Cn-down > Domestic news > News content

2021-07-12 来源:羽绒金网 浏览量:2367

summary

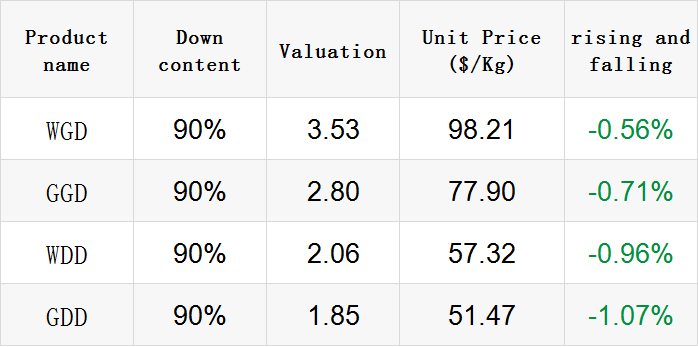

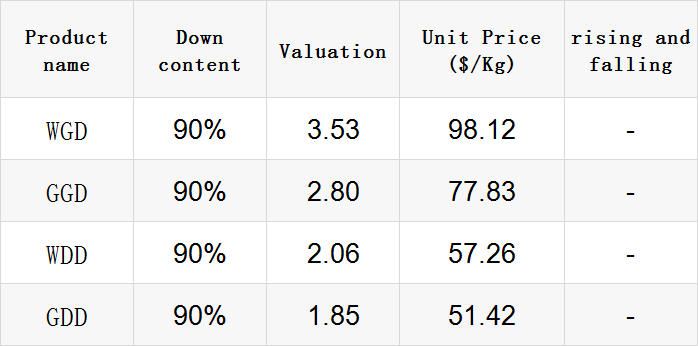

Market prices fell this week.

Recently, the demand for fabric linings of down jackets has been heating up, and the number of customers for inquiries from textile enterprises has increased, but the actual number of effective orders is limited.At the same time, the purchase-as-you-go purchasing method of apparel companies still makes it difficult to increase demand.

Under the dual pressure of capital and inventory, the number of down manufacturers who cut prices and promote sales has gradually increased.However, it should be noted that this year's raw material supply side has reduced significantly, which means that once downstream demand increases, the market may move upwards immediately.

Exchange rate of USD to RMB: 6.4695

Comments:

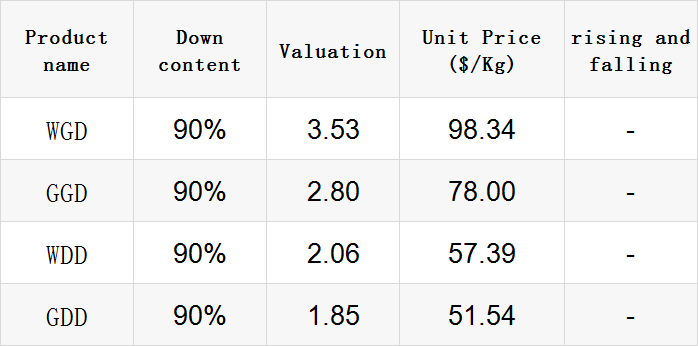

Exchange rate of USD to RMB: 6.4613

Comments:

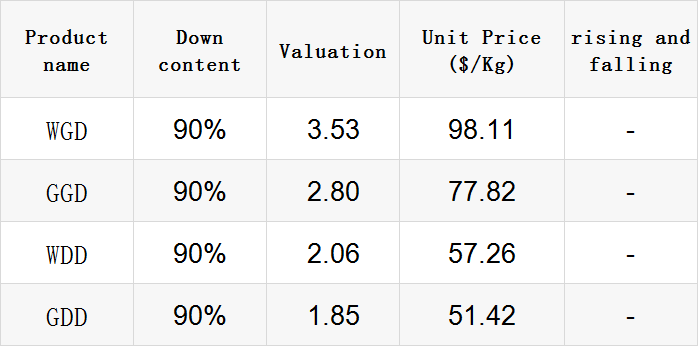

Exchange rate of USD to RMB: 6.4762

Comments:

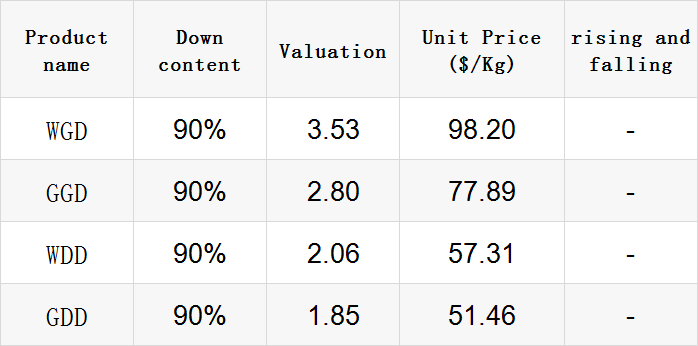

Exchange rate of USD to RMB: 6.4705

Comments:

Exchange rate of USD to RMB: 6.4755

Comments:

good news

"Now there is an order for 5 million meters from a well-known clothing company in the market, and no manufacturer has dared to accept it. This order is mainly 400T PONGEE..." said a textile boss in Shengze.

