Cn-down > Domestic news > News content

2022-04-11 来源:羽绒金网 浏览量:1700

summary

April was supposed to be the traditional peak season of "gold three silver four" in the textile and garment industry, but the butterfly effect caused by the epidemic is everywhere. Not only textiles and clothing, but also many other industries have also fallen into an "unprecedented winter". The inventory brought by slow sales will lead to tightening of liquidity and hinder the purchase of autumn and winter, which can be said to affect the whole body.

The domestic downstream product market is "frozen", which makes the down raw material market sluggish, and the European economic growth is affected by the Russian-Ukrainian war, which may also affect my country's foreign demand orders. Fortunately, Southeast Asian countries have resumed the production capacity of down garments.

The control measures started in the middle of last month have affected the transfer of ducklings, and the further impact of this situation is about to begin. The trend of sharp decline in meat duck production is happening, which supports the confidence of upstream companies in the down industry.

Exchange rate of USD to RMB: 6.3799

Exchange rate of USD to RMB: 6.3659

Exchange rate of USD to RMB: 6.3653

good news

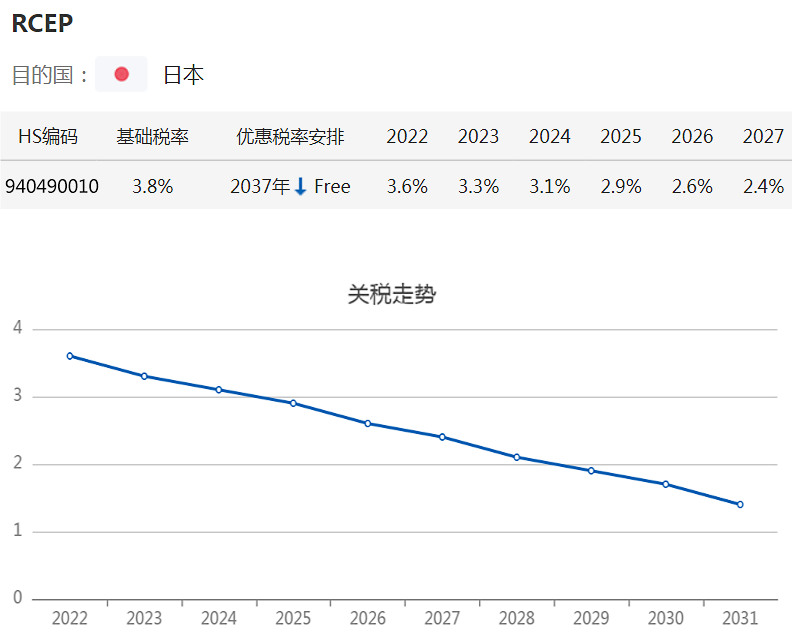

On April 1, Japan lowered its import tariffs for the second time under the Regional Comprehensive Economic Partnership (RCEP), and began to apply the tariff rates under the second year of the RCEP Japan Tariff Commitment Schedule.

According to Japan's commitment in RCEP, Japan will implement the first tariff reduction on the date of entry into force of the agreement (January 1, 2022), and the next tariff adjustment will be carried out on April 1 of that year thereafter.

For duvets exported from China to Japan, the tariff has been reduced from 3.8% of the basic tax rate to 3.3%. Since the entry into force of the agreement, the tariff of products under this tariff number will be reduced in 16 equal proportions each year, and will be reduced to 0 after 16 years.

For duvets exported from the remaining RCEP member countries to Japan, South Korea’s tariff was reduced to 3.6%, while ASEAN, Australia and New Zealand were 0.

For sleeping bags exported from China to Japan, the tariff has been reduced from 3.8% of the basic tax rate to 3.1%. Since the entry into force of the agreement, the tariff of products under this tariff number will be reduced in equal proportions 11 times a year, and will be reduced to 0 after 16 years.

