Cn-down > Domestic news > News content

2021-08-23 来源:羽绒金网 浏览量:3392

summary

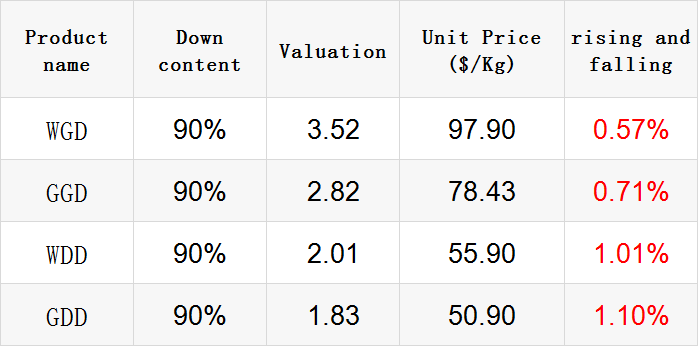

The market price rose last week.

In mid-August, the production volume of butcher enterprises continued to decline.In the near term, the overall quantity of duck seedlings is relatively small, and the price has risen slightly and frequently, which has also virtually increased the cost of delivery. Under the background of the sharp reduction in the supply of down raw materials, the market is still easy to rise but hard to fall.

From January to June 2021, the output of down jackets nationwide decreased by 0.39% year-on-year. Although the export of down jackets in July increased by 31.3% month-on-month, they fell by 7.1% year-on-year.It is an indisputable fact that the output of down jackets fell in the first half of this year, but with the rapid spread of the epidemic in Asia, some foreign orders have come to China.

Because of the rising market, the import of down and feathers has also shown signs of a surge. The import value from January to July increased by 79.2% year-on-year; and it increased by 183.9% compared with 2017.But also due to the increasingly serious epidemic situation abroad, the frantic import of down raw materials has been curbed to some extent in the near future.

