Cn-down > Domestic news > News content

2022-03-21 来源:羽绒金网 浏览量:2121

summary

In the context of the rebound of the epidemic, many European countries ushered in a "tidal wave of unblocking" this week, while the domestic epidemic prevention and control situation has become increasingly severe and complex. Expert analysis and judgment believe that the current round of the global epidemic is a high epidemic and will not end in the near future.

When the economic situation is not clear, mid-stream and downstream enterprises adopt cautious strategies, and the price of down is unlikely to improve in the short term. The textile peak season that was supposed to start is being delayed, and the down orders from garment factories are still hesitating.

Recently, the outbreak of the new crown epidemic in many places in Shandong has had an impact on the duck breeding industry, resulting in difficulties in duck acquisition and duck seedling feed transportation, and the suspension of contracts in many places. With the reduction of duck stocking, the market after the 40-day breeding cycle may change greatly.

Exchange rate of USD to RMB: 6.3506

Exchange rate of USD to RMB: 6.376

Exchange rate of USD to RMB: 6.3800

Exchange rate of USD to RMB: 6.3406

Exchange rate of USD to RMB: 6.3425

good news

According to the data of the China National Garment Association, the market size of down jackets in my country is growing rapidly. In recent years, the scale of my country's down jacket market has grown by more than 10% year-on-year.

The China National Business Information Center found that the average retail price of down jacket brands in November 2021 is mainly concentrated in the area of 500-1000 yuan. Brands with an average price between 500 yuan and 1,000 yuan have a year-on-year increase of 4.28% in their comprehensive share; brands with an average price of more than 3,000 yuan have a year-on-year increase of 1.22% in their comprehensive share.

The average retail price of down jacket brands has increased. In addition to the corresponding rise in down costs, there is also the price effect brought about by foreign light luxury brands entering the domestic market.

From 2019 to 2021, the import of down jackets in my country is on the rise, with import volumes of 4.87 million, 4.94 million and 6.02 million pieces respectively. At the same time, the average import price has increased from US$97.3 to US$136.9. In 2021, the average import price of down jackets will increase by 36.88%, an increase of 34.11 percentage points over the previous year.

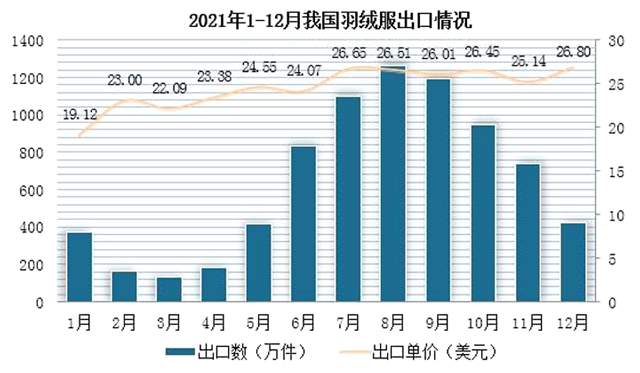

my country has always been a big exporter of down jackets. Customs data shows that in 2019, my country's export volume of down jackets was 94.58 million pieces. Although the export volume in 2020 and 2021 decreased, they also reached 73.11 million and 77.82 million pieces respectively.

The average export prices of down jackets in the past three years were 25.4, 23.6 and 25.4 US dollars respectively, and the prices fluctuated around 25 US dollars.

The data shows that the purchase price of down jackets is several times the export unit price, and the imported products and export products belong to different grades. Most of the imported down jackets are high-end products, which raises the unit price of imports; compared with imported products, export products are mainly low-priced mid-to-low-end products.

The import unit price of down jackets fluctuates greatly due to seasonal weather. The import unit price in December and January was both higher than 200 US dollars, while the import unit price in February was as high as 348.45 US dollars; on the other hand, the monthly export unit price of down jackets was generally stable.

In 2021, China's export of down jackets to the EU improved slightly, up 19.6% from the previous year, but it still did not return to pre-epidemic levels. However, France's import of down jackets from my country increased by 19.1% compared with that before the epidemic.

