Cn-down > Domestic news > News content

2022-05-09 来源:羽绒金网 浏览量:1742

summary

Due to the recent shortage of raw material duck feathers, the price fluctuated upwards, and there was a phenomenon of rushing to buy first-hand raw material wool in various markets, and some duck factories were reluctant to sell. However, the decline of the demand side has not changed much, and domestic and foreign brands continue to wait and see cautiously and have not placed orders for a long time.

Since April 22, the number of newly reported positive infections in a single day in Shanghai has shown a downward trend for two consecutive weeks. At present, 7 districts in Shanghai and some streets and towns in Pudong have basically cleared the social aspect, and the resumption of work and production is progressing in an orderly manner. May will enter the traditional peak season for down orders from garment factories. Under the circumstance that the textile and garment supply chain is expected to gradually recover, the market is relatively better than the beginning of the year.

The exchange rate has fluctuated greatly recently. On May 6, the onshore and offshore RMB continued to decline, and the offshore RMB against the US dollar once fell below the 6.71 mark. The devaluation of the RMB exchange rate is theoretically beneficial to export business and can reduce exchange gains and losses, which has a certain positive impact.

Exchange rate of USD to RMB: 6.5672

Exchange rate of USD to RMB: 6.6332

good news

The U.S. Trade Representative's Office announced that the action to impose tariffs on Chinese goods exported to the United States based on the results of the "Section 301 investigation" four years ago will end on July 6 this year. With immediate effect, the office will initiate a statutory review process for the action.

The first step in the process is to notify U.S. domestic industry representatives who have benefited from the tariffs on China that the tariffs may be removed, and industry representatives have until July 6 to apply to the office to maintain the tariffs.

Upon request, the office will issue additional notices after July 6 to review the tariffs, which remain in place during the review period.

The so-called "301 investigation" originates from Section 301 of the US Trade Act of 1974. The clause authorizes the US Trade Representative to launch an investigation into other countries' "unreasonable or unjust trade practices" and, after the investigation, recommends that the US president impose unilateral sanctions.

On August 18, 2017, the United States officially launched the "Section 301 investigation" against China, and on April 3, 2018, it announced the proposed list of Chinese products to be subject to additional tariffs, imposing a 25% tariff on about 1,300 products from China.

However, due to the sharp increase in inflationary pressure in the United States in recent months, there have been renewed calls in the United States to reduce or exempt additional tariffs on China.

On May 6, the central parity of the US dollar against the RMB was lowered by 660 points from the previous day to 6.6332, and the central parity depreciated to the lowest level since November 5, 2020. In addition, the U.S. dollar index soared rapidly overnight, breaking through 103 and approaching a high of 104 during the session, and the offshore USD/RMB also fell below the 6.71 mark during the session, the first time since November 2020.

Market participants said that the domestic economy is currently under pressure due to the impact of the epidemic, the superimposed dollar index is still in an upward channel, and the RMB exchange rate may still depreciate, but the onshore USD/RMB exchange rate is still strongly supported at 6.70-6.80.

Jin Yi, head of the fixed income team of Guohai Securities, believes that from a policy perspective, the central bank's desired range for the RMB/USD exchange rate seems to be between 6.40 and 6.80. On the whole, the tools available for the central bank to manage the risk of exchange rate depreciation are still abundant, and around 6.80 may be a strong "policy support level".

The Haiyin Wealth Research Report pointed out that because the fundamentals of the US dollar economy are weaker than previous US dollar cycles, the Fed’s hawkish attitude may gradually ease after the third quarter, and the RMB exchange rate depreciation cycle may be relatively short this time, only about half a year.

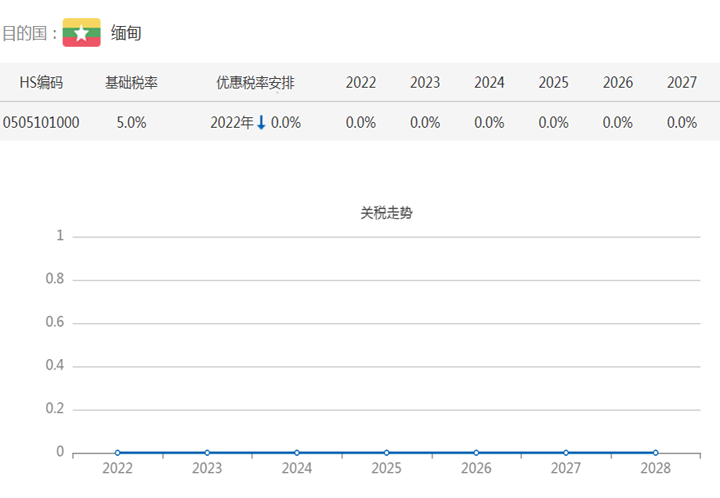

From May 1, 2022, Myanmar's implementation of the RCEP agreement to RCEP member countries will come into effect, and China will also give preferential agreement tax rates to goods imported from Myanmar that apply the RCEP origin standards.