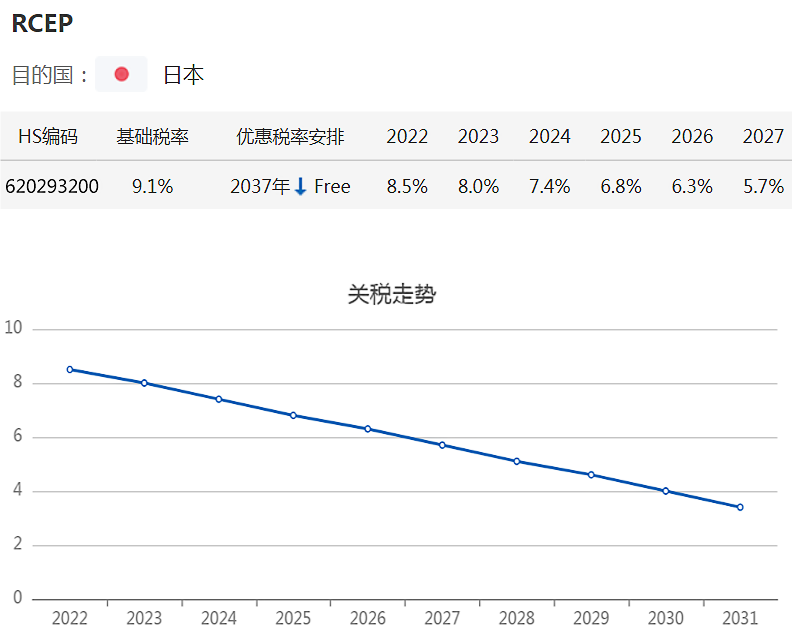

For the chemical fiber coats (ski suits, etc.) exported from China to Japan, the tariff is reduced from 9.1% of the basic tax rate to 8.0%. Since the entry into force of the agreement, the tariffs of men's and women's clothing will be reduced in equal proportions every year, and will be reduced to 0 after 16 years.

As for down and feathers exported from China to Japan, the tariff has always been 0, so it is not affected by the tariff reduction.

Japan has always been China's main exporter of down and products, and its export value ranks among the top. In 2021, my country's down industry exports to Japan US$319 million, a year-on-year increase of 10.3%. In the first two months of 2022, the export situation of my country's down products to Japan is not ideal, and this tariff reduction may bring about a turnaround.

On March 26, the international freight train from Chongqing Orchard Port to Hanoi, Vietnam slowly departed. This is the first international cross-border freight train of the new western land-sea corridor "China-Vietnam (Chongqing Orchard Port - Hanoi, Vietnam)".

With the entry into force of RCEP, the international trade between Chongqing and ASEAN countries has become more and more frequent. The opening of this cross-border railway train has added a convenient "southbound channel" for products in the western region.

Previously, most of the goods in the Sichuan-Chongqing region were transported eastward to Shanghai and other ports, and it took about 20 days to reach Vietnam, which was time-consuming and the risk of goods loss was high. Now with the opening of cross-border railway trains, the freight time from Chongqing to Vietnam will be shortened to 4-5 days, and the freight efficiency will also be greatly improved.

On April 2, the China-Myanmar-India international intermodal train started smoothly. The route of the train also starts from Chongqing, China, transits Laos and Thailand, and finally arrives in Yangon, Myanmar. Facing the Indian Ocean, Yangon is the largest port in Myanmar and one of the largest in Southeast Asia.

The passage of the China-Myanmar-India route signifies that Chinese products can also reach the Indian Ocean through this route, thereby being transported to various ASEAN countries. This will help improve the opening-up pattern of western China and bring new impetus to the economic growth of the western region.

According to customs data, in 2021, Chongqing's total import and export trade will be 800.06 billion yuan, a year-on-year increase of 22.8%. Among them, the trade volume with ASEAN is the largest. Among them, Chongqing exported 189.2 tons of down and feathers, with an export value of 1.736 million yuan. The main exporting countries were the Czech Republic, Italy, South Korea and Germany.