It is understood that the company is a well-known down jacket manufacturer in China, and 400T PONGEE is also the fabric for autumn and winter down jackets. Because of this, such enterprises will have very high requirements for fabrics.

The clothing company requires the weaving factory to have as few flaws as possible on the grey fabric, but according to the hardware conditions of most weaving factories, it is difficult to meet this requirement.However, the price given by the clothing company is very attractive.

"Usually speaking, a loom can make a profit of more than 50 yuan per day based on the market price for this piece of fabric, and the order price given by the well-known clothing company is 4.3-4.5 yuan per meter, so that one loom per day can be calculated. Can have a profit of more than 100 yuan." Said the above-mentioned textile boss.

The rise in oil prices has become a "domino", and polyester raw materials, textile raw materials, fabrics, etc. have ushered in price increases, and many products have reached their highest values during the year.However, the textile market is still in the off-season, downstream orders are still scarce, and how long the price increase out of terminal demand can last is still unknown.

Recently, terminal weaving orders have split in two levels, and new orders from major manufacturers have increased, but orders for small and medium-sized enterprises are still missing.The number of new orders of warp knitting machine enterprises has increased significantly, and the increase is mainly due to the increasing demand for warm winter fabrics at home and abroad. The demand for fabric linings such as down jackets on water jet looms has increased, and the number of inquiries has increased, but the actual effective number of orders is limited.

"It depends, sometimes two or three pieces are sold a day." On the day when the highest temperature in Hangzhou reached 37 degrees, the sales staff of several down clothing stores were surprisingly consistent. Compared with the "hot sale" of last winter, the down jacket specialty stores in midsummer are very few.

In fact, summer is the concentrated node of anti-season marketing for down jackets. According to industry insiders, most brands will clear the inventory of last year during this period to reduce inventory pressure.However, after random interviews, it was found that nearly 80% of consumers do not accept counter-season consumption.

Brands that focus on down jackets have long recognized the limitations of seasonal items and also know that off-season sales are not sustainable.

In the past few days, the Canadian Goose Hangzhou Building boutique has pushed out a lot of lighter and thinner jackets and waterproof jackets to subvert the heavy image in everyone's impression.According to statistics, as early as ten years ago, Canada Goose made "expanding product categories" its top priority. After testing raincoats, windbreakers and knitting series, the brand will launch footwear products for the first time this year.

Domestic down jacket brands are also stepping up their summer business. In the Bosideng store on Jingtan Road, in addition to two rows of lightweight down jackets, the store displays sunscreen clothing and short-sleeved T-shirts launched this summer; Wulin Yintai's brand store also gave the C position to summer items.

On various social platforms, the controversy over Bosideng’s summer items is mainly reflected in the price. Many netizens believe that the unit price is higher than 300 to 500 yuan. “Compared with the brand that specializes in sunscreen, the cost performance is much lower.” Some customers say so.

The temperature is approaching 40 degrees, the sales of down jackets are cold, but the production side is full of firepower.

"Down jackets are usually on the market in the fall. The products of the season are generally sold from September to the first month of the second year. Some factories start production at the end of April and start production later in June." An industry insider who has been engaged in the apparel industry for more than 20 years said , Now is the busiest time for the factory.

In the factory of Hangzhou Kezhen Import and Export Co., Ltd., more than 300 workers are processing various styles of down jackets in the factory. Wang Ruyuan, the relevant person in charge of the enterprise, said: "Basically, the production line has never stopped throughout the year, and the monthly production volume It's 20,000 to 30,000 pieces. The most recent order is 8,000 pieces."

The down jackets produced by Kezhen were supplied to foreign trade in the first half of the year and sold domestically in the second half of the year. They are the suppliers of international luxury products MaxMara and Zegna (Zegna). Wang Ruyuan also mastered the popular colors of down jackets this winter: "I found that these brands let us do The down jackets are dominated by camel and coffee, and this year's more popular green is not uncommon."

Bad news

Industry insiders pointed out that since the beginning of this year, problems such as shortage of ships, shortage of containers, shortage of labor and port congestion have been superimposed. In addition, Europe and the United States have successively unblocked the market in June and opened the mode of explosive buying. In addition, the market will enter the traditional peak season in the third quarter, and demand far exceeds With the supply of transportation capacity, the above all drove the transportation price skyrocket.