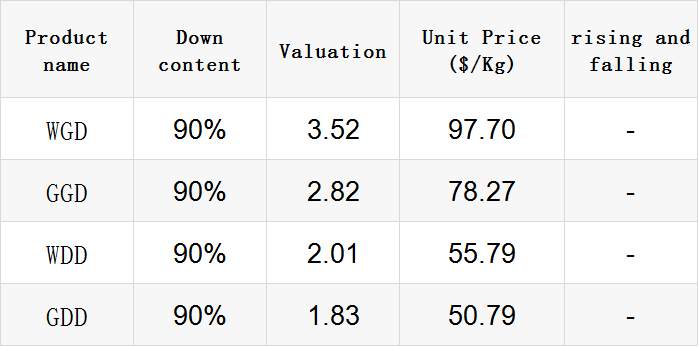

Exchange rate of USD to RMB: 6.4717

Exchange rate of USD to RMB: 6.4765

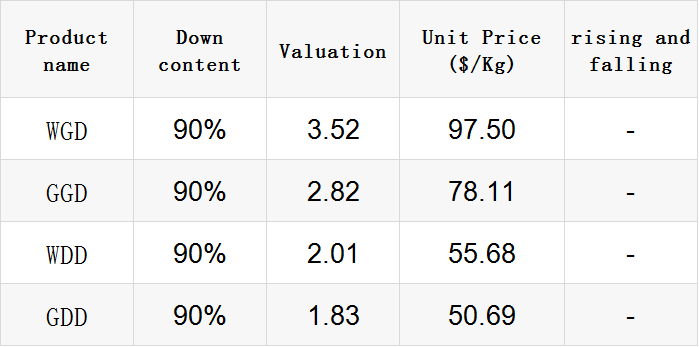

Exchange rate of USD to RMB: 6.4915

Exchange rate of USD to RMB: 6.4853

Exchange rate of USD to RMB: 6.4984

good news

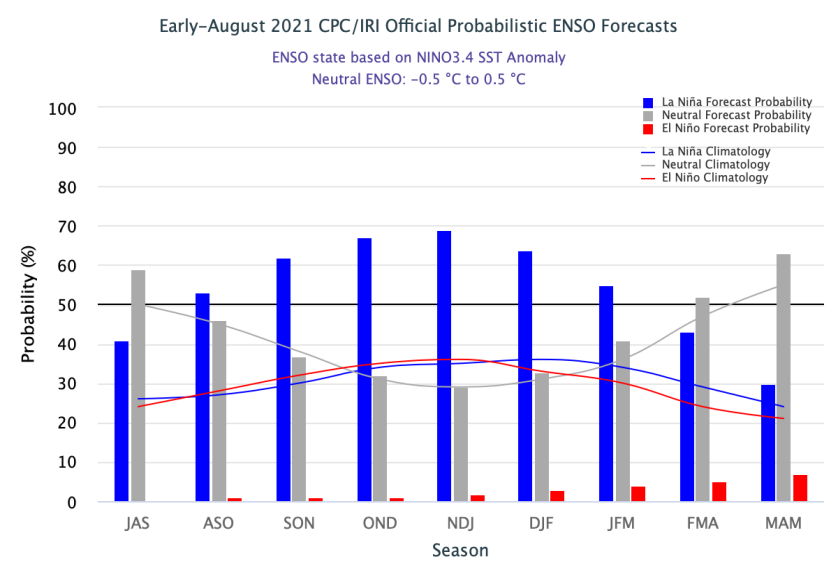

On August 16, the National Oceanic and Atmospheric Administration (NOAA) updated its weekly ENSO evolution, status, and forecast reports.

The La Niña phenomenon monitoring report released on July 8 shows that between November this year and January next year, the probability of La Niña phenomenon occurring for the second consecutive year rose to 66%.

Compared with last month's forecast, the probability of La Niña's appearance in August has also increased, and ahead of schedule.

The weekly report stated that El Niño will remain neutral for the rest of the northern hemisphere's summer, while La Niña is more likely to start from the August to October season and continue until the winter of 2021-2022.

NOAA analysts pointed out in a report issued on August 12 that the probability of La Niña occurring from September to November is about 62%, and the probability of occurrence between October and January next year has increased to about 70%. This means that the United States Meteorological Agency is now more optimistic that the La Niña phenomenon will occur again at the end of 2021.

The La Niña phenomenon is an abnormally cold water in the central and eastern Pacific Ocean. At the same time, when it occurs, it has a "temporary global cooling effect", so it means that it may make the winter colder.

"Some Southeast and South Asian countries have resumed their textile export orders, especially India and Bangladesh." On August 13, the Ministry of Commerce pointed out.

However, recently, the delta variant virus is coming on fiercely, and the number of new infections in many Southeast Asian countries has continued to hit new highs, making it one of the most severely affected areas in the world.In this regard, the textile and apparel industry believes that it may once again catalyze the return of some overseas orders to the country.

However, most companies said that they have not received such return orders, and there are not many such orders in the entire market. Some companies said: "I heard that there are orders back to the Southeast Asian market, but the number is not large, the signs are not obvious, and our company has not received it."

Recently, the manager of Heze Huayi Nalu Clothing Co., Ltd. stated that the company's factory in Heze will be able to export in the near future.

This is a Sino-Japanese joint venture, mainly producing and exporting down jackets. Originally, there was only one factory in Jiaxing, Zhejiang. Affected by the global new crown pneumonia epidemic, some overseas textile and garment processing plants are on the verge of suspending production or switching operations. Some European, American and Japanese customers have turned their orders to Chinese production. This company has ushered in the opportunity of overseas orders to return.

"Now we are increasing equipment, expanding production capacity, striving to get more orders and create more profits." Liu Ideal said. According to statistics, in the first seven months of this year, the export of clothing and clothing accessories in Heze's jurisdiction was 1.68 billion yuan, a year-on-year increase of 211.1%.

The epidemic in Vietnam is heating up, and the city closure measures have severely impacted the pace of production and delivery of the textile industry. The industry pointed out that the peak season for ready-made garments was disrupted by the epidemic. Fortunately, brand customers did not cancel orders, but delayed shipments. The industry could only wait for the release of the seal, and respond through outsourcing production and overtime work.

The garment industry analyzes that it is difficult to move orders to other domestic production lines.First of all, if the purchased raw materials are transferred to other regions, import duties may be imposed again, and profits will be greatly reduced;Second, under the US-China trade war, Vietnam enjoys preferential tariffs. If orders are moved to China, they will lose the advantage of tariffs.

Guangyue, a large down apparel OEM manufacturer, has factories in Vietnam, China, Jordan, Romania and other places. Vietnam's production capacity is nearly 50%. Guangyue has cooperated with the local epidemic prevention policy, and the current plant is almost completely shut down.

Guangyue General Manager Wu Chaobi pointed out that the short-term will inevitably be affected, but "orders are only deferred and not cancelled", and Guangyue down jacket technology has a high technical barrier and involves many patents. It cannot be produced through outsourcing, and can only wait for Vietnam to solve it. It will work overtime at that time.

The third season of each year is the traditional peak season of Guangyue, and the fourth season enters the off-season.Due to the deferral of orders this year, Wu Chaobi pointed out that he is optimistic that the off-season of the fourth quarter of this year is not weak, and the operating performance is expected to be the strongest fourth quarter in history.

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

2017羽绒原料价格一路上涨,究竟为何?

你的羽绒服为什么钻绒?涨知识了

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

2017羽绒原料价格一路上涨,究竟为何?

你的羽绒服为什么钻绒?涨知识了

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展