Almost all the print media in Myanmar published a long article reporting that "RCEP between Myanmar and China has officially come into effect." The article used various data to introduce the many opportunities that RCEP will bring to Myanmar!

Chinese companies engaged in Sino-Myanmar trade will enjoy relevant preferential treatment starting in May. For down and feathers imported from China, Myanmar adopted the method of "immediately reduced to zero" tariffs.

Aung Nai U, Minister of Investment and Foreign Economic Relations of Myanmar, said that Myanmar will introduce about 1,200 megawatts of electricity from neighboring countries such as China and Laos, which will be implemented soon. Myanmar will also carry out fiscal and taxation reforms in a timely manner, with tax cuts and profits to support the resumption of work and production by enterprises.

Aung Nai Ou also emphasized that Myanmar has been sanctioned by the West for a long time in history, and it has extraordinary resistance to resisting Western sanctions. The withdrawal of some Western energy companies from the Myanmar market will not be a big problem for Myanmar, and their combined share It also only accounts for 10% of this field.

At present, RMB is still limited to border trade in trade settlement methods. The second step will expand this settlement method to all bilateral trade. The third step will also use RMB for settlement in the field of Chinese investment in Myanmar to provide maximum convenience.

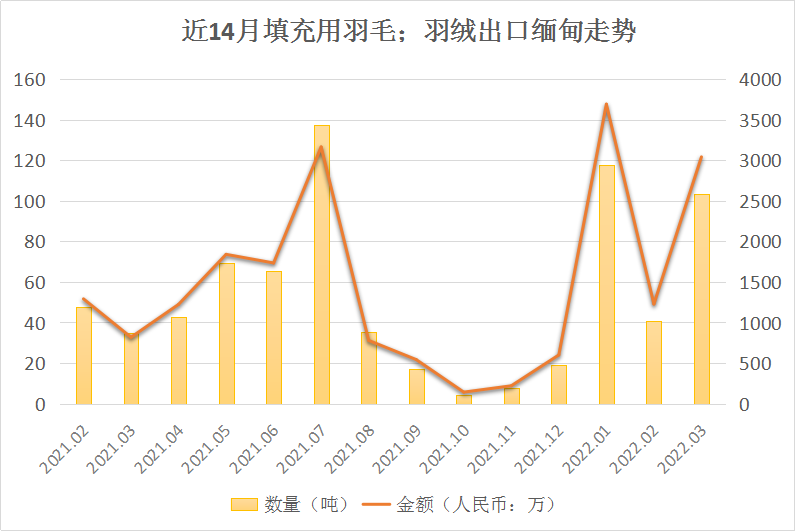

Affected by the political situation last year, China-Myanmar down trade was slightly stagnant, but this year has shown signs of recovery. The peak export season in previous years is usually between March and July.

In addition, the remaining Philippines and Indonesia of the RCEP have not yet entered into force.

bad news

Reuters reported that the current inflationary pressures are rising, so the Biden administration is under increasing business pressure to remove hundreds of billions of dollars of tariff barriers imposed by former President Trump on Chinese imports.

Additionally, recent comments by Deputy National Security Adviser Daleep Singh and Treasury Secretary Janet Yellen on the deflationary impact of tariff cuts have sparked a flurry of speculation that the administration is rethinking tariffs.

However, Katherine Tai does not seem to want the outside world to put too much expectations on the issue. Recently, the Peterson Institute for International Economics published a paper calling for significantly lower tariffs to reduce inflation. Katherine Tai challenged the paper on May 2.

Katherine Tai sarcastically said: "I have to challenge the premise of this study, which in my opinion is either writing fiction or some interesting academic activity."

Citing sources familiar with the U.S. government, Reuters said there would be no major move on tariffs in the near future, but Katherine Tai's office was continuing to consider a limited rollback of Trump-era tariffs.

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

2017羽绒原料价格一路上涨,究竟为何?

你的羽绒服为什么钻绒?涨知识了

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

2017羽绒原料价格一路上涨,究竟为何?

你的羽绒服为什么钻绒?涨知识了

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展