that the capital outflow caused by the inversion of the interest rate differential between China and the United States and the disturbance to economic fundamentals caused by the impact of the domestic epidemic are the main reasons for the devaluation of the yuan.

At present, the two major factors are still fermenting, so the devaluation process of the RMB may not be over yet.

Since the beginning of this year, the RMB exchange rate against the US dollar has fallen by more than 6%. Although the stability of the RMB exchange rate is still good, the continuous decline is still worrying whether it will have an impact on the A-share market.

It is reported that the Shanghai Headquarters of the People's Bank of China has requested to increase cross-border RMB financial support for anti-epidemic relief efforts, and has urged commercial banks to guide foreign trade enterprises to use cross-border RMB settlement to help enterprises effectively avoid exchange rate risks.

Some people in the industry estimate that for every 1% depreciation of the RMB against the US dollar, the sales profit margin of the textile and garment industry will increase by 2% to 6%. "The devaluation of the renminbi means that the bargaining power is in our hands." An industry person engaged in the export trade of fabrics said that the US dollars obtained from the trade can be exchanged for more renminbi at home.

"But the RMB exchange rate is only one of the reasons that affect the export (income) of the textile industry." Bai Ming, deputy director of the International Market Research Institute of the Ministry of Commerce Research Institute, pointed out, "At present, the impact of the exchange rate and the impact of the epidemic are 'competing' with each other."

bad news

According to the latest report of OIE (World Organization for Animal Health), from April 7, 2022 to April 27, 2022, a total of 128 new cases of (poultry) highly pathogenic avian influenza were reported worldwide, a decrease of 71% from the previous report. %.

During the period covered by this report, a total of 128 new outbreaks in poultry were reported by 12 countries (Bulgaria, Canada,Germany, Hungary, Japan, Korea (Rep. of), Mexico, Netherlands, Nigeria, Poland, United Kingdom, and United States of America).

During the period covered by this report, a total of 74 outbreaks in non-poultry were reported by 11 countries (Belgium, Bulgaria, Canada, Czech Republic, Germany, Greece, Japan, Lithuania, Netherlands, Russia, United States of America).

Non-poultry outbreaks also decreased by 53% from the previous report.

Since November 2021, European and American countries have suffered from bird flu. The epidemic not only caused the price of eggs to soar to a record high, but also caused the classic French dish foie gras to disappear from the Michelin menu.

According to the French Ministry of Agriculture, since the outbreak of bird flu in November last year, the country has culled 16 million poultry, setting a record for the number of poultry culled in France. Affected by this, 80% of foie gras producers in France have been forced to reduce production, and foie gras production is expected to fall by 50% this year.

To make matters worse, other foie gras producing countries such as Spain, Belgium, Bulgaria, Hungary, etc. have reported bird flu outbreaks, which means that the shortage of foie gras cannot be solved by importing.

Since April, feed prices have ushered in several downward windows. The May Day Golden Week has just ended, and many feed companies have once again announced to cut feed prices.

Due to the long-term downturn in the breeding market, there are very few farms who can insist on continuing to breed. Take poultry farming as an example. According to statistics, the empty stall rate of No-Ma chicken breeding has reached over 53%, and the empty stall rate of Ma ducks has even exceeded 60%.

A large number of farm households have abandoned their livestock, and the demand for feed has dropped significantly this year. Therefore, the life of feed manufacturers is not easy, and they are facing a lot of operating pressure. In order to increase shipments, they can only sell at lower prices.

In addition, since March this year, the price of raw materials for feed production has also dropped significantly. This is also one of the reasons why feed manufacturers are willing to take the initiative to cut prices. After all, there have been countless "feed price hikes" in the past two years, and now it's time to come down.

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

2017羽绒原料价格一路上涨,究竟为何?

你的羽绒服为什么钻绒?涨知识了

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

2017羽绒原料价格一路上涨,究竟为何?

你的羽绒服为什么钻绒?涨知识了

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展