With the successive adjustments of freight rates by major shipping companies around the world in July and August, if additional costs such as peak season surcharges, fuel costs, and cabin purchase fees are included, the current freight rate from the Far East to the East of the United States can reach US$15,000-18,000/ The FEU and Western US routes have also exceeded US$10,000/FEU, and the freight rate of the European routes is about US$15,000 to US$20,000/FEU.

According to OECD estimates, if international shipping prices remain at their current high levels throughout 2021, it will cause product import prices to rise by about 2%.

The Federation of American Retailers (NRF) estimates that as retailer inventories are still at a low point in the past 20 years, the strong demand for restocking will continue to push up the freight rate. Sales in May of this year were 388.6 billion U.S. dollars, the second highest level on record.

Consulting firm Hackett Associates is optimistic that the U.S. container imports will reach more than 29 million TEU in 2021, a substantial increase of 14.5% over 2020. This move will benefit Asian producing countries such as China, Japan, and Vietnam.

NRF Chief Economist Kleinhenz said: "It is clear that the U.S. economy and retail are growing at a much faster rate than anyone expected a few months ago. With the reopening of the economy, we have not only seen months of pent-up demand bring The unprecedented growth of China has also seen the momentum of continued growth."

Recently, dozens of mysterious deaths of birds have occurred in the Mid-Atlantic area of the United States, and relevant departments are trying to find out the cause of their deaths.

According to the National Public Radio (NPR) report on the 2nd, the specific symptoms of dead birds include neurological symptoms such as swollen or crusted eyes and dizziness. Lisa Murphy, associate professor of toxicology at the University of Pennsylvania School of Veterinary Medicine, said: "So far, all research results are either inconsistent or inconclusive."

Currently known affected bird species are: blue jay, European starling, common grapple, American robin, northern cardinal, house sparrow, sparrow, eastern bluebird, bull-bellied woodpecker, Carolina tit and Carolina Wren.

Local authorities have banned residents from feeding birds. At the same time, wildlife officials encourage people who have found sick birds to call wildlife agencies to allow pets and children to avoid contact with sick or dead birds.

On June 26, Nigeria notified 38 poultry H5N1 subtype highly pathogenic avian influenza outbreaks in Kano State. 389,000 poultry were infected, 43,000 died, and 346,000 were culled.

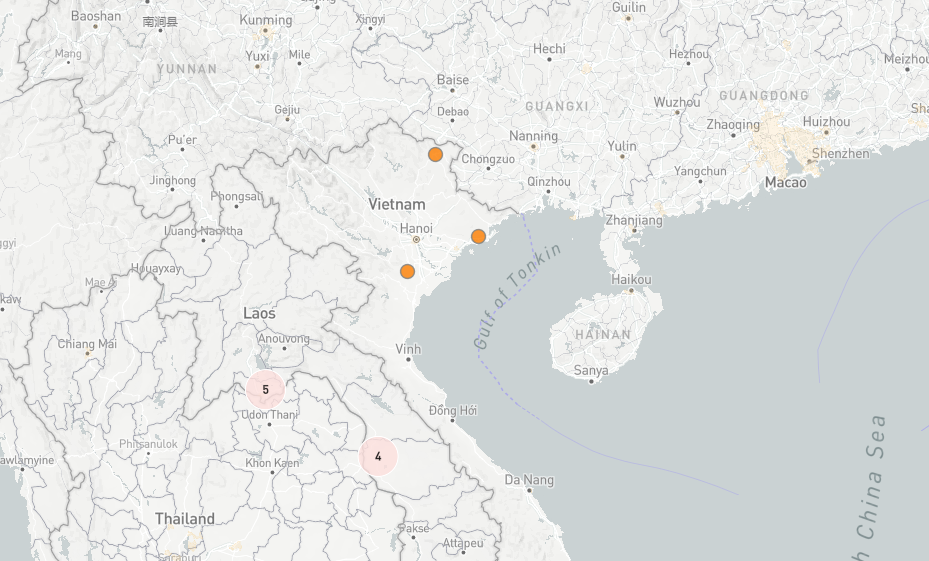

According to a report on the website of “Agricultural News” on July 2, Quang Ninh Province’s Breeding and Veterinary Bureau announced that the H5N8 avian influenza virus was detected in 3 samples collected from chickens.

The Ministry of Agriculture and Rural Development of Vietnam notified OIE that 3 cases of H5N8 highly pathogenic avian influenza have occurred in Vietnam. The outbreak occurred in Anshui County in Heping Province, Gaoping City in Gaoping Province, and Hengpu County in Quang Ninh Province. 7355 poultry were suspected of being infected, of which 3,100 became ill, 1,400 died, and 5,955 were killed and disposed of.