Vietnam, Thailand and Myanmar are all countries that have a large demand for high-quality filling down, so the opening of the new shift will undoubtedly bring business opportunities to the down export trade in the western region.

On April 6, Henan Province held the fourth phase of the "three batches" project construction activities working meeting, and the activities were carried out in a combination of online and offline methods.

Among them, there were 560 "contracted a batch" projects with a total investment of 436.4 billion yuan; 1,009 "started a batch" projects with a total investment of 632.8 billion yuan; 785 "production a batch" projects with a total investment of 422.7 billion yuan.

After the meeting, a ground-breaking ceremony was held at the site of the "started a batch" activity in Ningling County. The leaders at the meeting laid the foundation stone for the Donglong Shangqiu Garment Co., Ltd.'s annual output of 7 million pieces of down jacket processing project.

After the foundation stone laying ceremony in Fanxian County, the participating leaders visited the Longgang Down and Down Products Company in Henan Province, a project of "production a batch", and listened to the introduction of the project leader.

A few days ago, Hiroichi Kimura, president of MIKI SHOKO, the parent company of Japanese high-end children's brand miki HOUSE, said that the future business strategy will focus on "further strengthening brands and products aimed at wealthy groups" and "expanding overseas markets". conduct.

Kimura Hiroichi revealed that from the current sales performance, "the Chinese market has grown significantly. Although the sales of gifts in Japan have remained stable, we should not expect too much."

Previously, three firms held the 2022 autumn and winter exhibition, and miki HOUSE announced a new product line, Golden Label, aimed at affluent customers. One of the down jackets was priced at 220,000 yen (about 11,500 yuan).

It is said that Miki HOUSE adheres to a consistent production management system from the breeding of goose to the collection and processing of goose down, and the production and processing of down are all carried out in Japan.

bad news

American home textile wholesaler Elite Home Products filed for bankruptcy protection in district court last week.

This home textile company located in New Jersey, USA, established in 1998, mainly imports bed linen, such as bed sheets, duvets, blankets, etc. from India and China, and has certain product development capabilities.

Court documents show that a number of foreign suppliers were owed money by the company and became unsecured creditors. For now, the company's website is still available and doesn't show any information about the bankruptcy.

The two suppliers owed the most are from India, both exceeding $1 million. Two companies in my country's Nantong and Shaoxing Keqiao are also on the list of the top 20 creditors, but the amount is relatively small, not exceeding US$300,000 each.

The heightened negative impact of the Russia-Ukraine conflict could lead to slower global growth and faster inflation in 2022. The latest shock will fall on Germany, which is heavily reliant on energy suppliers from Russia and across Eastern Europe.

Germany's business confidence index posted its biggest monthly drop on record in March, factories across Europe are facing shortages of diesel and parts, and the time it takes to transport goods through major North Sea ports such as Bremerhaven is extending.

"Multiple industries rely on the same raw materials, and a large part of it comes from Russia. You can see that the already struggling global supply chain system is suffering a huge knock-on effect," said the CEO of Supply Chain Risk Management.

Nathan Sheets, Citigroup's global chief economist, said: "At the moment, the situation looks quite dangerous. In conclusion, the already complicated situation has become more complicated." This year's global GDP growth forecast and upward inflation outlook.

In the second half of last year, spot prices for a 40-foot cargo container from Asia to the U.S. averaged more than $10,000, about seven times pre-pandemic levels. Freight rates have fallen in recent weeks, but experts say this may reflect a seasonal lull before demand and costs for transport rise again. On the other hand, weakening demand represents the possibility of economic downturn.

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

2017羽绒原料价格一路上涨,究竟为何?

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

你的羽绒服为什么钻绒?涨知识了

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

2017羽绒原料价格一路上涨,究竟为何?

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

你的羽绒服为什么钻绒?涨知识了

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展