At the end of last year, there were 449 million live pigs in the country, a year-on-year increase of 10.5%. And these live pigs will be put on the market one after another in the next 6 months, that is, from January to June this year. Based on this calculation, the pork market supply must be at a high level in the first half of this year.

Monitoring data shows that the national average price of live pigs in February was 14.06 yuan per kilogram, which has fallen below the average breeding cost line. The loss of one live pig was about 150 yuan, and it fell to 13.21 yuan per kilogram last week.

Chen Guanghua, deputy director of the Animal Husbandry and Veterinary Bureau of the Ministry of Agriculture and Rural Affairs, said that the downward trend will continue for a while, and the price of pigs in March and April may drop to a bottom of about 12 yuan per kilogram.

It is understood that the breeding volume of ducks and geese is obviously affected by the pig cycle, and the two are related to one another.

In the duck breeding market for a period of time in the future, the favorable factors such as the off-season, the school season, and Qingming may all be small drivers. In the context of excess supply and demand of meat, and the constraints and influences of repeated epidemics, the cycle is generally weak.

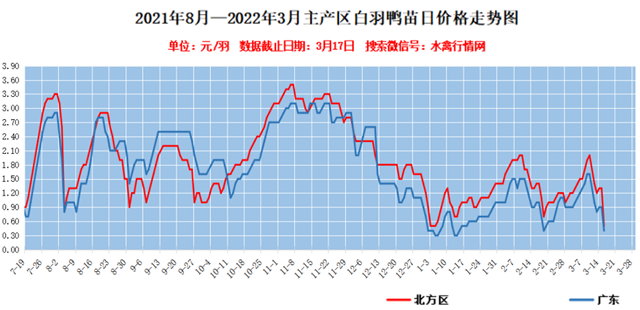

The outbreak of epidemics in Qingdao, Dezhou, Weihai and other places in Shandong, as well as in Jilin, Shenzhen, Lianyungang and other places, has a significant impact on the mood of restocking, and the duck seedling market has suffered successive setbacks.

Affected by factors such as multiple outbreaks, distribution, and wide coverage, the shipment of frozen duck products continued to be weak. For the slaughtering process, the cost of wool ducks is high, and the current slaughtering continues to lose money.

Recently, the price of duck seedlings has suffered successive setbacks, plummeting and plummeting again. On the 17th, the closing price in the northern area was 0.30-0.35 yuan/feet; the closing price in the southern area was 0.30 yuan/feather.

The outbreak of the epidemic in the main production areas of Qingdao, Dezhou, Weihai and other places has a significant impact on the mood of replenishment. At the same time, traffic control has also limited the transfer of ducklings.

The current situation of feather duck replenishment may have a greater impact on the market after 40 days, and the reduction in the amount of duck killing can also affect the trend of the down market.

bad news

"Recently, 380 and 400 nylons have been sold well, and there are some orders, but the price is very low. Last year, many bosses stocked up a lot of goods, so now even if they lose money, they are still out." A trader in Shengze area Express.

Last year, when many fabrics were still losing money, the price of nylon spinning was soaring. For example, the price of 380 and 400 nylon spinning at the end of last year could be sold at a high price of more than 5 yuan/meter. Of course, most of them are not real needs, and most of them are mainly stocked by traders.

However, because the down jackets were not easy to sell last winter, many traders still have at least three or five million meters of nylon stock in stock, and its price has dropped from more than 5 yuan/meter to the current 3.2 Yuan/meter. This price is clearly a loss.

"The raw materials of nylon spinning have risen a lot, but the price of grey fabrics is getting lower and lower. There is still demand for nylon spinning, but there are too many stocks in the market now, and many traders are able to sell a little bit. " Said a textile boss in Shengze area.

Although it is now in the peak season of "Golden Three", there are still textile bosses complaining that the peak season is not prosperous!

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

2017羽绒原料价格一路上涨,究竟为何?

你的羽绒服为什么钻绒?涨知识了

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

2017羽绒原料价格一路上涨,究竟为何?

你的羽绒服为什么钻绒?涨知识了

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展