According to the person in charge of the branch, this is the first detection of the H5N8 virus in Vietnam. The virus can cause zoonotic diseases and is therefore more harmful. It should be noted that Gaoping City in Gaoping Province almost borders Guangxi Province.

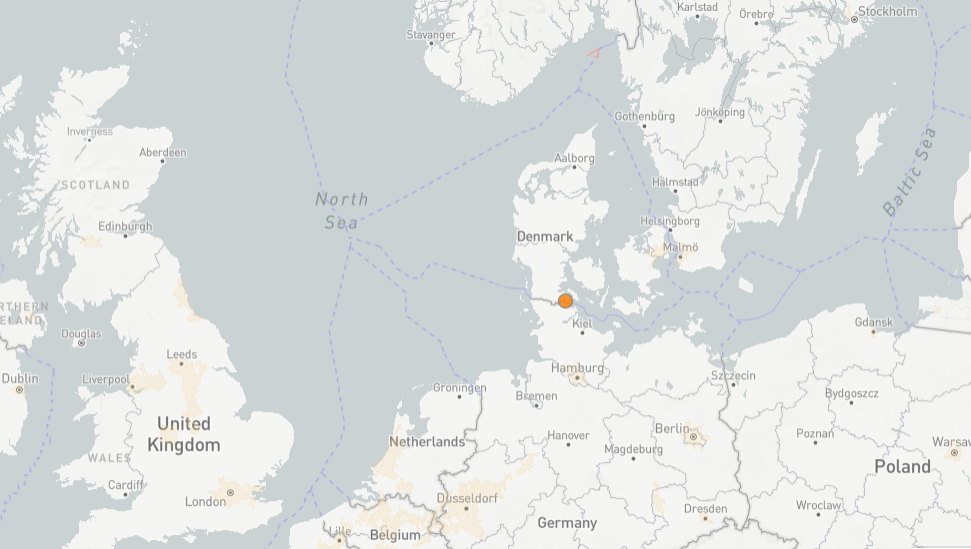

On July 6, 2021, the Danish Ministry of Environment and Food reported to OIE that an outbreak of H5N8 highly pathogenic avian influenza occurred in Denmark. The epidemic is still continuing, and the Danish Ministry of Environment and Food will submit follow-up reports every week.

The outbreak occurred in Sønderborg, Southern Denmark, and it was confirmed on July 5, 2021. The source of the epidemic is unknown or uncertain. Laboratory tests revealed that 38,000 birds were suspected of being infected, of which 198 died.

According to the Albanian "Daily News" report on July 7 local time, an outbreak of bird flu occurred in the village of Ade under the jurisdiction of the city of Fer in the southwest of the country. 120 infected raw chickens have been killed and burned.

This is the first outbreak of avian flu in the district of Fair City. A few years ago, bird flu outbreaks occurred in the country’s capital, Tirana, Korca, and Erbasan. On June 8 this year, an avian flu epidemic occurred in 3 cities including Albania, and it immediately spread to some villages in other surrounding cities.

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

2017羽绒原料价格一路上涨,究竟为何?

你的羽绒服为什么钻绒?涨知识了

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

热门排行

中国三大羽绒生产基地之—广东吴川

全球最奢侈羽绒服排行

一件羽绒服需要多少只鸭子的羽绒?

飞丝是什么?能代替羽绒?别被骗了,三种方法让你告别假羽绒服!

2017羽绒原料价格一路上涨,究竟为何?

你的羽绒服为什么钻绒?涨知识了

羽绒被的价格一般是多少 通过成本看羽绒被价格

中国羽绒服四大品牌调查:到底谁才是最强王者?

羽绒金网:羽毛、羽绒、毛绒计价

《羽绒羽毛》、《羽绒羽毛检验方法》新版标准发布,2017年7月1日实施

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展

推荐阅读

“吴川力量”助中国羽绒接轨世界

中国三大羽绒生产基地之—广东吴川

中羽协第二期新国标培训班 在“羽绒之乡”广东吴川成功举办

羽绒之乡:贵港桥圩镇将打造旅游休闲特色小镇

广西贵港桥圩镇:打造中国羽绒休闲旅游特色小镇

羽绒金网:羽毛、羽绒、毛绒计价

羽绒别急着收 中央气象台发布寒潮蓝色预警 部分地区降温超12℃

上海消保委检测 千元鹅绒被用鸭毛绒填充

冻哭丨降温10℃!鸡年首个寒潮预警来袭,你准备好了吗?

传统羽绒产业如何实现转型升级?四川玉泉镇产业集群发展